Question: I want you to answer all branches clearly Problem Set 2 Problems 1. A bond provides information about its par value, coupon interest rate, and

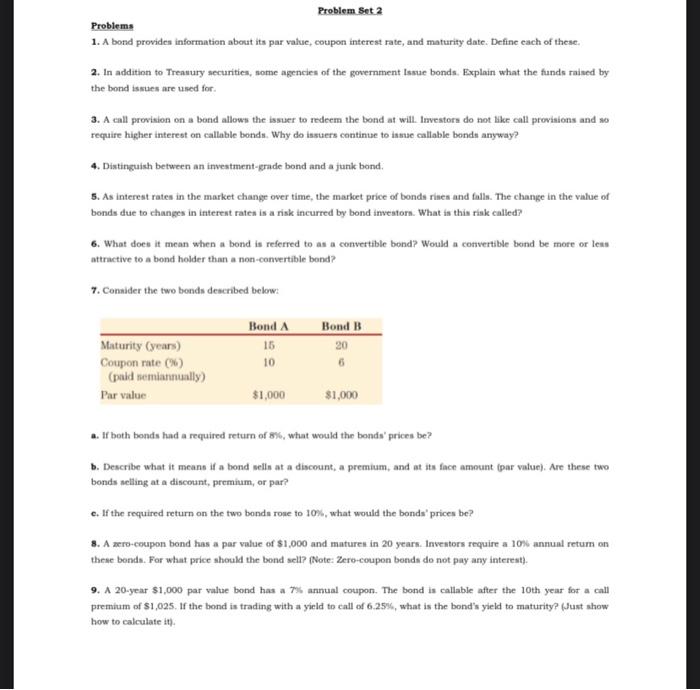

Problem Set 2 Problems 1. A bond provides information about its par value, coupon interest rate, and maturity date. Define each of these 2. In addition to Treasury securities, some agencies of the government Issue bonds. Explain what the funds raised by the bond issues are used for 3. A call provision on a bond allows the issuer to redeem the bond at will. Investors do not like call provisions and so require higher interest on callable bonds. Why do issuers continue to innae callable bondt anyway? 4. Distinguish between an investment-grade bond and a junk band, 5. As interest rates in the market change over time, the market price of bonda rines and falls. The change in the value of bonds due to changes in interest rates is a risk incurred by bond Investors. What is this rink called? 6. What does it mean when a bond is referred to as a convertible bond? Would a convertible bond be more or less attractive to a bond holder than a non-convertible bond? 7. Consider the two bonds described below: Bond B Bond A 15 10 Maturity Cyears) Coupon rate (%) (pold semiannually) Par value 20 $1,000 $1,000 If both bonds had a required return of 8%, what would the bonds' prices be? b. Describe what it means it a bond wells at a discount, a premium, and at its face amount (par value). Are these two bonds selling at a discount, premium, or par? e. If the required return on the two bonds rose to 10%, what would the bonds prices be? 8. A mero-coupon bond has a par value of $1,000 and matures in 20 years. Investors require a 10% annual retum on these bonds. For what price should the bond sell? (Note: Zero-coupon bonds do not pay any interest). 9. A 20-year $1,000 par valse bond has a 7% annual coupon. The bond is callable after the 10th year for a call premium of $1,025. If the bond is trading with a yield to call of 6.25%, what is the bond's yield to maturity? (Just show how to calculate it)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts