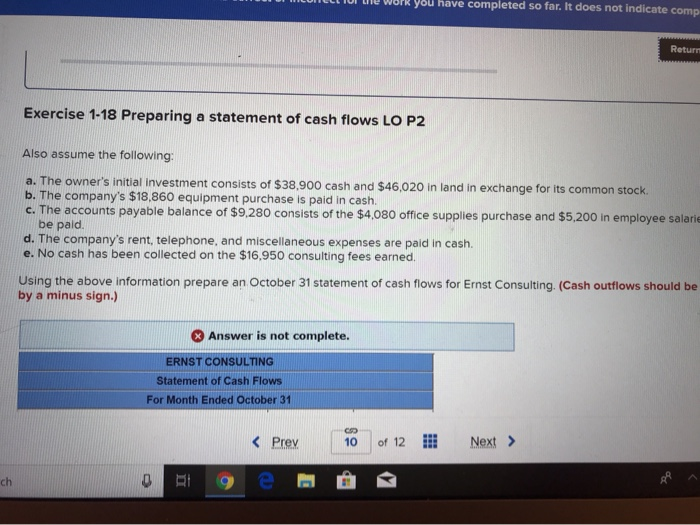

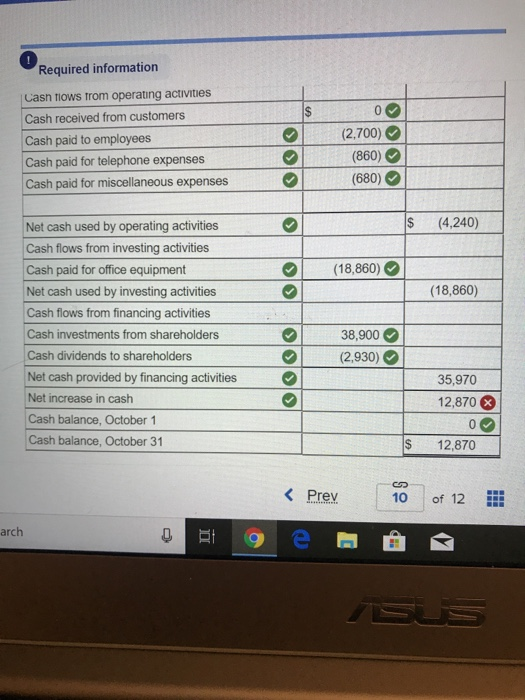

I WIL WUIL YOU HAVE completed so Tor. It does not indicate come Return Exercise 1-18 Preparing a statement of cash flows LO P2 Also assume the following: a. The owner's initial investment consists of $38,900 cash and $46,020 in land in exchange for its common stock. b. The company's $18.860 equipment purchase is paid in cash, c. The accounts payable balance of $9,280 consists of the $4,080 office supplies purchase and $5,200 in employee salarie be paid. d. The company's rent, telephone, and miscellaneous expenses are paid in cash. e. No cash has been collected on the $16,950 consulting fees earned Using the above information prepare an October 31 statement of cash flows for Ernst Consulting (Cash outflows should be by a minus sign.) Answer is not complete. ERNST CONSULTING Statement of Cash Flows For Month Ended October 31 Required information Cash flows from operating activities Cash received from customers Cash paid to employees Cash paid for telephone expenses Cash paid for miscellaneous expenses 0 (2,700) (860) (680) $ (4,240) (18,860) (18,860) Net cash used by operating activities Cash flows from investing activities Cash paid for office equipment Net cash used by investing activities Cash flows from financing activities Cash investments from shareholders Cash dividends to shareholders Net cash provided by financing activities Net increase in cash Cash balance, October 1 Cash balance, October 31 38,900 (2,930) 35,970 12,870 0 $ 12,870 Required information Cash flows from operating activities Cash received from customers Cash paid to employees Cash paid for telephone expenses Cash paid for miscellaneous expenses 0 (2,700) (860) (680) $ (4,240) (18,860) (18,860) Net cash used by operating activities Cash flows from investing activities Cash paid for office equipment Net cash used by investing activities Cash flows from financing activities Cash investments from shareholders Cash dividends to shareholders Net cash provided by financing activities Net increase in cash Cash balance, October 1 Cash balance, October 31 38,900 (2,930) 35,970 12,870 0 $ 12,870