Question

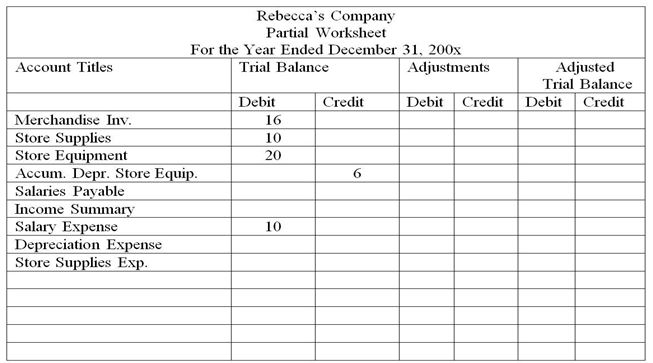

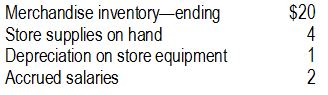

I. Use the following information to complete the partial worksheet for Rebecca's Company. Record the appropriate adjusting entries using the data below and extend the

I. Use the following information to complete the partial worksheet for Rebecca's Company. Record the appropriate adjusting entries using the data below and extend the balances over to the adjusted trial balance columns.

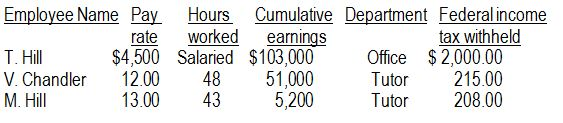

II. The table below, show the payment and retention for the period ending September 30. With this information you must be answer the question 1 to 12.

Kristi's Mentoring had the following information for the pay period ending September 30:

Assume:

F.I.C.A-O.A.S.D.I applied to the first $117,000 at a rate of 6.2%.

F.I.C.A-Medicare applied at a rate of 1.45%.

F.U.T.A applied to the first $7,000 at a rate of 0.8%.

S.U.T.A applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

1) Compute the total regular earnings.

2) Compute the total overtime earnings.

3) Compute the total gross earnings for the mentors.

4) Compute the total gross earnings for the office.

5) Compute the employees' F.I.C.A-O.A.S.D.I.

6) Compute the employees' F.I.C.A-Medicare.

7) Compute the total federal income tax.

8) Compute the total state income tax.

9) Compute the total retirement.

10) Compute the total employer's payroll tax.

11) Compute the total deductions.

12) Compute the net pay.

Rebecca's Company Partial Worksheet For the Year Ended December 31, 200x Trial Balance Adjustments Adjusted Account Titles Trial Balance Debit Credit Debit Credit Debit Credit Merchandise Inv. 16 Store Supplies 10 Store Equipment 20 6 Accum. Depr. Store Equip Salaries Payable Income Summary 10 Salary Expense Depreciation Expense Store Supplies Exp Rebecca's Company Partial Worksheet For the Year Ended December 31, 200x Trial Balance Adjustments Adjusted Account Titles Trial Balance Debit Credit Debit Credit Debit Credit Merchandise Inv. 16 Store Supplies 10 Store Equipment 20 6 Accum. Depr. Store Equip Salaries Payable Income Summary 10 Salary Expense Depreciation Expense Store Supplies ExpStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started