Answered step by step

Verified Expert Solution

Question

1 Approved Answer

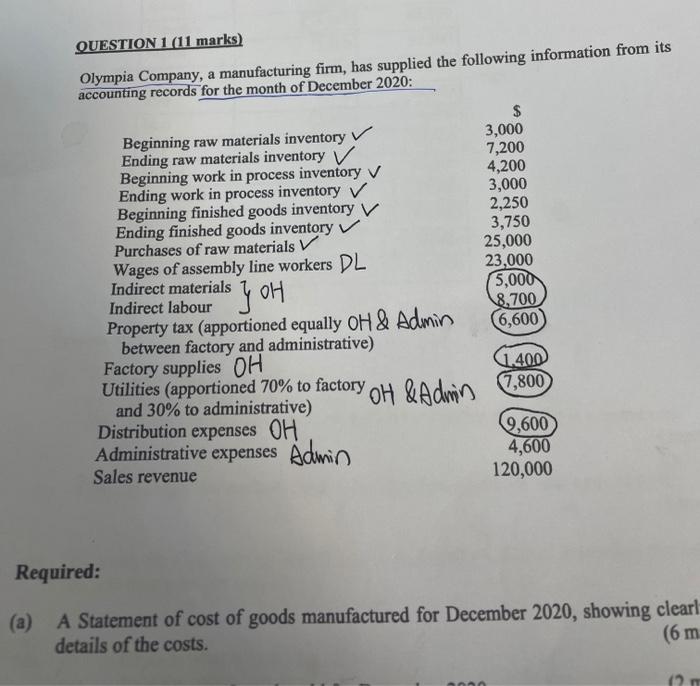

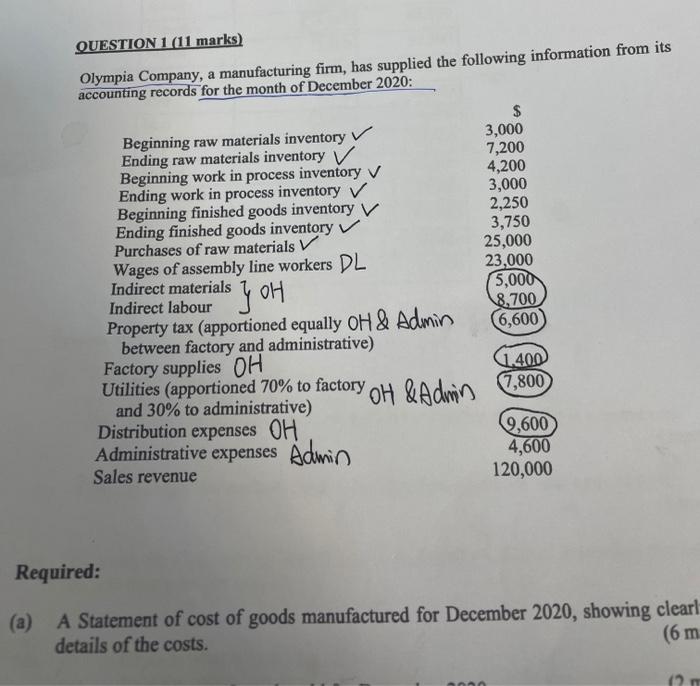

I want to ask the distribution expenses is blong to overhead or selling expense? QUESTION 1 (11 marks) Olympia Company, a manufacturing firm, has supplied

I want to ask the distribution expenses is blong to overhead or selling expense?

QUESTION 1 (11 marks) Olympia Company, a manufacturing firm, has supplied the following information from its accounting records for the month of December 2020: Beginning raw materials inventory Ending raw materials inventory V Beginning work in process inventory V Ending work in process inventory V Beginning finished goods inventory V Ending finished goods inventory v Purchases of raw materials V Wages of assembly line workers DL Indirect materials Indirect labour } Property tax (apportioned equally OH & Admin between factory and administrative) Factory supplies OH Utilities (apportioned 70% to factory oH & Admin and 30% to administrative) Distribution expenses OH Administrative expenses Admin Sales revenue $ 3,000 7,200 4,200 3,000 2,250 3,750 25,000 23,000 5,000 8,700 6,600 YOH (1.400 OH &Admin 7,800 9,600 4,600 120,000 Required: (a) A Statement of cost of goods manufactured for December 2020, showing clearl details of the costs. (6 m 12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started