Answered step by step

Verified Expert Solution

Question

1 Approved Answer

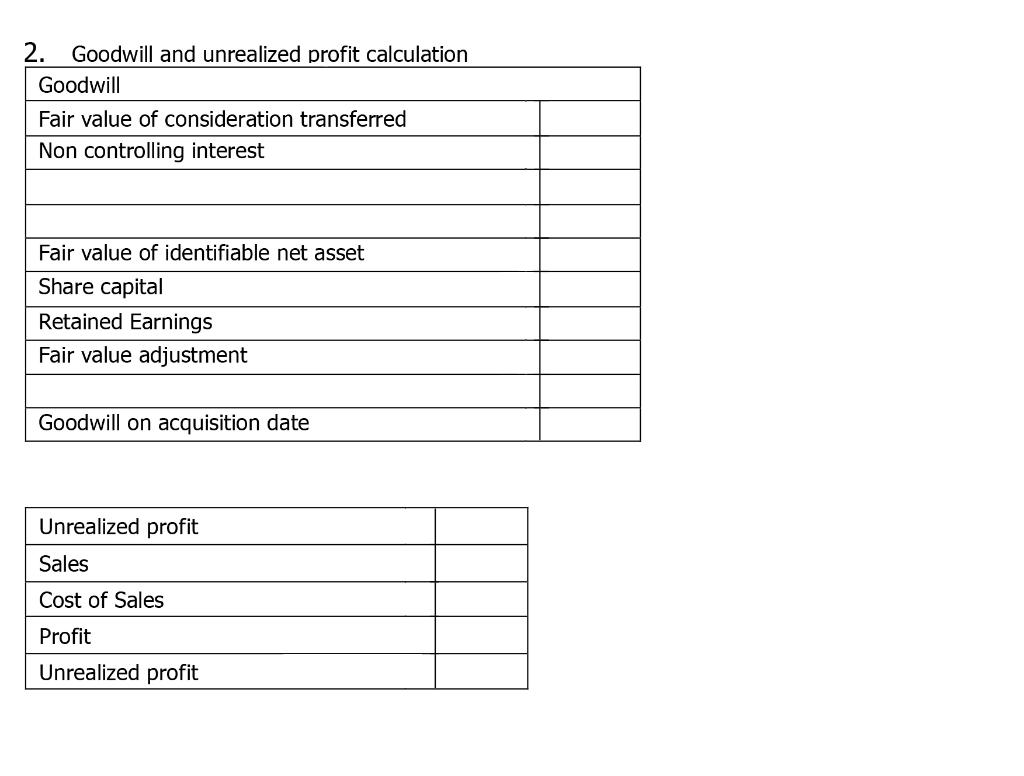

I want a explain how i can fill this table with details ask me In this question 2. Goodwill and unrealized profit calculation Goodwill Fair

I want a explain how i can fill this table with details ask me In this question

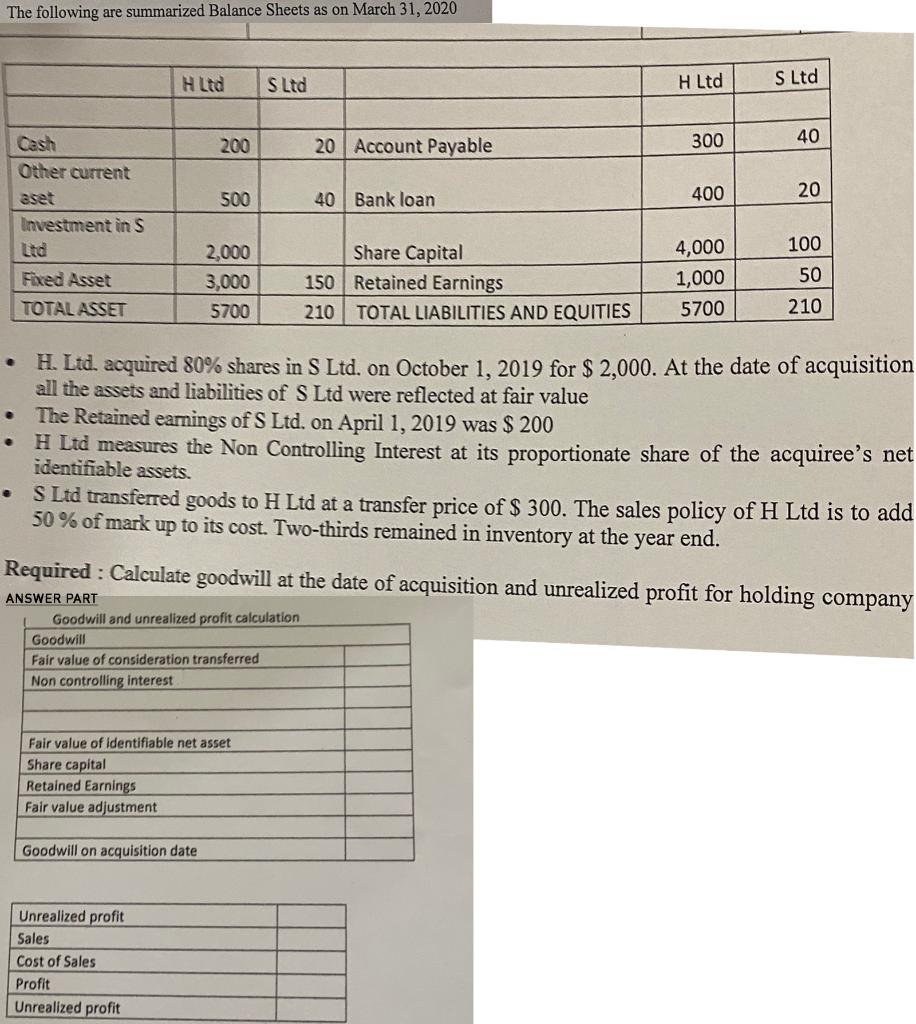

2. Goodwill and unrealized profit calculation Goodwill Fair value of consideration transferred Non controlling interest Fair value of identifiable net asset Share capital Retained Earnings Fair value adjustment Goodwill on acquisition date Unrealized profit Sales Cost of Sales Profit Unrealized profit The following are summarized Balance Sheets as on March 31, 2020 H Ltd S Ltd H Ltd S Ltd Cash 40 300 200 20 Account Payable Other current 20 400 aset 500 40 Bank loan Investment in S Ltd 100 2,000 Share Capital 4,000 Fixed Asset 50 3,000 150 Retained Earnings 1,000 TOTAL ASSET 210 5700 210 TOTAL LIABILITIES AND EQUITIES 5700 H. Ltd. acquired 80% shares in S Ltd. on October 1, 2019 for $ 2,000. At the date of acquisition all the assets and liabilities of S Ltd were reflected at fair value The Retained earnings of S Ltd. on April 1, 2019 was $ 200 H Ltd measures the Non Controlling Interest at its proportionate share of the acquiree's net identifiable assets. S Ltd transferred goods to H Ltd at a transfer price of $ 300. The sales policy of H Ltd is to add 50 % of mark up to its cost. Two-thirds remained in inventory at the year end. . Required : Calculate goodwill at the date of acquisition and unrealized profit for holding company ANSWER PART Goodwill and unrealized profit calculation Goodwill Fair value of consideration transferred Non controlling interest Fair value of identifiable net asset Share capital Retained Earnings Fair value adjustment Goodwill on acquisition date Unrealized profit Sales Cost of Sales Profit Unrealized profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started