Answered step by step

Verified Expert Solution

Question

1 Approved Answer

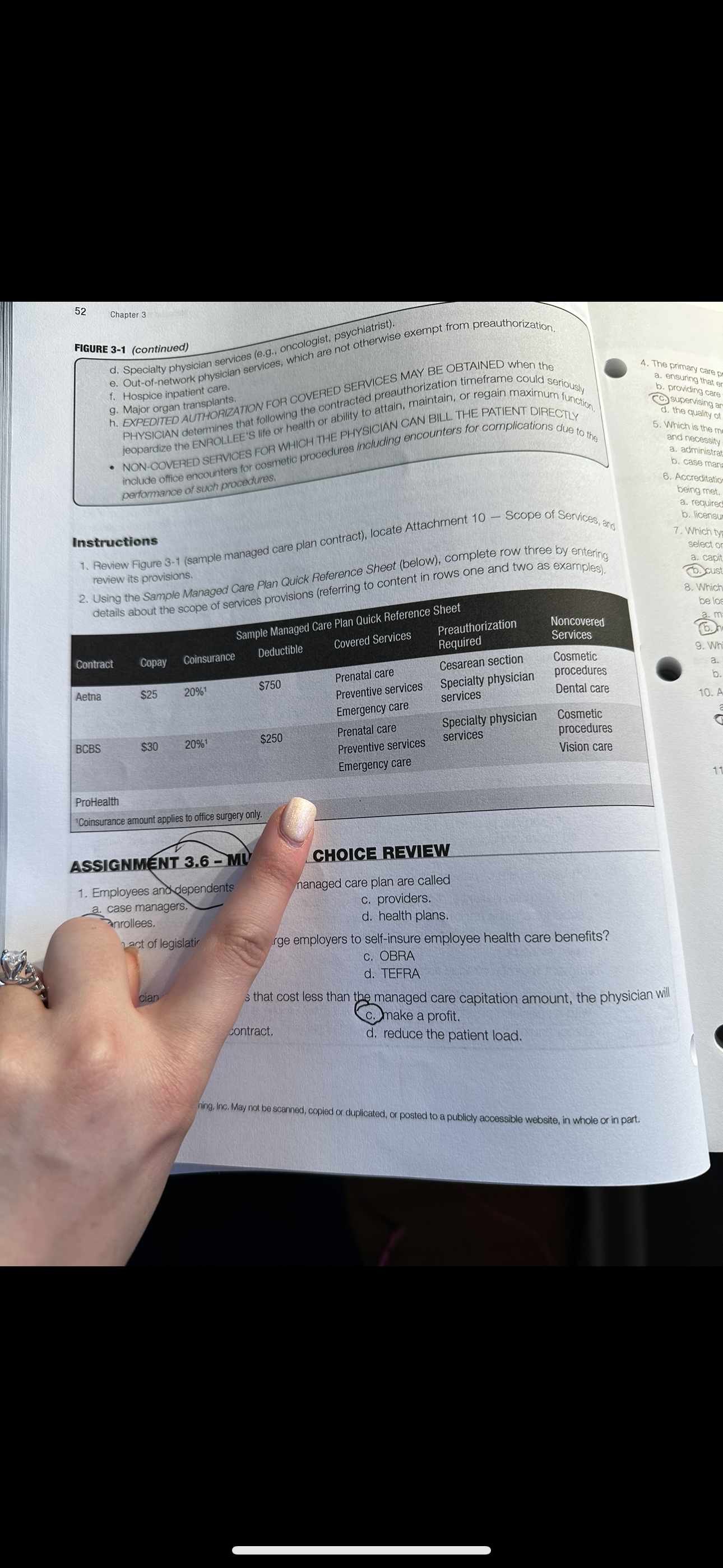

I was instructed to complete figure 3-1 (sample managed care plan contract) locate Attachment 10 - Scope of services and review the provisions. Using the

I was instructed to complete figure 3-1 (sample managed care plan contract) locate Attachment 10 - Scope of services and review the provisions.

Using the Sample managed care plan quick referencing sheet below, complete row three by entering details about the scope of services provisions (refering to content in rows one and two as examples.

- I am so confused by finding the answers to these questions and calculating patient reimbursement, I understand this is a lot in one sitting but I really need someones help to visually show me how to get these solutions. I need to be able to understand them and calculate them myself for future assignements. Please and thank you!

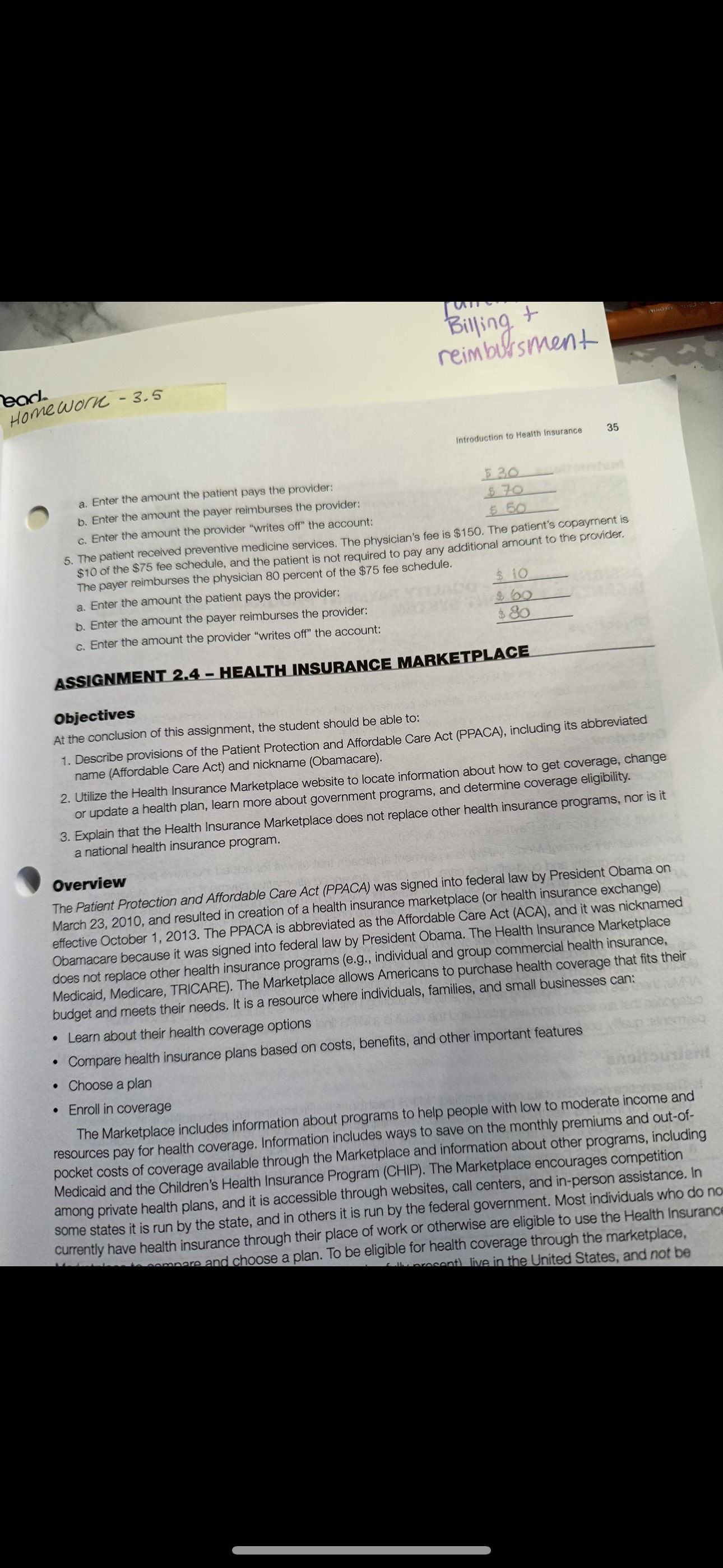

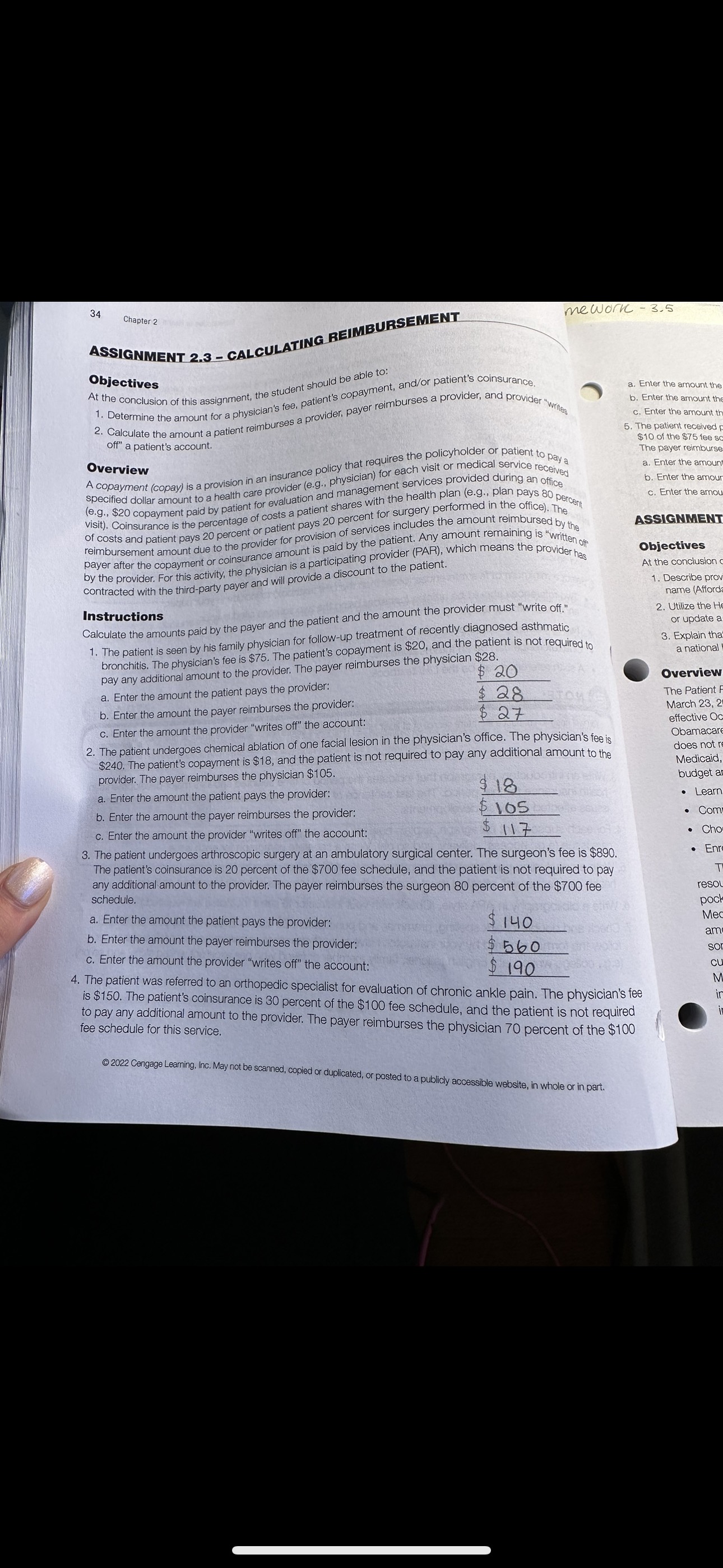

a. Enter the amount b. Enter the amount the payer reimburses the provider: c. Enter the amount the provider "writes off" the account: 5. The patient received preventive medicine services. The physician's fee is $150. The patient's copayment is $10 of the $75 fee schedule, and the patient is not required to pay any additional amount to the provider. The payer reimburses the physician 80 percent of the $75 fee schedule. a. Enter the amount the patient pays the provider: b. Enter the amount the payer reimburses the provider: c. Enter the amount the provider "writes off" the account: ASSIGNMENT 2.4 - HEALTH INSURANCE MARKETPLACE Objectives At the conclusion of this assignment, the student should be able to: 1. Describe provisions of the Patient Protection and Affordable Care Act (PPACA), including its abbreviated name (Affordable Care Act) and nickname (Obamacare). 2. Utilize the Health Insurance Marketplace website to locate information about how to get coverage, change or update a health plan, learn more about government programs, and determine coverage eligibility. 3. Explain that the Health Insurance Marketplace does not replace other health insurance programs, nor is it a national health insurance program. Overview The Patient Protection and Affordable Care Act (PPACA) was signed into federal law by President Obama on March 23, 2010, and resulted in creation of a health insurance marketplace (or health insurance exchange) effective October 1, 2013. The PPACA is abbreviated as the Affordable Care Act (ACA), and it was nicknamed Obamacare because it was signed into federal law by President Obama. The Health Insurance Marketplace does not replace other health insurance programs (e.g., individual and group commercial health insurance, Medicaid, Medicare, TRICARE). The Marketplace allows Americans to purchase health coverage that fits their budget and meets their needs. It is a resource where individuals, families, and small businesses can: - Learn about their health coverage options - Compare health insurance plans based on costs, benefits, and other important features - Choose a plan - Enroll in coverage The Marketplace includes information about programs to help people with low to moderate income and resources pay for health coverage. Information includes ways to save on the monthly premiums and out-ofpocket costs of coverage available through the Marketplace and information about other programs, including Medicaid and the Children's Health Insurance Program (CHIP). The Marketplace encourages competition among private health plans, and it is accessible through websites, call centers, and in-person assistance. In some states it is run by the state, and in others it is run by the federal government. Most individuals who do currently have health insurance through their place of work or otherwise are eligible to use the Health Insurar Objectives At the conclusion of this assignment, the student should be able to: 1. Determine the amount for a physiclan's fee, patient's copayment, and/or patient's coinsurance. 2. Calculate the amount a patient reimburses a provider, payer reimburses a provider, and provider "Writeg off" a patient's account. Overview A copayment (copay) is a provision in an insurance policy that requires the policyholder or patient to pay a specified dollar amount to a health care provider (e.g., physician) for each visit or medical service revices provided during an office (e.g., \$20 copayment paid by patient for evaluation and managernenthe health plan (e.g., plan pays 80 percent visit). Coinsurance is the percentage of costs a patient shares with for surgery performed in the office). The of costs and patient pays 20 percent or patient pays 20 per services includes the amount reimbursed by the reimbursement amount due to the provider for provision of by the patient. Any amount remaining is "written off" payer after the copayment or coinsurance amount is paid bating provider (PAR), which means the provider has by the provider. For this activity, the physician is a participating provido the patient. Instructions Calculate the amounts paid by the payer and the patient and the amount the provider must "write off." 1. The patient is seen by his family physician for follow-up treatment of recently diagnosed asthmatic bronchitis. The physician's fee is $75. The patient's copayment is $20, and the patient is not required to pay any additional amount to the provider. The payer reimburses the physician \$28. a. Enter the amount the patient pays the provider: b. Enter the amount the payer reimburses the provider: c. Enter the amount the provider "writes off" the account: 2. The patient undergoes chemical ablation of one facial lesion in the physician's office. The physician's fee is $240. The patient's copayment is $18, and the patient is not required to pay any additional amount to the provider. The payer reimburses the physician $105. a. Enter the amount the patient pays the provider: b. Enter the amount the payer reimburses the provider: c. Enter the amount the provider "writes off" the account: 3. The patient undergoes arthroscopic surgery at an ambulatory surgical center. The surgeon's fee is $890. The patient's coinsurance is 20 percent of the $700 fee schedule, and the patient is not required to pay any additional amount to the provider. The payer reimburses the surgeon 80 percent of the $700 fee schedule. a. Enter the amount the patient pays the provider: b. Enter the amount the payer reimburses the provider: c. Enter the amount the provider "writes off" the account: a. Enter the amount the b. Enter the amount the c. Enter the amount th 5. The patient received $10 of the $75 fee sc The payer reimburse a. Enter the amoun' b. Enter the amour c. Enter the amou ASSIGNMENT Objectives At the conclusion 1. Describe prov name (Afford: 2. Utilize the He or update a 3. Explain tha a national Overview The Patient F March 23, 2 effective Oc Obamacare does not r Medicaid, budget a - Learn - Com - Cho - Enr T resol $560$140 4. The patient was referred to an orthopedic specialist for evaluation of chronic ankle pain. The physician's fee is $150. The patient's coinsurance is 30 percent of the $100 fee schedule, and the patient is not required to pay any additional amount to the provider. The payer reimburses the physician 70 percent of the $100 fee schedule for this service. C) 2022 Cengage Learning, Inc. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. population of patients. The IDS also has many wellness and health programs focused on disease prevention a Instructions 2. Prepare a one- to two-page, double-spaced, word-processed document that summarizes information on HealthEast that was accessed from the website. Be sure to include the following information in your summ a. Discuss the IDS's privacy policy for payment b. Identify types of disease-focused programs offered by this IDS. c. Explain the IDS's patient safety focus. d. Discuss the IDS's wellness program. 3. Check and double-check spelling, grammar, and punctuation. Have at least one person review your dooumer (e.g., college writing lab, English teacher, family member or friend who has excellent writing skills, and so onl). NOTE: Navigate the Fairview Health Services integrated delivery system website to research information needed for your summary. This using tool bars and pull-down menus. ASSIGNMENT 3.5 - CREATING A MANAGED CARE CONTRACT QUICK REFERENCE SHEET Objectives At the conclusion of this assignment, the student should be able to: 1. Explain the purpose of managed care plans, and list six managed care models. 2. State the purpose of a managed care quick reference sheet, and interpret managed care contract provisions to prepare the quick reference sheet. Overview Managed care plans provide benefits to subscribers (or enrollees) who are required to receive services from netwolk providers (physicians or health care facilities under contract to the managed care plan). Network providers sign contracts (Figure 3-1) with the managed care organization, and subscribers are generally required to coordinate heatt care senvices through their primary care physician (PCP). Managed care is categorized according to six models: 1. Exclusive provider organization (EPO) 2. Integrated delivery system (IDS) 3. Health maintenance organization (HMO) (0) 2022 Cengage Leaming, Inc. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. FIGURE 3-1 (continued) d. Specialty physician senvices (e.g., Oncologist, psychiatrist) f. Hospice inpatient care. g. Major organ transplants. h. EXPEDITED AUTHORIZATION FOR COVERED SERV preauthorization timeframe could serious/y PHYSICIAN determines that following the contracte ability to attain, maintain, or regain maximum jeopardize the ENROLLLE'S life or health or a PHYSICIAN CAN BILL THE PATIENT DIREC TLY - NON-COVERED SERVICES FOR WHICH THE PI including encounters for complications due to tho include office encounters for cosmetic performance of such procedures. Instructions Sheet (below), complete row three by entering review its provisions. Care Plan Quick Reference she (ontent in rows one and two as examples). hing, Inc. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. a. Enter the amount b. Enter the amount the payer reimburses the provider: c. Enter the amount the provider "writes off" the account: 5. The patient received preventive medicine services. The physician's fee is $150. The patient's copayment is $10 of the $75 fee schedule, and the patient is not required to pay any additional amount to the provider. The payer reimburses the physician 80 percent of the $75 fee schedule. a. Enter the amount the patient pays the provider: b. Enter the amount the payer reimburses the provider: c. Enter the amount the provider "writes off" the account: ASSIGNMENT 2.4 - HEALTH INSURANCE MARKETPLACE Objectives At the conclusion of this assignment, the student should be able to: 1. Describe provisions of the Patient Protection and Affordable Care Act (PPACA), including its abbreviated name (Affordable Care Act) and nickname (Obamacare). 2. Utilize the Health Insurance Marketplace website to locate information about how to get coverage, change or update a health plan, learn more about government programs, and determine coverage eligibility. 3. Explain that the Health Insurance Marketplace does not replace other health insurance programs, nor is it a national health insurance program. Overview The Patient Protection and Affordable Care Act (PPACA) was signed into federal law by President Obama on March 23, 2010, and resulted in creation of a health insurance marketplace (or health insurance exchange) effective October 1, 2013. The PPACA is abbreviated as the Affordable Care Act (ACA), and it was nicknamed Obamacare because it was signed into federal law by President Obama. The Health Insurance Marketplace does not replace other health insurance programs (e.g., individual and group commercial health insurance, Medicaid, Medicare, TRICARE). The Marketplace allows Americans to purchase health coverage that fits their budget and meets their needs. It is a resource where individuals, families, and small businesses can: - Learn about their health coverage options - Compare health insurance plans based on costs, benefits, and other important features - Choose a plan - Enroll in coverage The Marketplace includes information about programs to help people with low to moderate income and resources pay for health coverage. Information includes ways to save on the monthly premiums and out-ofpocket costs of coverage available through the Marketplace and information about other programs, including Medicaid and the Children's Health Insurance Program (CHIP). The Marketplace encourages competition among private health plans, and it is accessible through websites, call centers, and in-person assistance. In some states it is run by the state, and in others it is run by the federal government. Most individuals who do currently have health insurance through their place of work or otherwise are eligible to use the Health Insurar Objectives At the conclusion of this assignment, the student should be able to: 1. Determine the amount for a physiclan's fee, patient's copayment, and/or patient's coinsurance. 2. Calculate the amount a patient reimburses a provider, payer reimburses a provider, and provider "Writeg off" a patient's account. Overview A copayment (copay) is a provision in an insurance policy that requires the policyholder or patient to pay a specified dollar amount to a health care provider (e.g., physician) for each visit or medical service revices provided during an office (e.g., \$20 copayment paid by patient for evaluation and managernenthe health plan (e.g., plan pays 80 percent visit). Coinsurance is the percentage of costs a patient shares with for surgery performed in the office). The of costs and patient pays 20 percent or patient pays 20 per services includes the amount reimbursed by the reimbursement amount due to the provider for provision of by the patient. Any amount remaining is "written off" payer after the copayment or coinsurance amount is paid bating provider (PAR), which means the provider has by the provider. For this activity, the physician is a participating provido the patient. Instructions Calculate the amounts paid by the payer and the patient and the amount the provider must "write off." 1. The patient is seen by his family physician for follow-up treatment of recently diagnosed asthmatic bronchitis. The physician's fee is $75. The patient's copayment is $20, and the patient is not required to pay any additional amount to the provider. The payer reimburses the physician \$28. a. Enter the amount the patient pays the provider: b. Enter the amount the payer reimburses the provider: c. Enter the amount the provider "writes off" the account: 2. The patient undergoes chemical ablation of one facial lesion in the physician's office. The physician's fee is $240. The patient's copayment is $18, and the patient is not required to pay any additional amount to the provider. The payer reimburses the physician $105. a. Enter the amount the patient pays the provider: b. Enter the amount the payer reimburses the provider: c. Enter the amount the provider "writes off" the account: 3. The patient undergoes arthroscopic surgery at an ambulatory surgical center. The surgeon's fee is $890. The patient's coinsurance is 20 percent of the $700 fee schedule, and the patient is not required to pay any additional amount to the provider. The payer reimburses the surgeon 80 percent of the $700 fee schedule. a. Enter the amount the patient pays the provider: b. Enter the amount the payer reimburses the provider: c. Enter the amount the provider "writes off" the account: a. Enter the amount the b. Enter the amount the c. Enter the amount th 5. The patient received $10 of the $75 fee sc The payer reimburse a. Enter the amoun' b. Enter the amour c. Enter the amou ASSIGNMENT Objectives At the conclusion 1. Describe prov name (Afford: 2. Utilize the He or update a 3. Explain tha a national Overview The Patient F March 23, 2 effective Oc Obamacare does not r Medicaid, budget a - Learn - Com - Cho - Enr T resol $560$140 4. The patient was referred to an orthopedic specialist for evaluation of chronic ankle pain. The physician's fee is $150. The patient's coinsurance is 30 percent of the $100 fee schedule, and the patient is not required to pay any additional amount to the provider. The payer reimburses the physician 70 percent of the $100 fee schedule for this service. C) 2022 Cengage Learning, Inc. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. population of patients. The IDS also has many wellness and health programs focused on disease prevention a Instructions 2. Prepare a one- to two-page, double-spaced, word-processed document that summarizes information on HealthEast that was accessed from the website. Be sure to include the following information in your summ a. Discuss the IDS's privacy policy for payment b. Identify types of disease-focused programs offered by this IDS. c. Explain the IDS's patient safety focus. d. Discuss the IDS's wellness program. 3. Check and double-check spelling, grammar, and punctuation. Have at least one person review your dooumer (e.g., college writing lab, English teacher, family member or friend who has excellent writing skills, and so onl). NOTE: Navigate the Fairview Health Services integrated delivery system website to research information needed for your summary. This using tool bars and pull-down menus. ASSIGNMENT 3.5 - CREATING A MANAGED CARE CONTRACT QUICK REFERENCE SHEET Objectives At the conclusion of this assignment, the student should be able to: 1. Explain the purpose of managed care plans, and list six managed care models. 2. State the purpose of a managed care quick reference sheet, and interpret managed care contract provisions to prepare the quick reference sheet. Overview Managed care plans provide benefits to subscribers (or enrollees) who are required to receive services from netwolk providers (physicians or health care facilities under contract to the managed care plan). Network providers sign contracts (Figure 3-1) with the managed care organization, and subscribers are generally required to coordinate heatt care senvices through their primary care physician (PCP). Managed care is categorized according to six models: 1. Exclusive provider organization (EPO) 2. Integrated delivery system (IDS) 3. Health maintenance organization (HMO) (0) 2022 Cengage Leaming, Inc. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. FIGURE 3-1 (continued) d. Specialty physician senvices (e.g., Oncologist, psychiatrist) f. Hospice inpatient care. g. Major organ transplants. h. EXPEDITED AUTHORIZATION FOR COVERED SERV preauthorization timeframe could serious/y PHYSICIAN determines that following the contracte ability to attain, maintain, or regain maximum jeopardize the ENROLLLE'S life or health or a PHYSICIAN CAN BILL THE PATIENT DIREC TLY - NON-COVERED SERVICES FOR WHICH THE PI including encounters for complications due to tho include office encounters for cosmetic performance of such procedures. Instructions Sheet (below), complete row three by entering review its provisions. Care Plan Quick Reference she (ontent in rows one and two as examples). hing, Inc. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started