Answered step by step

Verified Expert Solution

Question

1 Approved Answer

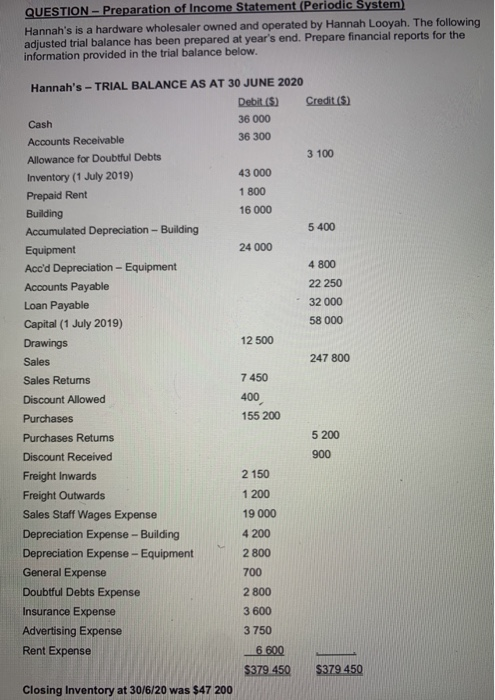

I want to know the income statement of these two QUESTION - Preparation of Income Statement (Periodic System Hannah's is a hardware wholesaler owned and

I want to know the income statement of these two

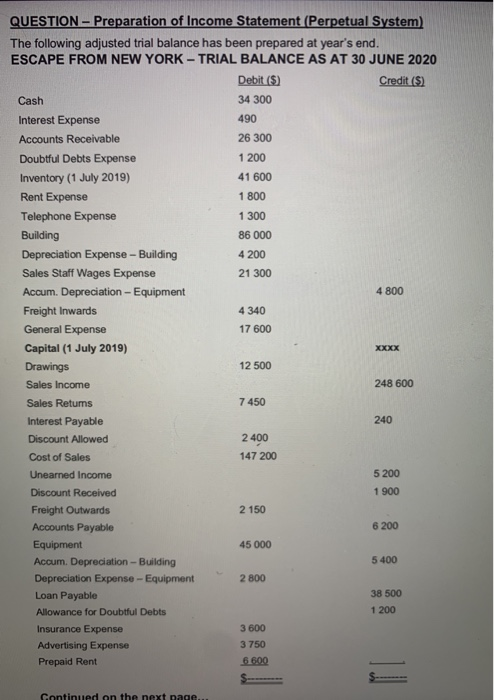

QUESTION - Preparation of Income Statement (Periodic System Hannah's is a hardware wholesaler owned and operated by Hannah Looyah. The following adjusted trial balance has been prepared at year's end. Prepare financial reports for the information provided in the trial balance below. Hannah's - TRIAL BALANCE AS AT 30 JUNE 2020 Debit (5) Credit ($) Cash 36 000 Accounts Receivable 36 300 Allowance for Doubtful Debts 3 100 Inventory (1 July 2019) 43 000 Prepaid Rent 1 800 Building 16 000 Accumulated Depreciation - Building 5 400 Equipment 24 000 Acc'd Depreciation - Equipment 4 800 Accounts Payable 22 250 Loan Payable 32 000 Capital (1 July 2019) 58 000 Drawings 12 500 Sales 247 800 Sales Retums 7 450 Discount Allowed Purchases 155 200 Purchases Retums 5 200 400 900 2 150 1 200 19 000 4 200 Discount Received Freight Inwards Freight Outwards Sales Staff Wages Expense Depreciation Expense - Building Depreciation Expense - Equipment General Expense Doubtful Debts Expense Insurance Expense Advertising Expense Rent Expense 2 800 700 2 800 3 600 3750 6.600 $379.450 $379.450 Closing Inventory at 30/6/20 was $47 200 QUESTION - Preparation of Income Statement (Perpetual System) The following adjusted trial balance has been prepared at year's end. ESCAPE FROM NEW YORK - TRIAL BALANCE AS AT 30 JUNE 2020 Debit ($) Credit ($) Cash 34 300 Interest Expense 490 Accounts Receivable 26 300 Doubtful Debts Expense 1 200 Inventory (1 July 2019) 41 600 Rent Expense 1 800 Telephone Expense 1 300 Building 86 000 Depreciation Expense - Building 4 200 Sales Staff Wages Expense 21 300 Accum. Depreciation - Equipment 4 800 Freight Inwards 4 340 General Expense 17 600 Capital (1 July 2019) Drawings 12 500 Sales Income 248 600 Sales Retums 7450 Interest Payable 240 Discount Allowed 2 400 Cost of Sales 147 200 Unearned Income 5200 Discount Received 1 900 Freight Outwards 2 150 Accounts Payable 6 200 Equipment 45 000 Accum. Depreciation - Building 5 400 Depreciation Expense - Equipment 2 800 Loan Payable 38 500 Allowance for Doubtful Debts 1 200 Insurance Expense 3 600 Advertising Expense 3 750 Prepaid Rent 6600 XXXX Continued on the next page Question (Continued) Requirements: Calculate the figure for Capital at 1/7/19 Prepare a fully classified Income Statement for the year ended 30th June 2020 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started