i want a review for this arricle

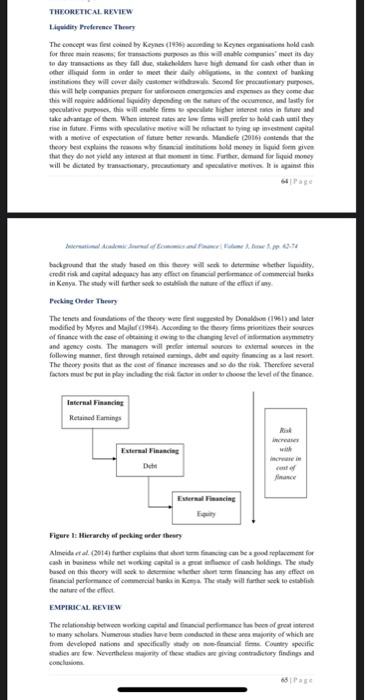

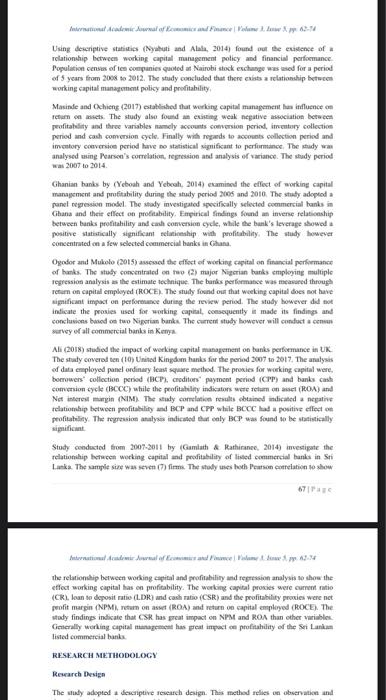

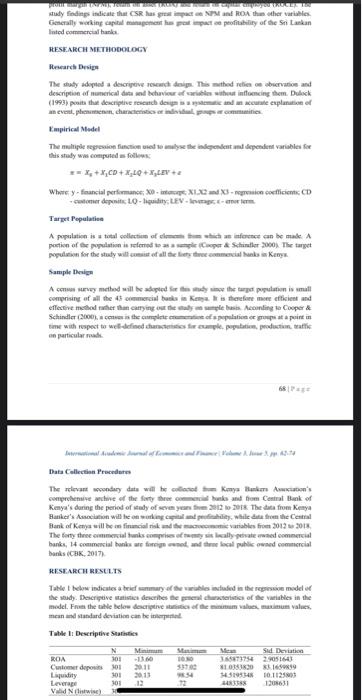

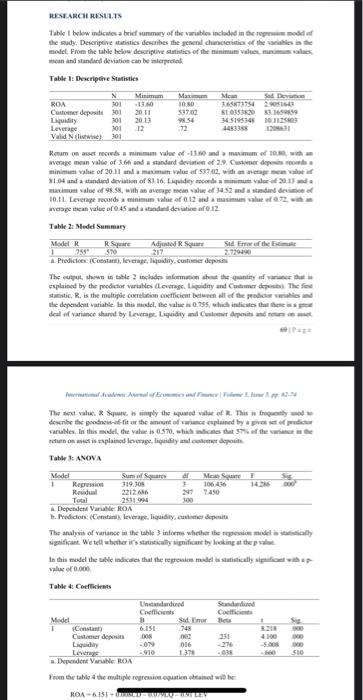

INTRODUCTION Banking industry plays a critical role as the macroeconomicement of any county the world. This would ultimately leader and development of a country's cc moviment. The financial manager is faced with tree hasic financial decisione in financial management, the financing decision madeni and investment decision Financing decisions plays the most critical role became at the onseta bosh to source for start-up capital hun et al. 2013) The banking in constantly faced the challenges of patient financial performance Corporate managers always have to ensure that the mes entraded to them are allocated to proper use. The pressure to ensure a fim predeces positive results mates from stakeholders who have invested financial resources with hope of obtaining pool tum. There i profitability is ayaktick mereafim'aperti efficiency Umrand 2015) Therefore effective and efficient working capital management practices majorly contribute to company's prosperity sit forms part of a company's shemdeg. More research has been carried on to examine faces that affect firma peability and among the trom variables considered working capital humedarby playing a critical role Mandiefe (2016Share financing is primarily concerned with the decision of day day ning of business. These decisions indule the appropriate cont of cash receivables, yables, inveces and as well as the level of mit of short-term financing Yahaya and Balatonds that a reduction in a fim financial performance is more likely a result of ineffective and inefficient management of short-term financing decision Makon (2015) pues that a firm which effectively maps its working capital has a high potential of improving is financial performance. Egally cash flows to fire bosted by elicient management of working capital and in turn into the prospect of investitum. again this background that this may seeks to establish the effect of shoes.com financing decisions on the financial performance of commercial banks in Kenya GENERAL OBJECTIVE The general bootive of the study is to examine the effect of short-term financing financial performance of commercial Banks in Kenya SPECIFIC OBJECTIVES To determine the effect of customer Sepetits on financial performance of commercial hanks in Kenya 2. To acertain the effect of liquidity ratu can financial performance of comercial hanks in Kenya 1. To establish the effect of leverape en financial performance of communcial hunks in Kenya RESEARCH HYPOTHESES Wer: Customer deposits do not have a significant effect on financial performance of Commercial Banks in Kenya Her Liquidity ratio de have significant eller en financial performance of Commercial Banks in Kenya WorLeverage does not have significant effect on financial performance of Commercial Banks is Kenya THEORETICAL REVIEW Liquidity Preference Theory The concept was first coined by Keynes (1986) according to Keynes en bold cash for three main confort papers as this will enable companiesmectits day to day transactions as they fall do takichelders have high demand for cash ther than in the liquid fom in onder med her daily ligation in the cost of banking institutions they will wer daily customer withdrawala Second for precautiary poses this will help ses as they comedie THEORETICAL REVIEW quidity Preference Theory The concept was fiel com by Keynes (1939 ding Konsehold for three main for this will enablecimet is day to day transactions as they fall destacades high demand flash ther than in ther liquid fom in ander to meet their daily in the context of hunking inst they will we del cerita come primary purpose this will help companies prepare for energies and messey come due this will require aliquidity depending on the near the comment, and by for speculative purpose, this will be fipeculate higher rotto in future and take advantage of them. When interest rates we will prefer to old cash with nie in future. Fims with speculathemat toimestment capital with more of expect of future bemer de Manliefe 2019 contends that the they best explain the why firma olid minu fim given that they do not yield my futute demand for liquid money will be dicted by transacter, precum si against Sertimento do background that the way used they will be determine whether ty Tetrisk and capital office formance of commercial banks in Kenya. They will further sock este the effectif any Pecking Order Theory The lents and foundation of the they were fint posted by Delon (1961) and later modified by Myres and Maju (1934. According artis priestere of finance with the case of wine che level of tinymmetry and apney The manage will peder mal temat we in the following munnet, first through retained inde quity financing na last resort The these positut as the core of finance to do them. There several factos must be put in play including the risk factor is under to choose the level of the finance Internal Financing Returned Fantings External Financing Estrancing Figure 1: Hierarchy of peeking and they Almeida et al. (2014) fer explain the imag can be a pod replacement for cash in business while working capital of cash kings. The way bused on this theory will come here coming has any affect financial performance of commercial i Ko They will further tests the nature of the effect EMPIRICAL REVIEW The relationship between doing capital and financial partement has been afval interest to many scholars Numerous studies have been in the majority of which we from developed nati pecifically cialis Country pocific studies are few. Neverthelemy of the giving contradictory findings and Virkkala (2015) conducted their study on profitability and working capital between the periods of 1990 to 2013. Their study established a concave impact of cash comesiyle on retum assets as a measure of profitability. This implies that there outs an optimal level of working capital resulting in a blance between risk and other maniming profit. They found cash conversion cycle having a negative relationship on the sectum equity and stock retum. The study used fedelected regression model to show the relationship Mandiefe (2016) conducted a tady to assess the effect of working capitales the profitability of Afriland first bank Cameroon for the period ranging from 2000 - 2013. The study stabied data using correlatice and dry a ute regression drie how working capital affect bank profitability. The study established the king capital management effectively inflaces the performance of Afriland Bank. The study shows that outstanding expenditure, return on asset customer deposits and hanke are significant und have a positive impact on hunks profitability. However the statybished tulan increase in reserves the reduction in profitability, while other comme lever had positive effect on profitability. The study however was conducted in Cameroon which has different social, comomic and political aspects than Karya Thapa (2013) while establishing sistemce of relationship between working capital ad probability between the periods 2000 16 2009 fed and beverage inity Sunda cowe nationship between working capital and profitability. While analysing working capital efficiency the study wined variables such as utilisation intes, performance index rather than the commonly used variables by majority of scholars such as arti Qureshi (2017) in his study conducted between 2009 and 2015 established the working capital components have insignificant relationship with financial performance. The study went ahead to analyse individual variables and came up with the following filip.com poyables and cash conversion cycles are insignificant to profitability implying that the variables have no relationship with financial prince Leverage and time have shown a positive relationship with profitability but insignificant for liquidity and prout. The staty analysed the panel data using Person's corelation and fixed effects regresi Chantou et al (2014) in the quest to establish relationship between working capital management and profitability concluded that there is a negative relationship betwem working capital management and profitability and also negative relationship between forme risk and profitability. The study was conducted between 2008 and 2010. The toucher modeled multiple regression analysis to come up with the above cond Rehman and Anjun (2014) established that action between working capital management and profitability is inverse and positively associated. To obtain the above conclusions the study wed condition and regression analysis. The study wela sample of 10 Pakistani cement companies within a period of years (2003 - 2005) Uung descriptive statistics (Nyabuti and Alle 2014 found on the customce of relationship between working capital management policy and financial permane Population comes of ten companies quoted at Nisbi back exchange was wed for a period of 5 years froen 2008 - 2012. The study concluded that there existem between working capital management policy and profitability Musinde and Ochieng (2017) established the working capital management has influence on retumets. The shidy also found existing weak nepieciem profitability and three variables namely accounts conversie period in collectie period and cash conversion de Finally with regards to collectie period inventory conversion period have to statistical significant to performance. They w analysed using Percorrelation regression and analysis of variance. The study period was 2007. 2014 Glunan buks by (Ychoah and Ychosh 2014) amined the effect of working capital management and profitability during the way period 2005 and 2010. The study adopted pranel regressiemodel commercial us in hana and their sect Eminal finnes over Indice Using deseriptive statistics (Nytti and Alala. 2014) found out the existence of relationship between working capital management policy and financial performance Population census often companies quoted at Nairobi stock exchange wassed for a period of 5 years from 2008 to 2012. The study concluded that there exists a relationship between working capital management policy and profitability, Masinde and Ochieng (2017) established that working capital management influence on retum amets. The study also found existing weak negative association between profitability and three variables amely accounts conversion period, intory collection period and cash comversion cycle. Finally with regards to accounts collection period and in colory conversie period have to statistical significant to performance. The study w analysed using Pearson's correlation, regression and analysis of variance. The study period was 2007 to 2014 Ghanian banks by (Yeboah and Yeheah, 2014) examined the effect of working capital management and profitability during the study period 2005 and 2010. The study adoptada panel regression model. The study investigated specifically selected commercial banks in Ghana and their effect on profitability. Empirical findings found on inverse relationship between bunks profitability and cash conversion cycle, while the bank's leverage showed positive statistically significant scuteship with profitability. The study however concentrated on a few selected commercial banks in Ghana Oyodor and Mukolo (2015) and the effect of working capital on financial performance of hanks. The study concentrated on to (2) major Nigerian bank employing multiple regression analysis as the estimate technique. The banks performance was measured through return on capital employed (ROCE). The study found out that working capital does not have significant impact on performance during the review period. The study however did not indicate the prosies used for working capital consequently it made its findings and conclusions based on two Nigerian banks. The current study however will condotcom survey of all commercial banks in Kenya Ali (2018) studied the impact of working capital management on bunks performance in UK The study covered ten (1) United Kingdom Hanks for the period 2007 to 2017. The analysis of data employed panel ordinary least square method. The proxies for working capital were. borrowers' collection period (BCP creditors' payment period (CPP) and banks case conversion cycle (BCCC) while the profitability indicators were cum one (ROA) and Net interest margin (NIM). The study correlation results obtained indicated negative relationship between profitability and BCP and CPP while BCCC positive effect on profitability. The repression analyses indicated that caly BCP was found to be statistically significant Study conducted from 2007-2011 by (Gamith & Rathinanee 2014) mestigate the relationship between working capital and proditability of listed commercial banks in Sti Lanka. The sample sire was seven (7) fim. The study wes hoch Pearson correlation to show 67 International Academi Awal of Ecommerce Volume 13.00 the relationship between working capital and profitability and regression analysis to show the effect working capital has on profitability. The working capital proxies were current ratio (CR. loan to deposit ratio (LDR) and cash ratio (CSR) and the profitability proxies were net profit margin (NPM, return on asset (ROA) and return on capital employed (ROCE). The stady findings indicate that CSR has great impact on NPM and ROA than other variable Generally working capital management has pret impact on profitability of the Sri Lanka listed commercial banks RESEARCH METHODOLOGY Research Design The study adopted a descriptive research design. This method relies on observation and ACEST tady findings indicate that CSR has great Na ROA thother variables Generally working capital mathemat e profitability of the Solankan inted commercial and RESEARCH METHODOLOGY Research Design The study adopted a descriptive design. This method retien bervation and description of numerical data send behaviour of cable without informing them. Daleck (1993) posts that descriptive design conte explanation of eventplimenchantistics is commix Empirical Model The multiple regression function et dependent independent variables for this study was compared as follow Where y-financial performance: 30 x 2X-region coefficient. CD - deponit LO-LEVI Target Populatie A population is total collection of the which are can be made. A praction of the plain fomed to sper & Shine 2000) The target population for the study wil.com the three miks Kenya Sample Design A co vy method will be adopted me the target putem is all comprising of all the commercial buat is therefore more efficient and effective method ather than carrying out the less According to Cooper & Schindler (2000). the easiest opta prin in time with respect to well-defined cases,pati production, trafic particular Data Collection Procedure The devant condary data will be called Keys Bankers Auto's comprehensive awe of the forty three chunks and from Central Bank of Kenya's during the period of taty of seven year 2018 The data from Kenya Baker's Accuton will be on ng Cape while the Central Bank of Kenya will be financial risk and variables from 3012 2013 The forty the commercial Bunks comprises Inally gevate et commercial hunki, 14 commercial banks we forged, and the local public gwned commercial banks (CBK.2017) RESEARCH RESULTS Table I below indicates a bed mmary of the bestuded in the repressive modele the way. Descriptive statistics describes the characteristics of the variables in the model. From the table below descriptive of me, maximum values, men and standard deviation can be interested Tuhle 1: Descriptive Statistics N Macam Sid Dito ROA 301 -15 TO 73754 29051687 Customer deposit 101 2011 33700 X1330 1619 Lidity 10 2013 151934 10112 Leverage 303 1208631 VN) RESEARCH RESULTS Table below indicates a brief summary of the variables included in the remode of the study. Descriptive writis describes the general chance of the model From the table below descriptive statistics of the minimum value me men and standard deviation can be interpretat Table 1: Descriptive Statistics N Sad Deum ROA 101 10:30 385871754 2016 Customer deposit 101 20.11 $17.00 10353620 389 Liquidity 201 9254 348195348 101125 Leverage 301 SI Valid N (litwie 301 Remotes a minimum value of 130 na mesmame with verage me value of 36 and standard deviation of 2.9. Customer des minime value of 20.11 and mean value of 53742 with me 1.04 and a standard deviation of 81.16. Ludity moco aval 2013 maximum value of 98.5, with an engem value of 4.5 standard de 10. Leverage records a minimum value of 0.12 anda masimum value wenye maan val of 0.45 and standard deviatice of 0.12 Table 2 Medel Summary Madel R Adjusted RS Sid. Emofthe 1 370 2017 27299 Predictos Constant, leverage, quidity, customer depois The cut shown in the includes inform the quantity of explained by the predictor variables ( La Lady and the fee stamist. R. is the multiple creation efficient between the price the dependent variable bathimedel, the 0.755, which indicates the deal of variance shared by leverage. Liquidity and depende The next valu. Sunt simply the quand of. This free describe the goodness of-fit or the art of wine esplained by a variables. In this model, the value is 0.370, which was that of the Fonis explained leverage. Tidity and Table 3: ANOVA Model Sum of MSF Regression 319.305 106.36 Residual Total 2531994 300 Dependend ROA Predictions Conta leverage liquidity.com The analysis of variance in the table 3 infoem whether the regime significant. We tell whether it's statistically significant by looking at the In this model the table indicates that the real made a statistically con wao.000 Table 4 Coefficients S 300 Unstandarded Standard Coefficiens Sad more 1 Constant 6.151 748 Cluster det DON 000 -0% 016 Love 910 - a Dependen Verwe ROA slo From the table the multiple regresi qution obtame will be ROA-6151 From the table the multiple regretted will be ROA151 0.001CD607910-001 LEY The predictive power of the independent variables in indian by the office in the table above. This implies that a comer deposit has a positive thanks profitability that Customer deposit: The model predicts that eas dinalni efemer, profitability increases by 000 unitholling liquidity leverage C deposits have a significant effect on banks profitability. Teing fic wc the mall hypothesis and conclude tut customer deposits affect bucks per the findings are consistent with the finding of mandiefe (2016) Liquidity: The model predict that is an additional mit of liquidity, huile decreases by 0.079 in holding customer deposits and leverage content des Auerstmal dentrinis.dow of Ecommend new... significant effect bank profitabilny Being significant we will see hypothesis and conclude the liquidity affects and performance. The findiepe with the liquidity preference towy which explains that may he most used for the day to day of his Leverage. The model predicts that madalt of lenge. Bespre decreases by 0.91 utiliding customer deposits and liquidity can be insignificant effect bank profitability ing ngificant we will also all hypothesis and conclude the leverage has no effect on bunks performance. The finding are comitent with the peaking order they which explains that componentely funds first before going for extema finde CONCLUSION The study sought to examine the effect of short-term finuty the final price of commercial basis Kenya. To achieve the objective punel det om 1239 extracted from financial statements of cercal banko Kimya tu wasio customer deposits and liquidity have significant effect optibility while forvente imignificant effect on ability of commercial REFERENCES Abeshamel, SNM. & Sulaiman 1 2014. Cal Holdings Coque Pub Some Evidence firm Janda Shitet 98-907 Alala. A Nyabuti, W. (2016). The relationship between Working Capital Management Policy and Financial Performance of Compact Son Exchange, Kenya International Journal of Em MS ALL, D. (2013) Impact of Working Capital Management on Previdence from UK Alshati. AS. 2016). The cost of liquidity mement the profile mercial banks Investment Manage and be Valome 1.26 Amed. G. (2008). Corporated London, English Education in Azeem. M.M., & Manap, A. (2015). Determinant factors and writing capital International Journal of Economic and in 221. 230-240 Red fron mp doorg10.553930 llagh, T. Nant, MIK, MA, Ram, 2010). The post of management of financial performance Evidence to Pet International of Economics and Financial OL 102-105 Retrieved from www.com.cn INTRODUCTION Banking industry plays a critical role in the screen moment of my country the world. This would limafely lead han development of contry's cc vironment. The financial manager is faced with tree basic financial decision in financial management, the financing decision management decision and investimmt decision Financing decision plays the most critical role became at the sea bainh ho source foc start-up capital hun et al. 2013) The banking industry is constantly faced with the challenges of pudient financial performance Corporate managers always have to that the mes enrested to them are allocated to proper use. The preure to a fim predeces positive results mates from stakeholders who have invested financial resources with hope of obtaining pool tum. The profitability is ayaktick este fimm's sperational efficiency Umerend 2013 Therefore effective and efficient working capital management practices may contribute to company's prosperityst forms part of a company's short termice More narch has been carried on camine factors that affect firm policability and attempt the rom variables considered working capital has come early playing a critical role Mandiufe (20 Sb.com financing is primarily concerned with the decision of day to day running of business. There decisions include the appeopriate cont of cash receivables, payables, inventaries and as well as the level of mix of short-term financing Yahaya and Balconiends that a reduction in a fim financial performance is more likely a result of ineffective and inefficient management of short-term financing decision Makon (2015) argues that a firm which effectively tapes its working capital has a high potential of improving its financial performance. Fully cash flows to firme boceted by elicient management of working capital and intun increase the prospect of investorstum Jernetum). Adem Journal of Commewe utume , dow Xma.se against this background that this study seeks to establish the feet of ston-term financing decisions on the financial performance of commercial hints in Kenya GENERAL OBJECTIVE The general bootive of the study is to examine the effect of so-term financing financial performance of commercial Bank in Kenya SPECIFIC OBJECTIVES 1. To determine the effect of customer deperits on financial performance of commercial hanks in Kenya 2. To ascertain the effect of liquidity ratu can financial performance of commercial hanks in Kanya To stablish the effect of severape en financial performance of commercial Banks in Kenya RESEARCH HYPOTHESES Nes: Customer deposits do not have a significant effect on financial performance of Commercial links in Kenya Hey Laundity ratio dies have significant eller en financial performance of Commercial Banks in Kenya Mos Leverage does not have significant effect on financial performance of Commercial Banks is Kenya THEORETICAL REVIEW Liquidity Preference They The concept was first comed by Keynes (1996) according to Keynes organisations hold cash for three main confor tractica para as this will enable companies meet its day to day transactions as they fall du stakeholders have high demand for cash her than in the liquid fom in onder to meet their daily ligation in the of banking institutions they will cover daily customer withdrawal Second for patiary as they cane de INTRODUCTION Banking industry plays a critical role as the macroeconomicement of any county the world. This would ultimately leader and development of a country's cc moviment. The financial manager is faced with tree hasic financial decisione in financial management, the financing decision madeni and investment decision Financing decisions plays the most critical role became at the onseta bosh to source for start-up capital hun et al. 2013) The banking in constantly faced the challenges of patient financial performance Corporate managers always have to ensure that the mes entraded to them are allocated to proper use. The pressure to ensure a fim predeces positive results mates from stakeholders who have invested financial resources with hope of obtaining pool tum. There i profitability is ayaktick mereafim'aperti efficiency Umrand 2015) Therefore effective and efficient working capital management practices majorly contribute to company's prosperity sit forms part of a company's shemdeg. More research has been carried on to examine faces that affect firma peability and among the trom variables considered working capital humedarby playing a critical role Mandiefe (2016Share financing is primarily concerned with the decision of day day ning of business. These decisions indule the appropriate cont of cash receivables, yables, inveces and as well as the level of mit of short-term financing Yahaya and Balatonds that a reduction in a fim financial performance is more likely a result of ineffective and inefficient management of short-term financing decision Makon (2015) pues that a firm which effectively maps its working capital has a high potential of improving is financial performance. Egally cash flows to fire bosted by elicient management of working capital and in turn into the prospect of investitum. again this background that this may seeks to establish the effect of shoes.com financing decisions on the financial performance of commercial banks in Kenya GENERAL OBJECTIVE The general bootive of the study is to examine the effect of short-term financing financial performance of commercial Banks in Kenya SPECIFIC OBJECTIVES To determine the effect of customer Sepetits on financial performance of commercial hanks in Kenya 2. To acertain the effect of liquidity ratu can financial performance of comercial hanks in Kenya 1. To establish the effect of leverape en financial performance of communcial hunks in Kenya RESEARCH HYPOTHESES Wer: Customer deposits do not have a significant effect on financial performance of Commercial Banks in Kenya Her Liquidity ratio de have significant eller en financial performance of Commercial Banks in Kenya WorLeverage does not have significant effect on financial performance of Commercial Banks is Kenya THEORETICAL REVIEW Liquidity Preference Theory The concept was first coined by Keynes (1986) according to Keynes en bold cash for three main confort papers as this will enable companiesmectits day to day transactions as they fall do takichelders have high demand for cash ther than in the liquid fom in onder med her daily ligation in the cost of banking institutions they will wer daily customer withdrawala Second for precautiary poses this will help ses as they comedie THEORETICAL REVIEW quidity Preference Theory The concept was fiel com by Keynes (1939 ding Konsehold for three main for this will enablecimet is day to day transactions as they fall destacades high demand flash ther than in ther liquid fom in ander to meet their daily in the context of hunking inst they will we del cerita come primary purpose this will help companies prepare for energies and messey come due this will require aliquidity depending on the near the comment, and by for speculative purpose, this will be fipeculate higher rotto in future and take advantage of them. When interest rates we will prefer to old cash with nie in future. Fims with speculathemat toimestment capital with more of expect of future bemer de Manliefe 2019 contends that the they best explain the why firma olid minu fim given that they do not yield my futute demand for liquid money will be dicted by transacter, precum si against Sertimento do background that the way used they will be determine whether ty Tetrisk and capital office formance of commercial banks in Kenya. They will further sock este the effectif any Pecking Order Theory The lents and foundation of the they were fint posted by Delon (1961) and later modified by Myres and Maju (1934. According artis priestere of finance with the case of wine che level of tinymmetry and apney The manage will peder mal temat we in the following munnet, first through retained inde quity financing na last resort The these positut as the core of finance to do them. There several factos must be put in play including the risk factor is under to choose the level of the finance Internal Financing Returned Fantings External Financing Estrancing Figure 1: Hierarchy of peeking and they Almeida et al. (2014) fer explain the imag can be a pod replacement for cash in business while working capital of cash kings. The way bused on this theory will come here coming has any affect financial performance of commercial i Ko They will further tests the nature of the effect EMPIRICAL REVIEW The relationship between doing capital and financial partement has been afval interest to many scholars Numerous studies have been in the majority of which we from developed nati pecifically cialis Country pocific studies are few. Neverthelemy of the giving contradictory findings and Virkkala (2015) conducted their study on profitability and working capital between the periods of 1990 to 2013. Their study established a concave impact of cash comesiyle on retum assets as a measure of profitability. This implies that there outs an optimal level of working capital resulting in a blance between risk and other maniming profit. They found cash conversion cycle having a negative relationship on the sectum equity and stock retum. The study used fedelected regression model to show the relationship Mandiefe (2016) conducted a tady to assess the effect of working capitales the profitability of Afriland first bank Cameroon for the period ranging from 2000 - 2013. The study stabied data using correlatice and dry a ute regression drie how working capital affect bank profitability. The study established the king capital management effectively inflaces the performance of Afriland Bank. The study shows that outstanding expenditure, return on asset customer deposits and hanke are significant und have a positive impact on hunks profitability. However the statybished tulan increase in reserves the reduction in profitability, while other comme lever had positive effect on profitability. The study however was conducted in Cameroon which has different social, comomic and political aspects than Karya Thapa (2013) while establishing sistemce of relationship between working capital ad probability between the periods 2000 16 2009 fed and beverage inity Sunda cowe nationship between working capital and profitability. While analysing working capital efficiency the study wined variables such as utilisation intes, performance index rather than the commonly used variables by majority of scholars such as arti Qureshi (2017) in his study conducted between 2009 and 2015 established the working capital components have insignificant relationship with financial performance. The study went ahead to analyse individual variables and came up with the following filip.com poyables and cash conversion cycles are insignificant to profitability implying that the variables have no relationship with financial prince Leverage and time have shown a positive relationship with profitability but insignificant for liquidity and prout. The staty analysed the panel data using Person's corelation and fixed effects regresi Chantou et al (2014) in the quest to establish relationship between working capital management and profitability concluded that there is a negative relationship betwem working capital management and profitability and also negative relationship between forme risk and profitability. The study was conducted between 2008 and 2010. The toucher modeled multiple regression analysis to come up with the above cond Rehman and Anjun (2014) established that action between working capital management and profitability is inverse and positively associated. To obtain the above conclusions the study wed condition and regression analysis. The study wela sample of 10 Pakistani cement companies within a period of years (2003 - 2005) Uung descriptive statistics (Nyabuti and Alle 2014 found on the customce of relationship between working capital management policy and financial permane Population comes of ten companies quoted at Nisbi back exchange was wed for a period of 5 years froen 2008 - 2012. The study concluded that there existem between working capital management policy and profitability Musinde and Ochieng (2017) established the working capital management has influence on retumets. The shidy also found existing weak nepieciem profitability and three variables namely accounts conversie period in collectie period and cash conversion de Finally with regards to collectie period inventory conversion period have to statistical significant to performance. They w analysed using Percorrelation regression and analysis of variance. The study period was 2007. 2014 Glunan buks by (Ychoah and Ychosh 2014) amined the effect of working capital management and profitability during the way period 2005 and 2010. The study adopted pranel regressiemodel commercial us in hana and their sect Eminal finnes over Indice Using deseriptive statistics (Nytti and Alala. 2014) found out the existence of relationship between working capital management policy and financial performance Population census often companies quoted at Nairobi stock exchange wassed for a period of 5 years from 2008 to 2012. The study concluded that there exists a relationship between working capital management policy and profitability, Masinde and Ochieng (2017) established that working capital management influence on retum amets. The study also found existing weak negative association between profitability and three variables amely accounts conversion period, intory collection period and cash comversion cycle. Finally with regards to accounts collection period and in colory conversie period have to statistical significant to performance. The study w analysed using Pearson's correlation, regression and analysis of variance. The study period was 2007 to 2014 Ghanian banks by (Yeboah and Yeheah, 2014) examined the effect of working capital management and profitability during the study period 2005 and 2010. The study adoptada panel regression model. The study investigated specifically selected commercial banks in Ghana and their effect on profitability. Empirical findings found on inverse relationship between bunks profitability and cash conversion cycle, while the bank's leverage showed positive statistically significant scuteship with profitability. The study however concentrated on a few selected commercial banks in Ghana Oyodor and Mukolo (2015) and the effect of working capital on financial performance of hanks. The study concentrated on to (2) major Nigerian bank employing multiple regression analysis as the estimate technique. The banks performance was measured through return on capital employed (ROCE). The study found out that working capital does not have significant impact on performance during the review period. The study however did not indicate the prosies used for working capital consequently it made its findings and conclusions based on two Nigerian banks. The current study however will condotcom survey of all commercial banks in Kenya Ali (2018) studied the impact of working capital management on bunks performance in UK The study covered ten (1) United Kingdom Hanks for the period 2007 to 2017. The analysis of data employed panel ordinary least square method. The proxies for working capital were. borrowers' collection period (BCP creditors' payment period (CPP) and banks case conversion cycle (BCCC) while the profitability indicators were cum one (ROA) and Net interest margin (NIM). The study correlation results obtained indicated negative relationship between profitability and BCP and CPP while BCCC positive effect on profitability. The repression analyses indicated that caly BCP was found to be statistically significant Study conducted from 2007-2011 by (Gamith & Rathinanee 2014) mestigate the relationship between working capital and proditability of listed commercial banks in Sti Lanka. The sample sire was seven (7) fim. The study wes hoch Pearson correlation to show 67 International Academi Awal of Ecommerce Volume 13.00 the relationship between working capital and profitability and regression analysis to show the effect working capital has on profitability. The working capital proxies were current ratio (CR. loan to deposit ratio (LDR) and cash ratio (CSR) and the profitability proxies were net profit margin (NPM, return on asset (ROA) and return on capital employed (ROCE). The stady findings indicate that CSR has great impact on NPM and ROA than other variable Generally working capital management has pret impact on profitability of the Sri Lanka listed commercial banks RESEARCH METHODOLOGY Research Design The study adopted a descriptive research design. This method relies on observation and ACEST tady findings indicate that CSR has great Na ROA thother variables Generally working capital mathemat e profitability of the Solankan inted commercial and RESEARCH METHODOLOGY Research Design The study adopted a descriptive design. This method retien bervation and description of numerical data send behaviour of cable without informing them. Daleck (1993) posts that descriptive design conte explanation of eventplimenchantistics is commix Empirical Model The multiple regression function et dependent independent variables for this study was compared as follow Where y-financial performance: 30 x 2X-region coefficient. CD - deponit LO-LEVI Target Populatie A population is total collection of the which are can be made. A praction of the plain fomed to sper & Shine 2000) The target population for the study wil.com the three miks Kenya Sample Design A co vy method will be adopted me the target putem is all comprising of all the commercial buat is therefore more efficient and effective method ather than carrying out the less According to Cooper & Schindler (2000). the easiest opta prin in time with respect to well-defined cases,pati production, trafic particular Data Collection Procedure The devant condary data will be called Keys Bankers Auto's comprehensive awe of the forty three chunks and from Central Bank of Kenya's during the period of taty of seven year 2018 The data from Kenya Baker's Accuton will be on ng Cape while the Central Bank of Kenya will be financial risk and variables from 3012 2013 The forty the commercial Bunks comprises Inally gevate et commercial hunki, 14 commercial banks we forged, and the local public gwned commercial banks (CBK.2017) RESEARCH RESULTS Table I below indicates a bed mmary of the bestuded in the repressive modele the way. Descriptive statistics describes the characteristics of the variables in the model. From the table below descriptive of me, maximum values, men and standard deviation can be interested Tuhle 1: Descriptive Statistics N Macam Sid Dito ROA 301 -15 TO 73754 29051687 Customer deposit 101 2011 33700 X1330 1619 Lidity 10 2013 151934 10112 Leverage 303 1208631 VN) RESEARCH RESULTS Table below indicates a brief summary of the variables included in the remode of the study. Descriptive writis describes the general chance of the model From the table below descriptive statistics of the minimum value me men and standard deviation can be interpretat Table 1: Descriptive Statistics N Sad Deum ROA 101 10:30 385871754 2016 Customer deposit 101 20.11 $17.00 10353620 389 Liquidity 201 9254 348195348 101125 Leverage 301 SI Valid N (litwie 301 Remotes a minimum value of 130 na mesmame with verage me value of 36 and standard deviation of 2.9. Customer des minime value of 20.11 and mean value of 53742 with me 1.04 and a standard deviation of 81.16. Ludity moco aval 2013 maximum value of 98.5, with an engem value of 4.5 standard de 10. Leverage records a minimum value of 0.12 anda masimum value wenye maan val of 0.45 and standard deviatice of 0.12 Table 2 Medel Summary Madel R Adjusted RS Sid. Emofthe 1 370 2017 27299 Predictos Constant, leverage, quidity, customer depois The cut shown in the includes inform the quantity of explained by the predictor variables ( La Lady and the fee stamist. R. is the multiple creation efficient between the price the dependent variable bathimedel, the 0.755, which indicates the deal of variance shared by leverage. Liquidity and depende The next valu. Sunt simply the quand of. This free describe the goodness of-fit or the art of wine esplained by a variables. In this model, the value is 0.370, which was that of the Fonis explained leverage. Tidity and Table 3: ANOVA Model Sum of MSF Regression 319.305 106.36 Residual Total 2531994 300 Dependend ROA Predictions Conta leverage liquidity.com The analysis of variance in the table 3 infoem whether the regime significant. We tell whether it's statistically significant by looking at the In this model the table indicates that the real made a statistically con wao.000 Table 4 Coefficients S 300 Unstandarded Standard Coefficiens Sad more 1 Constant 6.151 748 Cluster det DON 000 -0% 016 Love 910 - a Dependen Verwe ROA slo From the table the multiple regresi qution obtame will be ROA-6151 From the table the multiple regretted will be ROA151 0.001CD607910-001 LEY The predictive power of the independent variables in indian by the office in the table above. This implies that a comer deposit has a positive thanks profitability that Customer deposit: The model predicts that eas dinalni efemer, profitability increases by 000 unitholling liquidity leverage C deposits have a significant effect on banks profitability. Teing fic wc the mall hypothesis and conclude tut customer deposits affect bucks per the findings are consistent with the finding of mandiefe (2016) Liquidity: The model predict that is an additional mit of liquidity, huile decreases by 0.079 in holding customer deposits and leverage content des Auerstmal dentrinis.dow of Ecommend new... significant effect bank profitabilny Being significant we will see hypothesis and conclude the liquidity affects and performance. The findiepe with the liquidity preference towy which explains that may he most used for the day to day of his Leverage. The model predicts that madalt of lenge. Bespre decreases by 0.91 utiliding customer deposits and liquidity can be insignificant effect bank profitability ing ngificant we will also all hypothesis and conclude the leverage has no effect on bunks performance. The finding are comitent with the peaking order they which explains that componentely funds first before going for extema finde CONCLUSION The study sought to examine the effect of short-term finuty the final price of commercial basis Kenya. To achieve the objective punel det om 1239 extracted from financial statements of cercal banko Kimya tu wasio customer deposits and liquidity have significant effect optibility while forvente imignificant effect on ability of commercial REFERENCES Abeshamel, SNM. & Sulaiman 1 2014. Cal Holdings Coque Pub Some Evidence firm Janda Shitet 98-907 Alala. A Nyabuti, W. (2016). The relationship between Working Capital Management Policy and Financial Performance of Compact Son Exchange, Kenya International Journal of Em MS ALL, D. (2013) Impact of Working Capital Management on Previdence from UK Alshati. AS. 2016). The cost of liquidity mement the profile mercial banks Investment Manage and be Valome 1.26 Amed. G. (2008). Corporated London, English Education in Azeem. M.M., & Manap, A. (2015). Determinant factors and writing capital International Journal of Economic and in 221. 230-240 Red fron mp doorg10.553930 llagh, T. Nant, MIK, MA, Ram, 2010). The post of management of financial performance Evidence to Pet International of Economics and Financial OL 102-105 Retrieved from www.com.cn INTRODUCTION Banking industry plays a critical role in the screen moment of my country the world. This would limafely lead han development of contry's cc vironment. The financial manager is faced with tree basic financial decision in financial management, the financing decision management decision and investimmt decision Financing decision plays the most critical role became at the sea bainh ho source foc start-up capital hun et al. 2013) The banking industry is constantly faced with the challenges of pudient financial performance Corporate managers always have to that the mes enrested to them are allocated to proper use. The preure to a fim predeces positive results mates from stakeholders who have invested financial resources with hope of obtaining pool tum. The profitability is ayaktick este fimm's sperational efficiency Umerend 2013 Therefore effective and efficient working capital management practices may contribute to company's prosperityst forms part of a company's short termice More narch has been carried on camine factors that affect firm policability and attempt the rom variables considered working capital has come early playing a critical role Mandiufe (20 Sb.com financing is primarily concerned with the decision of day to day running of business. There decisions include the appeopriate cont of cash receivables, payables, inventaries and as well as the level of mix of short-term financing Yahaya and Balconiends that a reduction in a fim financial performance is more likely a result of ineffective and inefficient management of short-term financing decision Makon (2015) argues that a firm which effectively tapes its working capital has a high potential of improving its financial performance. Fully cash flows to firme boceted by elicient management of working capital and intun increase the prospect of investorstum Jernetum). Adem Journal of Commewe utume , dow Xma.se against this background that this study seeks to establish the feet of ston-term financing decisions on the financial performance of commercial hints in Kenya GENERAL OBJECTIVE The general bootive of the study is to examine the effect of so-term financing financial performance of commercial Bank in Kenya SPECIFIC OBJECTIVES 1. To determine the effect of customer deperits on financial performance of commercial hanks in Kenya 2. To ascertain the effect of liquidity ratu can financial performance of commercial hanks in Kanya To stablish the effect of severape en financial performance of commercial Banks in Kenya RESEARCH HYPOTHESES Nes: Customer deposits do not have a significant effect on financial performance of Commercial links in Kenya Hey Laundity ratio dies have significant eller en financial performance of Commercial Banks in Kenya Mos Leverage does not have significant effect on financial performance of Commercial Banks is Kenya THEORETICAL REVIEW Liquidity Preference They The concept was first comed by Keynes (1996) according to Keynes organisations hold cash for three main confor tractica para as this will enable companies meet its day to day transactions as they fall du stakeholders have high demand for cash her than in the liquid fom in onder to meet their daily ligation in the of banking institutions they will cover daily customer withdrawal Second for patiary as they cane de