I want the steps in details please

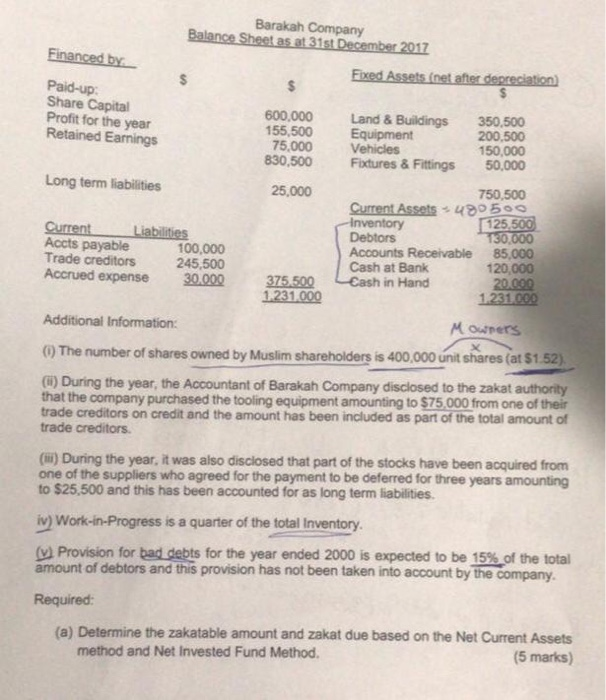

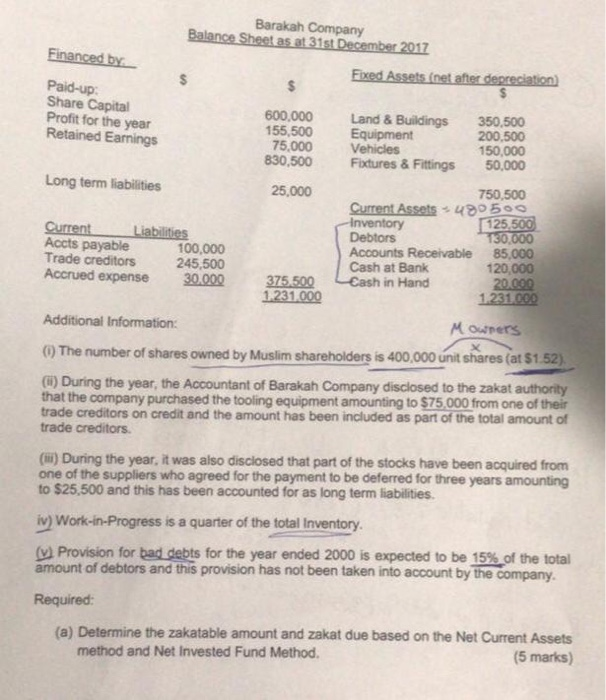

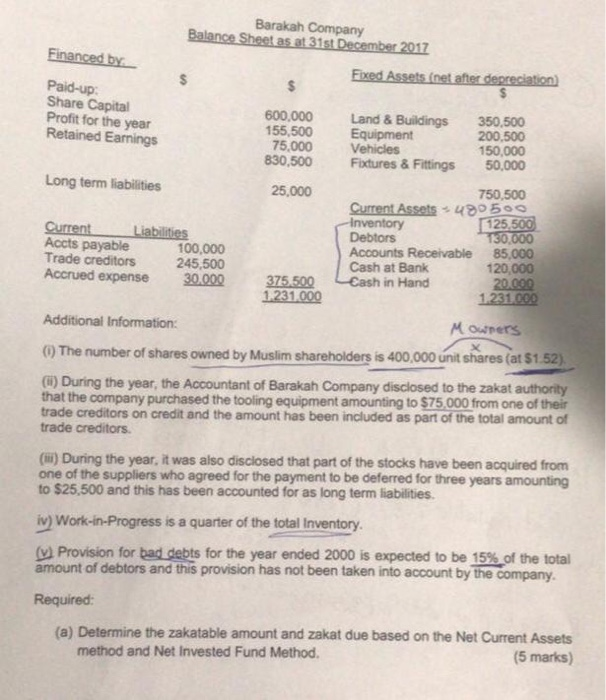

Barakah Company Balance Sheet as at 31st December 2017 Financed by Fixed Assets (net after depreciation) Paid-up: Share Capital Profit for the year Retained Earnings 600.000 155,500 75.000 830,500 25,000 Land & Buildings Equipment Vehicles Foxtures & Fittings 350.500 200.500 150,000 50.000 Long term liabilities Current Liabilities Accts payable 100,000 Trade creditors 245,500 Accrued expense 30.000 750.500 Current Assets - 430500 Inventory 125,500 Debtors 730.000 Accounts Receivable 85.000 Cash at Bank 120,000 Cash in Hand 20.000 1.231000 375.500 1.231.000 Additional Information: Mowners (1) The number of shares owned by Muslim shareholders is 400,000 unit shares (at $1.52). (6) During the year, the Accountant of Barakah Company disclosed to the zakat authority that the company purchased the tooling equipment amounting to $75,000 from one of their trade creditors on credit and the amount has been included as part of the total amount of trade creditors. () During the year, it was also disclosed that part of the stocks have been acquired from one of the suppliers who agreed for the payment to be deferred for three years amounting to $25,500 and this has been accounted for as long term liabilities iv) Work-in-Progress is a quarter of the total Inventory. Provision for bad debts for the year ended 2000 is expected to be 15% of the total amount of debtors and this provision has not been taken into account by the company. Required: (a) Determine the zakatable amount and zakat due based on the Net Current Assets method and Net Invested Fund Method. (5 marks) Barakah Company Balance Sheet as at 31st December 2017 Financed by Fixed Assets (net after depreciation) Paid-up: Share Capital Profit for the year Retained Earnings 600.000 155,500 75.000 830,500 25,000 Land & Buildings Equipment Vehicles Foxtures & Fittings 350.500 200.500 150,000 50.000 Long term liabilities Current Liabilities Accts payable 100,000 Trade creditors 245,500 Accrued expense 30.000 750.500 Current Assets - 430500 Inventory 125,500 Debtors 730.000 Accounts Receivable 85.000 Cash at Bank 120,000 Cash in Hand 20.000 1.231000 375.500 1.231.000 Additional Information: Mowners (1) The number of shares owned by Muslim shareholders is 400,000 unit shares (at $1.52). (6) During the year, the Accountant of Barakah Company disclosed to the zakat authority that the company purchased the tooling equipment amounting to $75,000 from one of their trade creditors on credit and the amount has been included as part of the total amount of trade creditors. () During the year, it was also disclosed that part of the stocks have been acquired from one of the suppliers who agreed for the payment to be deferred for three years amounting to $25,500 and this has been accounted for as long term liabilities iv) Work-in-Progress is a quarter of the total Inventory. Provision for bad debts for the year ended 2000 is expected to be 15% of the total amount of debtors and this provision has not been taken into account by the company. Required: (a) Determine the zakatable amount and zakat due based on the Net Current Assets method and Net Invested Fund Method