I welcome any microeconomics tutor to help me with a step by step calculation of each question, thank you

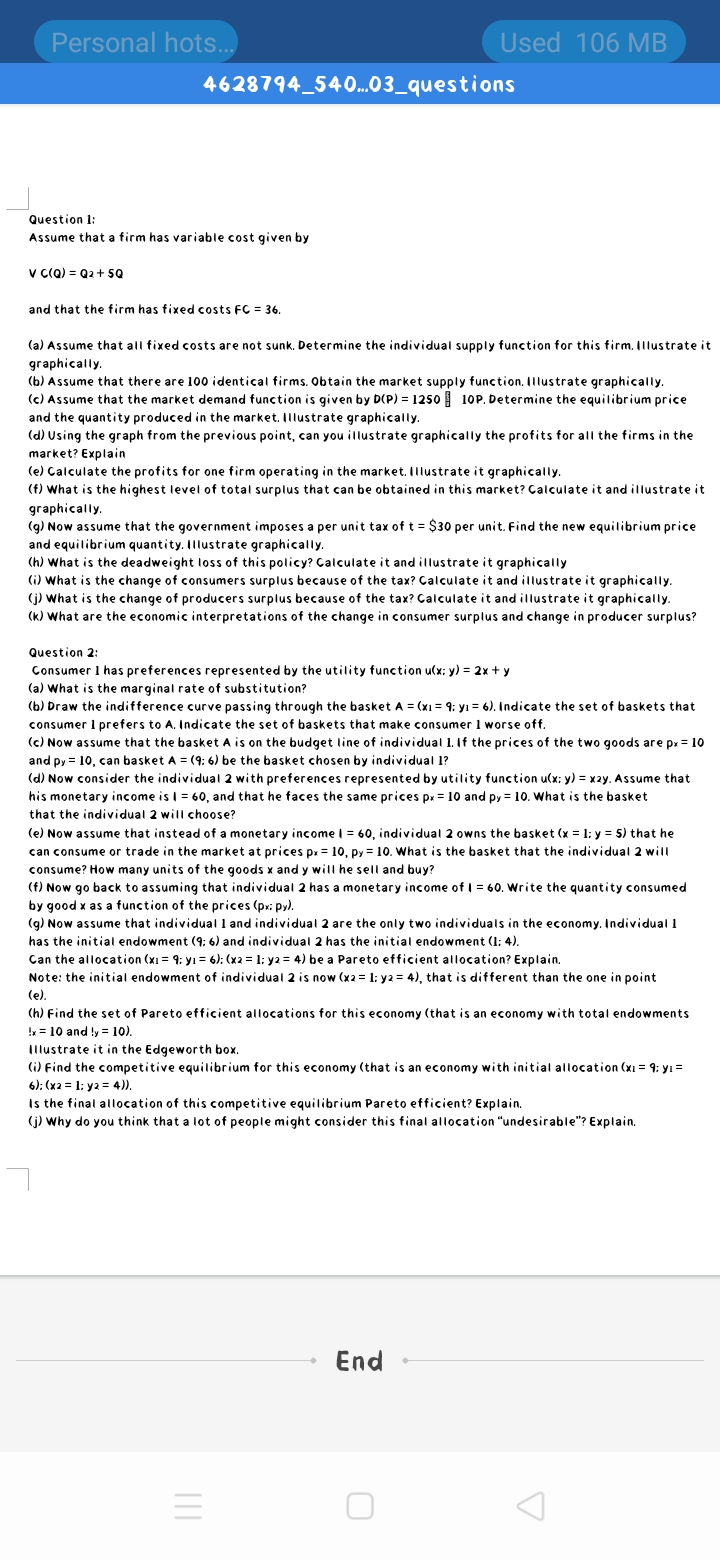

46 28794_S40...03_ques tions J Question I: assume that a firm has variable cost given by V cm! = 01+ 50 and that the firm has fixed costs F6 = 36. la] Assume that all fixed costs are not sunk. Betermine the individual supply function for this firnullustrate it graphically. {b} Assume that there are 100 identical firms.0btain the market supply function. Illustrate graphically. {c} Assume that the market demand function is given by MPJ=12SDE IDP. Determine the equilibrium price and the quantity produced in the market Illustrate graphically. fdl Using the graph from the previous point, can you illustrate graphically the profits for all the firms in the market? Explain tel Calculate the profits for one firm operating in the market. Illustrate it graphically. if] What is the highest level of total surplus that can be obtained in this market?0alculate it and illustrate it graphically. (g) Now assume that the government imposes a per unit tax of t = $30 per unit. Find the new equilibrium price and equilibrium quantity. Illustrate graphically. lhl What is the deadweight loss of this policy? Calculate it and illustrate it graphically ii) what is the change of consumers surplus because of the tax? Calculate it and illustrate it graphically. I]! What is the change of producers surplus because of the tax? Calculate it and illustrate it graphically. [kl What are the economic interpretations of the change in consumer surplus and change in producer surplus? Question 2: Consumer] has preferences represented by the utility function ufx: y] = 2: + y la! What is the marginal rate of substitution? lb) Draw the indifference curve passing through the basket 3. = lx1= 'i; y1= 6). indicate the set of baskets that consumer I prefers to 4!. Indicate the set of baskets that make consumer I worse off. {c} MowI assume that the basket A is on the budget line of individual 1. if the prices of the two goods are pg: 10 and P1! = 10, can basket ill = (1: 61 be the basket chosen by individual [1' [dl Now consider the individual 2. with preferences represented by utility function ul'x; y) = xiy. assume that his monetary income is l = 60, and that he faces the same prices pa: ID and Py= 10.What is the basket that the individual 2 will choose? tel Now assume that instead of a monetary income I = 60, individual 2 owns the basket (I = l: y = 51 that he can consume or trade in the market at prices PI: ID, P1: In. What is the basket that the individual 2 will consume? HowI many units of the goods I' and y will he sell and buy? if] Now go back to assuming that individual 2 has a monetary income of I = so. Write the quantity consumed by good x as a function of the prices lpx: P1]. lg) Now assume that individual land individual 2 are the only two individuals in the economy. individual I has the initial endowment ('l: 6! and individual 2 has the initial endowment ll; 4!. Can the allocation (xi = 'i; y1= 0;th = l: ya: 4] be a l'areto efficient allocation?Evplain Note: the initial endowment of individual 2 is nowtxa = 1: ya: 4}, that is different than the one in point tel. {hi Find the set of Pareto efficient allocations for this economy (that is an economy with total endowments la: la and hr: 10]. Illustrate it in the Edgeworth box. Ii) Find the competitive equilibrium for this economy (that is an economy with initial allocationfxi = 1: y: = 6!: (x: = 1: ya: 4}}. Is the final allocation of this competitive equilibrium Pareto efficient? Explain. (j) Why do you think that a lot of people might consider this final allocation \"undesirable\"? Explain. 7 'End