Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I want to know how the equilibrium returns of each group of assets are calculated, because I don't know how to find the value of

I want to know how the equilibrium returns of each group of assets are calculated, because I don't know how to find the value of the covariance matrix. Thank you very much.

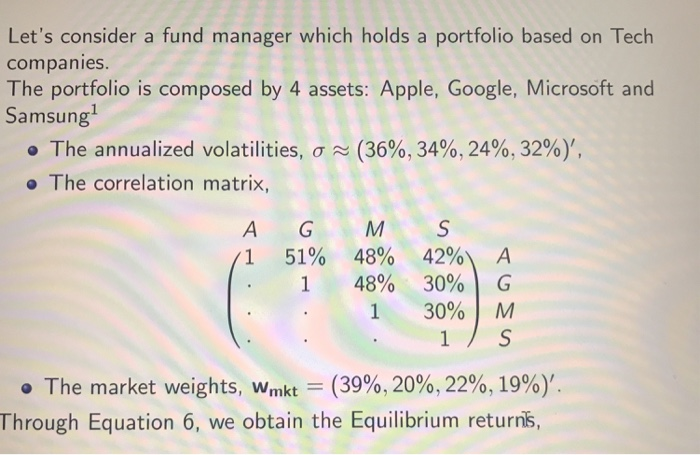

Let's consider a fund manager which holds a portfolio based on Tech companies. The portfolio is composed by 4 assets: Apple, Google, Microsoft and Samsung s(36%, 34%,24%, 32%)', . The annualized volatilities, o The correlation matrix, A G MS /1 48% 48% 42%) A 30%) G 30901 M 51% . The market weights, wmk.-(39%, 20%, 22%, 19%). Through Equation 6, we obtain the Equilibrium return hrough Equation 6, we obtain the Equilibrium returns, (10%, 8%, 5%, 6%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started