Answered step by step

Verified Expert Solution

Question

1 Approved Answer

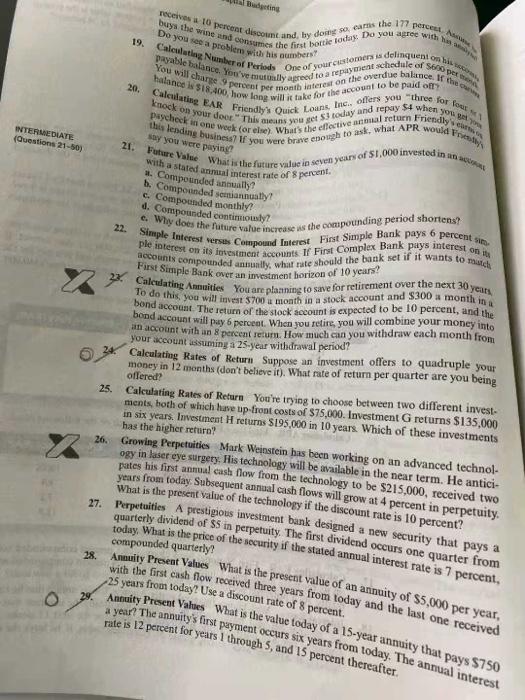

i want question 24 and 29 Bedeling receives 10 percent discount and by dos cams the 177 per Do you see a problem with his

i want question 24 and 29

Bedeling receives 10 percent discount and by dos cams the 177 per Do you see a problem with his numbers buys the wine and consumes the first borrie R Do you agree with us 19. Calculating Number of Periods One of your customers is delinquent on but payable balance. You've muy agreed to a repayment schedule of Spex You will charge 9 percent per month interest on the overdue balance. If 20. Calculating EAR Friendly's Quick Loans, Inc., offer you three for our halance is $18.400, how long will it take for the account to be paid of knock on your door. This as you ser today and repay $4 when you paycheck one weck (or eine). What's the effective actual return Friendly this leading business If you were brave enough to ask, what APR would love 21. Future Value What is the future value in seven years of $1,000 invested in a with a stated annual interest rate of 8 percent INTERMEDIATE (Questions 21-50 suy you were paying . Compounded annually? b. Compounded semiannually? Compounded monthly? d. c. Why does the future value increase the compounding period shortens? 6 22. Simple Interest versus Compound Interest First Simple Bank pays o percent ple interest on its investment accounts If First Complex Bank puys interest on accounts compounded annully, what rate should the bank set if it wants to match First Simple Bank over an investment horizon of 10 years? 2 Calculating Annuities You are planning to save for retirement over the next 30 y To do this, you will invest $700 a month in a stock account and $300 a month in a years, bond account. The return of the stock scount is expected to be 10 percent, and the bond account will pay 6 percent. When you retire, you will combine your money into account with an 8 percent return. How much can you withdraw each month from your account assuming a 25-year withdrawal period? Calculating Rates of Return Suppose an investment offers to quadruple your money in 12 months (don't believe it). What rate of return per quarter are you being offered 25. Calculating Rates of Return You're trying to choose between two different invest- ments, both of which have up front costs of $75,000. Investment G returns $135,000 in six years. Investment H returns $195,000 in 10 years. Which of these investments has the higher return? Growing Perpetuities Mark Weinstein has been working on an advanced technol- ogy in laser eye surgery. His technology will be available in the near term. He antici- pates his first annual cash flow from the technology to be $215,000, received two 26. years from today. Subsequent annual cash flows will grow at 4 percent in perpetuity. What is the present value of the technology if the discount rate is 10 percent? 27. Perpetuities A prestigious investment bank designed a new security that pays a quarterly dividend of $5 in perpetuity. The first dividend occurs one quarter from today. What is the price of the security if the stated annual interest rate is 7 percent, compounded quarterly? 28. Annuity Present Values What is the present value of an annuity of $5,000 per year, with the first cash flow received three years from today and the last one received 25 years from today? Use a discount rate of 8 percent. o Annuity Present Values What is the value today of a 15-year annuity that pays $750 a year? The annuity's first payment occurs six years from today. The annual interest rate is 12 percent for years I through 5, and 15 percent thereafter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started