Answered step by step

Verified Expert Solution

Question

1 Approved Answer

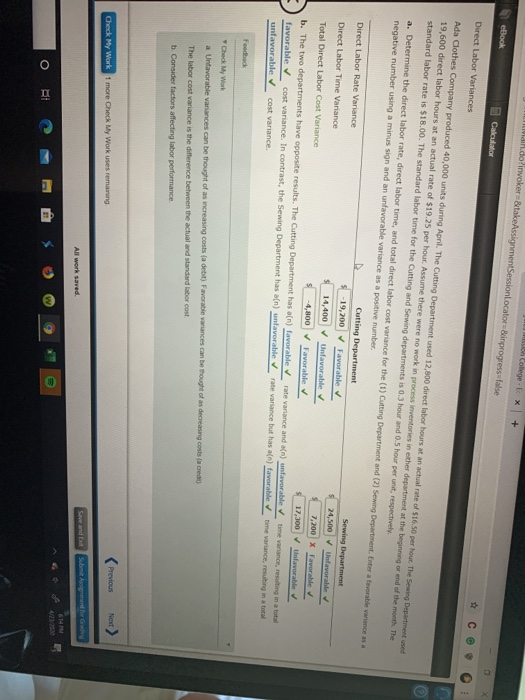

i was just missing the negative sing Www .doinvoker&takeAssignmentSessionlocator Binprogress=false College - X + eBook Calculator Direct Labor Variances Ada Clothes Company produced 40,000 units

i was just missing the negative sing

Www .doinvoker&takeAssignmentSessionlocator Binprogress=false College - X + eBook Calculator Direct Labor Variances Ada Clothes Company produced 40,000 units during April. The Cutting Department used 12,800 direct labor hours at an actual rate of $16.50 per hour. The Sewing Department used 19,600 direct labor hours at an actual rate of $19.25 per hour. Assume there were no work in process inventories in either department at the beginning or end of the month. The standard labor rate is $18.00. The standard labor time for the Cutting and Sewing departments is 0.3 hour and 0.5 hour per unit, respectively a. Determine the direct labor rate, direct labor time, and total direct labor cost variance for the (1) Cutting Department and (2) Sewing Department. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Cutting Department Sewing Department Direct Labor Rate Variance -19,200 Favorable $ 24.500 favorable Direct Labor Time Variance $ 14,400 Unfavorable 7,200 X Favorable Total Direct Labor Cost Variance 4.800 Favorable $ 17,300 navorable b. The two departments have opposite results. The Cutting Department has a[n) favorable rate variance and a(n) navorable time variance, resulting in a total favorable cost variance. In contrast, the Sewing Department has an unfavorable bevarance but has a favorevime vrance a unfavorable cost variance. Feedback Check My Work a Unfavorable variances can be thought of as increasing costs (a debit) Favorable variances can be thought of as decreasing costs acredit) The labor cost variance is the difference between the actual and standard labor cost . Consider factors affecting labor performance Check My Work 1 more Check My Work uses remaining Previous Next > All work saved Save and submission for Grey 6147 Www .doinvoker&takeAssignmentSessionlocator Binprogress=false College - X + eBook Calculator Direct Labor Variances Ada Clothes Company produced 40,000 units during April. The Cutting Department used 12,800 direct labor hours at an actual rate of $16.50 per hour. The Sewing Department used 19,600 direct labor hours at an actual rate of $19.25 per hour. Assume there were no work in process inventories in either department at the beginning or end of the month. The standard labor rate is $18.00. The standard labor time for the Cutting and Sewing departments is 0.3 hour and 0.5 hour per unit, respectively a. Determine the direct labor rate, direct labor time, and total direct labor cost variance for the (1) Cutting Department and (2) Sewing Department. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Cutting Department Sewing Department Direct Labor Rate Variance -19,200 Favorable $ 24.500 favorable Direct Labor Time Variance $ 14,400 Unfavorable 7,200 X Favorable Total Direct Labor Cost Variance 4.800 Favorable $ 17,300 navorable b. The two departments have opposite results. The Cutting Department has a[n) favorable rate variance and a(n) navorable time variance, resulting in a total favorable cost variance. In contrast, the Sewing Department has an unfavorable bevarance but has a favorevime vrance a unfavorable cost variance. Feedback Check My Work a Unfavorable variances can be thought of as increasing costs (a debit) Favorable variances can be thought of as decreasing costs acredit) The labor cost variance is the difference between the actual and standard labor cost . Consider factors affecting labor performance Check My Work 1 more Check My Work uses remaining Previous Next > All work saved Save and submission for Grey 6147 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started