Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I want detail answer please. will marks helpful Problem #3: Please refer to the corporate tax rates table and the Gross Profit Chart below: Account

I want detail answer please. will marks helpful

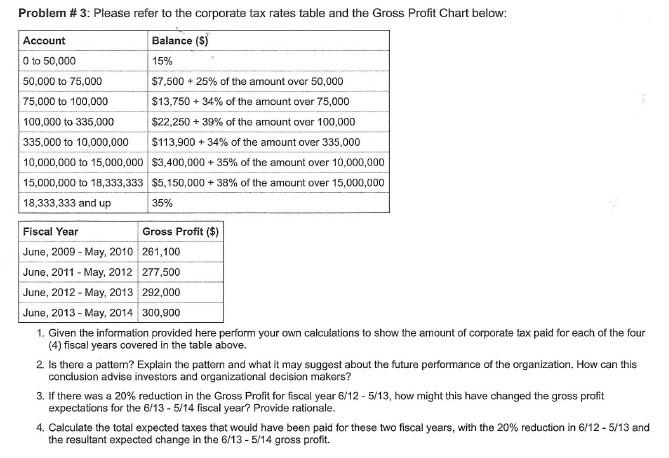

Problem #3: Please refer to the corporate tax rates table and the Gross Profit Chart below: Account Balance (s) 0 to 50,000 15% 50,000 to 75,000 $7,500 + 25% of the amount over 50,000 75,000 to 100,000 $13,750 + 34% of the amount over 75,000 100,000 to 335,000 $22,250 + 39% of the amount over 100,000 335,000 to 10,000,000 $113,900 + 34% of the amount over 335,000 10,000,000 to 15,000,000 $3,400,000 + 35% of the amount over 10,000,000 15,000,000 to 18,333,333 $5,150,000 + 38% of the amount over 15,000,000 18,333,333 and up 35% Fiscal Year Gross Profit ($) June, 2009 - May, 2010 261,100 June, 2011 - May, 2012 277,500 June, 2012 - May, 2013 292,000 June, 2013 - May, 2014 300,900 1. Given the information provided here perform your own calculations to show the amount of corporate tax paid for each of the four (4) fiscal years covered in the table above. 2. Is there a pattern? Explain the pattern and what it may suggest about the future performance of the organization. How can this conclusion advise investors and organizational decision makers? 3. If there was a 20% reduction in the Gross Profit for fiscal year 6/12-5/13, how might this have changed the gross profit expectations for the 6/13 - 5/14 fiscal year? Provide rationale. 4. Calculate the total expected taxes that would have been paid for these two fiscal years, with the 20% reduction in 6/12 - 5/13 and the resultant expected change in the 6/13 - 5/14 gross profitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started