Answered step by step

Verified Expert Solution

Question

1 Approved Answer

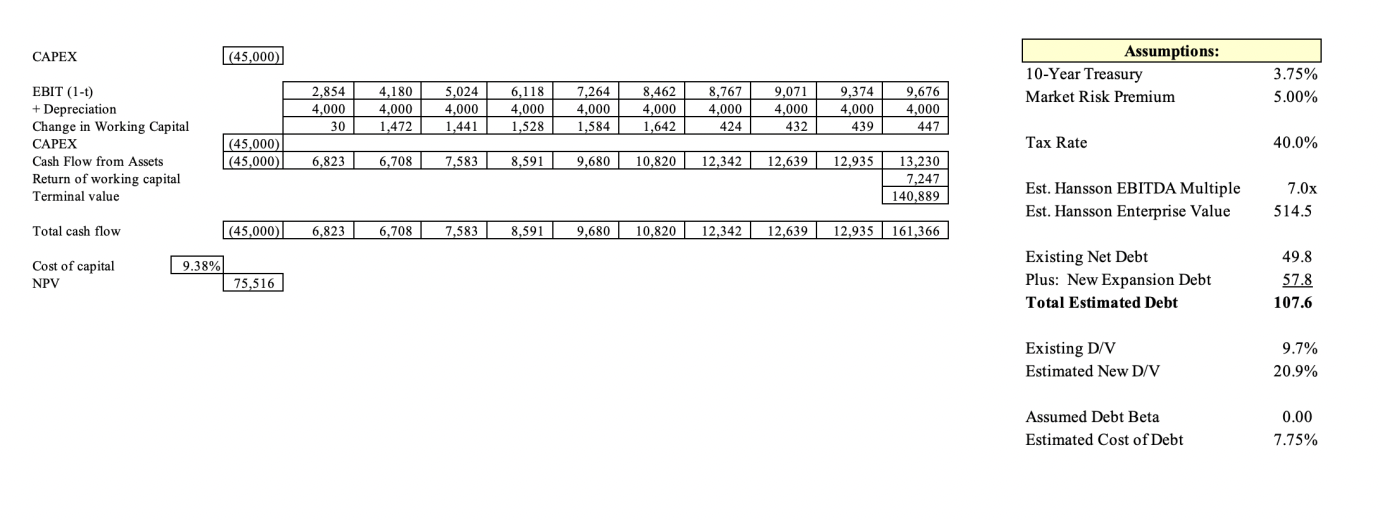

I was hoping for insight into the formula and correct answer for the final year terminal value based off of the DCF and assumptions shown.

I was hoping for insight into the formula and correct answer for the final year terminal value based off of the DCF and assumptions shown.

EBIT t

Depreciation

Change in Working Capital

CAPEX

Cash Flow from Assets

Return of working capital

Terminal value

Total cash flow

Cost of capital

NPV

This is information for the HBP case entitled "Hansson Private Lable." Can you provide insight into the formula for the terminal value in the final yearwhat it would beCAPEX

EBIT t

Depreciation

Change in Working Capital

CAPEX

Cash Flow from Assets

Return of working capital

Terminal value

Total cash flow

Cost of capital

NPV

EBIT t

Depreciation

Change in Working Capital

CAPEX

Cash Flow from Assets

Return of working capital

Terminal value

Total cash flow

Cost of capital

NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started