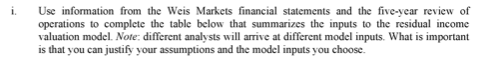

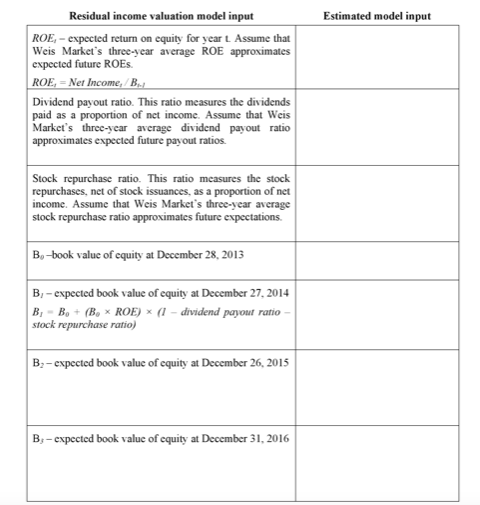

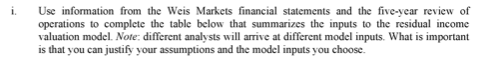

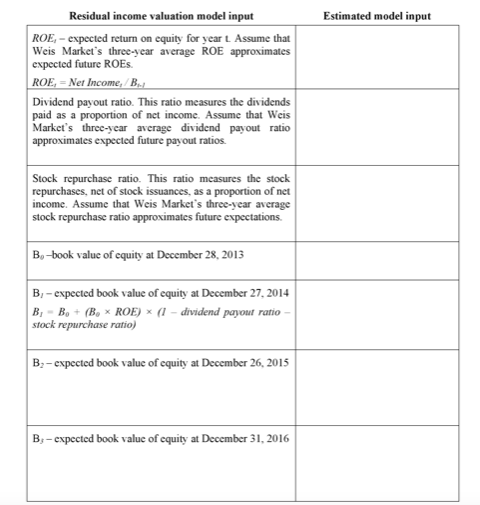

i. Use information from the Weis Markets financial statements and the five-year review of operations to complete the table below that summarizes the inputs to the residual income valuation model. Note: different analysts will arrive at different model inputs. What is important is that you can justify your assumptions and the model inputs you choose Estimated model input Residual income valuation model input ROE, - expected return on equity for yeart Assume that Weis Market's three-year average ROE approximates expected future ROES ROE, = Net Income, B., Dividend payout ratio. This ratio measures the dividends paid as a proportion of net income. Assume that Weis Market's three-year average dividend payout ratio approximates expected future payout ratios. Stock repurchase ratio. This ratio measures the stock repurchases, net of stock issuances, as a proportion of net income. Assume that Weis Market's three-year average stock repurchase ratio approximates future expectations. B-book value of equity at December 28, 2013 B; - expected book value of equity at December 27, 2014 B.-B. + (B. ROE) * (1 - dividend payout ratio- stock repurchase ratio) B2-expected book value of equity at December 26, 2015 B; -expected book value of equity at December 31, 2016 i. Use information from the Weis Markets financial statements and the five-year review of operations to complete the table below that summarizes the inputs to the residual income valuation model. Note: different analysts will arrive at different model inputs. What is important is that you can justify your assumptions and the model inputs you choose Estimated model input Residual income valuation model input ROE, - expected return on equity for yeart Assume that Weis Market's three-year average ROE approximates expected future ROES ROE, = Net Income, B., Dividend payout ratio. This ratio measures the dividends paid as a proportion of net income. Assume that Weis Market's three-year average dividend payout ratio approximates expected future payout ratios. Stock repurchase ratio. This ratio measures the stock repurchases, net of stock issuances, as a proportion of net income. Assume that Weis Market's three-year average stock repurchase ratio approximates future expectations. B-book value of equity at December 28, 2013 B; - expected book value of equity at December 27, 2014 B.-B. + (B. ROE) * (1 - dividend payout ratio- stock repurchase ratio) B2-expected book value of equity at December 26, 2015 B; -expected book value of equity at December 31, 2016