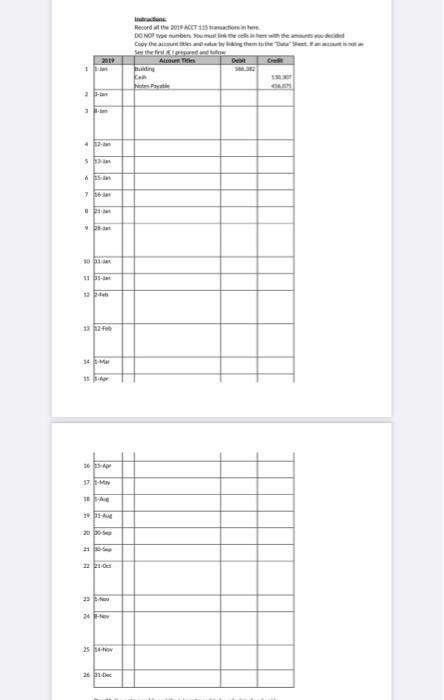

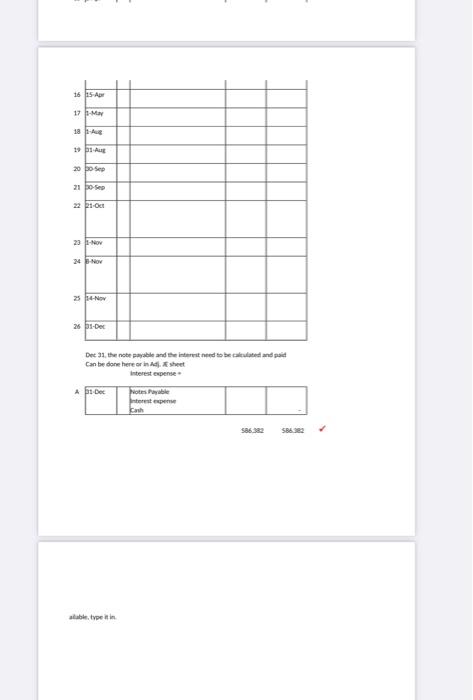

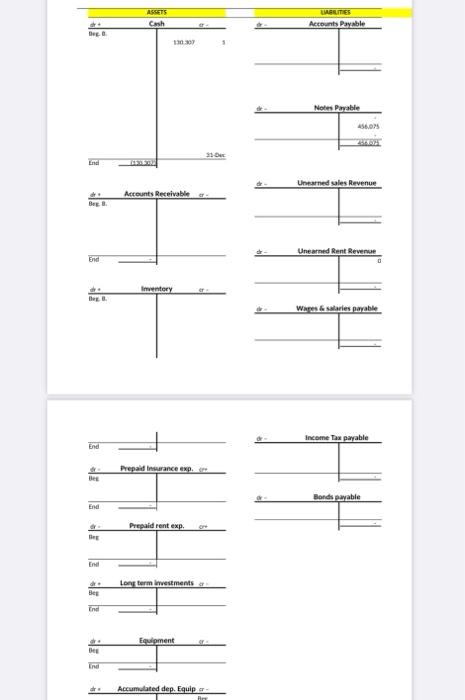

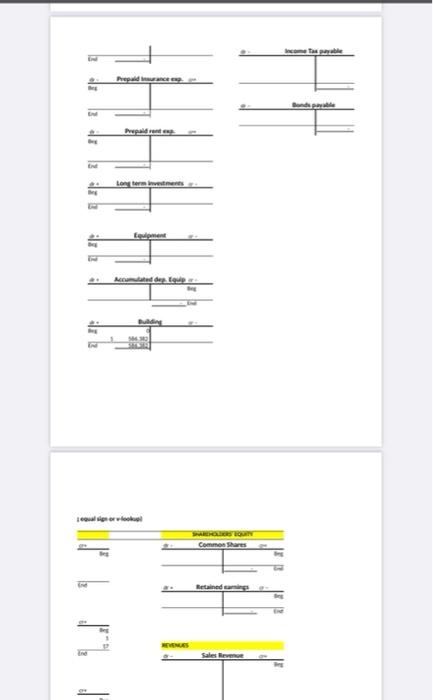

i want you to solve the journal entries , t accounts and unadjusted trial balance for the given data and to put it in the table as given

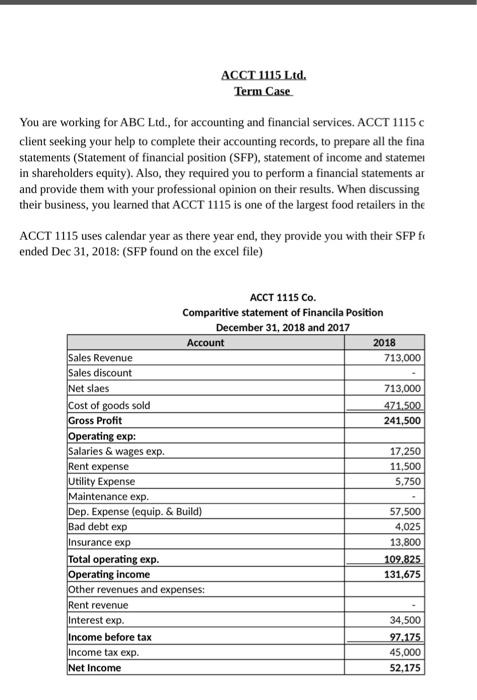

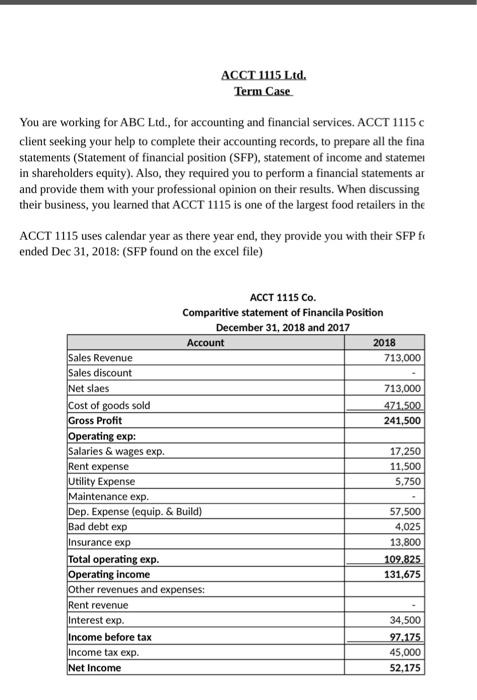

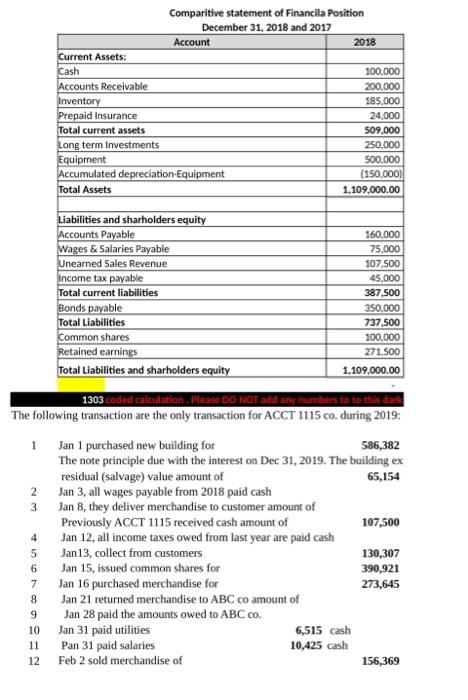

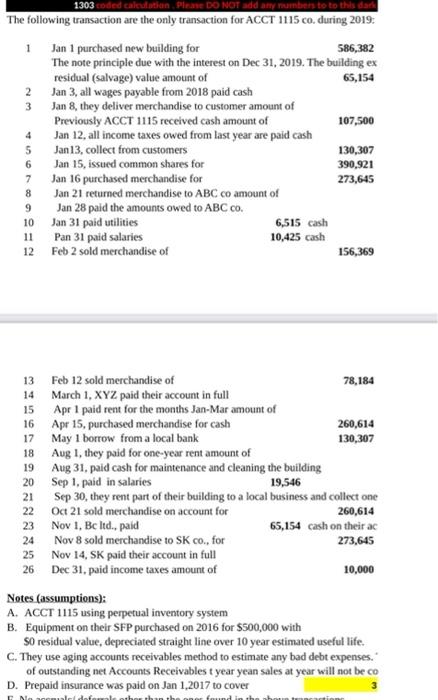

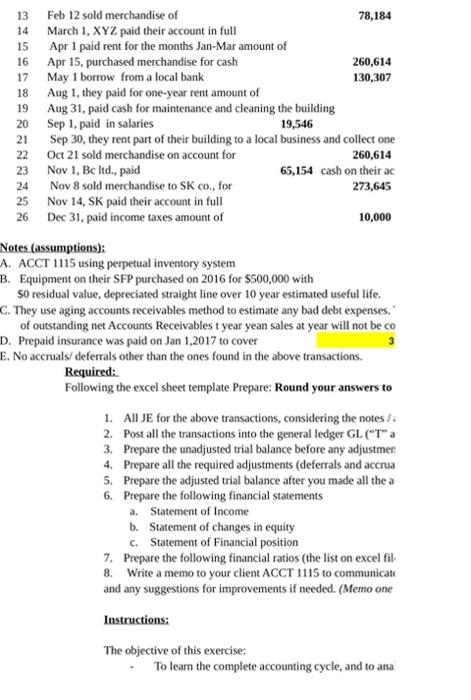

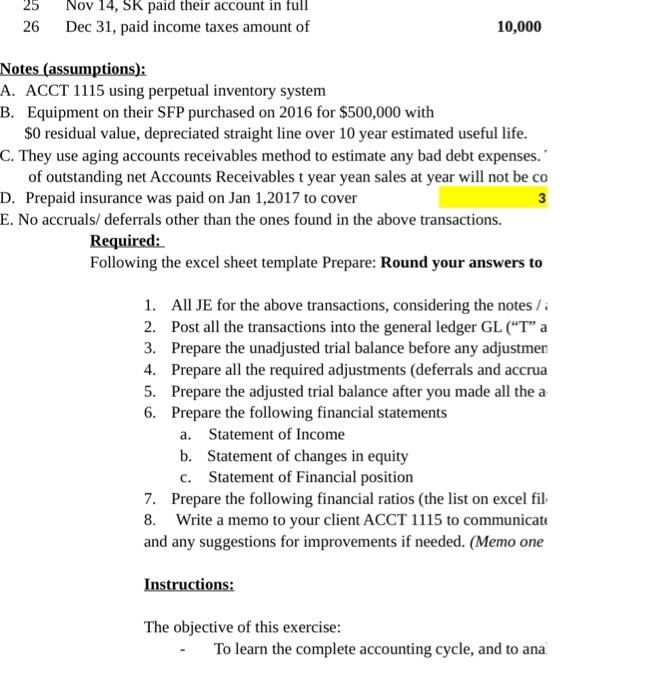

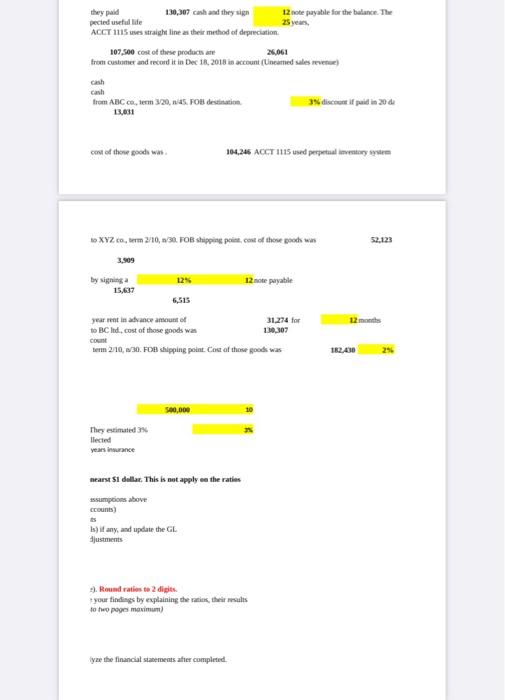

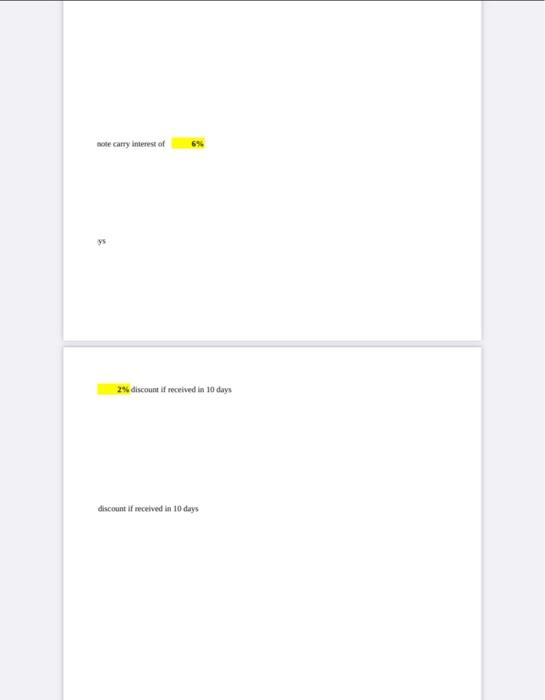

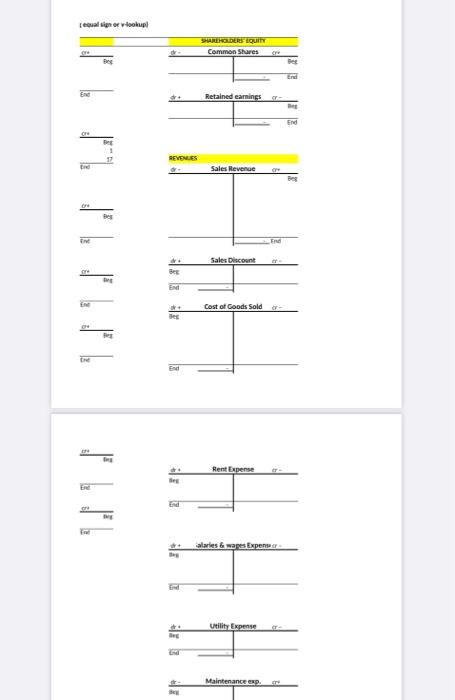

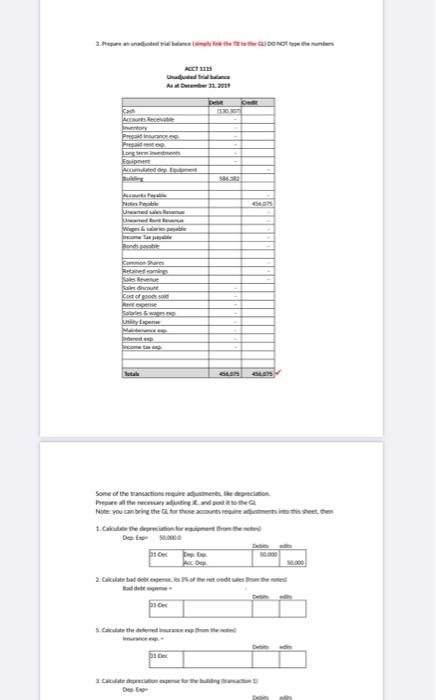

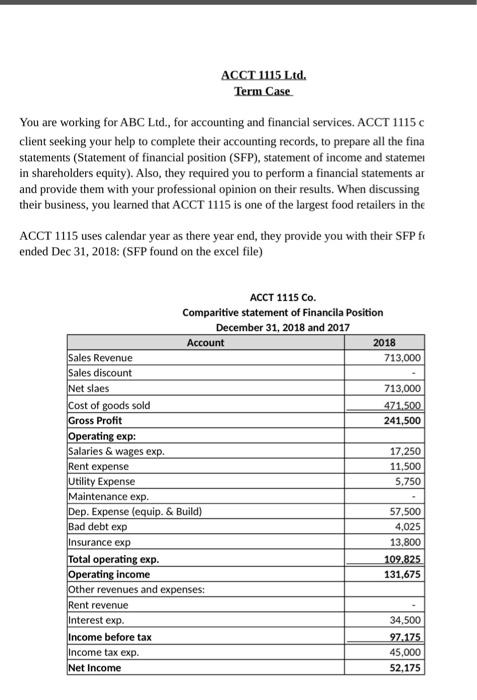

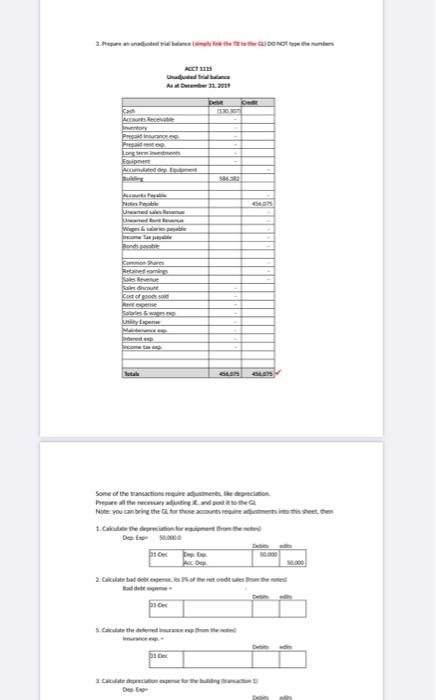

ACCT 1115 Ltd. Term Case You are working for ABC Ltd., for accounting and financial services. ACCT 1115c client seeking your help to complete their accounting records, to prepare all the fina statements (Statement of financial position (SFP), statement of income and statemet in shareholders equity). Also, they required you to perform a financial statements ar and provide them with your professional opinion on their results. When discussing their business, you learned that ACCT 1115 is one of the largest food retailers in the ACCT 1115 uses calendar year as there year end, they provide you with their SFP fi ended Dec 31, 2018: (SFP found on the excel file) ACCT 1115 Co. Comparitive statement of Financila Position December 31, 2018 and 2017 Account 2018 Sales Revenue 713,000 Sales discount Net slaes 713,000 Cost of goods sold 471.500 Gross Profit 241,500 Operating exp: Salaries & wages exp. 17,250 Rent expense 11,500 Utility Expense 5.750 Maintenance exp. Dep. Expense (equip. & Build) 57,500 Bad debt exp 4,025 Insurance exp 13,800 Total operating exp. 109.825 Operating income 131,675 Other revenues and expenses: Rent revenue Interest exp. 34,500 Income before tax 97.175 Income tax exp. 45,000 Net Income 52,175 Comparitive statement of Financila Position December 31, 2018 and 2017 Account 2018 Current Assets: Cash 100,000 Accounts Receivable 200,000 Inventory 185.000 Prepaid Insurance 24,000 Total current assets 509,000 Long term Investments 250,000 Equipment 500,000 Accumulated depreciation Equipment (150,000) Total Assets 1,109,000.00 Liabilities and sharholders equity Accounts Payable Wages & Salaries Payable Unearned Sales Revenue Income tax payable Total current liabilities Bonds payable Total Liabilities Common shares Retained earnings Total Liabilities and sharholders equity 160,000 75.000 107,500 45,000 387,500 350.000 737,500 100,000 271.500 1,109,000.00 1 3 1303 coded calculation. Please DO NOT add any numbers to to The following transaction are the only transaction for ACCT 1115 co during 2019: Jan 1 purchased new building for 586,382 The note principle due with the interest on Dec 31, 2019. The building ex residual (salvage) value amount of 65,154 2 Jan 3, all wages payable from 2018 paid cash Jan 8, they deliver merchandise to customer amount of Previously ACCT 1115 received cash amount of 107,500 Jan 12, all income taxes owed from last year are paid cash Jan 13, collect from customers 130,307 Jan 15, issued common shares for 390,921 7 Jan 16 purchased merchandise for 273,645 Jan 21 returned merchandise to ABC co amount of Jan 28 paid the amounts owed to ABC CO. 10 Jan 31 paid utilities 6,515 cash Pan 31 paid salaries 10,425 cash Feb 2 sold merchandise of 156,369 4 5 6 8 9 11 12 1303 coded calidation Plan DO NOT add any numbers to to this dark The following transaction are the only transaction for ACCT 1115 co during 2019: 1 Jan 1 purchased new building for 586,382 The note principle due with the interest on Dec 31, 2019. The building ex residual (salvage) value amount of 65,154 2 Jan 3, all wages payable from 2018 paid cash 3 Jan 8, they deliver merchandise to customer amount of Previously ACCT 1115 received cash amount of 107,500 4 Jan 12, all income taxes owed from last year are paid cash 5 Jan 13, collect from customers 130,307 6 Jan 15, issued common shares for 390,921 7 Jan 16 purchased merchandise for 273,645 8 Jan 21 returned merchandise to ABC co amount of 9 Jan 28 paid the amounts owed to ABC Co. 10 Jan 31 paid utilities 6,515 cash 11 Pan 31 paid salaries 10,425 cash 12 Feb 2 sold merchandise of 156,369 13 Feb 12 sold merchandise of 78,184 14 March 1, XYZ paid their account in full 15 Apr 1 paid rent for the months Jan-Mar amount of 16 Apr 15, purchased merchandise for cash 260,614 17 May 1 borrow from a local bank 130,307 18 Aug 1, they paid for one-year rent amount of 19 Aug 31, paid cash for maintenance and cleaning the building 20 Sep 1, paid in salaries 19,546 21 Sep 30, they rent part of their building to a local business and collect one 22 Oct 21 sold merchandise on account for 260,614 23 Nov 1, Bc Itd., paid 65,154 cash on their ac 24 Nov 8 sold merchandise to SK co., for 273,645 25 Nov 14, SK paid their account in full 26 Dec 31, paid income taxes amount of 10,000 Notes (assumptions): A. ACCT 1115 using perpetual inventory system B. Equipment on their SFP purchased on 2016 for $500,000 with SO residual value, depreciated straight line over 10 year estimated useful life. C. They use aging accounts receivables method to estimate any bad debt expenses. of outstanding net Accounts Receivables t year yean sales at year will not be co D. Prepaid insurance was paid on Jan 1,2017 to cover Infoule thoth found in the 13 Feb 12 sold merchandise of 78,184 14 March 1, XYZ paid their account in full 15 Apr 1 paid rent for the months Jan-Mar amount of 16 Apr 15, purchased merchandise for cash 260,614 17 May 1 borrow from a local bank 130,307 18 Aug 1, they paid for one-year rent amount of 19 Aug 31, paid cash for maintenance and cleaning the building 20 Sep 1. paid in salaries 19,546 21 Sep 30, they rent part of their building to a local business and collect one 22 Oct 21 sold merchandise on account for 260,614 23 Nov 1, Bc ltd., paid 65,154 cash on their ac 24 Nov 8 sold merchandise to SK co., for 273,645 25 Nov 14, SK paid their account in full 26 Dec 31, paid income taxes amount of 10,000 Notes (assumptions): A. ACCT 1115 using perpetual inventory system B. Equipment on their SFP purchased on 2016 for $500,000 with So residual value, depreciated straight line over 10 year estimated useful life. C. They use aging accounts receivables method to estimate any bad debt expenses. of outstanding net Accounts Receivables t year yean sales at year will not be co D. Prepaid insurance was paid on Jan 1,2017 to cover E. No accruals/deferrals other than the ones found in the above transactions. Required: Following the excel sheet template Prepare: Round your answers to 1. All JE for the above transactions, considering the notes ta 2. Post all the transactions into the general ledger GL ("T"a 3. Prepare the unadjusted trial balance before any adjustmen 4. Prepare all the required adjustments (deferrals and accrua 5. Prepare the adjusted trial balance after you made all the a 6. Prepare the following financial statements 3. Statement of Income b. Statement of changes in equity c. Statement of Financial position 7. Prepare the following financial ratios (the list on excel fil 8. Write a memo to your client ACCT 1115 to communicati and any suggestions for improvements if needed. (Memo one 3 Instructions: The objective of this exercise: To learn the complete accounting cycle, and to ana 25 26 Nov 14, SK paid their account in full Dec 31, paid income taxes amount of 10,000 Notes (assumptions): A. ACCT 1115 using perpetual inventory system B. Equipment on their SFP purchased on 2016 for $500,000 with $0 residual value, depreciated straight line over 10 year estimated useful life. C. They use aging accounts receivables method to estimate any bad debt expenses." of outstanding net Accounts Receivables t year yean sales at year will not be co D. Prepaid insurance was paid on Jan 1,2017 to cover 3 E. No accruals/deferrals other than the ones found in the above transactions. Required: Following the excel sheet template Prepare: Round your answers to 1. All JE for the above transactions, considering the notes / 2. Post all the transactions into the general ledger GL ("T" a 3. Prepare the unadjusted trial balance before any adjustmen 4. Prepare all the required adjustments (deferrals and accrua 5. Prepare the adjusted trial balance after you made all the a 6. Prepare the following financial statements a. Statement of Income b. Statement of changes in equity c. Statement of Financial position 7. Prepare the following financial ratios (the list on excel fil 8. Write a memo to your client ACCT 1115 to communicate and any suggestions for improvements if needed. (Memo one Instructions: The objective of this exercise: To learn the complete accounting cycle, and to ana they paid 130,307 cash and they sign 12note payable for the balance. The pected seal life 25 years, ACCT US uses straight line as their method of depreciation 107,500 cost of these products are 26,061 from customer and record it in Dec 18, 2018 in account (Uncated sales revenue) cash from acco, tem 3/20, 45. FOB destination 13,031 discount if peid in 20 de cost of the good was 104,246 AOCT 1115 used perpetual inventory system to XYZ. co, term 2/10, 130. FOB shipping point, cont of these poods wn 52.123 3.509 12% by signing a 15,637 12 note payable 6,515 12 months year rent in advance amount of 31.274 for to BCd., cost of those goods was 130,307 COM term 2/10, 03. Foe shipping point. Cost of those goods was 182.400 25 500,000 10 They estimated llected years insurance nearst 51 dollar. This is not apply on the raties assumptions above ccounts Is) if any, and update the GL justments 1. Roundatite 2 digits your tindings by explaining the rates, their results d t r lyze the financial statements after completed mote carry interest of 6% 2% discount if received in 10 days discount if received in 10 days | Records 2018 ACT 135 DO NOT beste Content See on Account Teles Dube Huntry 3 4 - 65 7 pm .. - 30 1. 12 54 15 - 16 17 May 19 - 20 po 22 10 23 26 25 - 26. 16 15 Apr 17 May 1 19 Aug 20 posep 21 Sep 22 1-Oct 23 - 24 Nov 21-Dec Dec 31, the noted thered to be condo Can be done here or in Adsheet Interest expense Abu Dec Notable terest 58638 SB b.type in ASSETS Cash UABRITIES Accounts Payable Deg 100 Notes Payable 4560 Unearned sales Revenue Accounts Receivable Beg Unearned Rent Revenue End Imetery Wire & salaries payable Income Tax payable End Prepaid insurance Bes Bords payable End do Prepaid rent exp. End de Beg Long term investments Endl Equipment De End dr. Accumulated dep. Equips Bee Landau EN Long termes Lement Adepto ARSON Common Shoes Retained ca Sales equal or tookpl SHAREHOLDERS UIT Common Shares Des End End dre Retained earnings mes End Bet 1 REVENUES Sales Revenue ber Bes TRE Sales Discount Beg EN ine Cost of Goods Sold Bes es . tre Rent Expense de ER ME alaries & ware Expert Utility Expense Maintenance esp. Beg dr. Rent Expense CF- Beg End End are Beg End dr. Beg ialaries & wages Expenster - End dr. Beg Utility Expense CF End dr Beg Maintenance expcr End dr + Interest expense Cr- Beg End dr. Income tax exp. Bes End ACT hade AS BR term. Acom. Buna! Weges Monda Camore Reming Sales Revenue Costos Net Some of the transactions et de recon Pregado Note: You can bring the forum 1. ed. Det 00000 De Badde bow ACCT 1115 Ltd. Term Case You are working for ABC Ltd., for accounting and financial services. ACCT 1115c client seeking your help to complete their accounting records, to prepare all the fina statements (Statement of financial position (SFP), statement of income and statemet in shareholders equity). Also, they required you to perform a financial statements ar and provide them with your professional opinion on their results. When discussing their business, you learned that ACCT 1115 is one of the largest food retailers in the ACCT 1115 uses calendar year as there year end, they provide you with their SFP fi ended Dec 31, 2018: (SFP found on the excel file) ACCT 1115 Co. Comparitive statement of Financila Position December 31, 2018 and 2017 Account 2018 Sales Revenue 713,000 Sales discount Net slaes 713,000 Cost of goods sold 471.500 Gross Profit 241,500 Operating exp: Salaries & wages exp. 17,250 Rent expense 11,500 Utility Expense 5.750 Maintenance exp. Dep. Expense (equip. & Build) 57,500 Bad debt exp 4,025 Insurance exp 13,800 Total operating exp. 109.825 Operating income 131,675 Other revenues and expenses: Rent revenue Interest exp. 34,500 Income before tax 97.175 Income tax exp. 45,000 Net Income 52,175 Comparitive statement of Financila Position December 31, 2018 and 2017 Account 2018 Current Assets: Cash 100,000 Accounts Receivable 200,000 Inventory 185.000 Prepaid Insurance 24,000 Total current assets 509,000 Long term Investments 250,000 Equipment 500,000 Accumulated depreciation Equipment (150,000) Total Assets 1,109,000.00 Liabilities and sharholders equity Accounts Payable Wages & Salaries Payable Unearned Sales Revenue Income tax payable Total current liabilities Bonds payable Total Liabilities Common shares Retained earnings Total Liabilities and sharholders equity 160,000 75.000 107,500 45,000 387,500 350.000 737,500 100,000 271.500 1,109,000.00 1 3 1303 coded calculation. Please DO NOT add any numbers to to The following transaction are the only transaction for ACCT 1115 co during 2019: Jan 1 purchased new building for 586,382 The note principle due with the interest on Dec 31, 2019. The building ex residual (salvage) value amount of 65,154 2 Jan 3, all wages payable from 2018 paid cash Jan 8, they deliver merchandise to customer amount of Previously ACCT 1115 received cash amount of 107,500 Jan 12, all income taxes owed from last year are paid cash Jan 13, collect from customers 130,307 Jan 15, issued common shares for 390,921 7 Jan 16 purchased merchandise for 273,645 Jan 21 returned merchandise to ABC co amount of Jan 28 paid the amounts owed to ABC CO. 10 Jan 31 paid utilities 6,515 cash Pan 31 paid salaries 10,425 cash Feb 2 sold merchandise of 156,369 4 5 6 8 9 11 12 1303 coded calidation Plan DO NOT add any numbers to to this dark The following transaction are the only transaction for ACCT 1115 co during 2019: 1 Jan 1 purchased new building for 586,382 The note principle due with the interest on Dec 31, 2019. The building ex residual (salvage) value amount of 65,154 2 Jan 3, all wages payable from 2018 paid cash 3 Jan 8, they deliver merchandise to customer amount of Previously ACCT 1115 received cash amount of 107,500 4 Jan 12, all income taxes owed from last year are paid cash 5 Jan 13, collect from customers 130,307 6 Jan 15, issued common shares for 390,921 7 Jan 16 purchased merchandise for 273,645 8 Jan 21 returned merchandise to ABC co amount of 9 Jan 28 paid the amounts owed to ABC Co. 10 Jan 31 paid utilities 6,515 cash 11 Pan 31 paid salaries 10,425 cash 12 Feb 2 sold merchandise of 156,369 13 Feb 12 sold merchandise of 78,184 14 March 1, XYZ paid their account in full 15 Apr 1 paid rent for the months Jan-Mar amount of 16 Apr 15, purchased merchandise for cash 260,614 17 May 1 borrow from a local bank 130,307 18 Aug 1, they paid for one-year rent amount of 19 Aug 31, paid cash for maintenance and cleaning the building 20 Sep 1, paid in salaries 19,546 21 Sep 30, they rent part of their building to a local business and collect one 22 Oct 21 sold merchandise on account for 260,614 23 Nov 1, Bc Itd., paid 65,154 cash on their ac 24 Nov 8 sold merchandise to SK co., for 273,645 25 Nov 14, SK paid their account in full 26 Dec 31, paid income taxes amount of 10,000 Notes (assumptions): A. ACCT 1115 using perpetual inventory system B. Equipment on their SFP purchased on 2016 for $500,000 with SO residual value, depreciated straight line over 10 year estimated useful life. C. They use aging accounts receivables method to estimate any bad debt expenses. of outstanding net Accounts Receivables t year yean sales at year will not be co D. Prepaid insurance was paid on Jan 1,2017 to cover Infoule thoth found in the 13 Feb 12 sold merchandise of 78,184 14 March 1, XYZ paid their account in full 15 Apr 1 paid rent for the months Jan-Mar amount of 16 Apr 15, purchased merchandise for cash 260,614 17 May 1 borrow from a local bank 130,307 18 Aug 1, they paid for one-year rent amount of 19 Aug 31, paid cash for maintenance and cleaning the building 20 Sep 1. paid in salaries 19,546 21 Sep 30, they rent part of their building to a local business and collect one 22 Oct 21 sold merchandise on account for 260,614 23 Nov 1, Bc ltd., paid 65,154 cash on their ac 24 Nov 8 sold merchandise to SK co., for 273,645 25 Nov 14, SK paid their account in full 26 Dec 31, paid income taxes amount of 10,000 Notes (assumptions): A. ACCT 1115 using perpetual inventory system B. Equipment on their SFP purchased on 2016 for $500,000 with So residual value, depreciated straight line over 10 year estimated useful life. C. They use aging accounts receivables method to estimate any bad debt expenses. of outstanding net Accounts Receivables t year yean sales at year will not be co D. Prepaid insurance was paid on Jan 1,2017 to cover E. No accruals/deferrals other than the ones found in the above transactions. Required: Following the excel sheet template Prepare: Round your answers to 1. All JE for the above transactions, considering the notes ta 2. Post all the transactions into the general ledger GL ("T"a 3. Prepare the unadjusted trial balance before any adjustmen 4. Prepare all the required adjustments (deferrals and accrua 5. Prepare the adjusted trial balance after you made all the a 6. Prepare the following financial statements 3. Statement of Income b. Statement of changes in equity c. Statement of Financial position 7. Prepare the following financial ratios (the list on excel fil 8. Write a memo to your client ACCT 1115 to communicati and any suggestions for improvements if needed. (Memo one 3 Instructions: The objective of this exercise: To learn the complete accounting cycle, and to ana 25 26 Nov 14, SK paid their account in full Dec 31, paid income taxes amount of 10,000 Notes (assumptions): A. ACCT 1115 using perpetual inventory system B. Equipment on their SFP purchased on 2016 for $500,000 with $0 residual value, depreciated straight line over 10 year estimated useful life. C. They use aging accounts receivables method to estimate any bad debt expenses." of outstanding net Accounts Receivables t year yean sales at year will not be co D. Prepaid insurance was paid on Jan 1,2017 to cover 3 E. No accruals/deferrals other than the ones found in the above transactions. Required: Following the excel sheet template Prepare: Round your answers to 1. All JE for the above transactions, considering the notes / 2. Post all the transactions into the general ledger GL ("T" a 3. Prepare the unadjusted trial balance before any adjustmen 4. Prepare all the required adjustments (deferrals and accrua 5. Prepare the adjusted trial balance after you made all the a 6. Prepare the following financial statements a. Statement of Income b. Statement of changes in equity c. Statement of Financial position 7. Prepare the following financial ratios (the list on excel fil 8. Write a memo to your client ACCT 1115 to communicate and any suggestions for improvements if needed. (Memo one Instructions: The objective of this exercise: To learn the complete accounting cycle, and to ana they paid 130,307 cash and they sign 12note payable for the balance. The pected seal life 25 years, ACCT US uses straight line as their method of depreciation 107,500 cost of these products are 26,061 from customer and record it in Dec 18, 2018 in account (Uncated sales revenue) cash from acco, tem 3/20, 45. FOB destination 13,031 discount if peid in 20 de cost of the good was 104,246 AOCT 1115 used perpetual inventory system to XYZ. co, term 2/10, 130. FOB shipping point, cont of these poods wn 52.123 3.509 12% by signing a 15,637 12 note payable 6,515 12 months year rent in advance amount of 31.274 for to BCd., cost of those goods was 130,307 COM term 2/10, 03. Foe shipping point. Cost of those goods was 182.400 25 500,000 10 They estimated llected years insurance nearst 51 dollar. This is not apply on the raties assumptions above ccounts Is) if any, and update the GL justments 1. Roundatite 2 digits your tindings by explaining the rates, their results d t r lyze the financial statements after completed mote carry interest of 6% 2% discount if received in 10 days discount if received in 10 days | Records 2018 ACT 135 DO NOT beste Content See on Account Teles Dube Huntry 3 4 - 65 7 pm .. - 30 1. 12 54 15 - 16 17 May 19 - 20 po 22 10 23 26 25 - 26. 16 15 Apr 17 May 1 19 Aug 20 posep 21 Sep 22 1-Oct 23 - 24 Nov 21-Dec Dec 31, the noted thered to be condo Can be done here or in Adsheet Interest expense Abu Dec Notable terest 58638 SB b.type in ASSETS Cash UABRITIES Accounts Payable Deg 100 Notes Payable 4560 Unearned sales Revenue Accounts Receivable Beg Unearned Rent Revenue End Imetery Wire & salaries payable Income Tax payable End Prepaid insurance Bes Bords payable End do Prepaid rent exp. End de Beg Long term investments Endl Equipment De End dr. Accumulated dep. Equips Bee Landau EN Long termes Lement Adepto ARSON Common Shoes Retained ca Sales equal or tookpl SHAREHOLDERS UIT Common Shares Des End End dre Retained earnings mes End Bet 1 REVENUES Sales Revenue ber Bes TRE Sales Discount Beg EN ine Cost of Goods Sold Bes es . tre Rent Expense de ER ME alaries & ware Expert Utility Expense Maintenance esp. Beg dr. Rent Expense CF- Beg End End are Beg End dr. Beg ialaries & wages Expenster - End dr. Beg Utility Expense CF End dr Beg Maintenance expcr End dr + Interest expense Cr- Beg End dr. Income tax exp. Bes End ACT hade AS BR term. Acom. Buna! Weges Monda Camore Reming Sales Revenue Costos Net Some of the transactions et de recon Pregado Note: You can bring the forum 1. ed. Det 00000 De Badde bow