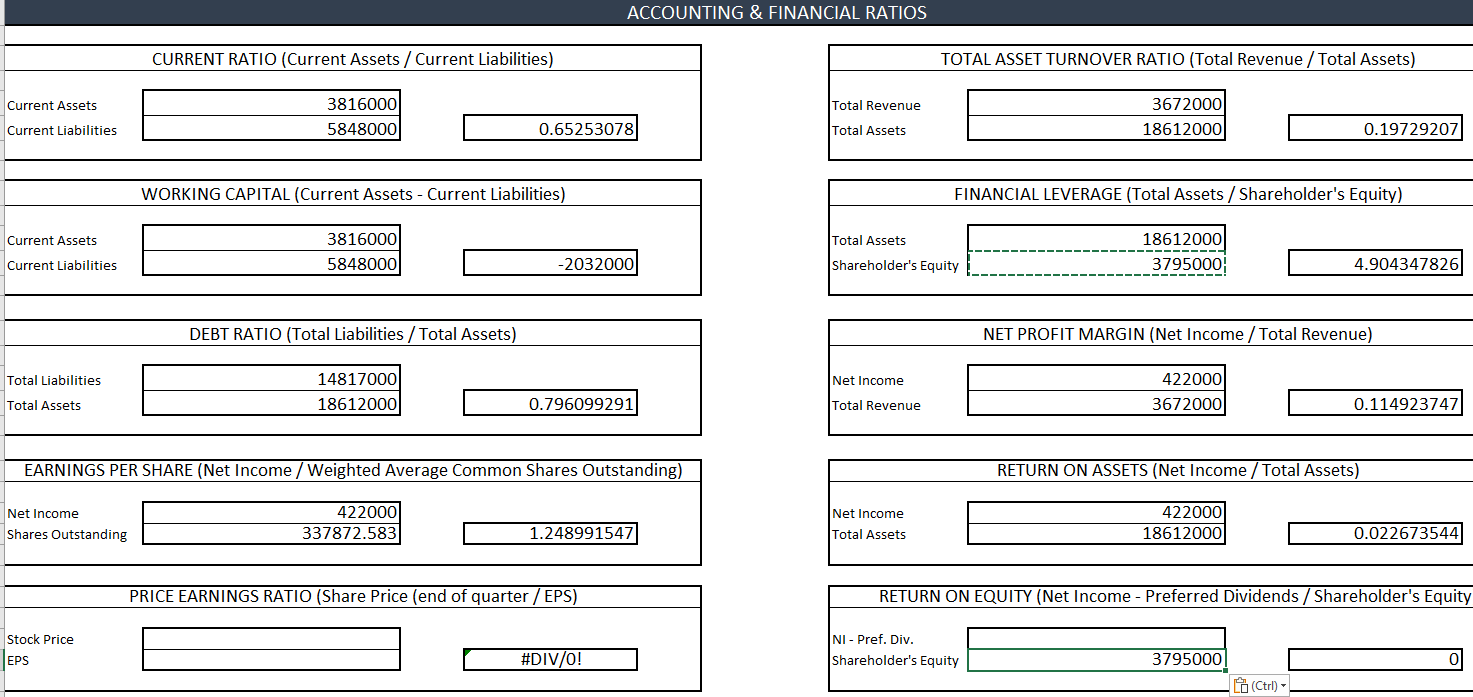

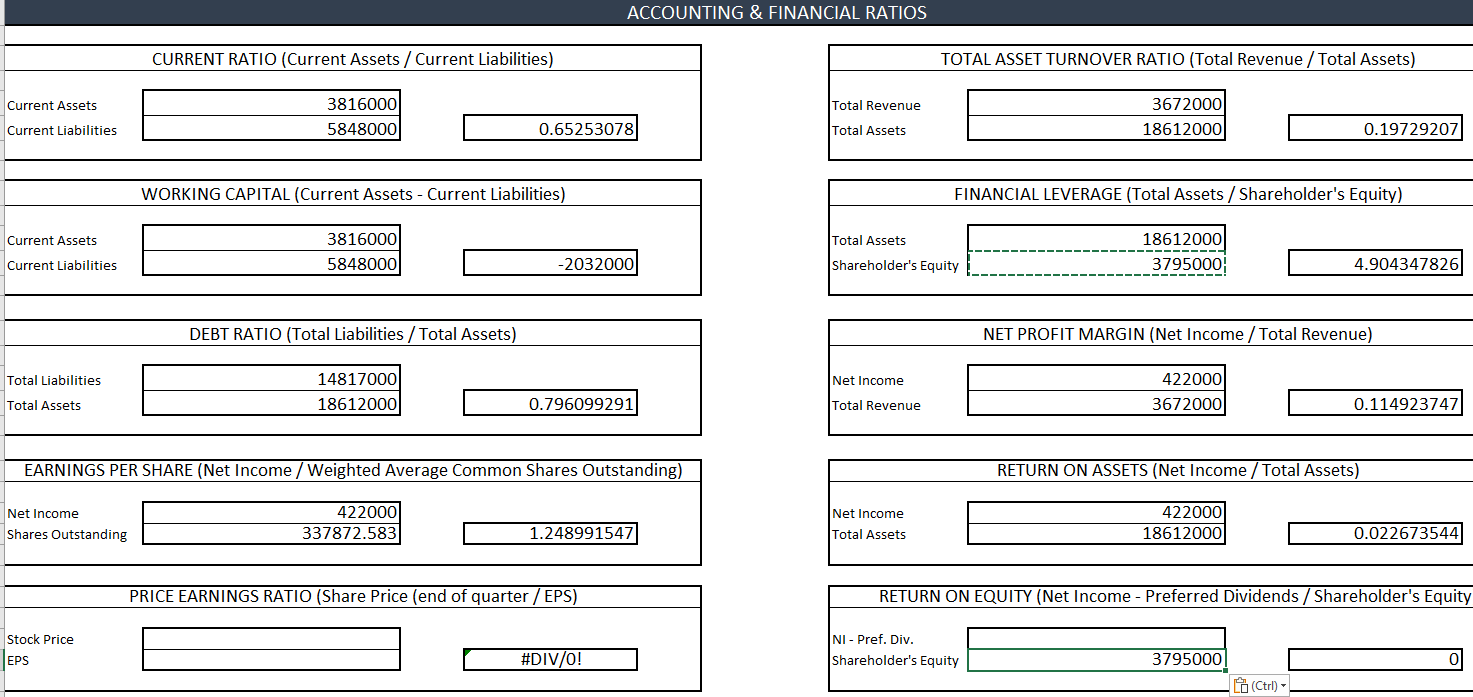

I was looking for feedback on how to correctly complete the price earnings ratio and the return on equity before I complete this for next year as well. Any feedback on the ones I completed already would be much appreciated as well. Thanks!

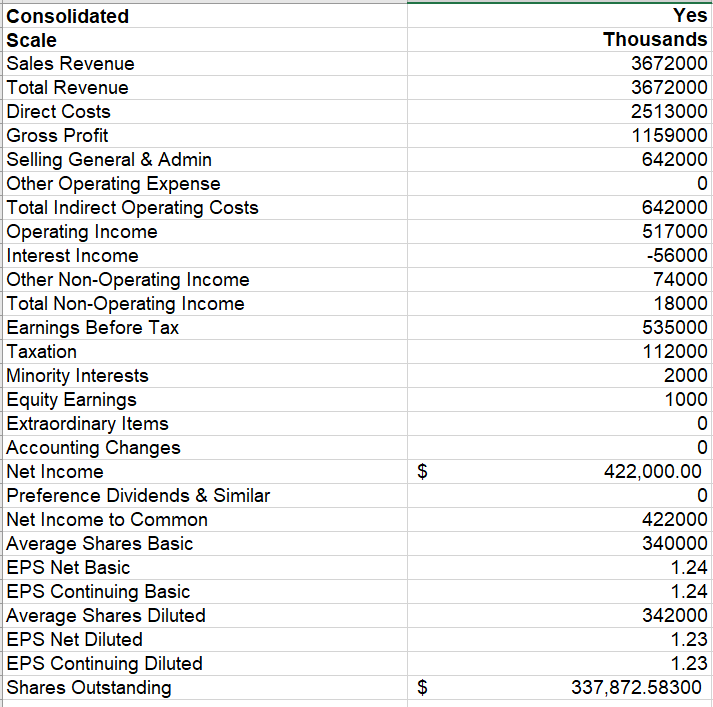

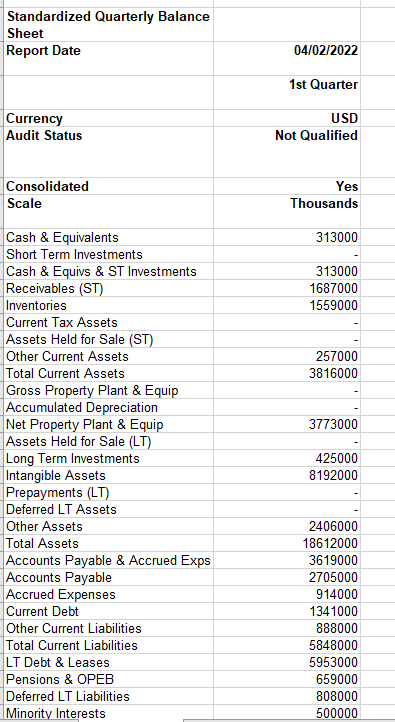

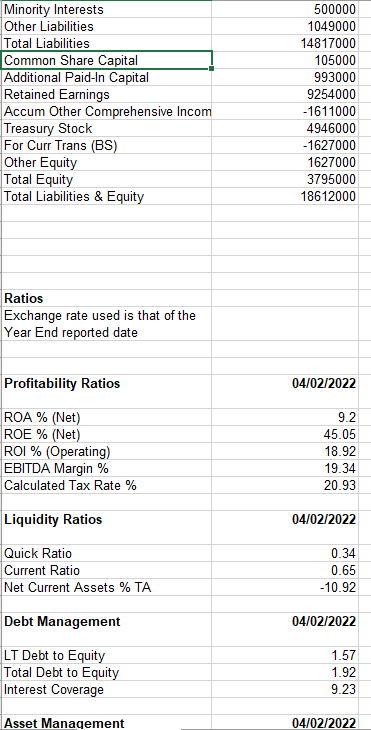

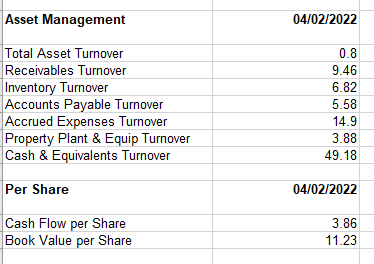

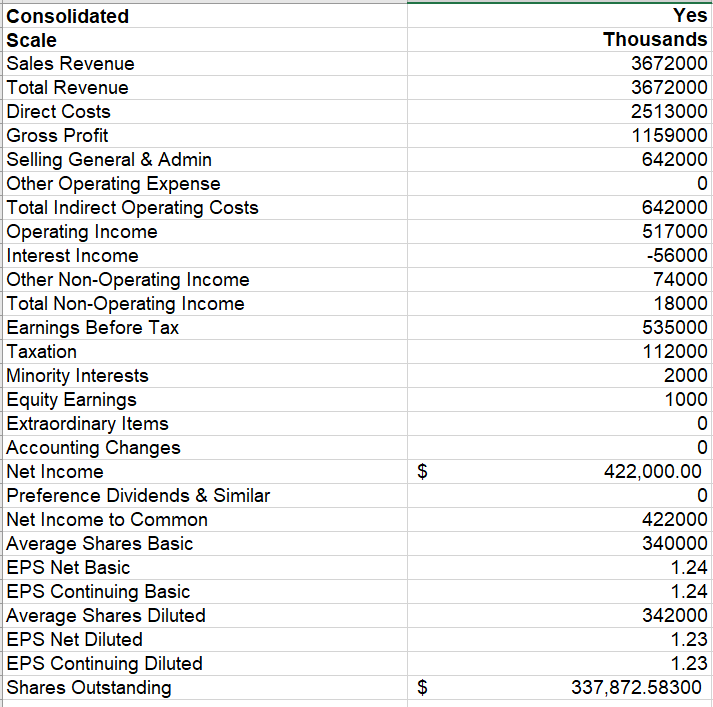

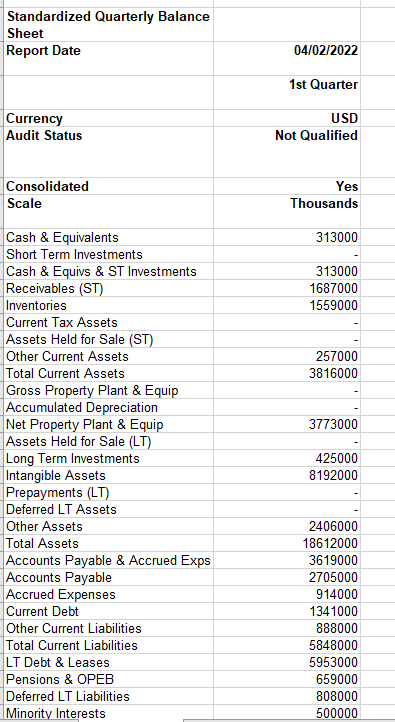

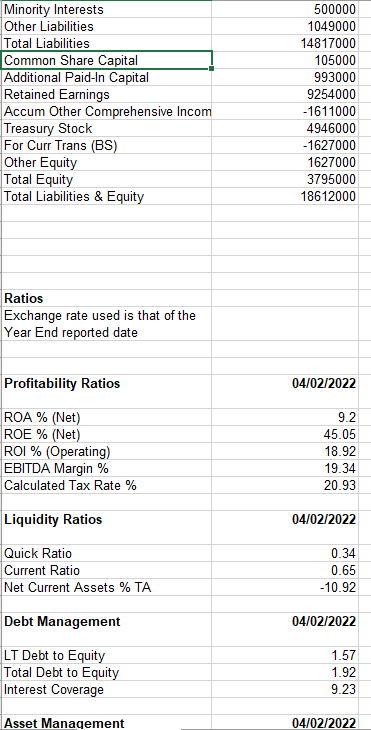

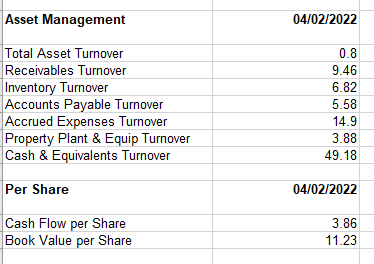

ACCOUNTING \& FINANCIAL RATIOS \begin{tabular}{lr} Consolidated & Yes \\ Scale & Thousands \\ Sales Revenue & 3672000 \\ Total Revenue & 3672000 \\ Direct Costs & 2513000 \\ Gross Profit & 1159000 \\ Selling General \& Admin & 642000 \\ Other Operating Expense & 0 \\ Total Indirect Operating Costs & 642000 \\ Operating Income & 517000 \\ Interest Income & 56000 \\ Other Non-Operating Income & 74000 \\ Total Non-Operating Income & 18000 \\ \hline Earnings Before Tax & 535000 \\ Taxation & 112000 \\ \hline Minority Interests & 2000 \\ Equity Earnings & 1000 \\ Extraordinary Items & 0 \\ Accounting Changes & 0 \\ Net Income & $22,000.00 \\ Preference Dividends \& Similar & 0 \\ Net Income to Common & 422000 \\ Average Shares Basic & 340000 \\ EPS Net Basic & 1.24 \\ EPS Continuing Basic & 1.24 \\ Average Shares Diluted & 342000 \\ \hline EPS Net Diluted & 1.23 \\ \hline EPS Continuing Diluted & 1.23 \\ Shares Outstanding & $37,872.58300 \end{tabular} Standardized Quarterly Balance Sheet \begin{tabular}{|l|r|} \hline Minority Interests & 500000 \\ \hline Other Liabilities & 1049000 \\ \hline Total Liabilities & 14817000 \\ \hline Common Share Capital & 105000 \\ \hline Additional Paid-In Capital & 993000 \\ \hline Retained Earnings & 9254000 \\ \hline Accum Other Comprehensive Incom & 1611000 \\ \hline Treasury Stock & 4946000 \\ \hline For Curr Trans (BS) & 1627000 \\ \hline Other Equity & 1627000 \\ \hline Total Equity & 3795000 \\ \hline Total Liabilities \& Equity & 18612000 \\ \hline \end{tabular} Ratios Exchange rate used is that of the Year End reported date \begin{tabular}{|lr|} \hline Profitability Ratios & 04/02/2022 \\ \hline ROA \% (Net) & 9.2 \\ \hline ROE \% (Net) & 45.05 \\ \hline ROI \% (Operating) & 18.92 \\ \hline EBITDA Margin \% & 19.34 \\ \hline Calculated Tax Rate \% & 20.93 \\ \hline Liquidity Ratios & 04/02/2022 \\ \hline Quick Ratio & 0.34 \\ \hline Current Ratio & 0.65 \\ \hline Net Current Assets \% TA & 10.92 \\ \hline Debt Management & 04/02/2022 \\ \hline LT Debt to Equity & 1.57 \\ \hline Total Debt to Equity & 1.92 \\ \hline Interest Coverage & 9.23 \\ \hline & 04/02/2022 \\ \hline Asset Manaqement & \\ \hline \end{tabular} \begin{tabular}{l|r|} \hline Asset Management & 04/02/2022 \\ \hline Total Asset Turnover & 0.8 \\ \hline Receivables Turnover & 9.46 \\ Inventory Turnover & 6.82 \\ \hline Accounts Payable Turnover & 5.58 \\ \hline Accrued Expenses Turnover & 14.9 \\ \hline Property Plant \& Equip Turnover & 3.88 \\ \hline Cash \& Equivalents Turnover & 49.18 \\ \hline Per Share & 04/02/2022 \\ \hline Cash Flow per Share & 3.86 \\ \hline Book Value per Share & 11.23 \\ \hline \end{tabular}