Answered step by step

Verified Expert Solution

Question

1 Approved Answer

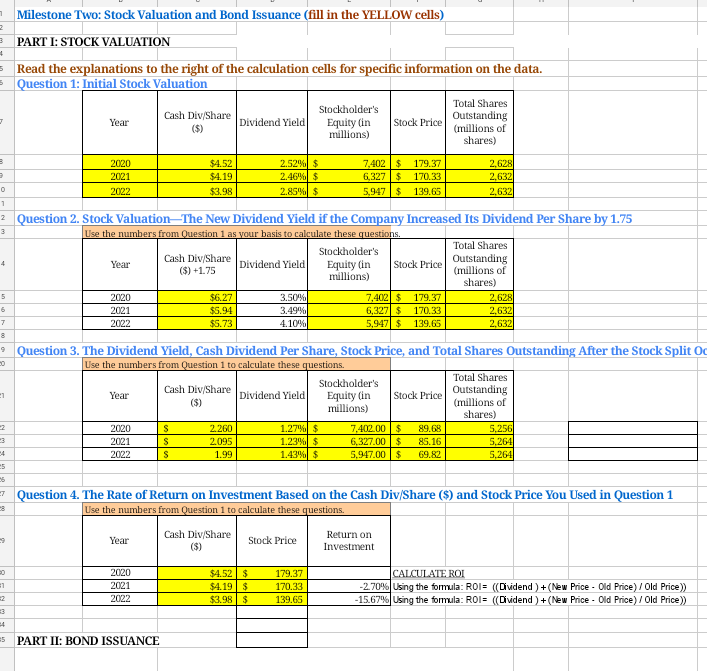

I want to know if the values are correct. Thanks! 7 Milestone Two: Stock Valuation and Bond Issuance (fill in the YELLOW cells) 2 3

I want to know if the values are correct. Thanks!

7 Milestone Two: Stock Valuation and Bond Issuance (fill in the YELLOW cells) 2 3 4 3 3 3 4 5 6 7 8 21 2 25 15 #1 =2 #4 PART I: STOCK VALUATION Read the explanations to the right of the calculation cells for specific information on the data. Question 1: Initial Stock Valuation #5 Year 2020 2021 2022 1 2 Question 2. Stock Valuation The New Dividend Yield if the Company Increased Its Dividend Per Share by 1.75 Use the numbers from Question 1 as your basis to calculate these questions. 3 Year 2020 2021 2022 Year 2020 2021 2022 Cash Div/Share ($) Year 2020 2021 2022 $4.52 $4.19 $3.98 PART II: BOND ISSUANCE Cash Div/Share ($) +1.75 $6.27 $5.94 $5.73 $ $ $ Cash Div/Share ($) Dividend Yield 2.260 2.095 1.99 2.52% $ 2.46% $ 2.85% $ Dividend Yield 3.50% 3.49% 4.10% Dividend Yield] Stockholder's Equity (in millions) $4.52 $ $4.19 $ $3.98 $ Question 3. The Dividend Yield, Cash Dividend Per Share, Stock Price, and Total Shares Outstanding After the Stock Split O Use the numbers from Question 1 to calculate these questions. Stock Price 1.27% $ 1.23% $ 1.43% $ 7,402 $ 179.37 6,327 $ 170.33 5,947 $ 139.65 Stockholder's Equity (in millions) 179.37 170.33 139.65 Stock Price 7,402 $ 6,327 $ 5,947 $ Stockholder's Equity (in millions) Stock Price 179.37 170.33 139.65 Return on Investment Total Shares Outstanding (millions of shares) Stock Price 7,402.00 $ 89.68 6,327.00 $ 85.16 5,947.00 $ 69.82 2,628 2,632 2,632 Question 4. The Rate of Return on Investment Based on the Cash Div/Share ($) and Stock Price You Used in Question 1 Use the numbers from Question 1 to calculate these questions. Cash Div/Share Total Shares Outstanding (millions of shares) 2,628 2,632 2,632 Total Shares Outstanding (millions of shares) 5,256 5,264 5,264 CALCULATE ROI -2.70% Using the formula: ROI= ((Dividend) + (New Price - Old Price) / Old Price)) -15.67% Using the formula: ROI= ((Dividend ) + (New Price - Old Price) / Old Price)) 7 Milestone Two: Stock Valuation and Bond Issuance (fill in the YELLOW cells) 2 3 4 3 3 3 4 5 6 7 8 21 2 25 15 #1 =2 #4 PART I: STOCK VALUATION Read the explanations to the right of the calculation cells for specific information on the data. Question 1: Initial Stock Valuation #5 Year 2020 2021 2022 1 2 Question 2. Stock Valuation The New Dividend Yield if the Company Increased Its Dividend Per Share by 1.75 Use the numbers from Question 1 as your basis to calculate these questions. 3 Year 2020 2021 2022 Year 2020 2021 2022 Cash Div/Share ($) Year 2020 2021 2022 $4.52 $4.19 $3.98 PART II: BOND ISSUANCE Cash Div/Share ($) +1.75 $6.27 $5.94 $5.73 $ $ $ Cash Div/Share ($) Dividend Yield 2.260 2.095 1.99 2.52% $ 2.46% $ 2.85% $ Dividend Yield 3.50% 3.49% 4.10% Dividend Yield] Stockholder's Equity (in millions) $4.52 $ $4.19 $ $3.98 $ Question 3. The Dividend Yield, Cash Dividend Per Share, Stock Price, and Total Shares Outstanding After the Stock Split O Use the numbers from Question 1 to calculate these questions. Stock Price 1.27% $ 1.23% $ 1.43% $ 7,402 $ 179.37 6,327 $ 170.33 5,947 $ 139.65 Stockholder's Equity (in millions) 179.37 170.33 139.65 Stock Price 7,402 $ 6,327 $ 5,947 $ Stockholder's Equity (in millions) Stock Price 179.37 170.33 139.65 Return on Investment Total Shares Outstanding (millions of shares) Stock Price 7,402.00 $ 89.68 6,327.00 $ 85.16 5,947.00 $ 69.82 2,628 2,632 2,632 Question 4. The Rate of Return on Investment Based on the Cash Div/Share ($) and Stock Price You Used in Question 1 Use the numbers from Question 1 to calculate these questions. Cash Div/Share Total Shares Outstanding (millions of shares) 2,628 2,632 2,632 Total Shares Outstanding (millions of shares) 5,256 5,264 5,264 CALCULATE ROI -2.70% Using the formula: ROI= ((Dividend) + (New Price - Old Price) / Old Price)) -15.67% Using the formula: ROI= ((Dividend ) + (New Price - Old Price) / Old Price))Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started