Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I want the solution as soon as possible without mentioning the steps only the solution Suppose that a portfolio manager holds $40 million of ABC

I want the solution as soon as possible without mentioning the steps only the solution

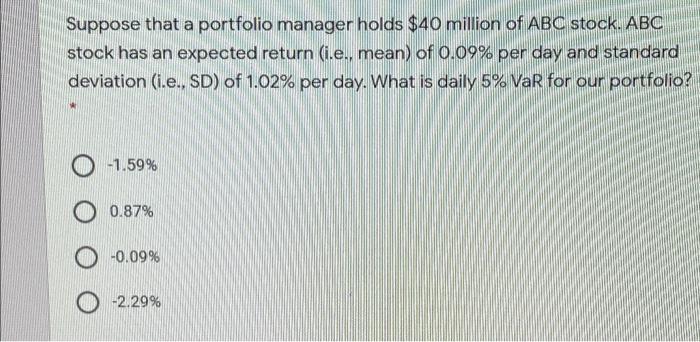

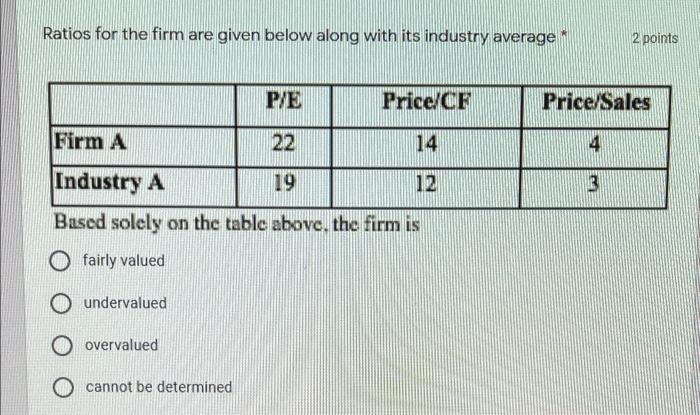

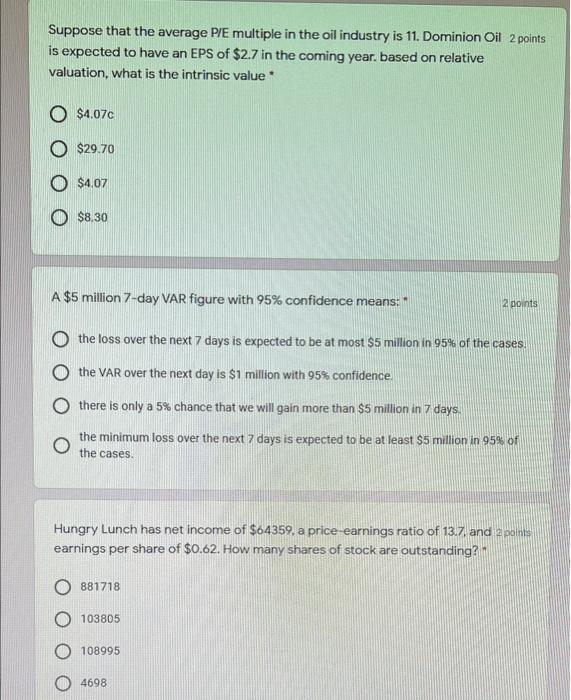

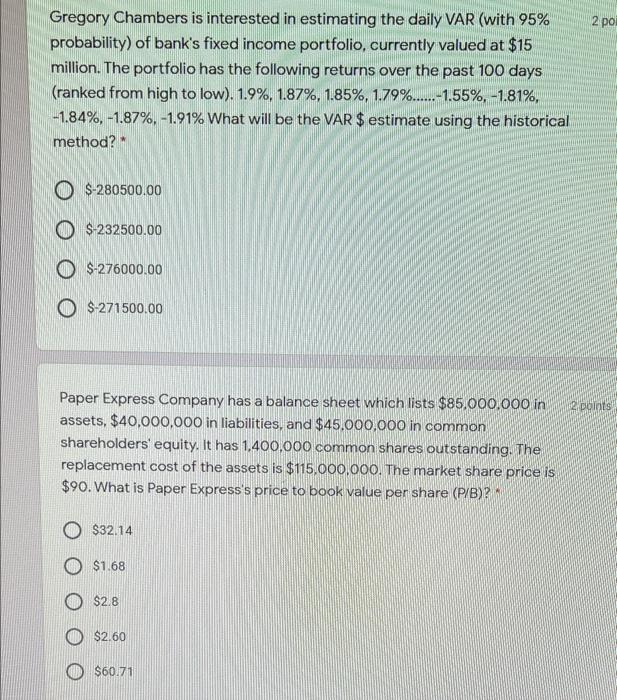

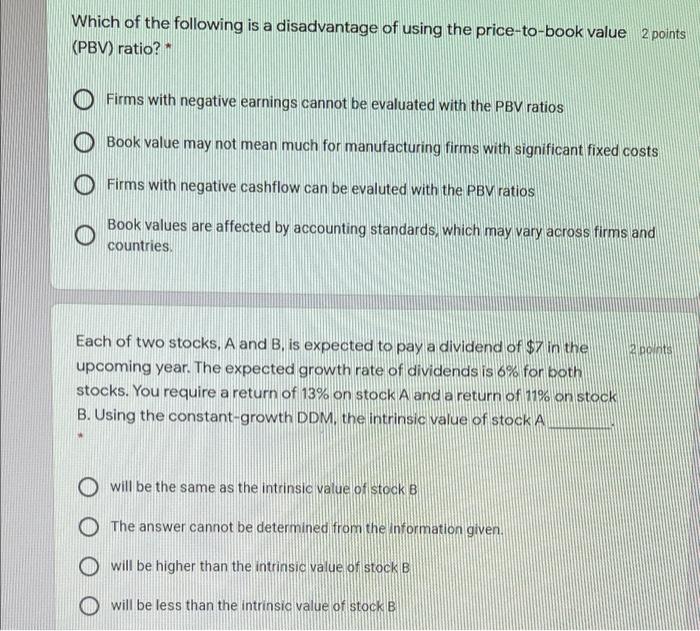

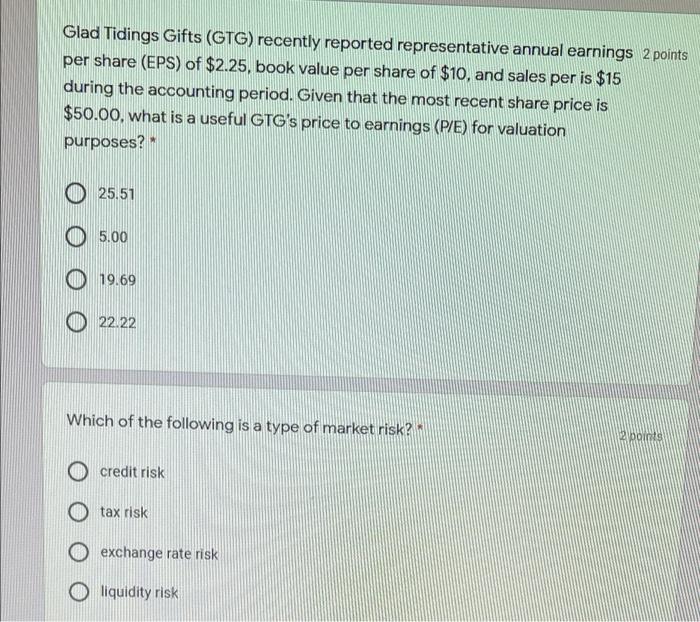

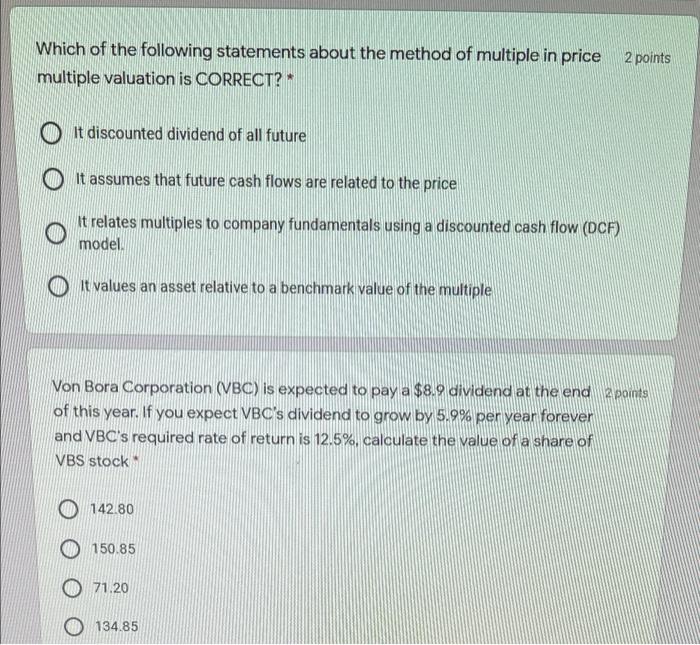

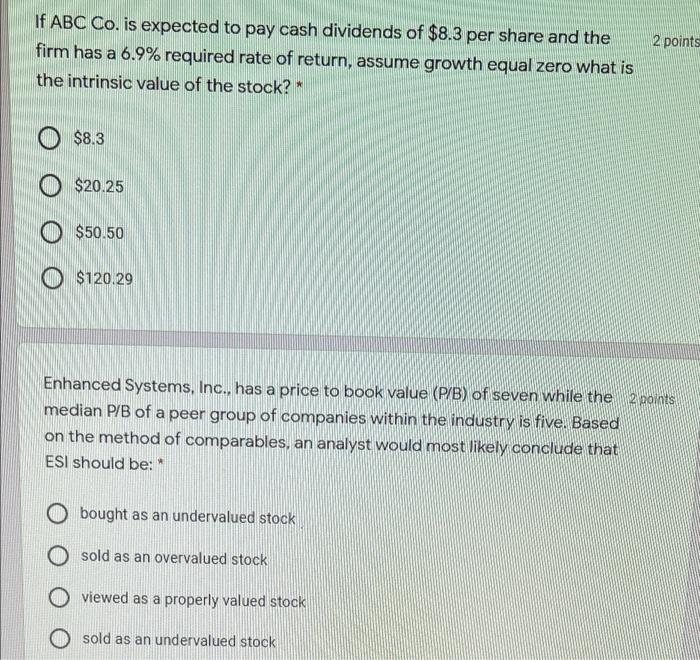

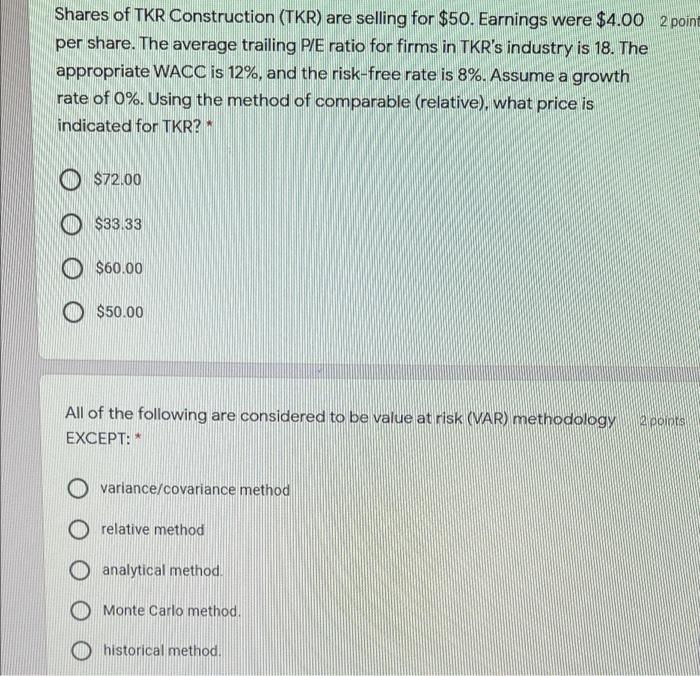

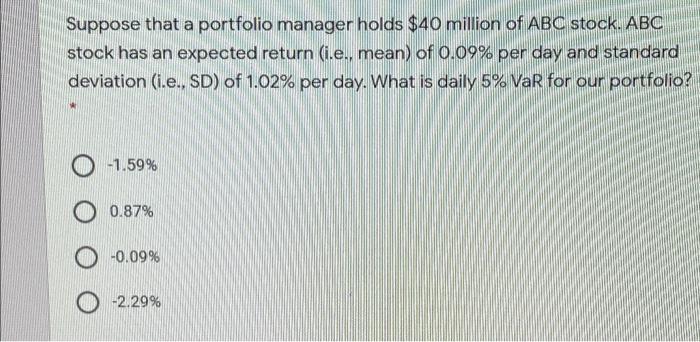

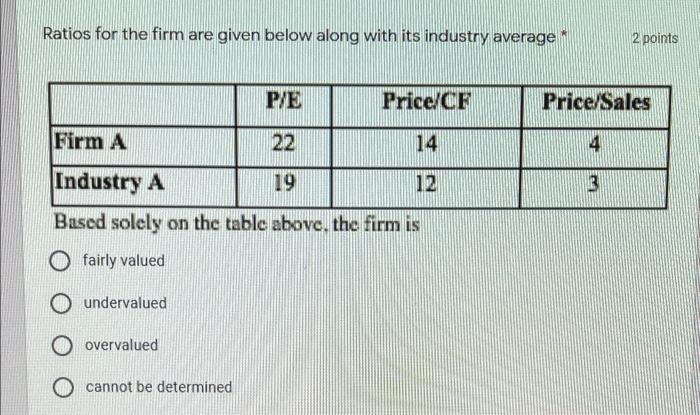

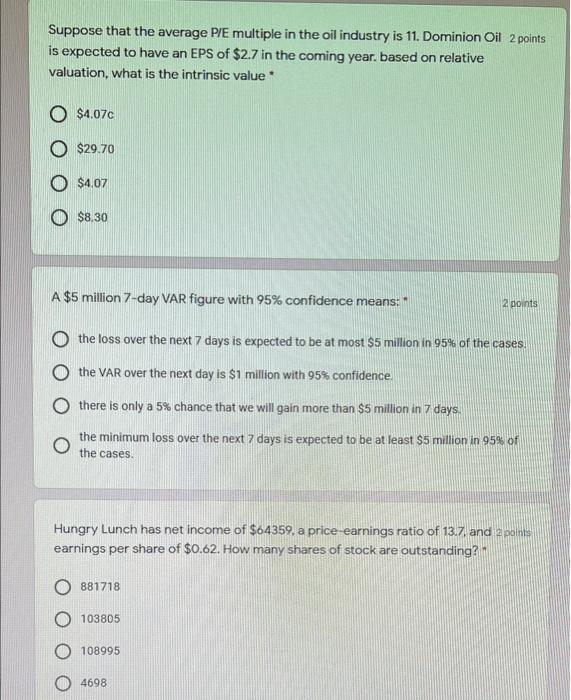

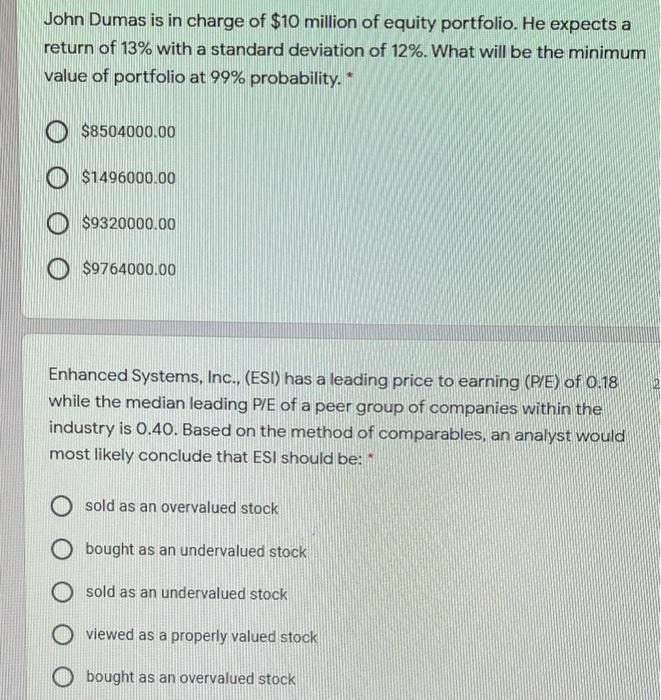

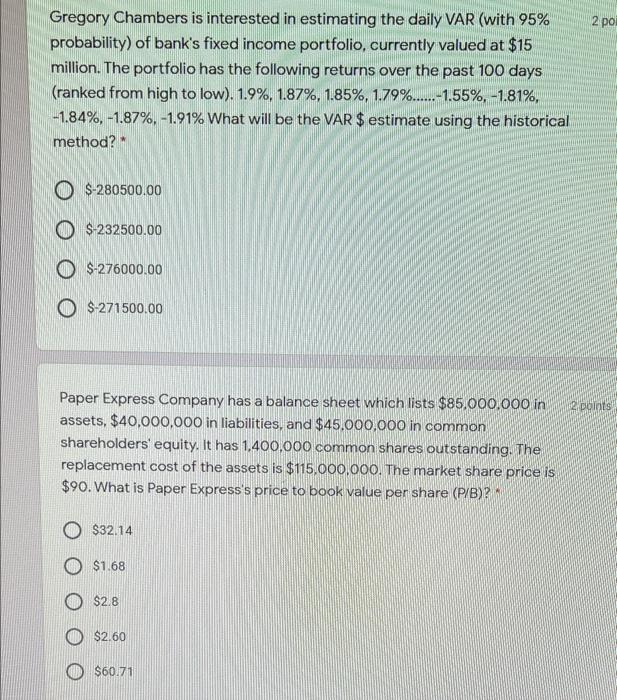

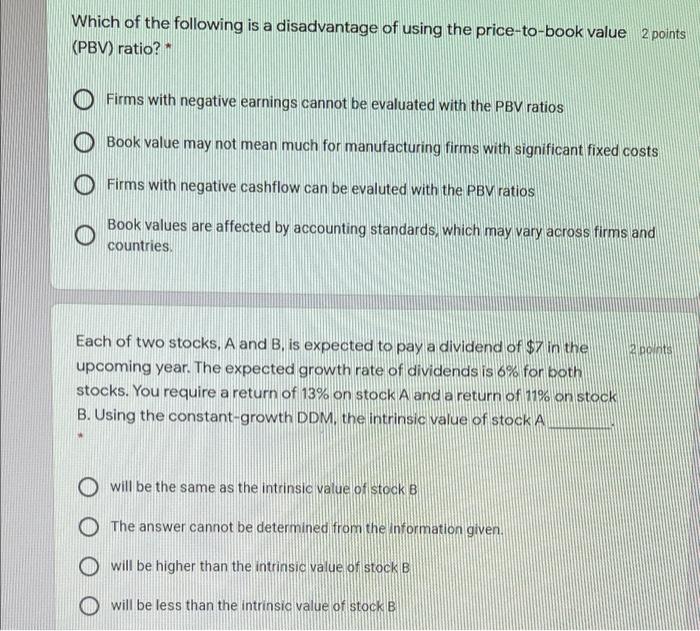

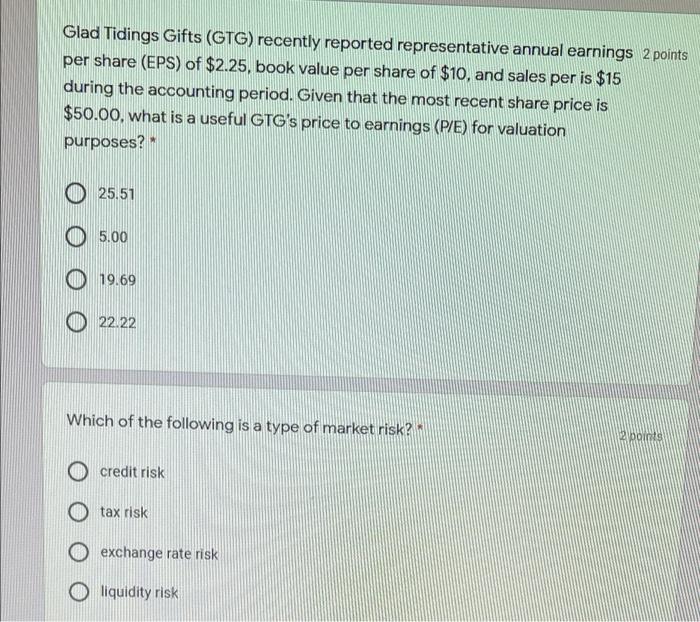

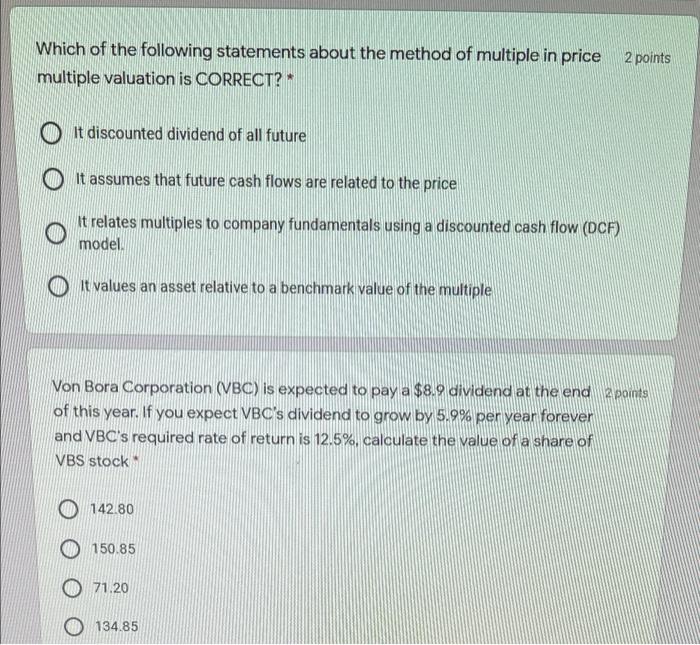

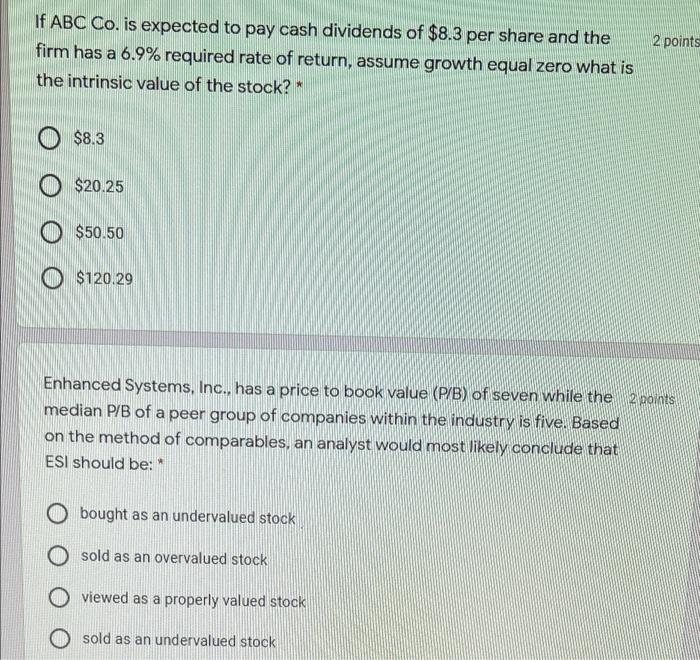

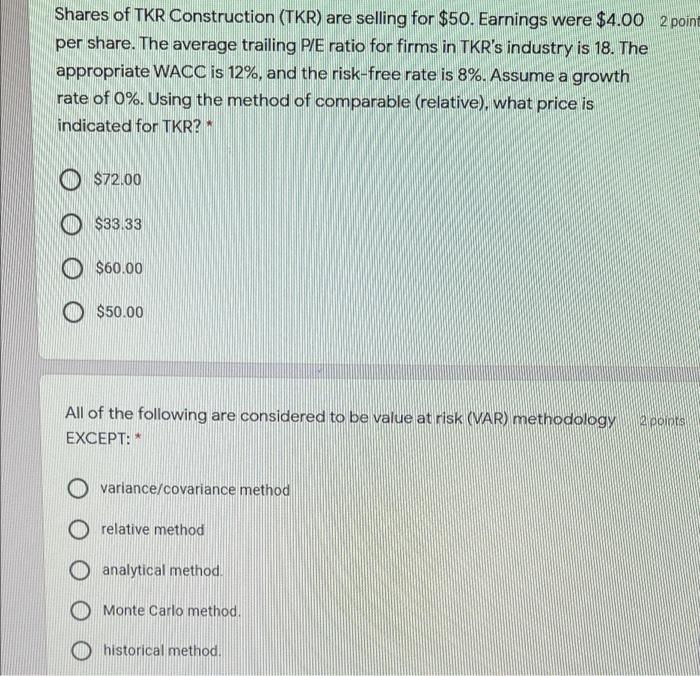

Suppose that a portfolio manager holds $40 million of ABC stock. ABC stock has an expected return (i.e., mean) of 0.09% per day and standard deviation (i.e., SD) of 1.02% per day. What is daily 5% VaR for our portfolio? O-1.59% 0.87% 0 -0.09% -2.29% Ratios for the firm are given below along with its industry average 2 points P/E Price/CF Price/Sales Firm A 22 14 Industry A 19 12 Based solely on the table abovc. the firm is O fairly valued O undervalued overvalued cannot be determined Suppose that the average P/E multiple in the oil industry is 11. Dominion Oil 2 points is expected to have an EPS of $2.7 in the coming year. based on relative valuation, what is the intrinsic value * O $4.07c O $29.70 $4.07 $8.30 A $5 million 7-day VaR figure with 95% confidence means: 2 points the loss over the next 7 days is expected to be at most $5 million in 95% of the cases. the VAR over the next day is $1 million with 95% confidence there is only a 5% chance that we will gain more than $5 million in 7 days the minimum loss over the next 7 days is expected to be at least $5 million in 95% of the cases. Hungry Lunch has net income of $64359, a price-earnings ratio of 13.7 and 2 points earnings per share of $0.62. How many shares of stock are outstanding? 881718 103805 108995 4698 John Dumas is in charge of $10 million of equity portfolio. He expects a return of 13% with a standard deviation of 12%. What will be the minimum value of portfolio at 99% probability. * O $8504000.00 O $1496000.00 $9320000.00 $9764000.00 Enhanced Systems, Inc., (ESI) has a leading price to earning (P/E) of 0.18 while the median leading P/E of a peer group of companies within the industry is 0.40. Based on the method of comparables, an analyst would most likely conclude that ESI should be: h sold as an overvalued stock bought as an undervalued stock sold as an undervalued stock viewed as a properly valued stock bought as an overvalued stock 2 po Gregory Chambers is interested in estimating the daily VAR (with 95% probability) of bank's fixed income portfolio, currently valued at $15 million. The portfolio has the following returns over the past 100 days (ranked from high to low). 1.9%, 1.87%, 1.85%, 1.79%......-1.55%, -1.81%, -1.84%, -1.87%. -1.91% What will be the VAR $ estimate using the historical method? O S-280500.00 O $-232500.00 O $-276000.00 O $-271500.00 2 points Paper Express Company has a balance sheet which lists $85.000.000 in assets, $40,000,000 in liabilities, and $45,000,000 in common shareholders' equity. It has 1,400,000 common shares outstanding. The replacement cost of the assets is $115.000.000. The market share price is $90. What is Paper Express's price to book value per share (P/B)? O $32.14 $1.68 $2.8 $2.60 $60.71 Which of the following is a disadvantage of using the price-to-book value 2 points (PBV) ratio? O Firms with negative earnings cannot be evaluated with the PBV ratios Book value may not mean much for manufacturing firms with significant fixed costs Firms with negative cashflow can be evaluted with the PBV ratios Book values are affected by accounting standards, which may vary across firms and countries a points Each of two stocks, A and B is expected to pay a dividend of $7 in the upcoming year. The expected growth rate of dividends is 6% for both stocks. You require a return of 13% on stock A and a return of 1% on stock B. Using the constant-growth DDM. the intrinsic value of stockA O will be the same as the intrinsic value of stock B The answer cannot be determined from the Information given. will be higher than the intrinsic value of stock B will be less than the intrinsic value of stock B Glad Tidings Gifts (GTG) recently reported representative annual earnings 2 points per share (EPS) of $2.25, book value per share of $10, and sales per is $15 during the accounting period. Given that the most recent share price is $50.00, what is a useful GTG's price to earnings (P/E) for valuation purposes? 25.51 O 5.00 O 19.69 22.22 Which of the following is a type of market risk? 2 points credit risk tax risk exchange rate risk liquidity risk Which of the following statements about the method of multiple in price multiple valuation is CORRECT? 2 points O It discounted dividend of all future o It assumes that future cash flows are related to the price it relates multiples to company fundamentals using a discounted cash flow (DCF) model. It values an asset relative to a benchmark value of the multiple Von Bora Corporation (VBC) is expected to pay a $8.9 dividend at the end 2 points of this year. If you expect VBC's dividend to grow by 5.9% per year forever and VBC's required rate of return is 12.5%, calculate the value of a share of VBS stock 142.80 150.85 71.20 134.85 If ABC Co. is expected to pay cash dividends of $8.3 per share and the firm has a 6.9% required rate of return, assume growth equal zero what is the intrinsic value of the stock? 2 points O $8.3 O $20.25 O $50.50 O $120.29 Enhanced Systems, Inc., has a price to book value (P/B) of seven while the 2 points median P/B of a peer group of companies within the industry is five. Based on the method of comparables, an analyst would most likely conclude that ESI should be: * bought as an undervalued stock sold as an overvalued stock viewed as a properly valued stock O sold as an undervalued stock Shares of TKR Construction (TKR) are selling for $50. Earnings were $4.00 2 point per share. The average trailing P/E ratio for firms in TKR's industry is 18. The appropriate WACC is 12%, and the risk-free rate is 8%. Assume a growth rate of 0%. Using the method of comparable (relative), what price is indicated for TKR? O $72.00 $33.33 O $60.00 O $50.00 All of the following are considered to be value at risk (VAR) methodology EXCEPT: a points variance/covariance method relative method analytical method Monte Carlo method. historical method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started