Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i wanted someone to check my work, not sure if its correct. Need help thank you Taffy Co manufactures and sells adjustable windows for remodeling

i wanted someone to check my work, not sure if its correct. Need help

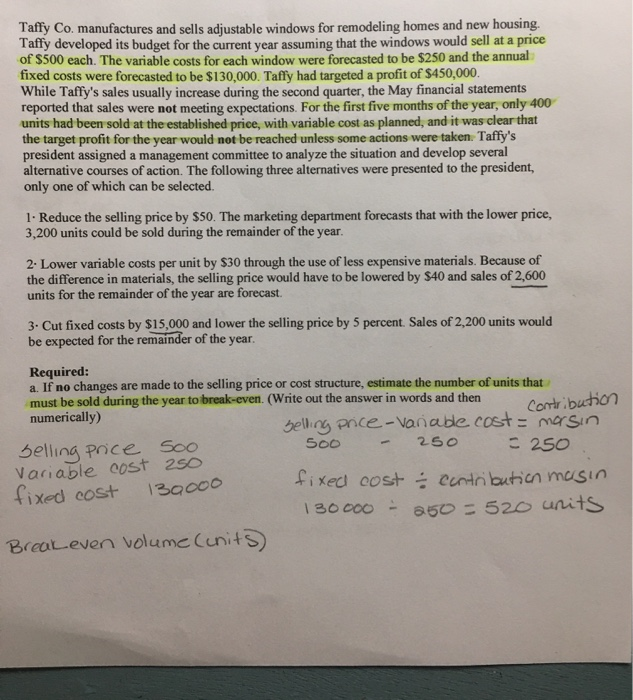

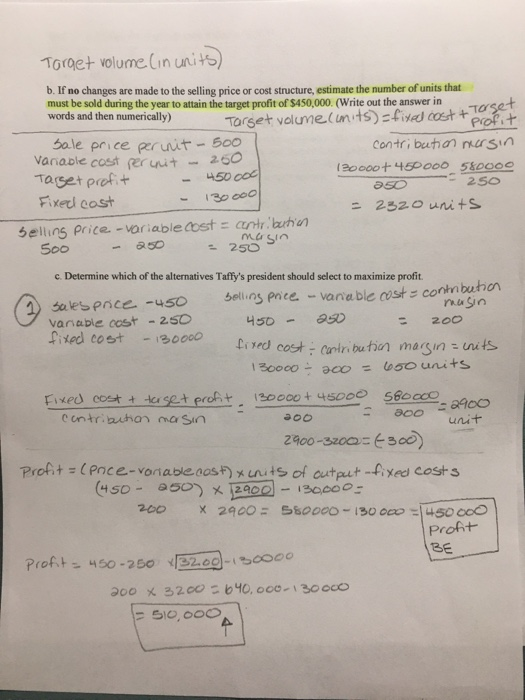

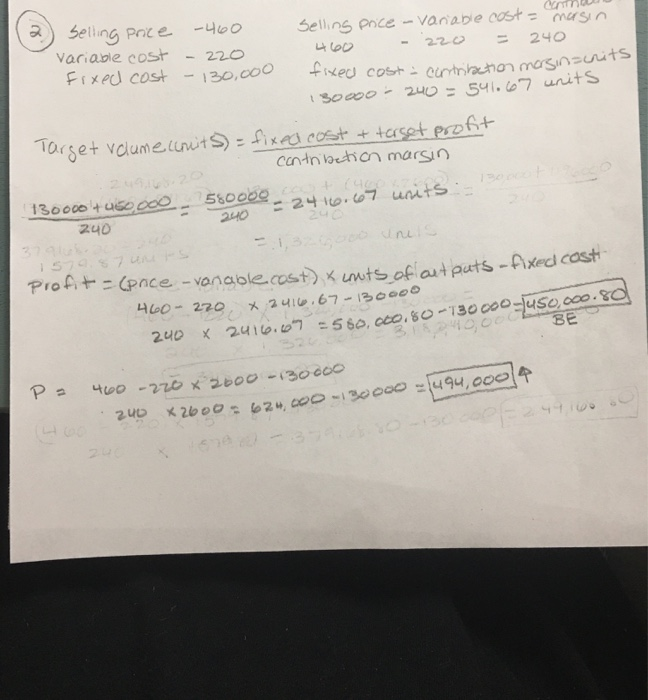

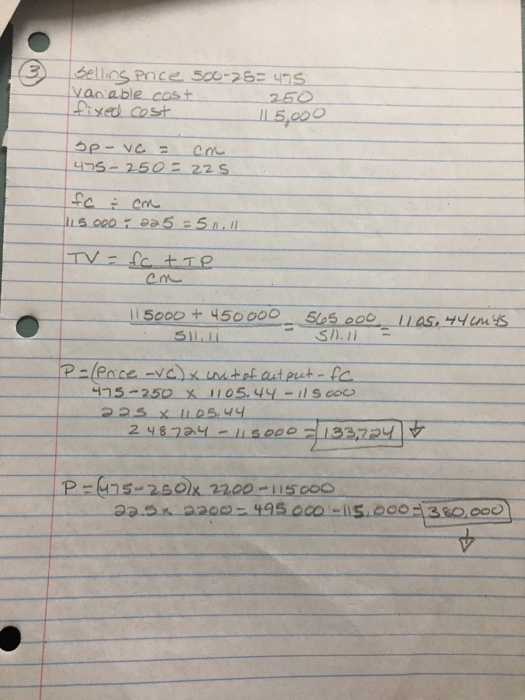

Taffy Co manufactures and sells adjustable windows for remodeling homes and new housing. Taffy developed its budget for the current year assuming that the windows would sell at a price of $500 each. The variable costs for each window were forecasted to be $250 and the annual fixed costs were forecasted to be $130,000. Taffy had targeted a profit of $450,000. While Taffy's sales usually increase during the second quarter, the May financial statements reported that sales were not meeting expectations. For the first five months of the year, only 400 units had been sold at the established price, with variable cost as planned, and it was clear that the target profit for the year would not be reached unless some actions were taken Taffy's president assigned a management committee to analyze the situation and develop several alternative courses of action. The following three alternatives were presented to the president, only one of which can be selected. 1. Reduce the selling price by $50. The marketing department forecasts that with the lower price, 3,200 units could be sold during the remainder of the year. 2. Lower variable costs per unit by $30 through the use of less expensive materials. Because of the difference in materials, the selling price would have to be lowered by S40 and sales of 2,600 units for the remainder of the year are forecast. 3. Cut fixed costs by $15,000 and lower the selling price by 5 percent. Sales of 2,200 units would be expected for the remainder of the year. Required: a. If no changes are made to the selling price or cost structure, estimate the number of units that must be sold during the year to break-even. (Write out the answer in words and then numerically) Selling price - Variabe cost = morsin Selling Price soo 500 250 - 250 Variable cost 250 fixed cost fixed cost : contribution masin 130000 - 250 - 520 units Breakeven volume Cunits) Contribution 139000 Torset volume Cunits) - fixed cost + Target Torget volume (in units) b. If no changes are made to the selling price or cost structure, estimate the number of units that must be sold during the year to attain the target profit of $450,000. (Write out the answer in words and then numerically) sale price permit - 500 contribution morsin. Variable cost peruut 250 120000+ 450 000 580000 Target profit 450 00 a50 2 SO Fixed cost = 2320 units selling price -variable cost contribution 500 - 250 profit 13 cod masin 200 c. Determine which of the alternatives Taffy's president should select to maximize profit. 1) sales price-450 Selling price variable cost = contribution masin variable cost - 250 450 250 fixed cost - 130000 fixed cost contribution margin = hits 130000 - 200 = 650 units Fixed cost & target profit 130000 + 45000 580000 contribution morsin - 2900 aoo unit 2900-3200-6300) Profit = (price-variable cast) & crits of output - fixed costs (450 - 250) x 2900 130,000 200 X 2400 = 580000 - 130 000 = 450 000 Profit IBE Profit= 450-250 x 32.00-180000 200 x 3200 = 640,000-130 000 510,000 ^ 130,000 fixed cost contribution magin=cnits] X 2416.607 -560, Co.80-190-450,000.80 2) Selling Price -460 Selling Price - Variable cost = masin Variable cost 220 460 220 240 Fixed cost 130000 - 200 = 541.67 units Target volume comits) = fixed cost & terset profit contri betion margin Boot 130000'+450.000 58006095 - 2416.67 units. 240 240 15 SUS Profit - (pace -vanable.cost) wuts oficutputs - fixed cost 460-220 * 2416.67-13000 240 BE P= 494,000 4 460-220 x 2000-130000 200*2600: 624,000 - - DOOD 20 (3 Selling once 500-25= 475 van able cost 250 fixed cost 115,00 sp- vc = 435-250 22 s fc cm 15.000 225 = 5 / TV = fc tte cm 115000 + 450.000 . 565000 1105.44cm'ts. S7). // P=/Price -vc) x unit of output - fc. 475-250 X 1105.44 - 1l Scou 225 X 1105.44 248724 - 115.000 = 183,724 + P-475-250X 22.00 -115000 22.5 2200- 495.00-15.000-380,000 thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started