Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I want more detailed and detailed answer starting from calculating the balance of the income from Sun account and the balance of the investment in

I want more detailed and detailed answer starting from calculating the balance of the income from Sun account and the balance of the investment in Sun account. There is no cost of sales balance in this question, why? Then I need a journaling with alphabetical numbering (abcd). Then, the consolidated financial statements in the adjusting journal section may be marked with the ABCD numbering sourced from the results of posting the adjusting journals.

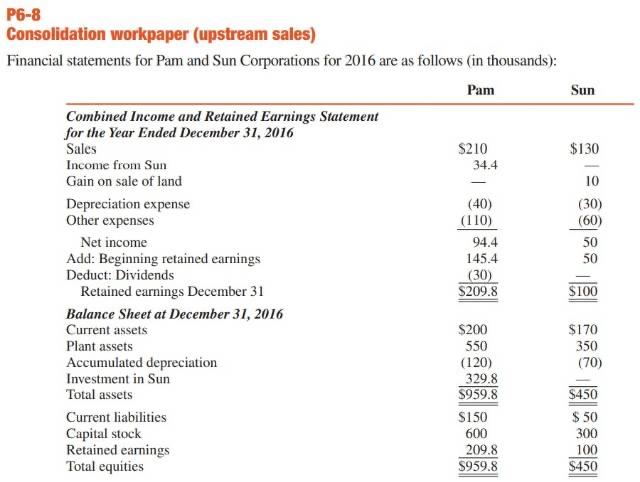

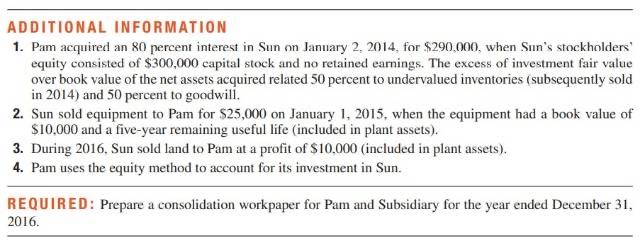

68 Consolidation workpaper (upstream sales) inancial statements for Pam and Sun Corporations for 2016 are as follows (in thousands): 1. Pam acquired an 80 percent interest in Sun on January 2, 2014, for $290,000, when Sun's stockholders' equity consisted of $300,000 eapital stock and no retained earnings. The excess of investment fair value over book value of the net assets acquired related 50 percent to undervalued inventories (subsequently sold in 2014) and 50 percent to goodwill. 2. Sun sold equipment to Pam for $25,000 on January 1, 2015, when the equipment had a book value of $10,000 and a five-year remaining useful life (included in plant assets). 3. During 2016, Sun sold land to Pam at a profit of $10,000 (included in plant assets). 4. Pam uses the equity method to account for its investment in Sun. REQUIRED: Prepare a consolidation workpaper for Pam and Subsidiary for the year ended December 31, 2016. 68 Consolidation workpaper (upstream sales) inancial statements for Pam and Sun Corporations for 2016 are as follows (in thousands): 1. Pam acquired an 80 percent interest in Sun on January 2, 2014, for $290,000, when Sun's stockholders' equity consisted of $300,000 eapital stock and no retained earnings. The excess of investment fair value over book value of the net assets acquired related 50 percent to undervalued inventories (subsequently sold in 2014) and 50 percent to goodwill. 2. Sun sold equipment to Pam for $25,000 on January 1, 2015, when the equipment had a book value of $10,000 and a five-year remaining useful life (included in plant assets). 3. During 2016, Sun sold land to Pam at a profit of $10,000 (included in plant assets). 4. Pam uses the equity method to account for its investment in Sun. REQUIRED: Prepare a consolidation workpaper for Pam and Subsidiary for the year ended December 31, 2016Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started