Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i want to see how you guys solve this. i dont the solution, so i just need to how you solve it. 15-17 T12 per

i want to see how you guys solve this. i dont the solution, so i just need to how you solve it.

15-17

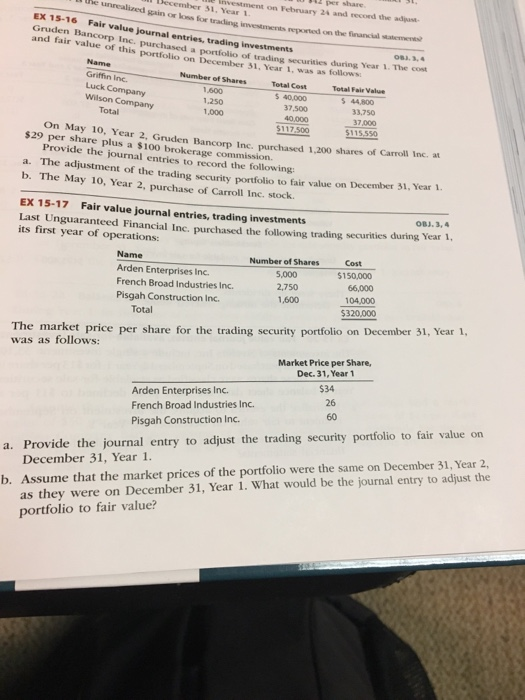

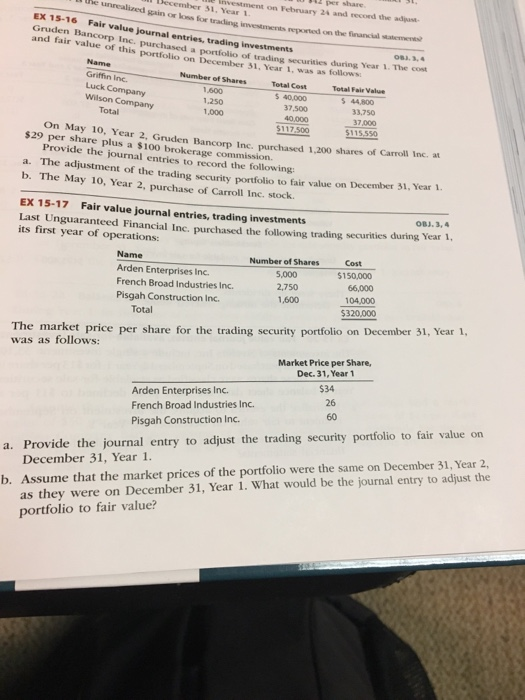

T12 per share. nvestment on February 24 and record the adiast- Becember 51, Year 1 gain or loss for trading investments reported on the financial ateme EX 15- Gruden Bancorp Inc. and fair value of this 16 Fair value journal entries, trading purchased a portfolio of trading securities during Year 1. The cos portfolio on December 31, Year 1, was as follows OBJ. 3.4 December 3 Number of Shares 1,600 1,250 1,000 Griffin Inc Total Cost 5 40,000 37,500 40,000 Total Fair Value 5 44,800 33,750 37,000 Wilson Company Total $117500$115550 2aOn May 10, Year 2. Gruden Bancorp Inc. purchased 1,200 shares of Carrol Ine. at $29 per share plus a $100 brokerage commission Provide the journal entries to record the following: a. The adjustment of the b. The May 10, Year 2, purchase of Carroll Inc. stock. trading security portfolio to fair value on December 31, Year 1. EX 15-17 Fair value journal entries, trading investments Last Unguaranteed Financial Inc. purchased the following trading securities during Year 1 081. 3, 4 its first year of operations: Name Arden Enterprises Inc. French Broad Industries Inc. Pisgah Construction Inc. Number of Shares 5,000 2,750 1,600 Cost $150,000 66,000 104,000 $320,000 Total talstruc The market price per share for the trading security portfolio on December 31, Year 1, was as follows: Market Price per Share, Dec. 31, Year 1 $34 Arden Enterprises Inc. French Broad Industries Inc. Pisgah Construction Inc. 26 60 December 31, Year 1. Assume that the market prices of the portfolio were the same on December 31, Year 2, as they were on December 31, Year 1. What would be the journal entry to adjust the portfolio to fair value? a. Provide the journal entry to adjust the trading security portfolio to fair value on b Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started