Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i. Use information from the Weis Markets financial statements and the five-year review of operations to complete the table below that summarizes the inputs

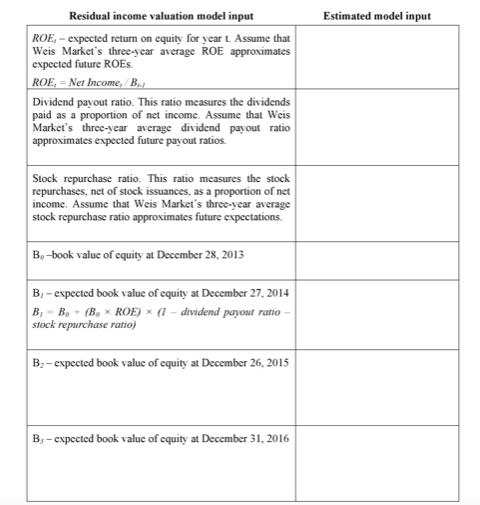

i. Use information from the Weis Markets financial statements and the five-year review of operations to complete the table below that summarizes the inputs to the residual income valuation model. Note: different analysts will arrive at different model inputs. What is important is that you can justify your assumptions and the model inputs you choose. Residual income valuation model input ROE, - expected return on equity for year 1. Assume that Weis Market's three-year average ROE approximates expected future ROES. ROE, = Net Income,/B.. Dividend payout ratio. This ratio measures the dividends paid as a proportion of net income. Assume that Weis Market's three-year average dividend payout ratio approximates expected future payout ratios. Stock repurchase ratio. This ratio measures the stock repurchases, net of stock issuances, as a proportion of net income. Assume that Weis Market's three-year average stock repurchase ratio approximates future expectations. B-book value of equity at December 28, 2013 B-expected book value of equity at December 27, 2014 (1 - dividend payout ratio- B-B (BROE) stock repurchase ratio) B-expected book value of equity at December 26, 2015 B-expected book value of equity at December 31, 2016 Estimated model input

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ROE ROE is the return on equity which measures the rate of return of a companys net income relative ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started