Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i want correct answer of A&B both and in operationg income also , previous answer in chegg wrong don't copy for any where with answer

i want correct answer of A&B both and in operationg income also , previous answer in chegg wrong don't copy for any where with answer i want explanantion how did u calculate else i will give dislikes

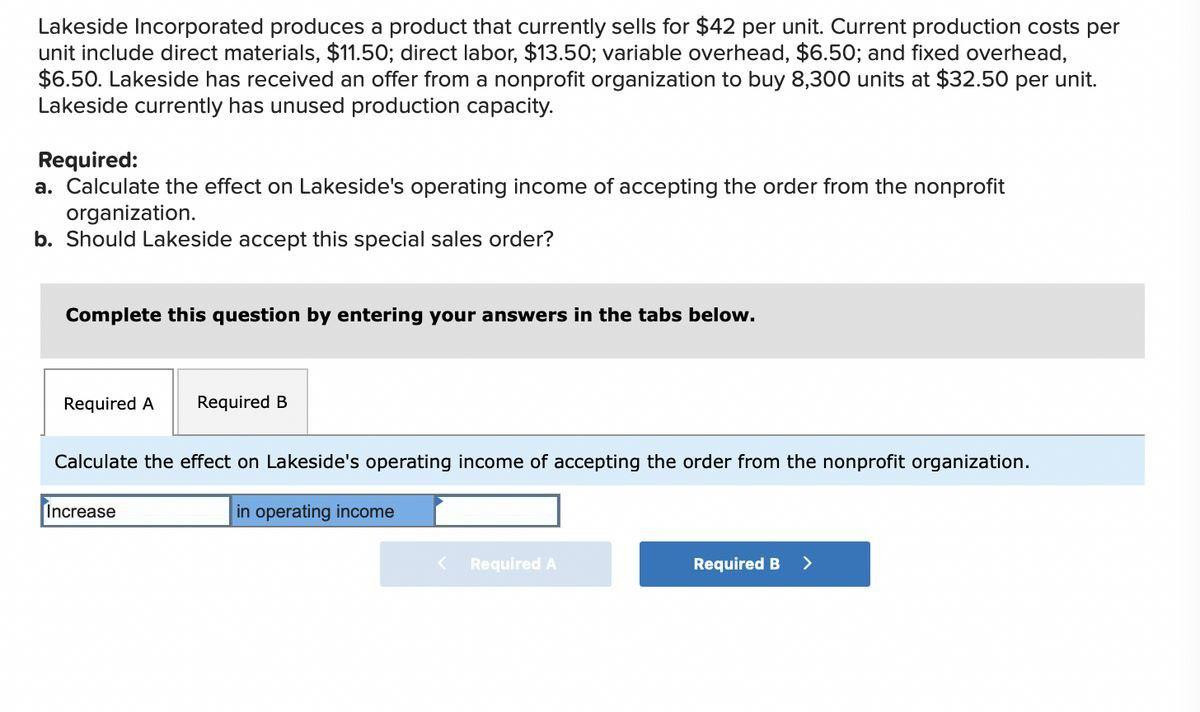

Lakeside Incorporated produces a product that currently sells for $42 per unit. Current production costs per unit include direct materials, \$11.50; direct labor, \$13.50; variable overhead, $6.50; and fixed overhead, $6.50. Lakeside has received an offer from a nonprofit organization to buy 8,300 units at $32.50 per unit. Lakeside currently has unused production capacity. Required: a. Calculate the effect on Lakeside's operating income of accepting the order from the nonprofit organization. b. Should Lakeside accept this special sales order? Complete this question by entering your answers in the tabs below. Calculate the effect on Lakeside's operating income of accepting the order from the nonprofit organization

Lakeside Incorporated produces a product that currently sells for $42 per unit. Current production costs per unit include direct materials, \$11.50; direct labor, \$13.50; variable overhead, $6.50; and fixed overhead, $6.50. Lakeside has received an offer from a nonprofit organization to buy 8,300 units at $32.50 per unit. Lakeside currently has unused production capacity. Required: a. Calculate the effect on Lakeside's operating income of accepting the order from the nonprofit organization. b. Should Lakeside accept this special sales order? Complete this question by entering your answers in the tabs below. Calculate the effect on Lakeside's operating income of accepting the order from the nonprofit organization Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started