Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I want to know what might need to be filled in in these blanks? Especially in the POST. REF. Journalizing and Posting On October 3,

I want to know what might need to be filled in in these blanks? Especially in the POST. REF.

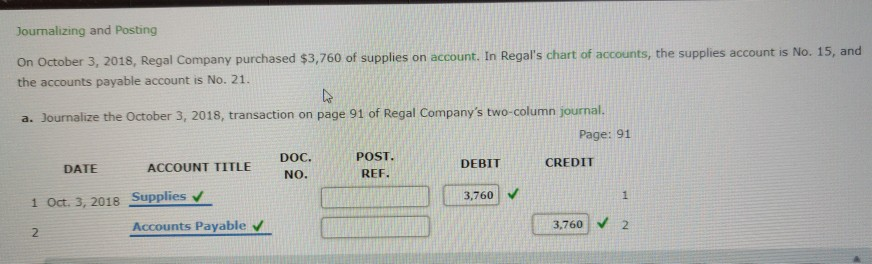

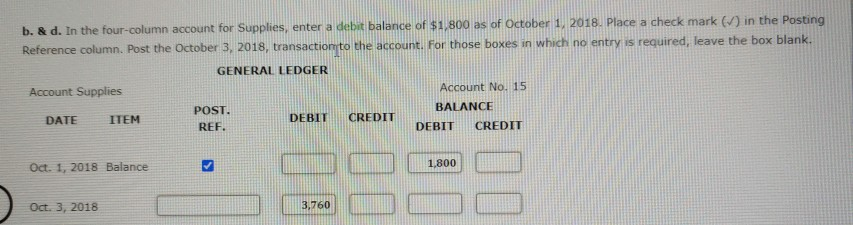

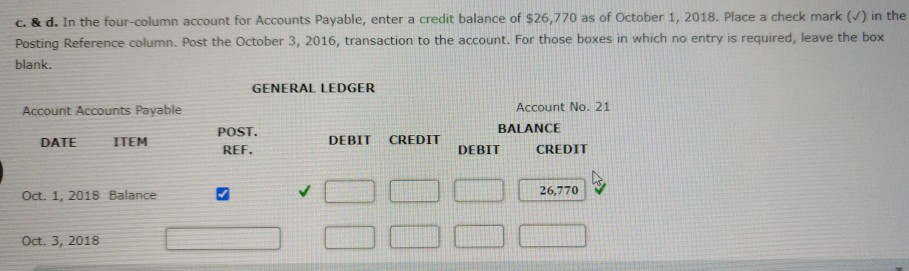

Journalizing and Posting On October 3, 2018, Regal Company purchased $3,760 of supplies on account. In Regal's chart of accounts, the supplies account is No. 15, and the accounts payable account is No. 21. a. Journalize the October 3, 2018, transaction on page 91 of Regal Company's two-column journal. Page: 91 DOC. POST. DATE ACCOUNT TITLE DEBIT CREDIT NO. REF. 1 Oct. 3, 2018 Supplies 3,760 1 2 Accounts Payable 3.7602 b. & d. In the four-column account for Supplies, enter a debit balance of $1,800 as of October 1, 2018. Place a check mark (/) in the Posting Reference column. Post the October 3, 2018, transaction to the account. For those boxes in which no entry is required, leave the box blank. GENERAL LEDGER Account Supplies Account No. 15 POST. BALANCE DATE ITEM DEBIT CREDIT REF. DEBIT CREDIT 1,800 Oct. 1, 2018 Balance Oct. 3, 2018 3,760 c. & d. In the four-column account for Accounts Payable, enter a credit balance of $26,770 as of October 1, 2018. Place a check mark (V) in the Posting Reference column. Post the October 3, 2016, transaction to the account. For those boxes in which no entry is required, leave the box blank. GENERAL LEDGER Account Accounts Payable Account No. 21 BALANCE DEBIT CREDIT DATE POST. REF. ITEM DEBIT CREDIT Oct. 1, 2018 Balance 26,770 Oct. 3, 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started