Answered step by step

Verified Expert Solution

Question

1 Approved Answer

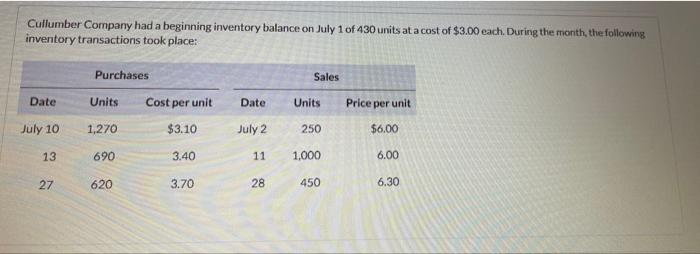

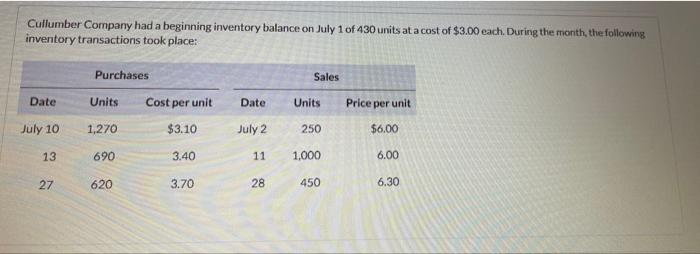

i want full answer , please Cullumber Company had a beginning inventory balance on July 1 of 430 units at a cost of $3.00 each.

i want full answer , please

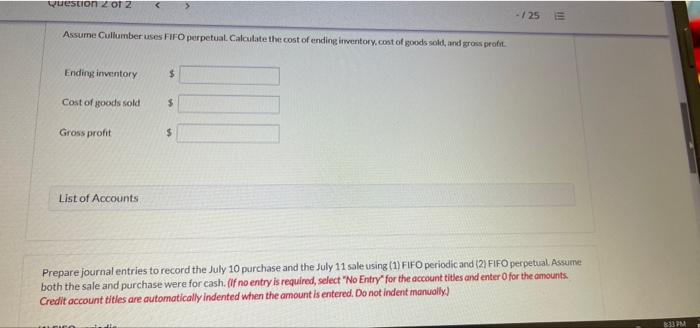

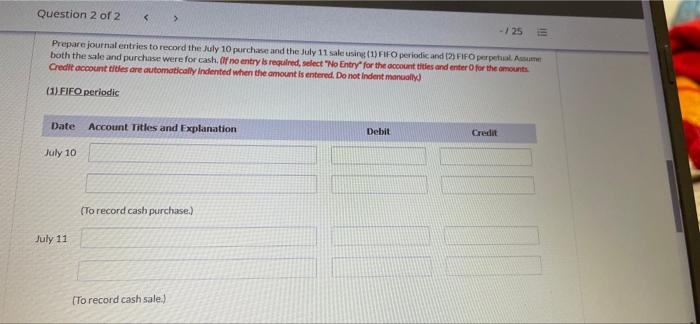

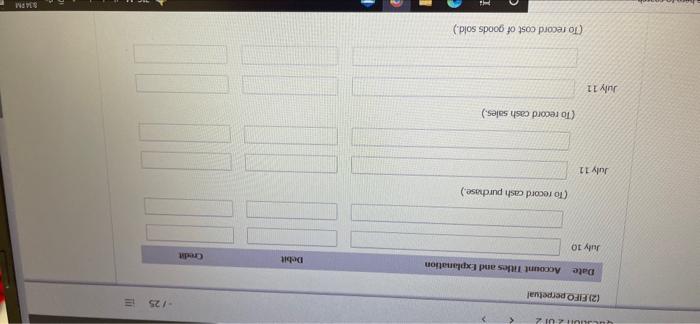

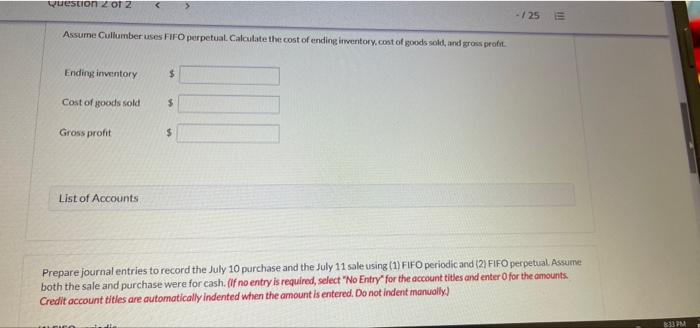

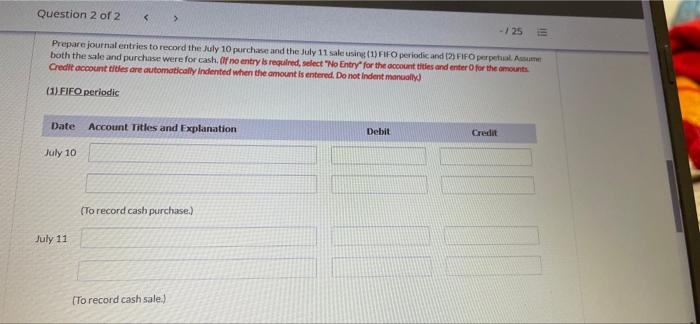

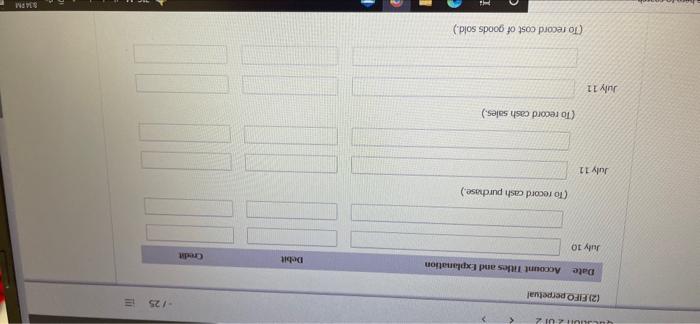

Cullumber Company had a beginning inventory balance on July 1 of 430 units at a cost of $3.00 each. During the month, the following inventory transactions took place: Purchases Sales Date Units Cost per unit Date Units Price per unit July 10 1,270 $3.10 July 2 250 $6.00 13 690 3.40 11 1.000 6.00 27 620 3.70 28 450 6.30 Question 2 of 2 -125 Il Assume Cullumber uses FIFO perpetual Calculate the cost of ending inventory.cost of goods sold, and gross profit Ending inventory $ Cost of goods sold $ Gross pront $ List of Accounts Prepare journal entries to record the July 10 purchase and the July 11 sale using (1) FIFO periodic and (2) FIFO perpetual. Assume both the sale and purchase were for cash. (If no entry is required, select "No Entry for the account titles and enter for the amounts Credit account titles are automatically indented when the amount is entered. Do not Indent manually) 811 PM Question 2 of 2 > - 25 Prepare journal entries to record the July 10 purchase and the July 11 sale using (1) FIFO periodic and (2) FIFO perpetual both the sale and purchase were for cash. Of no entry is required, select "No Entry for the account tities and enter for the amounts Credit account dies are automatically Indented when the amount is entered. Do not Indent manually (1) FIFO periodic Date Account Titles and Explanation Debit Credit July 10 (To record cash purchase.) July 11 (To record cash sale.) ULIE 2012 -125 123 FIFO perpetual Date Account Titles and Explanation Credit July 10 (To record cash purchase.) July 11 (To record cash sales.) July 11 (To record cost of goods sold.) 8:14 PM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started