Answered step by step

Verified Expert Solution

Question

1 Approved Answer

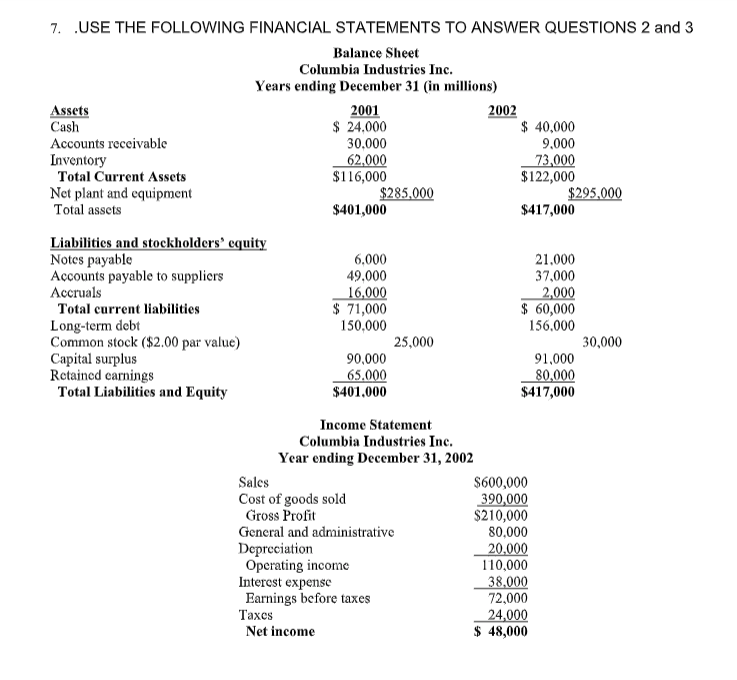

i. Using appropriate ratios, comment on the liquidity position of the company. ii. How efficient is the company in managing its Cash Cycle? Use relevant

i. Using appropriate ratios, comment on the liquidity position of the company.

ii. How efficient is the company in managing its Cash Cycle? Use relevant rations to comment on this.

iii. Comment on the company's Profitability levels

2001 7. USE THE FOLLOWING FINANCIAL STATEMENTS TO ANSWER QUESTIONS 2 and 3 Balance Sheet Columbia Industries Inc. Years ending December 31 (in millions) Assets 2002 Cash $ 24,000 $ 40,000 Accounts receivable 30.000 9,000 Inventory 62.000 73,000 Total Current Assets $116,000 $122,000 Not plant and equipment $285.000 $295.000 Total assets $401,000 $417,000 Liabilities and stockholders' equity Notes payable Accounts payable to suppliers Accruals Total current liabilities Long-term debt Common stock ($2.00 par value) Capital surplus Retained carnings Total Liabilities and Equity 6.000 49.000 16.000 $ 71,000 150.000 25,000 90,000 65.000 $401,000 21.000 37,000 2,000 $ 60,000 156,000 30,000 91,000 80,000 $417,000 Income Statement Columbia Industries Inc. Year ending December 31, 2002 Sales $600,000 Cost of goods sold 390,000 Gross Profit $210,000 General and administrative 80,000 Depreciation 20.000 Operating income 110,000 Interest expense 38,000 Earnings before taxes 72,000 Taxes 24.000 Net income $ 48,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started