Answered step by step

Verified Expert Solution

Question

1 Approved Answer

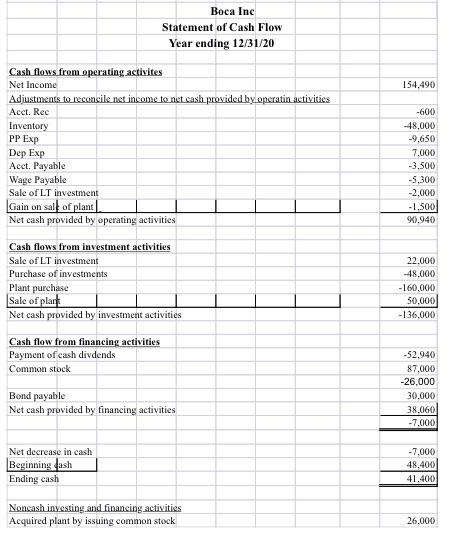

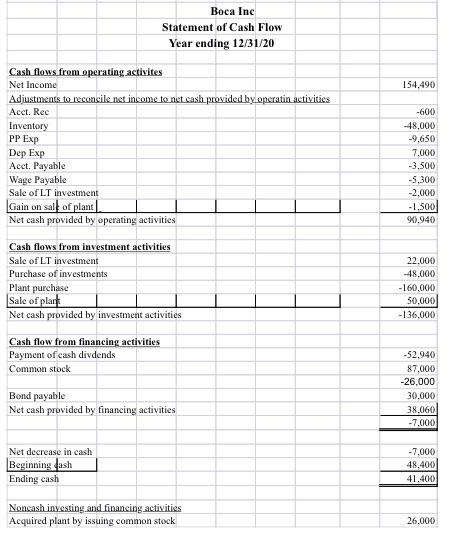

I was able to get everything with the exception of 26,000 in the financing section, that I can't figure out. I added it in to

I was able to get everything with the exception of 26,000 in the financing section, that I can't figure out. I added it in to balance but have no clue where it coming from. Please help! Thanks!

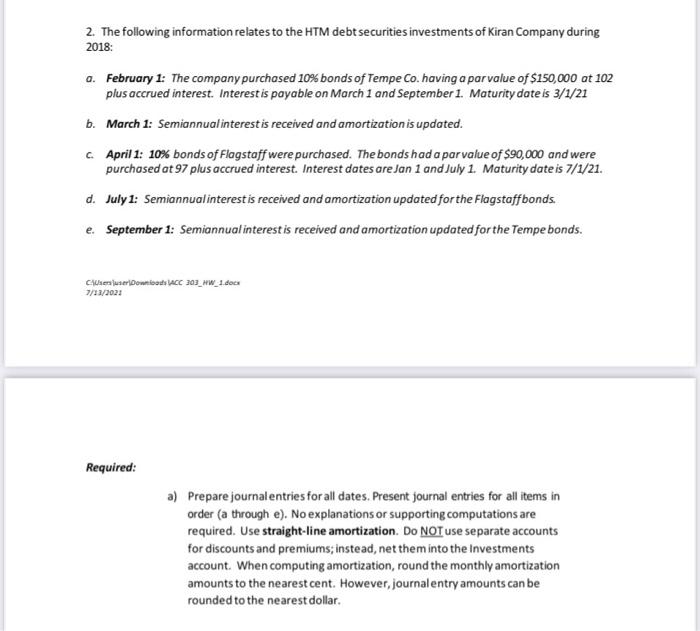

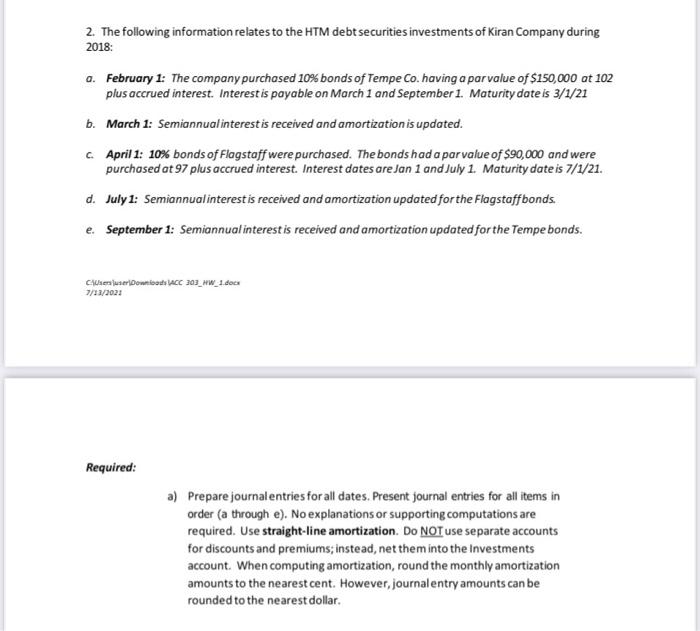

2. The following information relates to the HTM debt securities investments of Kiran Company during 2018: Q. February 1: The company purchased 10% bonds of Tempe Co. having a par value of $150,000 at 102 plus accrued interest. Interest is payable on March 1 and September 1. Maturity date is 3/1/21 b. March 1: Semiannual interest is received and amortization is updated. April 1: 10% bonds of Flagstaff were purchased. The bonds had a parvalue of $90,000 and were purchased at 97 plus accrued interest. Interest dates are Jan 1 and July 1. Maturity date is 7/1/21. d. July 1: Semiannual interest is received and amortization updated forthe Flagstaffbonds. e. September 1: Semiannual interest is received and amortization updated for the Tempe bonds. Cser user Downloads ACC 203_HW_1.doc 7/23/2021 Required: a) Prepare journal entries for all dates. Present journal entries for all items in order (a through e). No explanations or supporting computations are required. Use straight-line amortization. Do NOT use separate accounts for discounts and premiums; instead, net them into the Investments account. When computing amortization, round the monthly amortization amounts to the nearest cent. However, journal entry amounts can be rounded to the nearest dollar. Boca Inc Statement of Cash Flow Year ending 12/31/20 154.490 Cash flows from operating activites Net Income Adjustments to reconcile net income to net cash provided by operatin activities Acct. Rec Inventory PP Exp Dep Exp Acct. Payable Wage Payable Sale of LT investment Gain on salt of plant Net cash provided by operating activities -600 -48,000 -9,650 7.000 -3.500 -5,300 -2.000 -1.500 9).940 Cash flows from investment activities Sale of LT investment Purchase of investments Plant purchase Sale of plant Net cash provided by investment activities 22.000 -48,000 -160,000 50.000 -136,000 Cash flow from financing activities Payment of cash divdends Common stock -52.940 87,000 -26,000 30.000 38.060 -7.000 Bond payable Net cash provided by financing activities Net decrease in cash Beginning ash Ending cash -7,000 48,400 41.400 Noncash investing and financing activities Acquired plant by issuing common stock 26.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started