Answered step by step

Verified Expert Solution

Question

1 Approved Answer

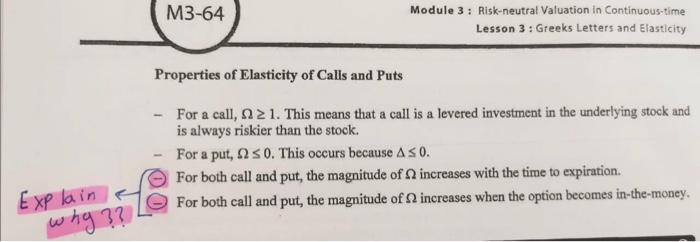

i want the detailed explanation M3-64 Module 3: Risk-neutral Valuation in Continuous-time Lesson 3 : Greeks Letters and Elasticity Properties of Elasticity of Calls and

i want the detailed explanation

M3-64 Module 3: Risk-neutral Valuation in Continuous-time Lesson 3 : Greeks Letters and Elasticity Properties of Elasticity of Calls and Puts For a call, 2 1. This means that a call is a levered investment in the underlying stock and is always riskier than the stock. - For a put, 50. This occurs because AS 0. For both call and put the magnitude of increases with the time to expiration. For both call and put the magnitude of increases when the option becomes in-the-money. Explain why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started