Answered step by step

Verified Expert Solution

Question

1 Approved Answer

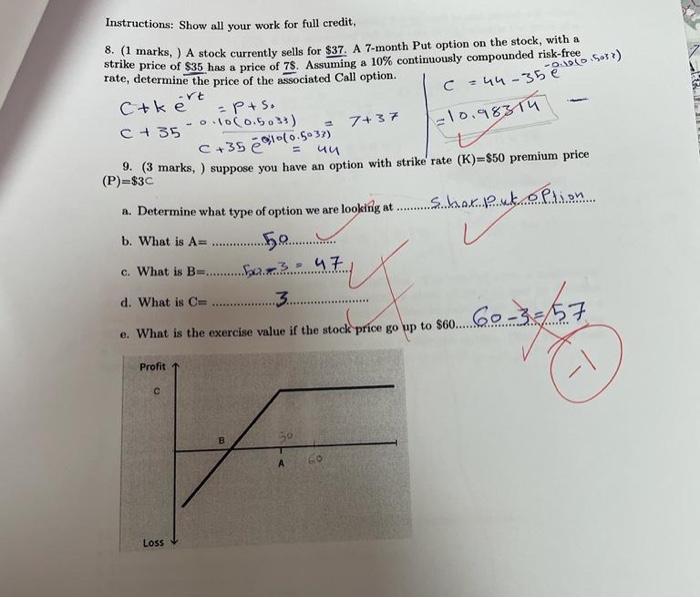

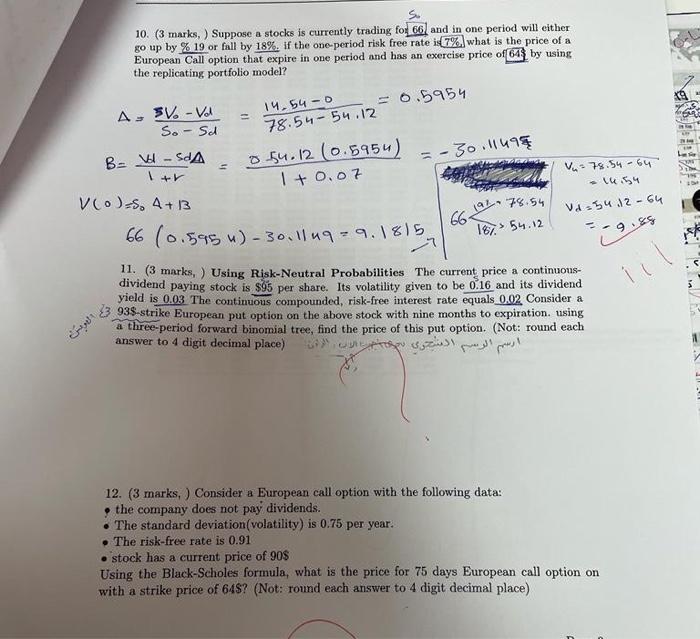

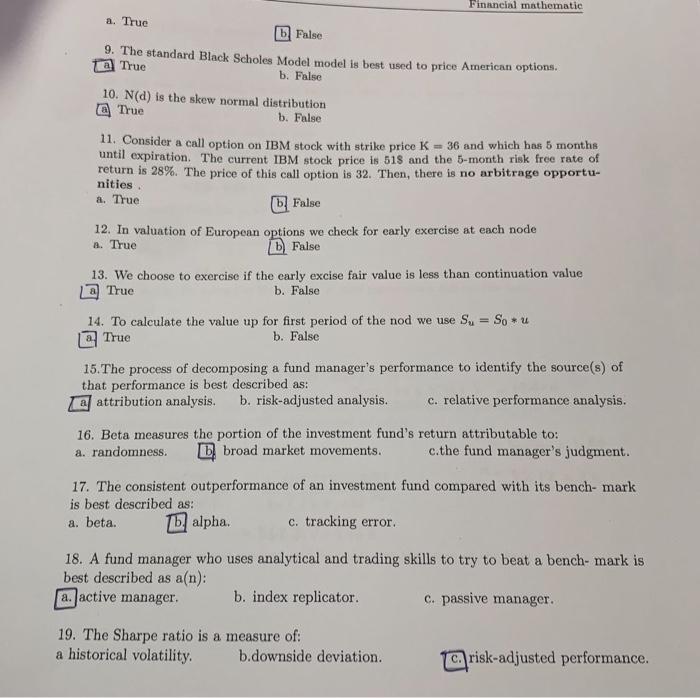

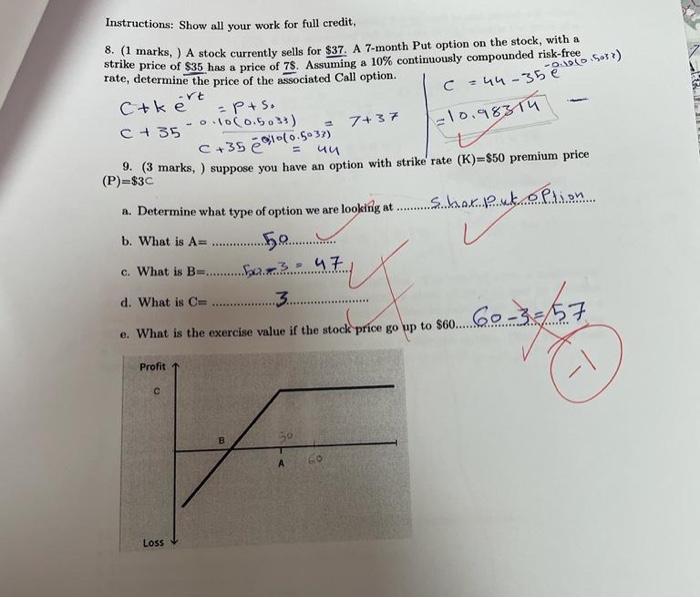

i want the correct answers for this KE - 44-35e 16:50) -10.983th 7+37 C+35 21040.5033 Instructions: Show all your work for full credit, 8. (1

i want the correct answers for this

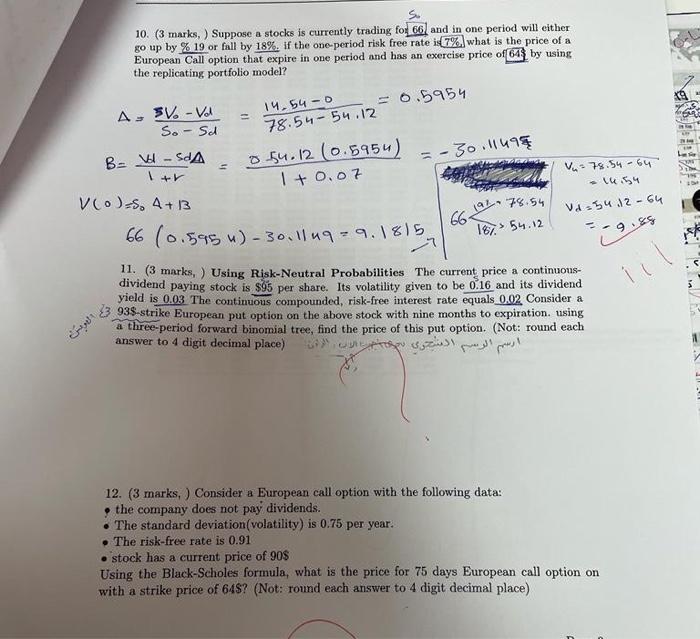

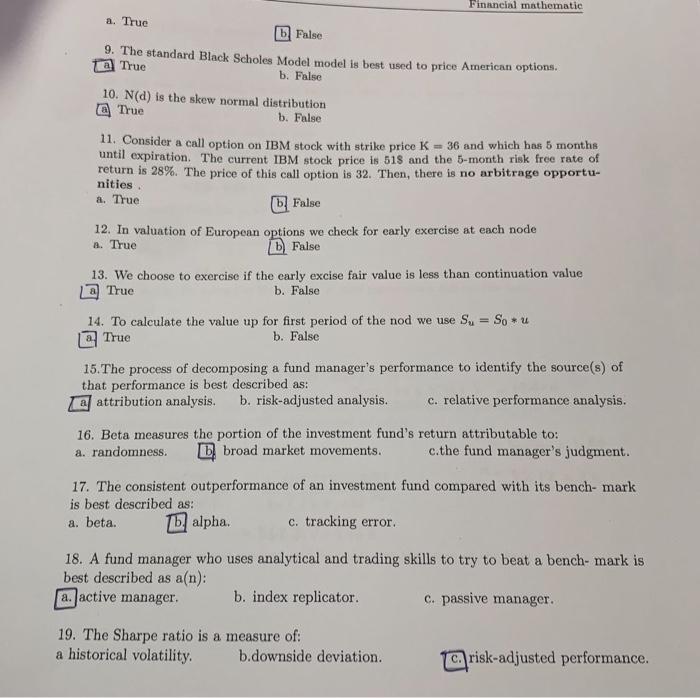

KE - 44-35e 16:50) -10.983th 7+37 C+35 21040.5033 Instructions: Show all your work for full credit, 8. (1 marks, ) A stock currently sells for $37. A 7-month Put option on the stock, with a strike price of $35 has a price of 78. Assuming a 10% continuously compounded risk-free rate, determine the price of the associated Call option. ort Ctke - Pts. o.100.503) C + 35 un 9. (3 marks, ) suppose you have an option with strike rate (K)=$50 premium price (P)-$3C a. Determine what type of option we are looking at Skorupkolition No....... c. What is B. d. What is C ..3 What is the exercise value if the stock price go up to 8o...60-355. harpenter b. What is A= ........... ......47 60-3-157 Profit Loss 10. (3 marks, ) Suppose a stocks is currently trading for 66) and in one period will either go up by % 19 or fall by 18%. If the one-period risk free rate is 7% what is the price of a European Call option that expire in one period and has an exercise price of 643 by using the replicating portfolio model? A, SV. -VA So- Scd 14,54 - = 0.5954 78.54 - 54.12 54.12 (0.5954) 1+0.07 =-30.11499 B-VI-SA + V75.54-64 - 14:54 27 78.54 Vds 541264 66 > 161. 54.12 9.85 V $ - . 7 VCD-s, 4+13 66 (0.595 ") 30. 11u9-9. 1815 11. (3 marks, ) Using Risk-Neutral Probabilities The current price a continuous- dividend paying stock is $65 per share. Its volatility given to be 0.16 and its dividend yield is 0.03 The continuous compounded, risk-free interest rate equals 0.02 Consider a 33 938-strike European put option on the above stock with nine months to expiration using a three-period forward binomial tree, find the price of this put option. (Not: round each answer to 4 digit decimal place) iil : 12. (3 marks, ) Consider a European call option with the following data: the company does not pay dividends. The standard deviation(volatility) is 0.75 per year. The risk-free rate is 0.91 stock has a current price of 90$ Using the Black-Scholes formula, what is the price for 75 days European call option on with a strike price of 648? (Not: round each answer to 4 digit decimal place) inancial mathematie a. True bl False 9. The standard Black Scholes Model model is best used to price American options.. a True b. False 10. N(d) is the skew normal distribution @ True b. False 11. Consider a call option on IBM stock with strike price K - 36 and which has 5 months until expiration. The current IBM stock price is 518 and the 6-month risk free rate of return is 28%. The price of this call option is 32. Then, there is no arbitrage opportu- nities a. True (6) False 12. In valuation of European options we check for early exercise at each node A. True B) False 13. We choose to exercise if the early excise fair value is less than continuation value b. False La True 14. To calculate the value up for first period of the nod we use S. = Sou @ True b. False 15. The process of decomposing a fund manager's performance to identify the source(s) of that performance is best described as: B a attribution analysis. b. risk-adjusted analysis. C. relative performance analysis. 16. Beta measures the portion of the investment fund's return attributable to: a. randomness. broad market movements. c.the fund manager's judgment. 17. The consistent outperformance of an investment fund compared with its bench- mark is best described as: a. beta. D. alpha. c. tracking error. 18. A fund manager who uses analytical and trading skills to try to beat a bench- mark is best described as a(n): a. active manager b. index replicator. c. passive manager. 19. The Sharpe ratio is a measure of: a historical volatility. b.downside deviation. C risk-adjusted performance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started