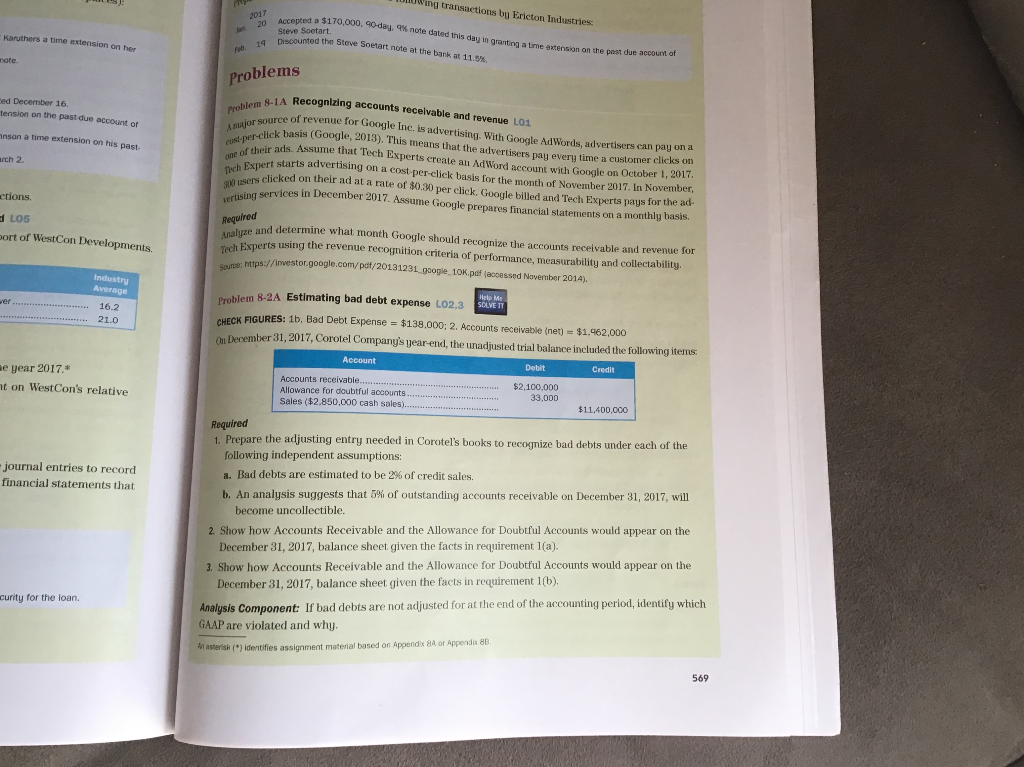

I was wondering if you could help me with Problem 8-2A Chapter 8 in the book fundamental accounting principles.

t by Ericton Industries 2017 Accepted a $170,000, 90day, q% Steve Soetart. Discounted the Stowe Soetart note at the bank at 11.5% note dated this day in grating a tine extension on the past due account of this da Karuthers a time extension on her note. -IA Recognlzing accounts recelvable and revenue L01 urce of revenue for Google Inc. is advetising. With Google AdWords, advertisers can pay on a lick basis (Google, 2013). This means that the advertisers pay every time a customer clicks on ed December 16. Pro A l tension on the past due account of nson a time extension on his past- rch 2. major s heir ads. Assume that Tech Experts create au AdWord account with Google on October I of their t starts advertising on a cost perclick licked on their ad at a rate of $0.30 per click. Google billed and Tech Experts pays le on October 1, 2017 a cost per-click basis for the month of November 2017. In November, 300 users ng services in December 2017. Assume Google prepares financial statements on a for the ad- ctions. monthlg basis Required LOS ort of WestCon Developments. Amalize and determine what month Google should recognize the accounts receivable and revenue for tech Experts using the revenue recognition criteria of performance, measurability and collectability. nttps://investor.google.com/ pat/20131231 goople 10K.pat laccessed Navembor 2014). Help Me SOLVE IT er16.2 21.0 Problem 8-2A Estimating bad debt expense Lo2,3 CHECK FIGURES: 1b. Bad Debt Expense = $138,000, 2. Accounts receivable (net-$1.962,000 ber 31,2017, Corotel Company's year-end, the unadjusted trial balance included the following items. On Decembe Debit Credit e year 2017.* t on WestCon's relative Accounts receivable Allowance for doubtful accounts Sales ($2,850,000 cash sales) $2,100,000 33,000 $11,400,00o Required 1. Prepare the adjusting entry needed in Corotel's books to recognize bad debts under each of the following independent assumptions: a. Bad debts are estimated to be 2% of credit sales. b An analysis suggests that 5% of outstanding accounts receivable on December 31, 2017, will journal entries to record financial statements that become uncollectible. 2 Show how Accounts Receivable and the Allowance for Doubtful Accounts would appear on the 3. Show how Accounts Receivable and the Allowance for Doubtful Accounts would appear on the Analysis Component: If bad debts are not adjusted for at the end of the accounting period, identify which December 31, 2017, balance sheet given the facts in requirement I(a) December 31, 2017, balance sheet given the facts in requirement 1(b). curity for the loan. GAAP are violated and why kn asterisk() identifies assignment material based on Appendix 8A or Appendia 8B 569