Question

I want to see what you get for the answer please. Problem 11.5A Computing and recording unemployment taxes; completing Form 940. LO 11-6, 11-7 Certain

I want to see what you get for the answer please.

Problem 11.5A Computing and recording unemployment taxes; completing Form 940. LO 11-6, 11-7

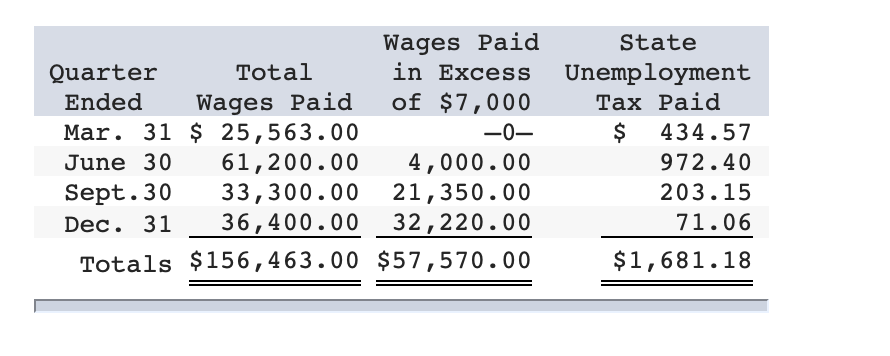

Certain transactions and procedures relating to federal and state unemployment taxes follow for Fancy Nancy LLC, a retail store owned by Nancy Roberts. The firms address is 2007 Trendsetter Lane, Dallas, TX 75268-0967. The firms phone number is 972-456-1200.The employers federal and state identification numbers are 75-9462315 and 37-9462315, respectively. Carry out the procedures as instructed in each of the following steps. Assume that all wages have been paid and that all quarterly payments have been submitted to the state as required. The payroll information for 2019 appears below. The federal tax deposits were submitted as follows: a deposit of $153.38 on April 21, a deposit of $343.20 on July 22, and a deposit of 71.70 on October 21.

Side note! You can only use these options below to solve the entry.

Cash

Employee income tax payable

Federal unemployment tax payable

Interest expense

Interest payable

Medicare tax payable

Notes payable

Office salaries expense

Payroll taxes expense

Petty cash

Prepaid expenses

Prepaid worker's compensation insurance

Rent expense

Salaries expense

Salaries payable

Sales salaries expense

Sales tax payable

Social security tax payable

State unemployment tax payable

Utilities expense

Workers' compensation insurance expense

Workers' compensation insurance payabl

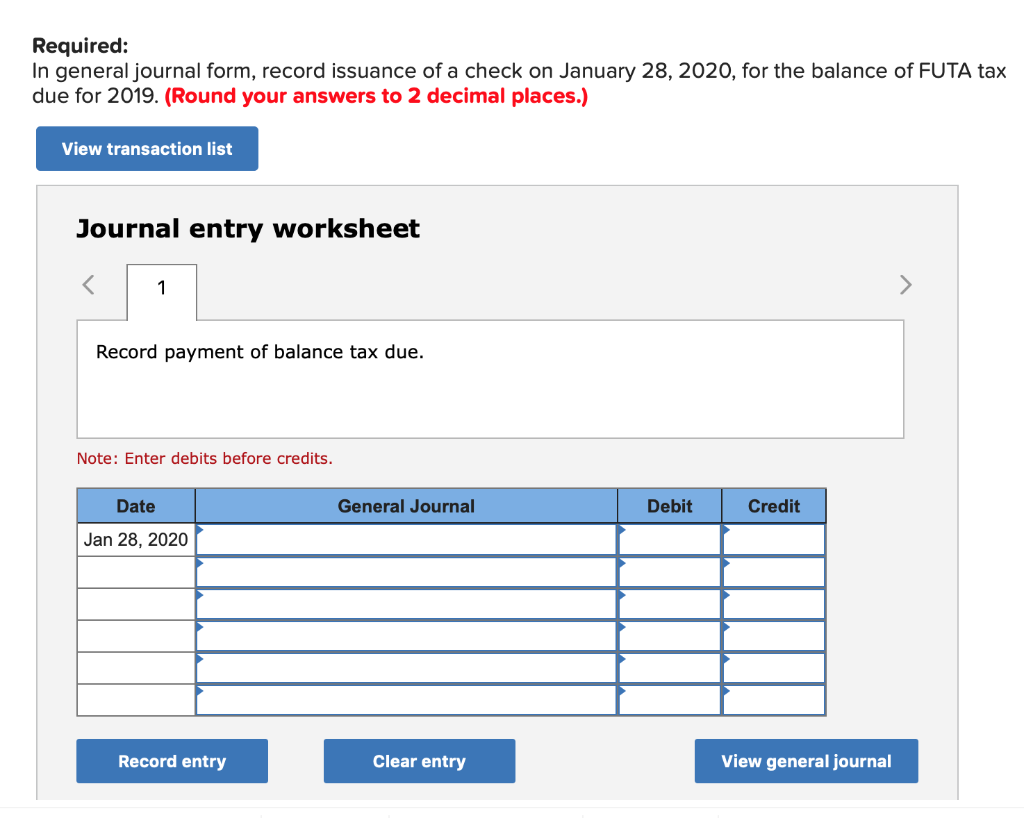

Wages Paid in Excess State Total Unemployment x aid $ Quarter Wages Paid Mar. 31 25,563.00 61,200.00 33,300.00 36,400.00 Ended of $7,000 -0- 434.57 4,000.00 21,350.00 32,220.00 972.40 June 30 203.15 Sept. 30 71.06 Dec. 31 $1,681.18 Totals $156,463.00 $57,570.00 Required: In general journal form, record issuance of a check on January 28, 2020, for the balance of FUTA tax due for 2019. (Round your answers to 2 decimal places.) View transaction list Journal entry worksheet 1 Record payment of balance tax due. Note: Enter debits before credits. Date General Journal Debit Credit Jan 28, 2020 Record entry Clear entry View general journalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started