Question

I want the answer in Arabic The first question : Choose the correct answer and move it obligatory in the table below the question: 1

I want the answer in Arabic

The first question : Choose the correct answer and move it obligatory in the table below the question: 1 / Which of the following is not considered within the facility's operational activities: D- sale of fixed assets c- receipts from customers b- tax payments a- payments to suppliers 2 / Among the methods for disclosing additional information: D- All of the above c- Corresponding items b- Explanatory notes a- Clarifications in parentheses 3 / When displaying information in the statement of financial position, it must be achieved in the presentation: D- All of the above. C- Full disclosure B- Readability A- Clarity 4 / Certificates of assurance of sold goods that extend for more than one accounting period appear within: D- Answer A & B C- Short Term Assets B- Estimated potential liabilities A- Long-term liabilities 5 / You have had the following information related to Al-Ofoq Company for the year ended 31/12/2019: Cash collected from customers: 500,000 riyals, dividends to shareholders paid in cash: 25,000 riyals, taxes paid in cash: 50,000 riyals, interest paid to lenders: 12,000 riyals, granting loans to others: 50,000 riyals, issuance of bonds: 100,000 riyals, cash paid to suppliers: 200,000 riyals . What is the amount of net cash flow from operating activities during 2019? D- 250,000 riyals c- 275,000 riyals b- 263,000 riyals a- 238,000 riyals 6 / The net income of Al-Abeer Company was 200,000 riyals for the year 2019, and the only item in the income statement that did not affect the cash was the consumption, which amounted to 15,000 riyals for the year. The changes in the items of the financial position list during the year 2019 were as follows: Net debtors account 45,000 riyals (increase), inventory: 30,000 riyals (decrease), creditors account: 25,000 riyals (decrease). What is the amount of net cash flow from operating activities during 2019? D - Nothing, which was mentioned c - an increase of 195,000 b - an increase of 175,000 a - an increase of 205,000 7 / You have the following information related to Al-Sabah Company for the year ended 31/12/2019: Cash dividends to shareholders: 20,000 riyals, payments for the purchase of fixed assets: 25,000 riyals, proceeds from the issuance of shares: 60,000 riyals, payments to pay bonds: 200,000 riyals, receipts from the issuance of bonds: 100,000 riyals, payments to lenders against interest on loans: 12,000 riyals What is the amount of net cash flows from financing activities during 2019? D - Nothing, which was mentioned c - a decrease of 60,000 riyals b - a decrease of 72,000 a - a decrease of 97,000

7 6 5 4 3 2 1 Question ..... ..... ..... ..... ..... ..... ..... the answer

7 second question : The following are a number of the items on the financial position of Nawras, bearing in mind that the balances (in riyals) were extracted on December 31, 2019: Provision for machine consumption 68,000, commodity stock 56,000 Taxes payable 17,600 capital 79,000 Expenses submitted 69,000 Goodwill 31,000 Machinery 442.000 bonds issued 60,000 Buildings 451,000 Discount for issuing bonds 3,000 The lands of 75,000 receipts of 157,000 Creditors 175,000 securities for the purpose of trading 24,000 Retained earnings ???? The debtors 23,000 Short term receivable rent 8,400 long term payment papers 410,000 Long term lease obligations 115,000 60,000 cash Payment notes for short-term banks 60,000 Allocated building consumption 20,000 In light of the above information, fill in the following table: Gross statement in riyals ..................... 1- Total current assets ..................... 2- Total fixed assets ..................... 3- Total Assets ..................... 4- Total current liabilities ..................... 5- Total long-term liabilities ..................... 6- Retained earnings ..................... 7- Total Equity

6 The third question : On 1/1/2019, Al-Qemma Company purchased 2,000 ordinary shares for the purpose of trading from Al-Baraka Company at 100 riyals per share, and brokerage fees amounted to 2 riyals per share. On 31/12/2019, the portfolio of securities acquired for the purpose of trading for the Summit facility was as follows: 000 2,000 ordinary shares of Al-Baraka acquired on 1/1/2019 1.600 ordinary shares from Al-Rabie share price, 150 riyals. The fair value (market) for each share of Al-Baraka was 90 riyals and Al-Rabie 180. And the balance of the adjustments account appeared in the fair value for the previous period, 15,000 riyals. On 02/15/2020, 400 shares were sold from Al-Rabie Company, at 120 riyals per share, and the brokerage expenses amounted to 4 riyals per share. Required :

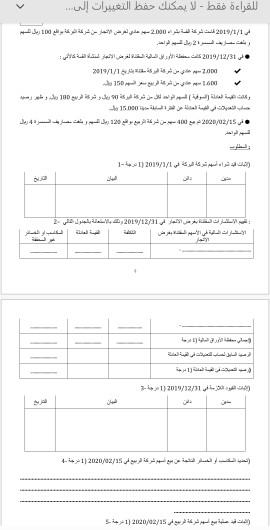

1- Proof of registration for the purchase of Al Baraka shares on 1/1/2019 (1 score) Date statement debit creditor

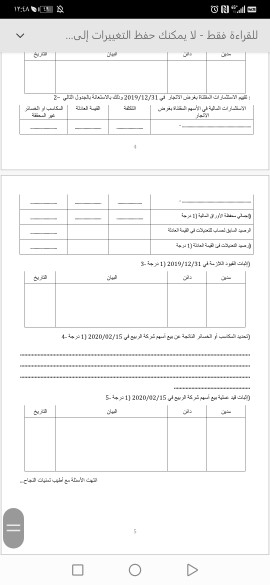

2- Evaluating the investments acquired for the purpose of trading on 12/31/2019, using the following table: Unrealized gains or losses, fair value, cost, financial investments in stocks acquired for the purpose of trading ........................ ........................ .. ...................... - ........................... ................................... ........................ ........................ .. .................... - ............................. ................................. ........................ ........................ .. ...................... Total portfolio of securities (1 score) ........................ The previous balance of an account for adjustments in fair value ........................ Balance of adjustments in fair value category (1 degree) 3- Prove the necessary restrictions on 12/31/2019 (1 score) Date statement debit creditor

4- Determining the gains or losses resulting from the sale of shares of Al-Rabie Company on 02/15/2020 (1 score) ...............................

261981 180 (3) 1 . 36 249 211 : 180 I II 10 100 5 1 4 2019 / 11 [1 -1 29/ 12 / 11 (1 2010 (1 4 15 / )II [1 = . :48 12 - ... 2 191231 | 11 2 1 2011 (1 * 15 08 2012 (1 45 2 8 2020 [1 261981 180 (3) 1 . 36 249 211 : 180 I II 10 100 5 1 4 2019 / 11 [1 -1 29/ 12 / 11 (1 2010 (1 4 15 / )II [1 = . :48 12 - ... 2 191231 | 11 2 1 2011 (1 * 15 08 2012 (1 45 2 8 2020 [1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started