Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I want all of the pros and cons of taking out a bond and pros and cons of issuing preferred stock. on the picture of

I want all of the pros and cons of taking out a bond and pros and cons of issuing preferred stock.

on the picture of the assignment. above " required" should give both financeing options. 1) Instalment loan at 9% for 6years compounded annually. or 2)non-cumulative, 125 par value, 10%perferd stock. I need to know all the advantages and disadvantages to both

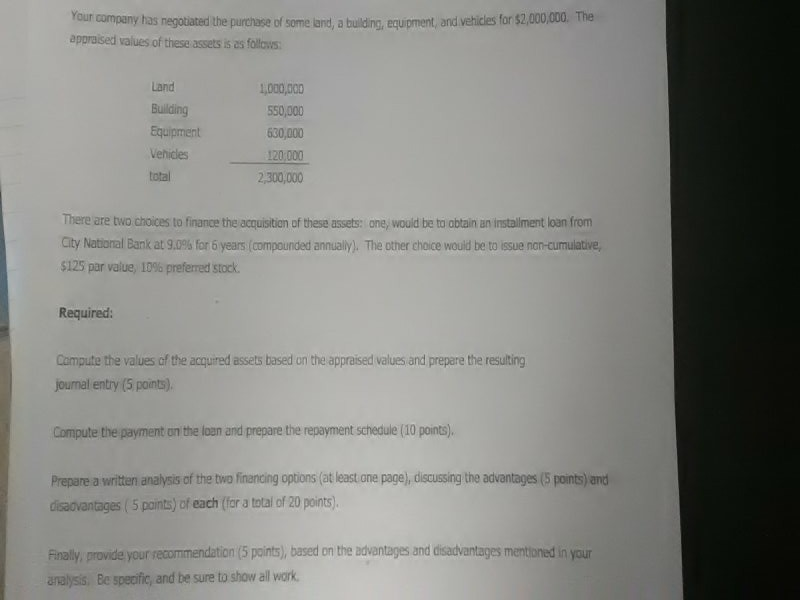

Your company has negotiated the purchase of some land, a building, equipment, and vehicles for $2,000,000. The appraised values of these assets is as follaws Land 1,000,000 Building 550,000 Equipment 630,000 Vehicles 120.000 total 2,300,000 There are two choices to finance the acquisition of these assets: one, would be to obtain an installment loan from City National Bank at 9.09% for 6 years(compounded annually). The other choice would be to issue non-cumulative $125 par value, ID96 preferred stock Required: Compute the values cf the acquired assets based on the appraised values and prepare the resulting journal entry (5 points). Compute the payment on the loan and prepare the repayment schedule (10 points) Prepare a written analysis of the two financing options (at least one page), discussing the advantages (5 points) amd disadvantages (5 paints) of each (for a total of 20 points) Finally provide your recommendation(5 points), based on the advantages and disadvantages mentioned in your analysis Be specific, and be sure to show all work Your company has negotiated the purchase of some land, a building, equipment, and vehicles for $2,000,000. The appraised values of these assets is as follaws Land 1,000,000 Building 550,000 Equipment 630,000 Vehicles 120.000 total 2,300,000 There are two choices to finance the acquisition of these assets: one, would be to obtain an installment loan from City National Bank at 9.09% for 6 years(compounded annually). The other choice would be to issue non-cumulative $125 par value, ID96 preferred stock Required: Compute the values cf the acquired assets based on the appraised values and prepare the resulting journal entry (5 points). Compute the payment on the loan and prepare the repayment schedule (10 points) Prepare a written analysis of the two financing options (at least one page), discussing the advantages (5 points) amd disadvantages (5 paints) of each (for a total of 20 points) Finally provide your recommendation(5 points), based on the advantages and disadvantages mentioned in your analysis Be specific, and be sure to show all workStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started