Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I want a second opinon on this if possible Calculate the initial outlay, annual cash flows, WACC, NPV, IRR, PI, and payback period for the

I want a second opinon on this if possible

I want a second opinon on this if possible

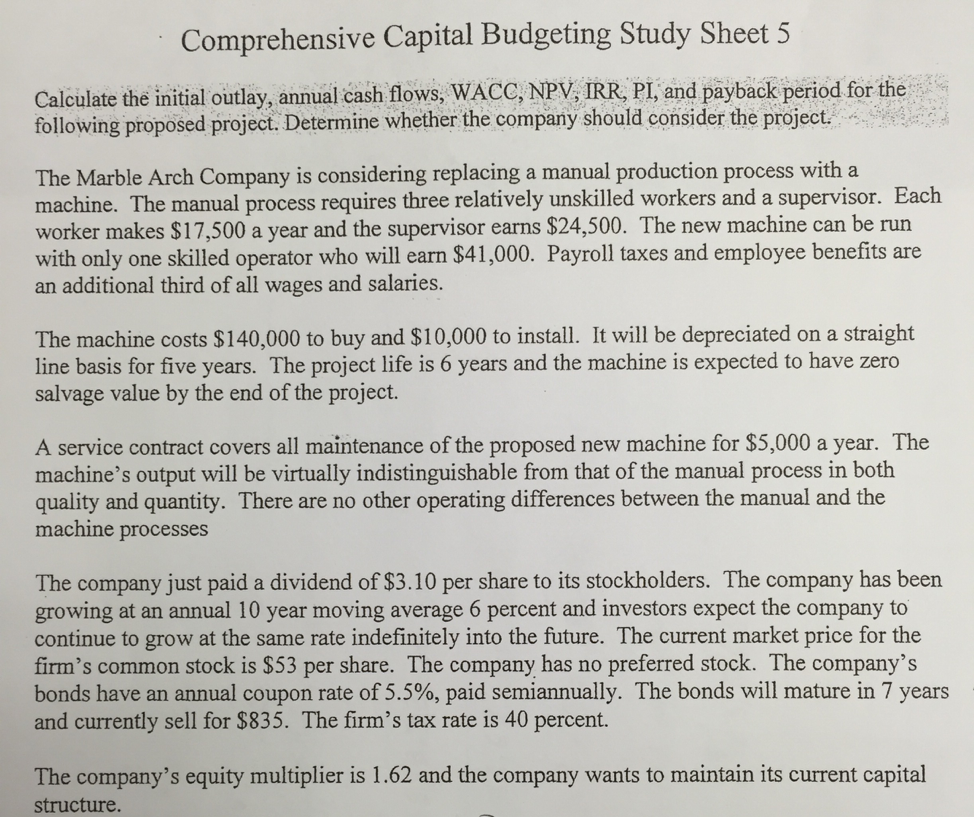

Calculate the initial outlay, annual cash flows, WACC, NPV, IRR, PI, and payback period for the following proposed project. Determine whether the company should consider the project. The Marble Arch Company is considering replacing a manual production process with a machine. The manual process requires three relatively unskilled workers and a supervisor. Each worker makes $17,500 a year and the supervisor earns $24,500. The new machine can be run with only one skilled operator who will earn $41,000. Payroll taxes and employee benefits are an additional third of all wages and salaries. The machine costs $140,000 to buy and $10,000 to install. It will be depreciated on a straight line basis for five years. The project life is 6 years and the machine is expected to have zero salvage value by the end of the project. A service contract covers all maintenance of the proposed new machine for $5,000 a year. The machine's output will be virtually indistinguishable from that of the manual process in both quality and quantity. There are no other operating differences between the manual and the machine processes. The company just paid a dividend of $3.10 per share to its stockholders. The company has been growing at an annual 10 year moving average 6 percent and investors expect the company to continue to grow at the same rate indefinitely into the future. The current market price for the firm's common stock is $53 per share. The company has no preferred stock. The company's bonds have an annual coupon rate of 5.5%, paid semiannually. The bonds will mature in 7 years and currently sell for $835. The firm's tax rate is 40 percent. The company's equity multiplier is 1.62 and the company wants to maintain its current capital structure

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started