Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need ASAP Mrs. Wu comes to you for advice in February 2021. Last year 2020, was a year of considerable change and turmoil for her.

Need ASAP

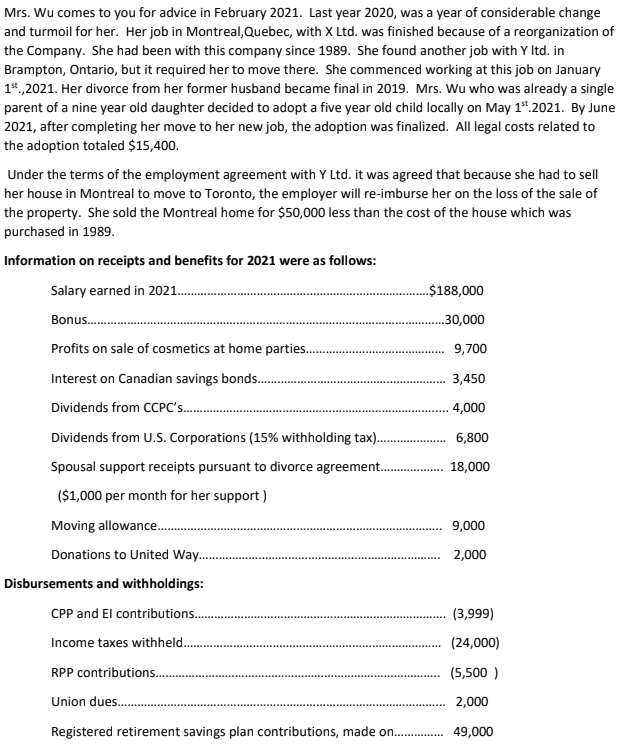

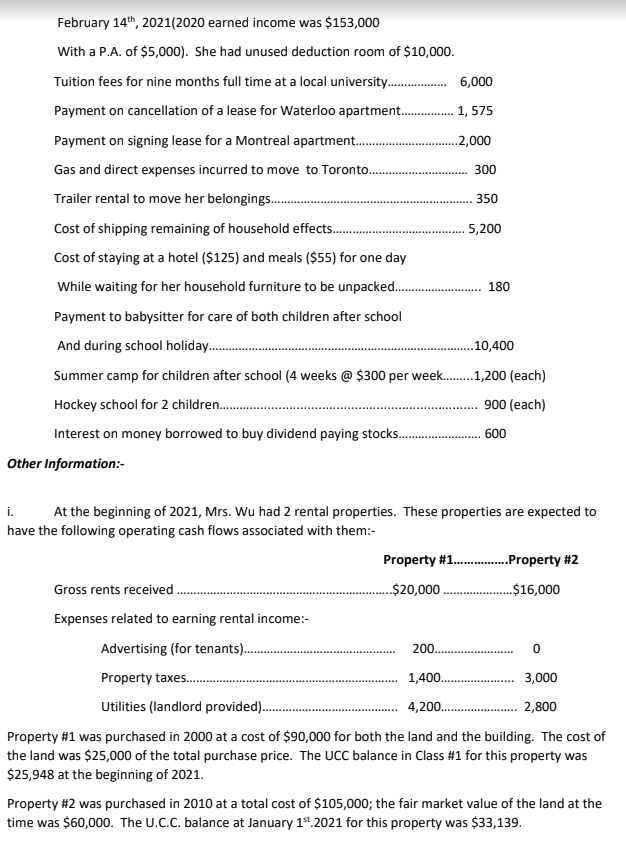

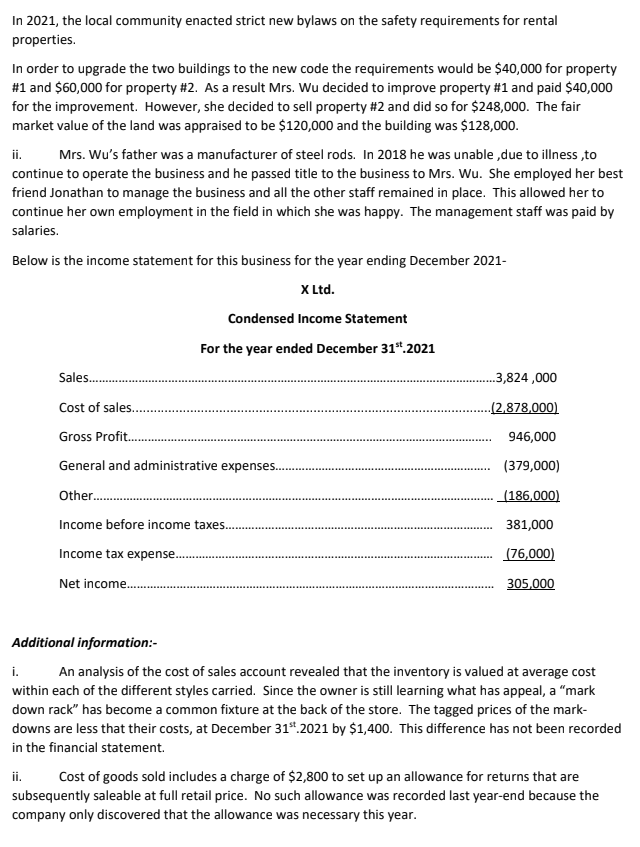

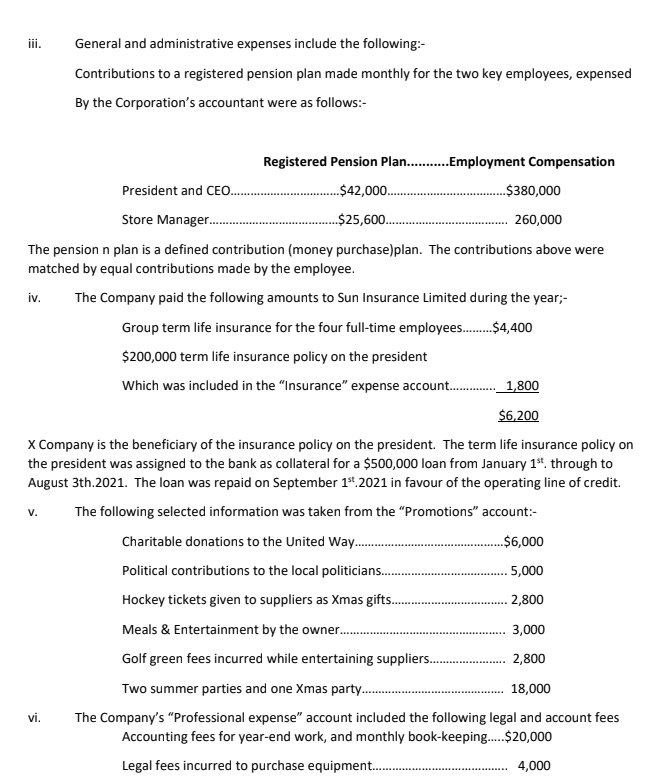

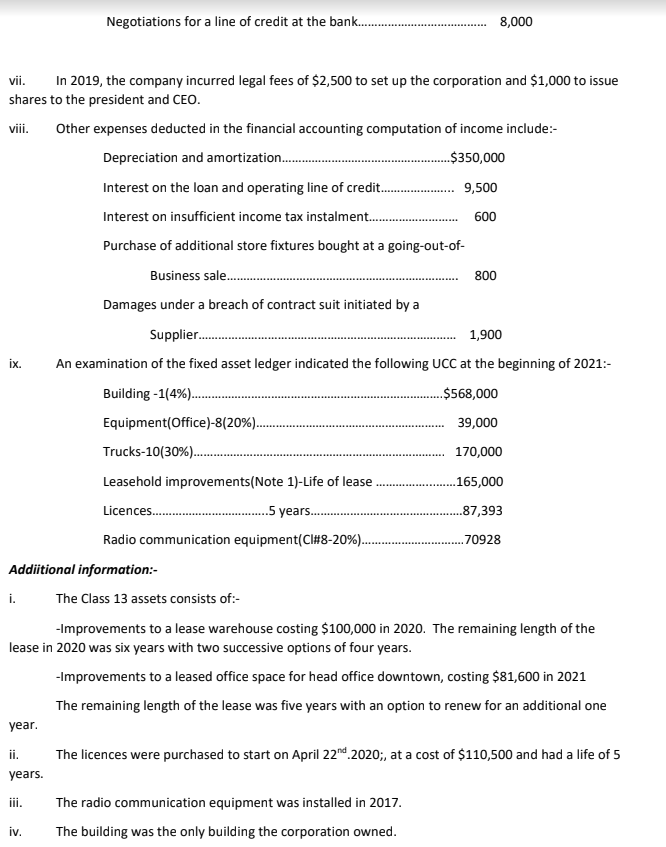

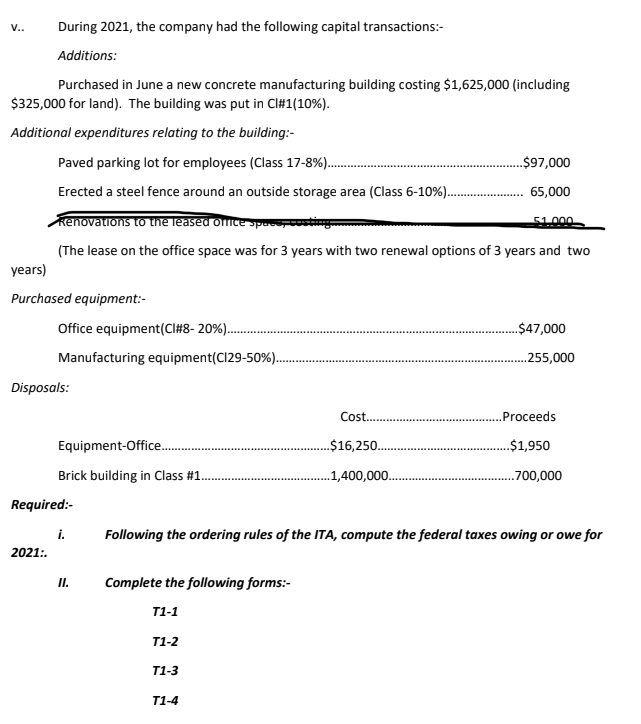

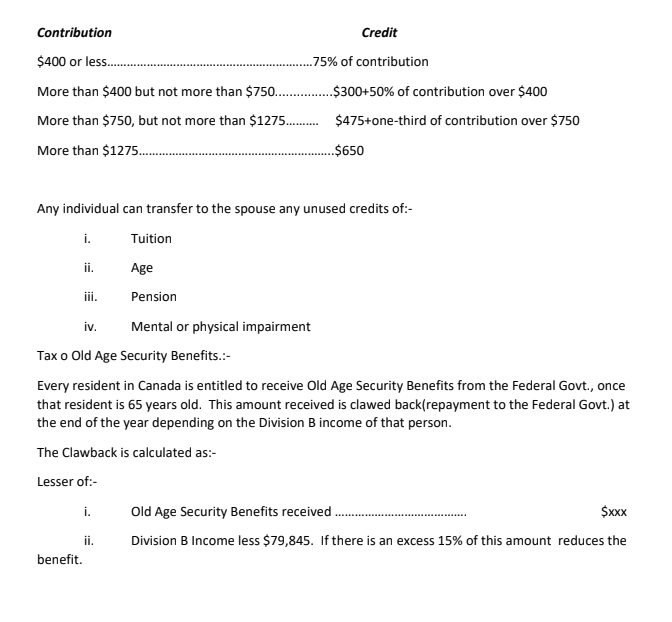

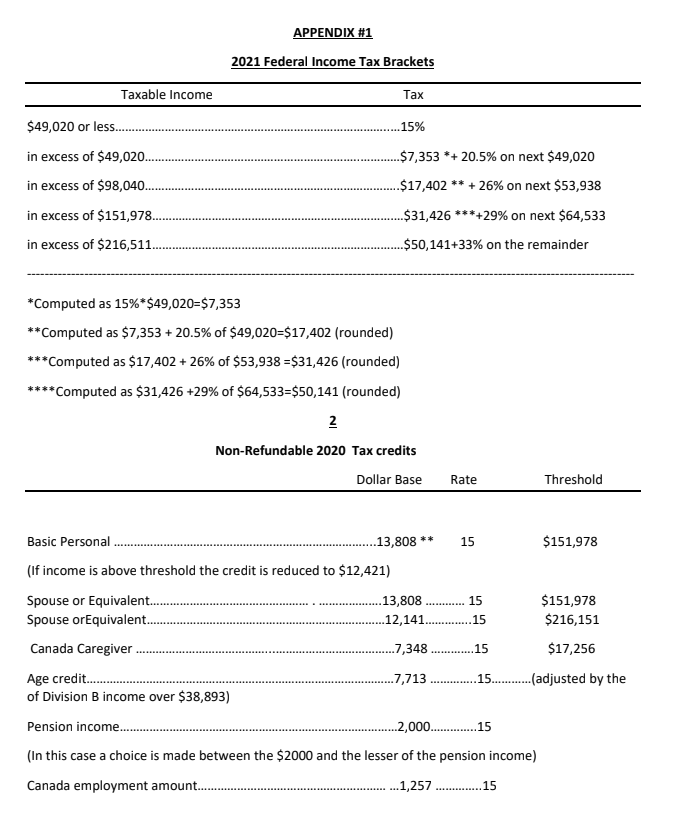

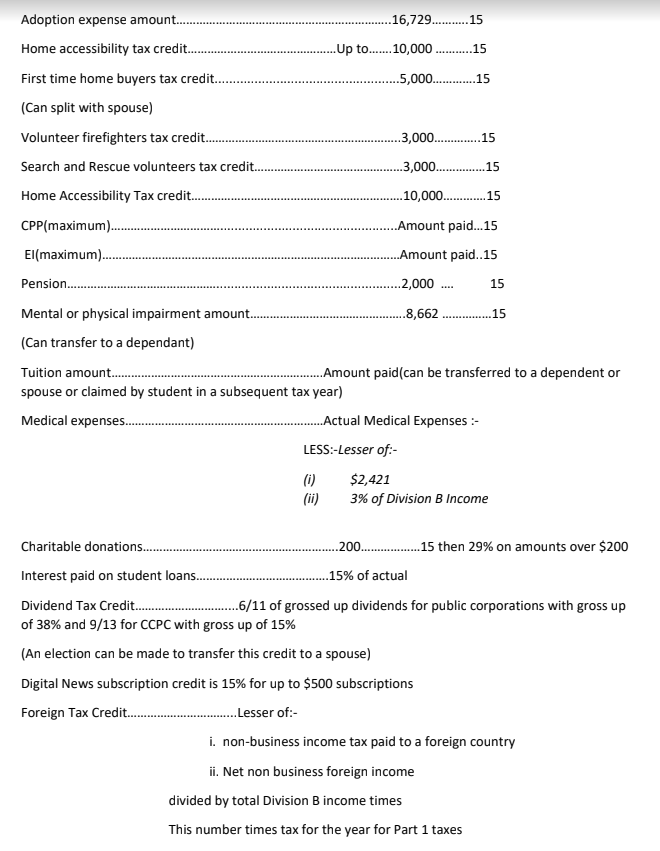

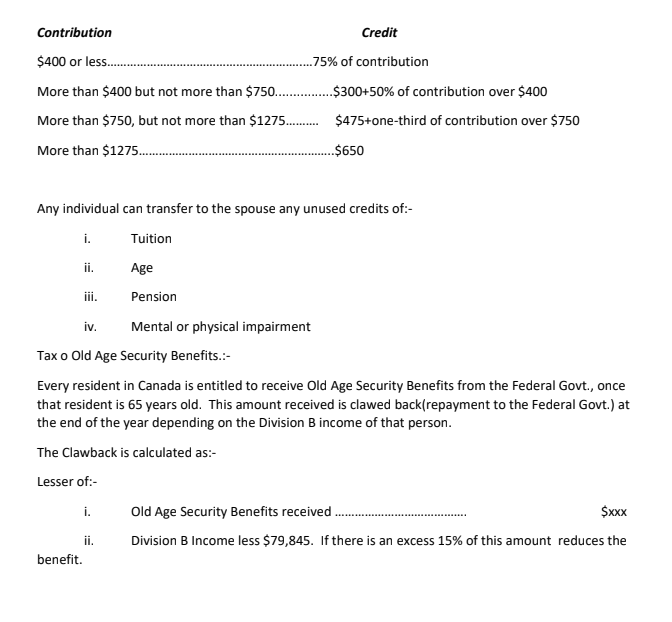

Mrs. Wu comes to you for advice in February 2021. Last year 2020, was a year of considerable change and turmoil for her. Her job in Montreal, Quebec, with X Ltd. was finished because of a reorganization of the Company. She had been with this company since 1989. She found another job with Y ltd. in Brampton, Ontario, but it required her to move there. She commenced working at this job on January 14.,2021. Her divorce from her former husband became final in 2019. Mrs. Wu who was already a single parent of a nine year old daughter decided to adopt a five year old child locally on May 184.2021. By June 2021, after completing her move to her new job, the adoption was finalized. All legal costs related to the adoption totaled $15,400. Under the terms of the employment agreement with Y Ltd. it was agreed that because she had to sell her house in Montreal to move to Toronto, the employer will re-imburse her on the loss of the sale of the property. She sold the Montreal home for $50,000 less than the cost of the house which was purchased in 1989. Information on receipts and benefits for 2021 were as follows: Salary earned in 2021.. $188,000 Bonus. 30,000 Profits on sale of cosmetics at home parties...... 9,700 Interest on Canadian savings bonds. . 3,450 Dividends from CCPC's.... 4,000 Dividends from U.S. Corporations (15% withholding tax). ............. 6,800 Spousal support receipts pursuant to divorce agreement...... 18,000 ($1,000 per month for her support) Moving allowance... 9,000 Donations to United Way.......... 2,000 Disbursements and withholdings: CPP and El contributions. (3,999) Income taxes withheld. (24,000) RPP contributions..... (5,500) Union dues....... 2,000 Registered retirement savings plan contributions, made on.............. 49,000 February 14th, 2021(2020 earned income was $153,000 With a P.A. of $5,000). She had unused deduction room of $10,000. Tuition fees for nine months full time at a local university.......... 6,000 Payment on cancellation of a lease for Waterloo apartment....... 1,575 Payment on signing lease for a Montreal apartment... ..2,000 Gas and direct expenses incurred to move to Toronto... 300 Trailer rental to move her belongings.... 350 Cost of shipping remaining of household effects.. 5,200 Cost of staying at a hotel ($125) and meals ($55) for one day While waiting for her household furniture to be unpacked.. Payment to babysitter for care of both children after school And during school holiday... ..10,400 Summer camp for children after school (4 weeks @ $300 per week....1,200 (each) Hockey school for 2 children..... 900 (each) Interest on money borrowed to buy dividend paying stocks.. Other Information:- 180 600 200... 0 i. At the beginning of 2021, Mrs. Wu had 2 rental properties. These properties are expected to have the following operating cash flows associated with them:- Property #1.............Property #2 Gross rents received $20,000 ........$16,000 Expenses related to earning rental income:- Advertising (for tenants).... Property taxes.. 1,400. 3,000 Utilities (landlord provided)... 4,200... 2,800 Property #1 was purchased in 2000 at a cost of $90,000 for both the land and the building. The cost of the land was $25,000 of the total purchase price. The UCC balance in Class #1 for this property was $25,948 at the beginning of 2021. Property #2 was purchased in 2010 at a total cost of $105,000; the fair market value of the land at the time was $60,000. The U.C.C. balance at January 14.2021 for this property was $33,139. In 2021, the local community enacted strict new bylaws on the safety requirements for rental properties In order to upgrade the two buildings to the new code the requirements would be $40,000 for property #1 and $60,000 for property #2. As a result Mrs. Wu decided to improve property #1 and paid $40,000 for the improvement. However, she decided to sell property #2 and did so for $248,000. The fair market value of the land was appraised to be $120,000 and the building was $128,000. ii. Mrs. Wu's father was a manufacturer of steel rods. In 2018 he was unable ,due to illness,to continue to operate the business and he passed title to the business to Mrs. Wu. She employed her best friend Jonathan to manage the business and all the other staff remained in place. This allowed her to continue her own employment in the field in which she was happy. The management staff was paid by salaries. Below is the income statement for this business for the year ending December 2021- X Ltd. Condensed Income Statement For the year ended December 31st 2021 Sales.... .3,824,000 Cost of sales.. ..(2,878,000) Gross Profit... 946,000 General and administrative expenses. (379,000) Other..... (186,000) Income before income taxes... 381,000 Income tax expense... (76,000) Net income...... 305,000 Additional information:- i. An analysis of the cost of sales account revealed that the inventory is valued at average cost within each of the different styles carried. Since the owner is still learning what has appeal, a "mark down rack has become a common fixture at the back of the store. The tagged prices of the mark- downs are less that their costs, at December 31st 2021 by $1,400. This difference has not been recorded in the financial statement. ii. Cost of goods sold includes a charge of $2,800 to set up an allowance for returns that are subsequently saleable at full retail price. No such allowance was recorded last year-end because the company only discovered that the allowance was necessary this year. iii. General and administrative expenses include the following:- Contributions to a registered pension plan made monthly for the two key employees, expensed By the Corporation's accountant were as follows:- Registered Pension Plan...........Employment Compensation President and CEO... $42,000..... $380,000 Store Manager.. ..$25,600.. 260,000 The pension n plan is a defined contribution (money purchase)plan. The contributions above were matched by equal contributions made by the employee. iv. The Company paid the following amounts to Sun Insurance Limited during the year;- Group term life insurance for the four full-time employees......$4,400 $200,000 term life insurance policy on the president Which was included in the "Insurance" expense account.. 1,800 $6,200 X Company is the beneficiary of the insurance policy on the president. The term life insurance policy on the president was assigned to the bank as collateral for a $500,000 loan from January 1st through to August 3th.2021. The loan was repaid on September 1st.2021 in favour of the operating line of credit. The following selected information was taken from the Promotions" account:- Charitable donations to the United Way... .............$6,000 Political contributions to the local politicians..... 5,000 Hockey tickets given to suppliers as Xmas gifts... 2,800 Meals & Entertainment by the owner.... 3,000 Golf green fees incurred while entertaining suppliers..... 2,800 Two summer parties and one Xmas party... 18,000 vi. The Company's "Professional expense" account included the following legal and account fees Accounting fees for year-end work, and monthly book-keeping.....$20,000 Legal fees incurred to purchase equipment... 4,000 v. Negotiations for a line of credit at the bank........ 8,000 ix. vii. In 2019, the company incurred legal fees of $2,500 to set up the corporation and $1,000 to issue shares to the president and CEO. viii. Other expenses deducted in the financial accounting computation of income include:- Depreciation and amortization..... $350,000 Interest on the loan and operating line of credit..... 9,500 Interest on insufficient income tax instalment.... 600 Purchase of additional store fixtures bought at a going-out-of- Business sale..... 800 Damages under a breach of contract suit initiated by a Supplier..... 1,900 An examination of the fixed asset ledger indicated the following UCC at the beginning of 2021:- Building - 1(4%).... ...$568,000 Equipment(Office)-8(20%).. 39,000 Trucks-10(30%)..... 170,000 Leasehold improvements(Note 1)-Life of lease. .165,000 Licences............. ............5 years........ .87,393 Radio communication equipment(Cl#8-20%). 70928 Addiitional information:- i. The Class 13 assets consists of:- -Improvements to a lease warehouse costing $100,000 in 2020. The remaining length of the lease in 2020 was six years with two successive options of four years. -Improvements to a leased office space for head office downtown, costing $81,600 in 2021 The remaining length of the lease was five years with an option to renew for an additional one year. ii. The licences were purchased to start on April 22md.2020;, at a cost of $110,500 and had a life of 5 years. iii. The radio communication equipment was installed in 2017. iv. The building was the only building the corporation owned. V.. During 2021, the company had the following capital transactions:- Additions: Purchased in June a new concrete manufacturing building costing $1,625,000 (including $325,000 for land). The building was put in Cl#1(10%). Additional expenditures relating to the building:- Paved parking lot for employees (Class 17-8%.... $97,000 Erected a steel fence around an outside storage area (Class 6-10%... 65,000 Renovations to the leased Orice spo 51.000 (The lease on the office space was for 3 years with two renewal options of 3 years and two years) Purchased equipment: Office equipment(Cl#8-20%)............ $47,000 Manufacturing equipment(C129-50%.. ..255,000 Disposals: Cost... Proceeds Equipment Office.... ...$16,250.. $1,950 Brick building in Class #1. .1,400,000... ..700,000 Required: i. Following the ordering rules of the ITA, compute the federal taxes owing or owe for 2021: II. Complete the following forms:- T1-1 T1-2 T1-3 T1-4 Contribution Credit $400 or less... ..75% of contribution More than $400 but not more than $750...........$300+50% of contribution over $400 More than $750, but not more than $1275.... $475+one-third of contribution over $750 More than $1275. ...$650 Any individual can transfer to the spouse any unused credits of:- i. Tuition ii. Age iii. Pension iv. Mental or physical impairment Taxo Old Age Security Benefits.:- Every resident in Canada is entitled to receive Old Age Security Benefits from the Federal Govt., once that resident is 65 years old. This amount received is clawed back(repayment to the Federal Govt.) at the end of the year depending on the Division B income of that person. The Clawback is calculated as:- Lesser of:- i. $xxx Old Age Security Benefits received. Division B Income less $79,845. If there is an excess 15% of this amount reduces the ii. benefit. APPENDIX #1 2021 Federal Income Tax Brackets Taxable income Tax $49,020 or less.. .15% in excess of $49,020.. + in excess of $98,040... in excess of $151,978. in excess of $216,511.. $7,353 *+ 20.5% on next $49,020 $17,402 ** + 26% on next $53,938 $31,426 ***+29% on next $64,533 $50,141+33% on the remainder + *Computed as 15%*$49,020=$7,353 **Computed as $7,353 + 20.5% of $49,020=$17,402 (rounded) ***Computed as $17,402 + 26% of $53,938 =$31,426 (rounded) ****Computed as $31,426 +29% of $64,533=$50,141 (rounded) 2 Non-Refundable 2020 Tax credits Dollar Base Rate Threshold Basic Personal .13,808 ** 15 $151,978 (If income is above threshold the credit is reduced to $12,421) Spouse or Equivalent.... .13,808 15 $151,978 Spouse or Equivalent... .12,141. 15 $216,151 Canada Caregiver ..7,348 .15 $17,256 Age credit...... ..7,713 .15........... (adjusted by the of Division B income over $38,893) Pension income... ...2,000............15 (In this case a choice is made between the $2000 and the lesser of the pension income) Canada employment amount... ...1,257 .............15 ........... 15 15 Adoption expense amount.. .16,729...........15 Home accessibility tax credit... ..Up to....... 10,000 First time home buyers tax credit....... .5,000............15 (Can split with spouse) Volunteer firefighters tax credit... ..3,000.............15 Search and Rescue volunteers tax credit... .3,000...............15 Home Accessibility Tax credit.... .10,000...... CPP(maximum... .Amount paid...15 El(maximum. .....Amount paid.. 15 Pension....... ..2,000 ... Mental or physical impairment amount... .8,662 ...15 (Can transfer to a dependant) Tuition amount.... ...Amount paid(can be transferred to a dependent or spouse or claimed by student in a subsequent tax year) Medical expenses.. ...Actual Medical Expenses :- LESS:-Lesser of:- (i) $2,421 (ii) 3% of Division B Income 15 Charitable donations..... ...200............15 then 29% on amounts over $200 Interest paid on student loans.. .15% of actual Dividend Tax Credit... .6/11 of grossed up dividends for public corporations with gross up of 38% and 9/13 for CCPC with gross up of 15% (An election can be made to transfer this credit to a spouse) Digital News subscription credit is 15% for up to $500 subscriptions Foreign Tax Credit..... ............Lesser of:- i. non-business income tax paid to a foreign country ii. Net non business foreign income divided by total Division B income times This number times tax for the year for Part 1 taxes Contribution Credit $400 or less... ..75% of contribution More than $400 but not more than $750...........$300+50% of contribution over $400 More than $750, but not more than $1275.... $475+one-third of contribution over $750 More than $1275. ...$650 Any individual can transfer to the spouse any unused credits of:- i. Tuition ii. Age iii. Pension iv. Mental or physical impairment Taxo Old Age Security Benefits.:- Every resident in Canada is entitled to receive Old Age Security Benefits from the Federal Govt., once that resident is 65 years old. This amount received is clawed back(repayment to the Federal Govt.) at the end of the year depending on the Division B income of that person. The Clawback is calculated as:- Lesser of:- i. $xxx Old Age Security Benefits received. Division B Income less $79,845. If there is an excess 15% of this amount reduces the ii. benefit. Mrs. Wu comes to you for advice in February 2021. Last year 2020, was a year of considerable change and turmoil for her. Her job in Montreal, Quebec, with X Ltd. was finished because of a reorganization of the Company. She had been with this company since 1989. She found another job with Y ltd. in Brampton, Ontario, but it required her to move there. She commenced working at this job on January 14.,2021. Her divorce from her former husband became final in 2019. Mrs. Wu who was already a single parent of a nine year old daughter decided to adopt a five year old child locally on May 184.2021. By June 2021, after completing her move to her new job, the adoption was finalized. All legal costs related to the adoption totaled $15,400. Under the terms of the employment agreement with Y Ltd. it was agreed that because she had to sell her house in Montreal to move to Toronto, the employer will re-imburse her on the loss of the sale of the property. She sold the Montreal home for $50,000 less than the cost of the house which was purchased in 1989. Information on receipts and benefits for 2021 were as follows: Salary earned in 2021.. $188,000 Bonus. 30,000 Profits on sale of cosmetics at home parties...... 9,700 Interest on Canadian savings bonds. . 3,450 Dividends from CCPC's.... 4,000 Dividends from U.S. Corporations (15% withholding tax). ............. 6,800 Spousal support receipts pursuant to divorce agreement...... 18,000 ($1,000 per month for her support) Moving allowance... 9,000 Donations to United Way.......... 2,000 Disbursements and withholdings: CPP and El contributions. (3,999) Income taxes withheld. (24,000) RPP contributions..... (5,500) Union dues....... 2,000 Registered retirement savings plan contributions, made on.............. 49,000 February 14th, 2021(2020 earned income was $153,000 With a P.A. of $5,000). She had unused deduction room of $10,000. Tuition fees for nine months full time at a local university.......... 6,000 Payment on cancellation of a lease for Waterloo apartment....... 1,575 Payment on signing lease for a Montreal apartment... ..2,000 Gas and direct expenses incurred to move to Toronto... 300 Trailer rental to move her belongings.... 350 Cost of shipping remaining of household effects.. 5,200 Cost of staying at a hotel ($125) and meals ($55) for one day While waiting for her household furniture to be unpacked.. Payment to babysitter for care of both children after school And during school holiday... ..10,400 Summer camp for children after school (4 weeks @ $300 per week....1,200 (each) Hockey school for 2 children..... 900 (each) Interest on money borrowed to buy dividend paying stocks.. Other Information:- 180 600 200... 0 i. At the beginning of 2021, Mrs. Wu had 2 rental properties. These properties are expected to have the following operating cash flows associated with them:- Property #1.............Property #2 Gross rents received $20,000 ........$16,000 Expenses related to earning rental income:- Advertising (for tenants).... Property taxes.. 1,400. 3,000 Utilities (landlord provided)... 4,200... 2,800 Property #1 was purchased in 2000 at a cost of $90,000 for both the land and the building. The cost of the land was $25,000 of the total purchase price. The UCC balance in Class #1 for this property was $25,948 at the beginning of 2021. Property #2 was purchased in 2010 at a total cost of $105,000; the fair market value of the land at the time was $60,000. The U.C.C. balance at January 14.2021 for this property was $33,139. In 2021, the local community enacted strict new bylaws on the safety requirements for rental properties In order to upgrade the two buildings to the new code the requirements would be $40,000 for property #1 and $60,000 for property #2. As a result Mrs. Wu decided to improve property #1 and paid $40,000 for the improvement. However, she decided to sell property #2 and did so for $248,000. The fair market value of the land was appraised to be $120,000 and the building was $128,000. ii. Mrs. Wu's father was a manufacturer of steel rods. In 2018 he was unable ,due to illness,to continue to operate the business and he passed title to the business to Mrs. Wu. She employed her best friend Jonathan to manage the business and all the other staff remained in place. This allowed her to continue her own employment in the field in which she was happy. The management staff was paid by salaries. Below is the income statement for this business for the year ending December 2021- X Ltd. Condensed Income Statement For the year ended December 31st 2021 Sales.... .3,824,000 Cost of sales.. ..(2,878,000) Gross Profit... 946,000 General and administrative expenses. (379,000) Other..... (186,000) Income before income taxes... 381,000 Income tax expense... (76,000) Net income...... 305,000 Additional information:- i. An analysis of the cost of sales account revealed that the inventory is valued at average cost within each of the different styles carried. Since the owner is still learning what has appeal, a "mark down rack has become a common fixture at the back of the store. The tagged prices of the mark- downs are less that their costs, at December 31st 2021 by $1,400. This difference has not been recorded in the financial statement. ii. Cost of goods sold includes a charge of $2,800 to set up an allowance for returns that are subsequently saleable at full retail price. No such allowance was recorded last year-end because the company only discovered that the allowance was necessary this year. iii. General and administrative expenses include the following:- Contributions to a registered pension plan made monthly for the two key employees, expensed By the Corporation's accountant were as follows:- Registered Pension Plan...........Employment Compensation President and CEO... $42,000..... $380,000 Store Manager.. ..$25,600.. 260,000 The pension n plan is a defined contribution (money purchase)plan. The contributions above were matched by equal contributions made by the employee. iv. The Company paid the following amounts to Sun Insurance Limited during the year;- Group term life insurance for the four full-time employees......$4,400 $200,000 term life insurance policy on the president Which was included in the "Insurance" expense account.. 1,800 $6,200 X Company is the beneficiary of the insurance policy on the president. The term life insurance policy on the president was assigned to the bank as collateral for a $500,000 loan from January 1st through to August 3th.2021. The loan was repaid on September 1st.2021 in favour of the operating line of credit. The following selected information was taken from the Promotions" account:- Charitable donations to the United Way... .............$6,000 Political contributions to the local politicians..... 5,000 Hockey tickets given to suppliers as Xmas gifts... 2,800 Meals & Entertainment by the owner.... 3,000 Golf green fees incurred while entertaining suppliers..... 2,800 Two summer parties and one Xmas party... 18,000 vi. The Company's "Professional expense" account included the following legal and account fees Accounting fees for year-end work, and monthly book-keeping.....$20,000 Legal fees incurred to purchase equipment... 4,000 v. Negotiations for a line of credit at the bank........ 8,000 ix. vii. In 2019, the company incurred legal fees of $2,500 to set up the corporation and $1,000 to issue shares to the president and CEO. viii. Other expenses deducted in the financial accounting computation of income include:- Depreciation and amortization..... $350,000 Interest on the loan and operating line of credit..... 9,500 Interest on insufficient income tax instalment.... 600 Purchase of additional store fixtures bought at a going-out-of- Business sale..... 800 Damages under a breach of contract suit initiated by a Supplier..... 1,900 An examination of the fixed asset ledger indicated the following UCC at the beginning of 2021:- Building - 1(4%).... ...$568,000 Equipment(Office)-8(20%).. 39,000 Trucks-10(30%)..... 170,000 Leasehold improvements(Note 1)-Life of lease. .165,000 Licences............. ............5 years........ .87,393 Radio communication equipment(Cl#8-20%). 70928 Addiitional information:- i. The Class 13 assets consists of:- -Improvements to a lease warehouse costing $100,000 in 2020. The remaining length of the lease in 2020 was six years with two successive options of four years. -Improvements to a leased office space for head office downtown, costing $81,600 in 2021 The remaining length of the lease was five years with an option to renew for an additional one year. ii. The licences were purchased to start on April 22md.2020;, at a cost of $110,500 and had a life of 5 years. iii. The radio communication equipment was installed in 2017. iv. The building was the only building the corporation owned. V.. During 2021, the company had the following capital transactions:- Additions: Purchased in June a new concrete manufacturing building costing $1,625,000 (including $325,000 for land). The building was put in Cl#1(10%). Additional expenditures relating to the building:- Paved parking lot for employees (Class 17-8%.... $97,000 Erected a steel fence around an outside storage area (Class 6-10%... 65,000 Renovations to the leased Orice spo 51.000 (The lease on the office space was for 3 years with two renewal options of 3 years and two years) Purchased equipment: Office equipment(Cl#8-20%)............ $47,000 Manufacturing equipment(C129-50%.. ..255,000 Disposals: Cost... Proceeds Equipment Office.... ...$16,250.. $1,950 Brick building in Class #1. .1,400,000... ..700,000 Required: i. Following the ordering rules of the ITA, compute the federal taxes owing or owe for 2021: II. Complete the following forms:- T1-1 T1-2 T1-3 T1-4 Contribution Credit $400 or less... ..75% of contribution More than $400 but not more than $750...........$300+50% of contribution over $400 More than $750, but not more than $1275.... $475+one-third of contribution over $750 More than $1275. ...$650 Any individual can transfer to the spouse any unused credits of:- i. Tuition ii. Age iii. Pension iv. Mental or physical impairment Taxo Old Age Security Benefits.:- Every resident in Canada is entitled to receive Old Age Security Benefits from the Federal Govt., once that resident is 65 years old. This amount received is clawed back(repayment to the Federal Govt.) at the end of the year depending on the Division B income of that person. The Clawback is calculated as:- Lesser of:- i. $xxx Old Age Security Benefits received. Division B Income less $79,845. If there is an excess 15% of this amount reduces the ii. benefit. APPENDIX #1 2021 Federal Income Tax Brackets Taxable income Tax $49,020 or less.. .15% in excess of $49,020.. + in excess of $98,040... in excess of $151,978. in excess of $216,511.. $7,353 *+ 20.5% on next $49,020 $17,402 ** + 26% on next $53,938 $31,426 ***+29% on next $64,533 $50,141+33% on the remainder + *Computed as 15%*$49,020=$7,353 **Computed as $7,353 + 20.5% of $49,020=$17,402 (rounded) ***Computed as $17,402 + 26% of $53,938 =$31,426 (rounded) ****Computed as $31,426 +29% of $64,533=$50,141 (rounded) 2 Non-Refundable 2020 Tax credits Dollar Base Rate Threshold Basic Personal .13,808 ** 15 $151,978 (If income is above threshold the credit is reduced to $12,421) Spouse or Equivalent.... .13,808 15 $151,978 Spouse or Equivalent... .12,141. 15 $216,151 Canada Caregiver ..7,348 .15 $17,256 Age credit...... ..7,713 .15........... (adjusted by the of Division B income over $38,893) Pension income... ...2,000............15 (In this case a choice is made between the $2000 and the lesser of the pension income) Canada employment amount... ...1,257 .............15 ........... 15 15 Adoption expense amount.. .16,729...........15 Home accessibility tax credit... ..Up to....... 10,000 First time home buyers tax credit....... .5,000............15 (Can split with spouse) Volunteer firefighters tax credit... ..3,000.............15 Search and Rescue volunteers tax credit... .3,000...............15 Home Accessibility Tax credit.... .10,000...... CPP(maximum... .Amount paid...15 El(maximum. .....Amount paid.. 15 Pension....... ..2,000 ... Mental or physical impairment amount... .8,662 ...15 (Can transfer to a dependant) Tuition amount.... ...Amount paid(can be transferred to a dependent or spouse or claimed by student in a subsequent tax year) Medical expenses.. ...Actual Medical Expenses :- LESS:-Lesser of:- (i) $2,421 (ii) 3% of Division B Income 15 Charitable donations..... ...200............15 then 29% on amounts over $200 Interest paid on student loans.. .15% of actual Dividend Tax Credit... .6/11 of grossed up dividends for public corporations with gross up of 38% and 9/13 for CCPC with gross up of 15% (An election can be made to transfer this credit to a spouse) Digital News subscription credit is 15% for up to $500 subscriptions Foreign Tax Credit..... ............Lesser of:- i. non-business income tax paid to a foreign country ii. Net non business foreign income divided by total Division B income times This number times tax for the year for Part 1 taxes Contribution Credit $400 or less... ..75% of contribution More than $400 but not more than $750...........$300+50% of contribution over $400 More than $750, but not more than $1275.... $475+one-third of contribution over $750 More than $1275. ...$650 Any individual can transfer to the spouse any unused credits of:- i. Tuition ii. Age iii. Pension iv. Mental or physical impairment Taxo Old Age Security Benefits.:- Every resident in Canada is entitled to receive Old Age Security Benefits from the Federal Govt., once that resident is 65 years old. This amount received is clawed back(repayment to the Federal Govt.) at the end of the year depending on the Division B income of that person. The Clawback is calculated as:- Lesser of:- i. $xxx Old Age Security Benefits received. Division B Income less $79,845. If there is an excess 15% of this amount reduces the ii. benefit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started