Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I want to solve these previous questions based on the following Excel file: I have an exam that I want to solve, but I don't

I want to solve these previous questions based on the following Excel file:

I have an exam that I want to solve, but I don't have much time

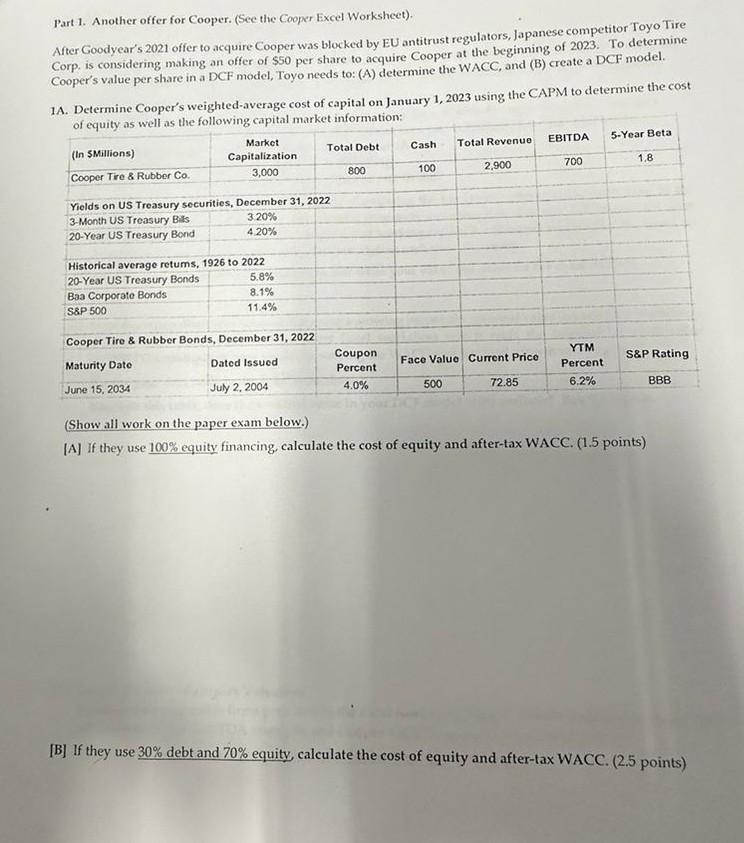

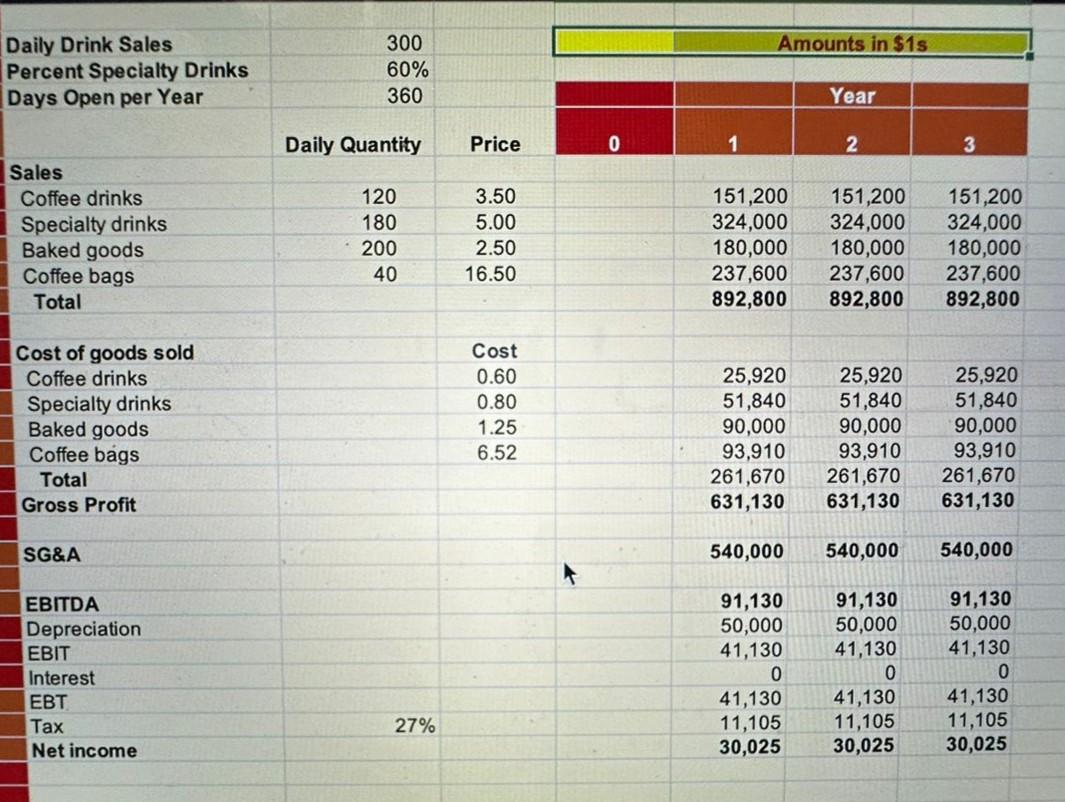

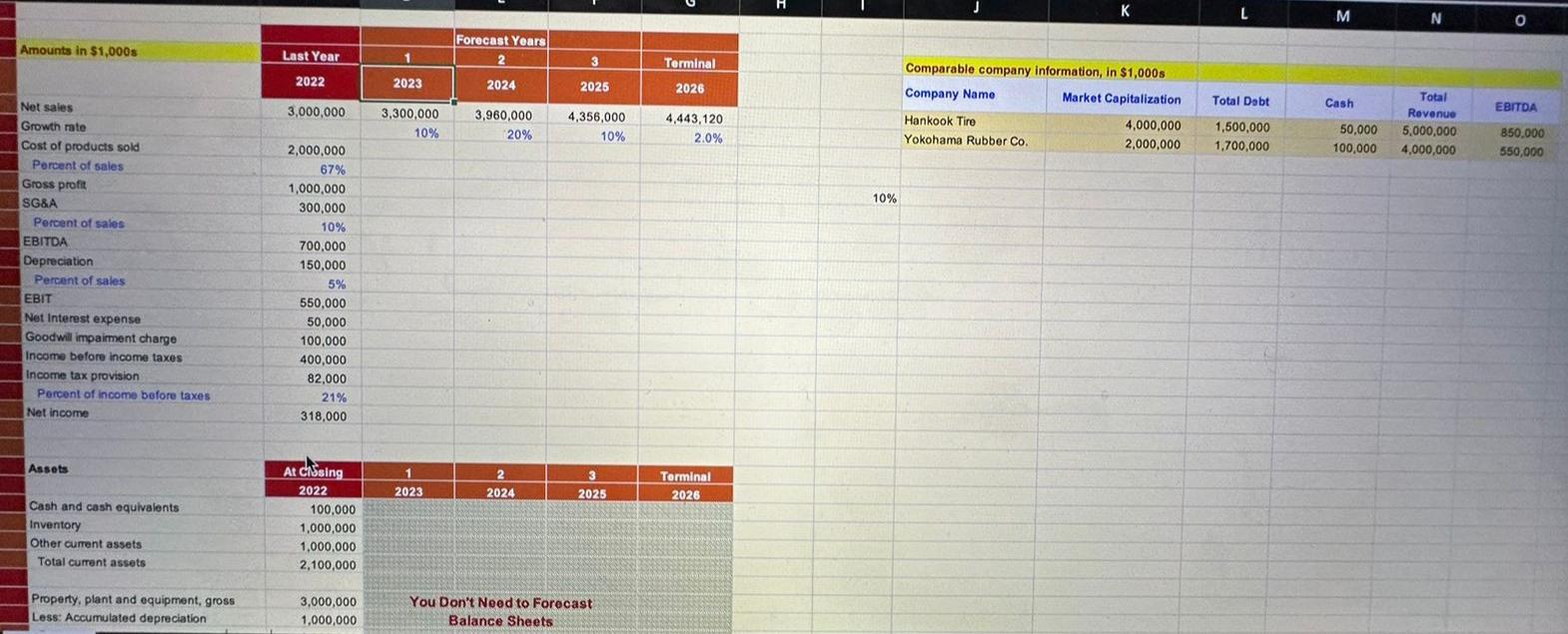

Part 1. Another offer for Cooper. (See the Cooper Excel Worksheet). After Goodyear's 2021 offer to acquire Cooper was blocked by EU antitrust regulators, Japanese competitor Toyo Tire Corp, is considering making an offer of $50 per share to acquire Cooper at the beginning of 2023 . To determine Cooper's value per share in a DCF model, Toyo needs to: (A) determine the WACC, and (B) create a DCF model. 1A. Determine Cooper's weighted-average cost of capital on January 1,2023 using the CAPM to determine the cost (Show all work on the paper exam below.) [A] If they use 100% equity financing, calculate the cost of equity and after-tax WACC. (1.5 points) [B] If they use 30% debt and 70% equity, calculate the cost of equity and after-tax WACC. (2.5 points) \begin{tabular}{|c|c|c|c|c|c|c|} \hline Daily Drink Sales & 300 & & & \multicolumn{3}{|c|}{ Amounts in \$1s } \\ \hline Percent Specialty Drinks & 60% & & & & & \\ \hline \multirow[t]{2}{*}{ Days Open per Year } & 360 & & & & Year & \\ \hline & Daily Quantity & Price & 0 & 1 & 2 & 3 \\ \hline \multicolumn{7}{|l|}{ Sales } \\ \hline Coffee drinks & 120 & 3.50 & & 151,200 & 151,200 & 151,200 \\ \hline Specialty drinks & 180 & 5.00 & & 324,000 & 324,000 & 324,000 \\ \hline Baked goods & 200 & 2.50 & & 180,000 & 180,000 & 180,000 \\ \hline Coffee bags & 40 & 16.50 & & 237,600 & 237,600 & 237,600 \\ \hline Total & & . & & 892,800 & 892,800 & 892,800 \\ \hline Cost of goods sold & & Cost & & & & \\ \hline Coffee drinks & & 0.60 & & 25,920 & 25,920 & 25,920 \\ \hline Specialty drinks & & 0.80 & & 51,840 & 51,840 & 51,840 \\ \hline Baked goods & & 1.25 & & 90,000 & 90,000 & 90,000 \\ \hline Coffee bags & & 6.52 & & 93,910 & 93,910 & 93,910 \\ \hline Total & & & & 261,670 & 261,670 & 261,670 \\ \hline Gross Profit & & & & 631,130 & 631,130 & 631,130 \\ \hline \multirow[t]{2}{*}{ SG\&A } & 2 & & & 540,000 & 540,000 & 540,000 \\ \hline & & + & 4 & & & \\ \hline EBITDA & & & & 91,130 & 91,130 & 91,130 \\ \hline Depreciation & & & & 50,000 & 50,000 & 50,000 \\ \hline EBIT & & & & 41,130 & 41,130 & 41,130 \\ \hline Interest & & & & 0 & 0 & 0 \\ \hline EBT & & & & 41,130 & 41,130 & 41,130 \\ \hline Tax & 27% & 3 & & 11,105 & 11,105 & 11,105 \\ \hline Net income & & & . & 30,025 & 30,025 & 30,025 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started