I wander know how to get "63321, 249358098,1246790490" these three outcome

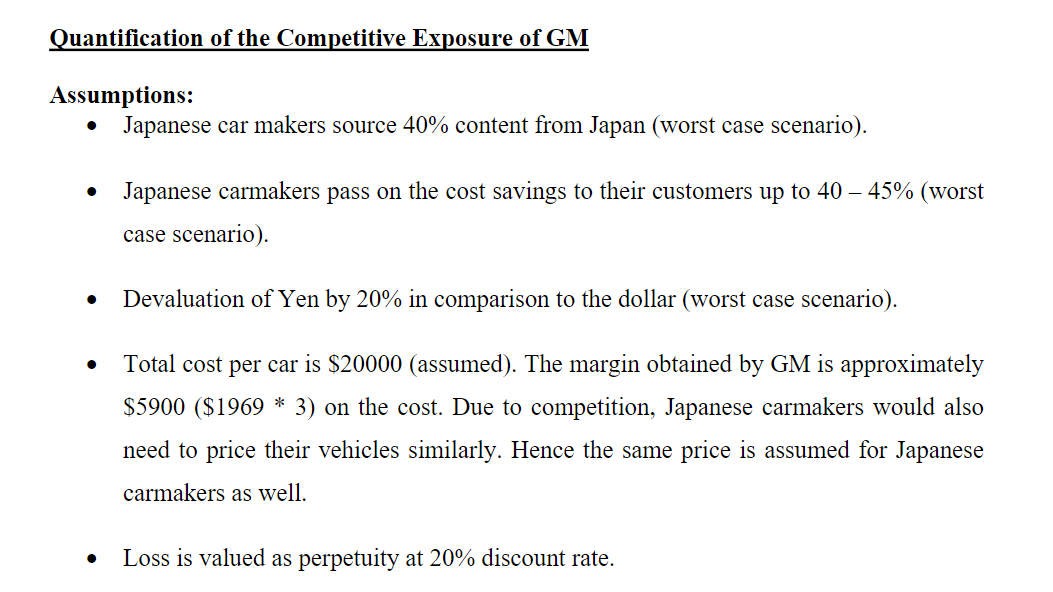

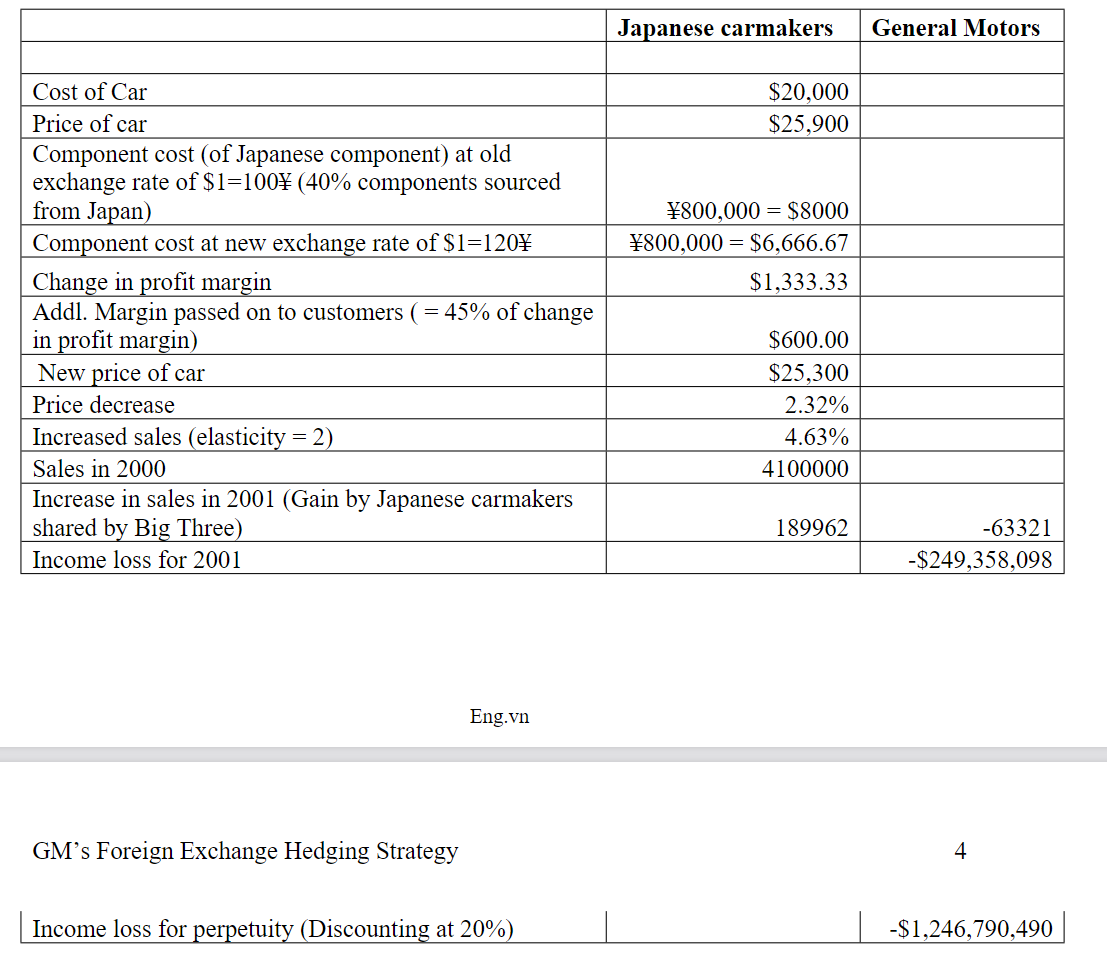

Quantification of the Competitive Exposure of GM Assumptions: - Japanese car makers source 40% content from Japan (worst case scenario). - Japanese carmakers pass on the cost savings to their customers up to 4045% (worst case scenario). - Devaluation of Yen by 20% in comparison to the dollar (worst case scenario). - Total cost per car is $20000 (assumed). The margin obtained by GM is approximately $5900($19693) on the cost. Due to competition, Japanese carmakers would also need to price their vehicles similarly. Hence the same price is assumed for Japanese carmakers as well. - Loss is valued as perpetuity at 20% discount rate. \begin{tabular}{|l|r|r|} \hline & Japanese carmakers & General Motors \\ \hline & & \\ \hline Cost of Car & $20,000 & \\ \hline Price of car & 25,900 & \\ \hline \begin{tabular}{l} Component cost (of Japanese component) at old \\ exchange rate of $1=100(40% components sourced \\ from Japan) \end{tabular} & 800,000=$8000 & \\ \hline Component cost at new exchange rate of $1=120 & $1,333.33 & \\ \hline Change in profit margin & $600.00 & \\ \hline \begin{tabular}{l} Addl. Margin passed on to customers (=45% of change \\ in profit margin) \end{tabular} & $25,300 & \\ \hline New price of car & 2.32% & \\ \hline Price decrease & 4.63% & \\ \hline Increased sales (elasticity =2) & 4100000 & \\ \hline Sales in 2000 & 189962 & \\ \hline \begin{tabular}{l} Increase in sales in 2001 (Gain by Japanese carmakers \\ shared by Big Three) \end{tabular} & & $249,358,098 \\ \hline Income loss for 2001 & & \\ \hline \end{tabular} Eng.vn GM's Foreign Exchange Hedging Strategy 4 Income loss for perpetuity (Discounting at 20\%) $1,246,790,490 Quantification of the Competitive Exposure of GM Assumptions: - Japanese car makers source 40% content from Japan (worst case scenario). - Japanese carmakers pass on the cost savings to their customers up to 4045% (worst case scenario). - Devaluation of Yen by 20% in comparison to the dollar (worst case scenario). - Total cost per car is $20000 (assumed). The margin obtained by GM is approximately $5900($19693) on the cost. Due to competition, Japanese carmakers would also need to price their vehicles similarly. Hence the same price is assumed for Japanese carmakers as well. - Loss is valued as perpetuity at 20% discount rate. \begin{tabular}{|l|r|r|} \hline & Japanese carmakers & General Motors \\ \hline & & \\ \hline Cost of Car & $20,000 & \\ \hline Price of car & 25,900 & \\ \hline \begin{tabular}{l} Component cost (of Japanese component) at old \\ exchange rate of $1=100(40% components sourced \\ from Japan) \end{tabular} & 800,000=$8000 & \\ \hline Component cost at new exchange rate of $1=120 & $1,333.33 & \\ \hline Change in profit margin & $600.00 & \\ \hline \begin{tabular}{l} Addl. Margin passed on to customers (=45% of change \\ in profit margin) \end{tabular} & $25,300 & \\ \hline New price of car & 2.32% & \\ \hline Price decrease & 4.63% & \\ \hline Increased sales (elasticity =2) & 4100000 & \\ \hline Sales in 2000 & 189962 & \\ \hline \begin{tabular}{l} Increase in sales in 2001 (Gain by Japanese carmakers \\ shared by Big Three) \end{tabular} & & $249,358,098 \\ \hline Income loss for 2001 & & \\ \hline \end{tabular} Eng.vn GM's Foreign Exchange Hedging Strategy 4 Income loss for perpetuity (Discounting at 20\%) $1,246,790,490