Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I want all the financial ratios for the above data. The Business Plan Introduction about my business plan: My business plan is to grow organic

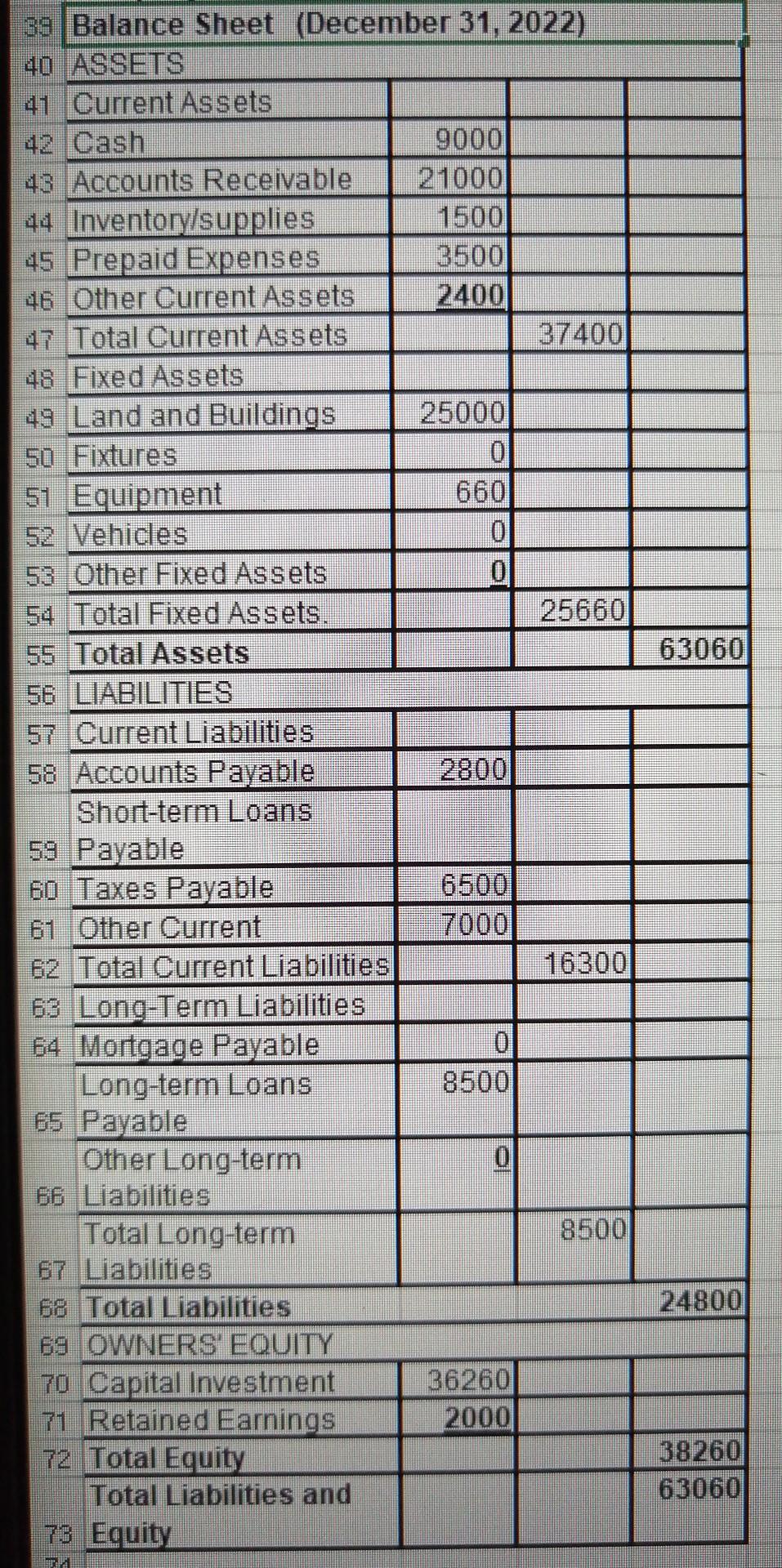

I want all the financial ratios for the above data.

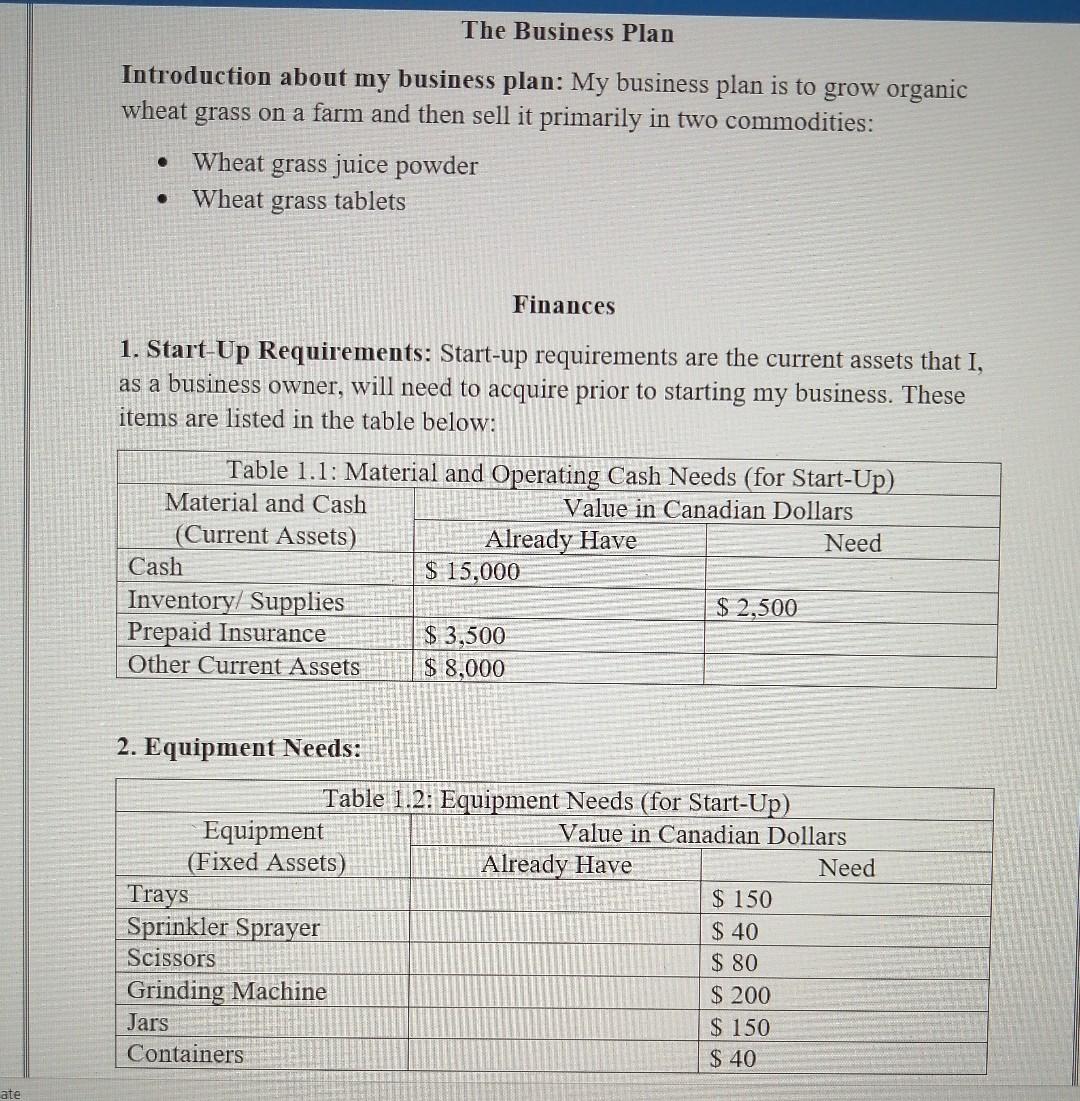

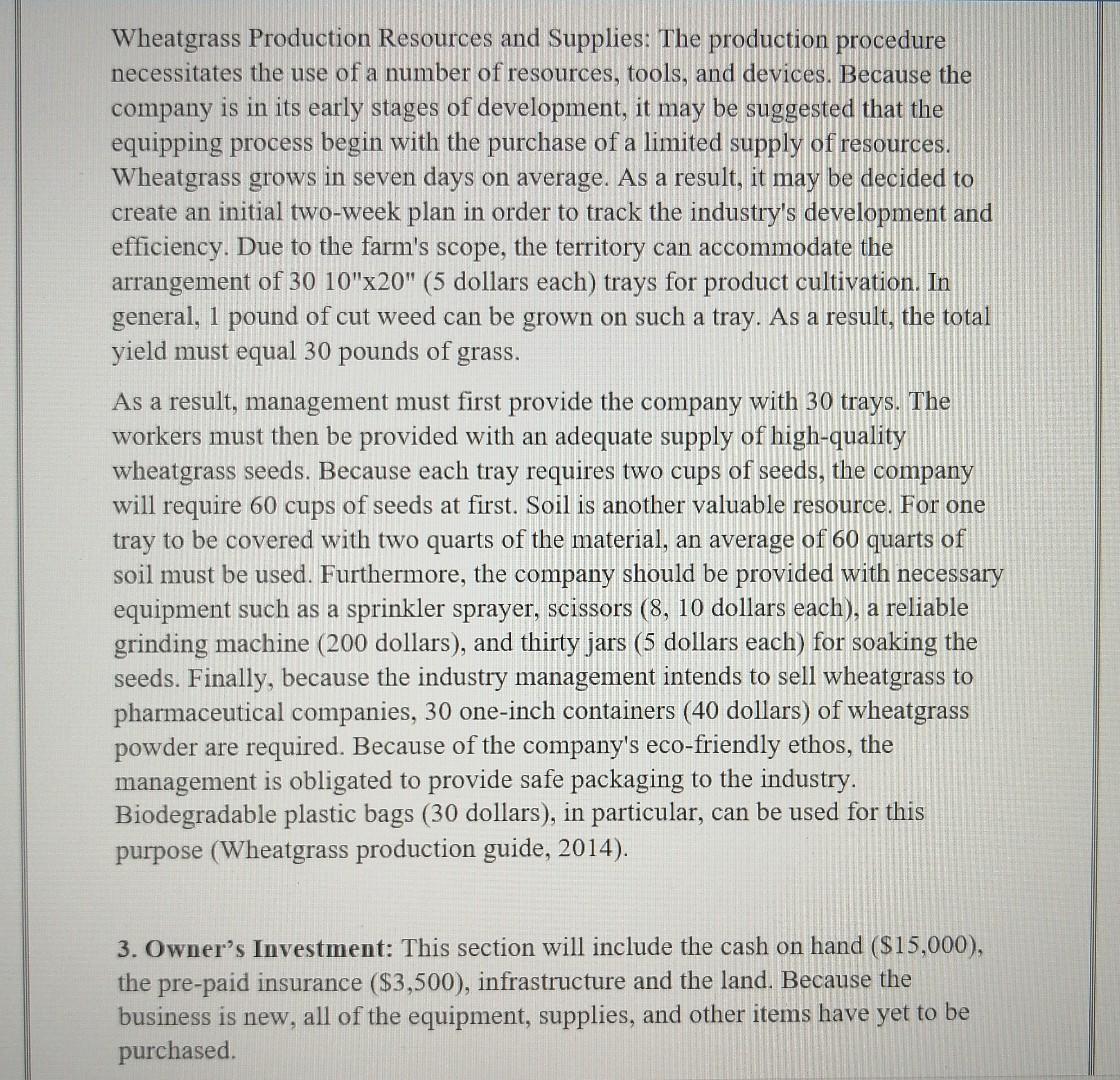

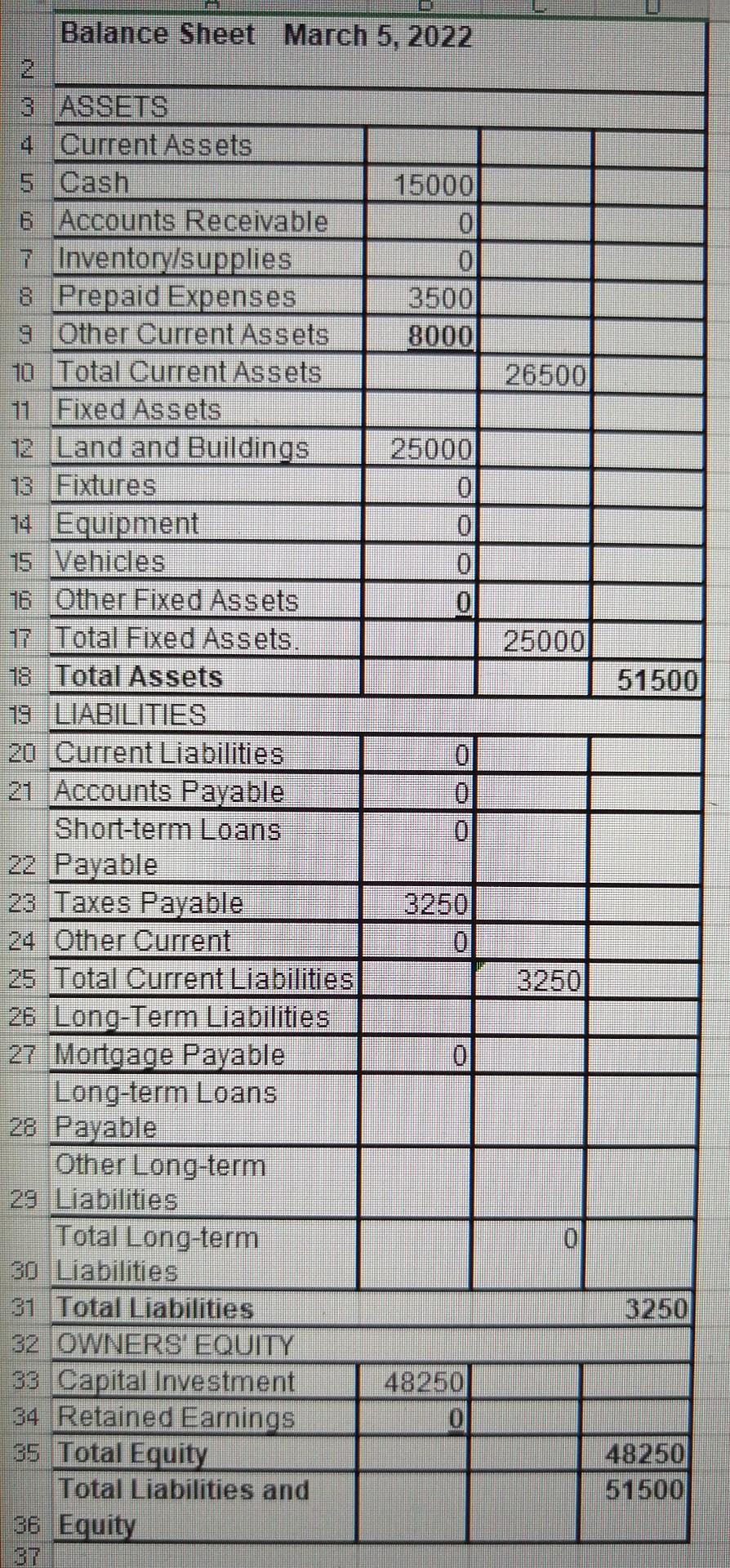

The Business Plan Introduction about my business plan: My business plan is to grow organic wheat grass on a farm and then sell it primarily in two commodities: Wheat grass juice powder Wheat grass tablets Finances 1. Start-Up Requirements: Start-up requirements are the current assets that I, as a business owner, will need to acquire prior to starting my business. These items are listed in the table below: Table 1.1: Material and Operating Cash Needs (for Start-Up) Material and Cash Value in Canadian Dollars (Current Assets) Already Have Need Cash $ 15,000 Inventory Supplies $ 2,500 Prepaid Insurance $ 3,500 Other Current Assets $ 8,000 2. Equipment Needs: Table 1.2: Equipment Needs (for Start-Up) Equipment Value in Canadian Dollars (Fixed Assets) Already Have Need Trays $ 150 Sprinkler Sprayer $ 40 Scissors $ 80 Grinding Machine $ 200 Jars $ 150 Containers $ 40 ate Wheatgrass Production Resources and Supplies: The production procedure necessitates the use of a number of resources, tools, and devices. Because the company is in its early stages of development, it may be suggested that the equipping process begin with the purchase of a limited supply of resources. Wheatgrass grows in seven days on average. As a result, it may be decided to create an initial two-week plan in order to track the industry's development and efficiency. Due to the farm's scope, the territory can accommodate the arrangement of 30 10"x20" (5 dollars each) trays for product cultivation. In general, 1 pound of cut weed can be grown on such a tray. As a result, the total yield must equal 30 pounds of grass. As a result, management must first provide the company with 30 trays. The workers must then be provided with an adequate supply of high-quality wheatgrass seeds. Because each tray requires two cups of seeds, the company will require 60 cups of seeds at first. Soil is another valuable resource. For one tray to be covered with two quarts of the material, an average of 60 quarts of soil must be used. Furthermore, the company should be provided with necessary equipment such as a sprinkler sprayer, scissors (8, 10 dollars each), a reliable grinding machine (200 dollars), and thirty jars (5 dollars each) for soaking the seeds. Finally, because the industry management intends to sell wheatgrass to pharmaceutical companies, 30 one-inch containers (40 dollars) of wheatgrass powder are required. Because of the company's eco-friendly ethos, the management is obligated to provide safe packaging to the industry. Biodegradable plastic bags (30 dollars), in particular, can be used for this purpose (Wheatgrass production guide, 2014). 3. Owner's Investment: This section will include the cash on hand ($15,000), the pre-paid insurance ($3,500), infrastructure and the land. Because the business is new, all of the equipment, supplies, and other items have yet to be purchased. 3. Owner's Investment: This section will include the cash on hand ($15,000), the pre-paid insurance ($3,500), infrastructure and the land. Because the business is new, all of the equipment, supplies, and other items have yet to be purchased 4. Borrowed Money: As a business owner, I would rather take out a loan from a bank than borrow money from other sources. Loans or long-term liabilities of around 35,000 dollars are estimated. 5. Balance Sheet: Balance sheet is on excel submitted along with this document. Balance Sheet March 5, 2022 15000 0 3500 8000 26500 25000 0 0 0 25000 51500 0 3 ASSETS 4. Current Assets 5 Cash 6 Accounts Receivable 7 Inventory/supplies 8 Prepaid Expenses 9 lOther Current Assets 10 Total Current Assets 11 Fixed Assets 12 Land and Buildings 13 Fixtures 14 Equipment 15 Vehicles 16 Other Fixed Assets 17 Total Fixed Assets. 18 Total Assets 19 LIABILITIES 20 Current Liabilities 21 Accounts Payable Short-term Loans 22 Payable 23 Taxes Payable 24 Other Current 25 Total Current Liabilities 26 Long-Term Liabilities 27 Mortgage Payable Long-term Loans 28 Payable Other Long-term 29 Liabilities Total Long-term 30 Liabilities 31 Total Liabilities 32 OWNERS' EQUITY 33 Capital Investment 34 Retained Earnings 35 Total Equity Total Liabilities and 36 Equity 0 0 0 3250 3250 48250 0 48250 51500 63060 39 Balance Sheet (December 31, 2022) 40 ASSETS 41 Current Assets 42 Cash 9000 43 Accounts Receivable 21000 44 Inventory/supplies 1500 45 Prepaid Expenses 3500 46 Other Current Assets 2400 47 Total Current Assets 37400 48 Fixed Assets 49 Land and Buildings 25000 50 Fixtures 0 51 Equipment 660 52 Vehicles 53 Other Fixed Assets 0 54 Total Fixed Assets. 25660 55 Total Assets 56 LIABILITIES 57 Current Liabilities 58 Accounts Payable 2800 Short-term Loans 59 Payable 60 Taxes Payable 6500 61 Other Current 7000 62 Total Current Liabilities 16300 63 Long-Term Liabilities 64 Mortgage Payable 0 Long-term Loans 8500 65 Payable Other Long-term 66 Liabilities Total Long-term 8500 67 Liabilities 68 Total Liabilities 69 OWNERS' EQUITY 70 Capital Investment 36260 71 Retained Earnings 2000 72 Total Equity Total Liabilities and 73 Equity 0 24800 38260 63060 The Business Plan Introduction about my business plan: My business plan is to grow organic wheat grass on a farm and then sell it primarily in two commodities: Wheat grass juice powder Wheat grass tablets Finances 1. Start-Up Requirements: Start-up requirements are the current assets that I, as a business owner, will need to acquire prior to starting my business. These items are listed in the table below: Table 1.1: Material and Operating Cash Needs (for Start-Up) Material and Cash Value in Canadian Dollars (Current Assets) Already Have Need Cash $ 15,000 Inventory Supplies $ 2,500 Prepaid Insurance $ 3,500 Other Current Assets $ 8,000 2. Equipment Needs: Table 1.2: Equipment Needs (for Start-Up) Equipment Value in Canadian Dollars (Fixed Assets) Already Have Need Trays $ 150 Sprinkler Sprayer $ 40 Scissors $ 80 Grinding Machine $ 200 Jars $ 150 Containers $ 40 ate Wheatgrass Production Resources and Supplies: The production procedure necessitates the use of a number of resources, tools, and devices. Because the company is in its early stages of development, it may be suggested that the equipping process begin with the purchase of a limited supply of resources. Wheatgrass grows in seven days on average. As a result, it may be decided to create an initial two-week plan in order to track the industry's development and efficiency. Due to the farm's scope, the territory can accommodate the arrangement of 30 10"x20" (5 dollars each) trays for product cultivation. In general, 1 pound of cut weed can be grown on such a tray. As a result, the total yield must equal 30 pounds of grass. As a result, management must first provide the company with 30 trays. The workers must then be provided with an adequate supply of high-quality wheatgrass seeds. Because each tray requires two cups of seeds, the company will require 60 cups of seeds at first. Soil is another valuable resource. For one tray to be covered with two quarts of the material, an average of 60 quarts of soil must be used. Furthermore, the company should be provided with necessary equipment such as a sprinkler sprayer, scissors (8, 10 dollars each), a reliable grinding machine (200 dollars), and thirty jars (5 dollars each) for soaking the seeds. Finally, because the industry management intends to sell wheatgrass to pharmaceutical companies, 30 one-inch containers (40 dollars) of wheatgrass powder are required. Because of the company's eco-friendly ethos, the management is obligated to provide safe packaging to the industry. Biodegradable plastic bags (30 dollars), in particular, can be used for this purpose (Wheatgrass production guide, 2014). 3. Owner's Investment: This section will include the cash on hand ($15,000), the pre-paid insurance ($3,500), infrastructure and the land. Because the business is new, all of the equipment, supplies, and other items have yet to be purchased. 3. Owner's Investment: This section will include the cash on hand ($15,000), the pre-paid insurance ($3,500), infrastructure and the land. Because the business is new, all of the equipment, supplies, and other items have yet to be purchased 4. Borrowed Money: As a business owner, I would rather take out a loan from a bank than borrow money from other sources. Loans or long-term liabilities of around 35,000 dollars are estimated. 5. Balance Sheet: Balance sheet is on excel submitted along with this document. Balance Sheet March 5, 2022 15000 0 3500 8000 26500 25000 0 0 0 25000 51500 0 3 ASSETS 4. Current Assets 5 Cash 6 Accounts Receivable 7 Inventory/supplies 8 Prepaid Expenses 9 lOther Current Assets 10 Total Current Assets 11 Fixed Assets 12 Land and Buildings 13 Fixtures 14 Equipment 15 Vehicles 16 Other Fixed Assets 17 Total Fixed Assets. 18 Total Assets 19 LIABILITIES 20 Current Liabilities 21 Accounts Payable Short-term Loans 22 Payable 23 Taxes Payable 24 Other Current 25 Total Current Liabilities 26 Long-Term Liabilities 27 Mortgage Payable Long-term Loans 28 Payable Other Long-term 29 Liabilities Total Long-term 30 Liabilities 31 Total Liabilities 32 OWNERS' EQUITY 33 Capital Investment 34 Retained Earnings 35 Total Equity Total Liabilities and 36 Equity 0 0 0 3250 3250 48250 0 48250 51500 63060 39 Balance Sheet (December 31, 2022) 40 ASSETS 41 Current Assets 42 Cash 9000 43 Accounts Receivable 21000 44 Inventory/supplies 1500 45 Prepaid Expenses 3500 46 Other Current Assets 2400 47 Total Current Assets 37400 48 Fixed Assets 49 Land and Buildings 25000 50 Fixtures 0 51 Equipment 660 52 Vehicles 53 Other Fixed Assets 0 54 Total Fixed Assets. 25660 55 Total Assets 56 LIABILITIES 57 Current Liabilities 58 Accounts Payable 2800 Short-term Loans 59 Payable 60 Taxes Payable 6500 61 Other Current 7000 62 Total Current Liabilities 16300 63 Long-Term Liabilities 64 Mortgage Payable 0 Long-term Loans 8500 65 Payable Other Long-term 66 Liabilities Total Long-term 8500 67 Liabilities 68 Total Liabilities 69 OWNERS' EQUITY 70 Capital Investment 36260 71 Retained Earnings 2000 72 Total Equity Total Liabilities and 73 Equity 0 24800 38260 63060Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started