Answered step by step

Verified Expert Solution

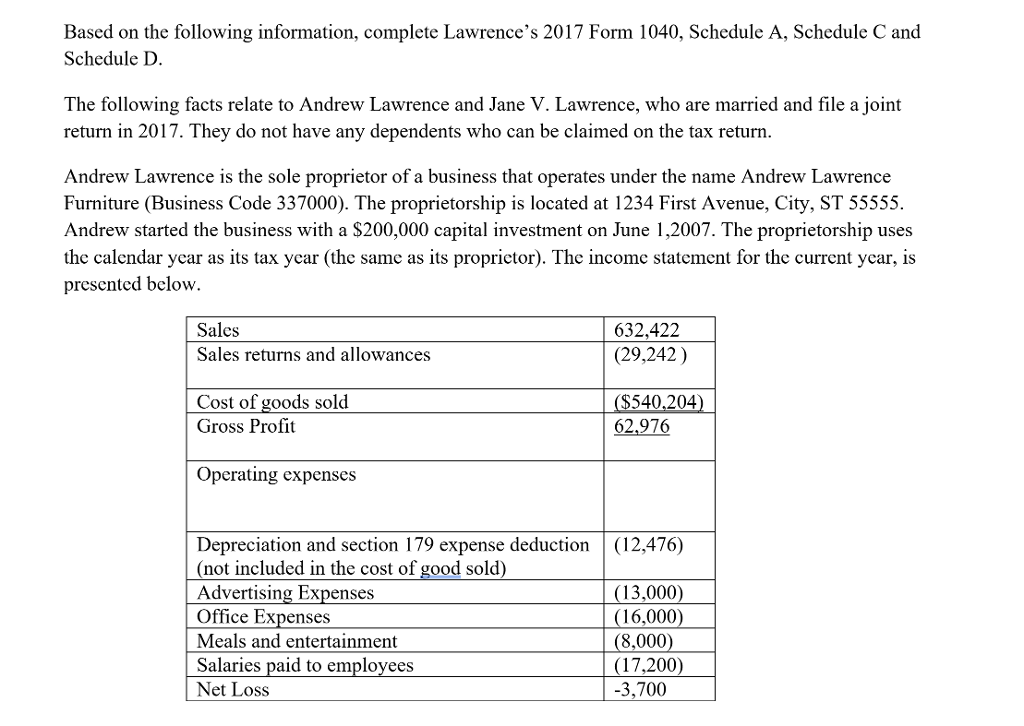

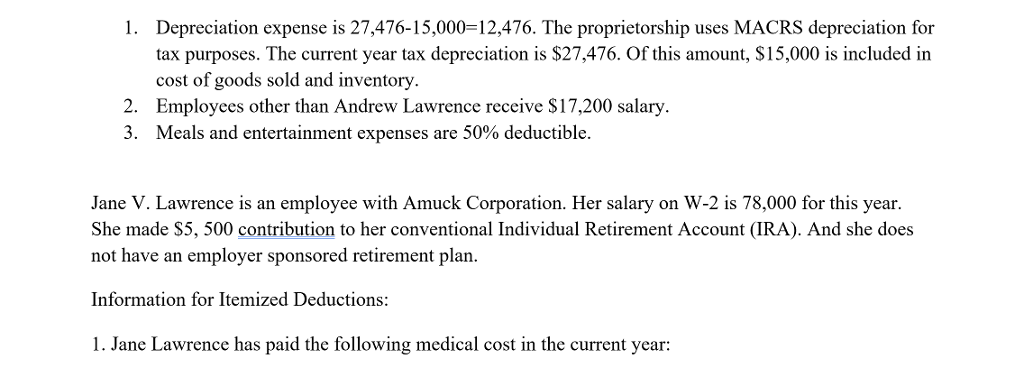

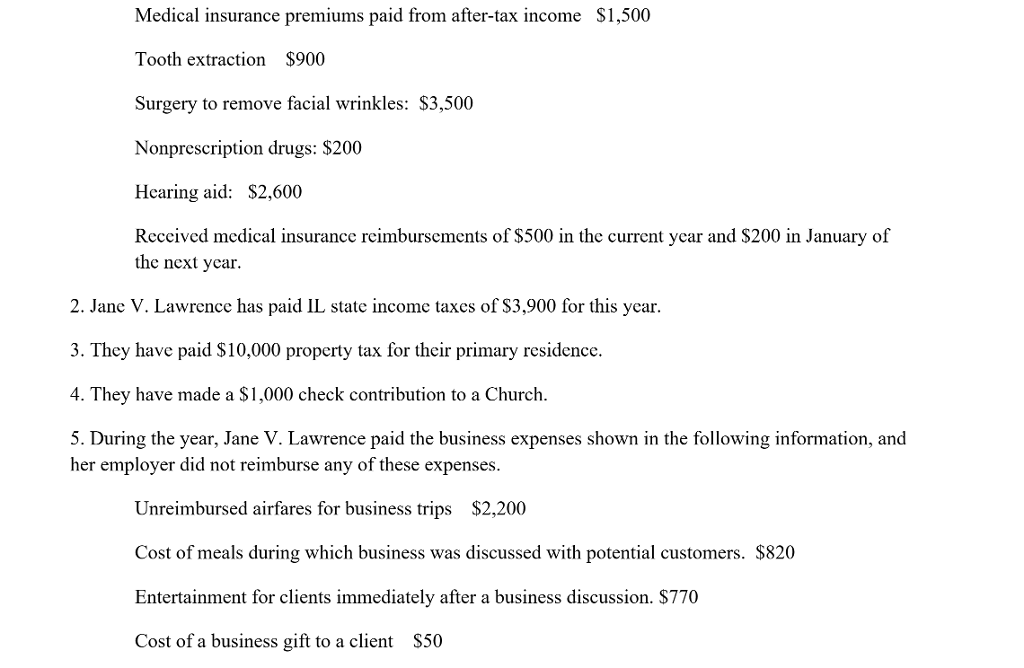

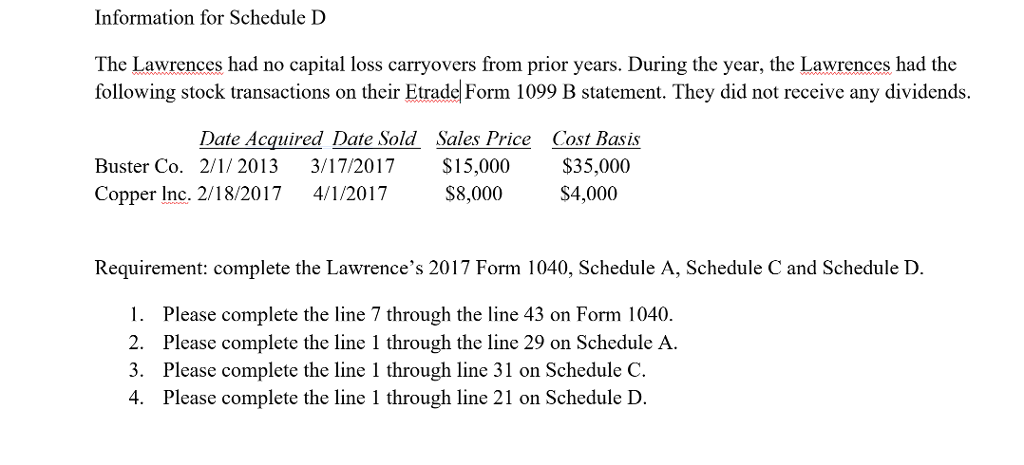

Question

1 Approved Answer

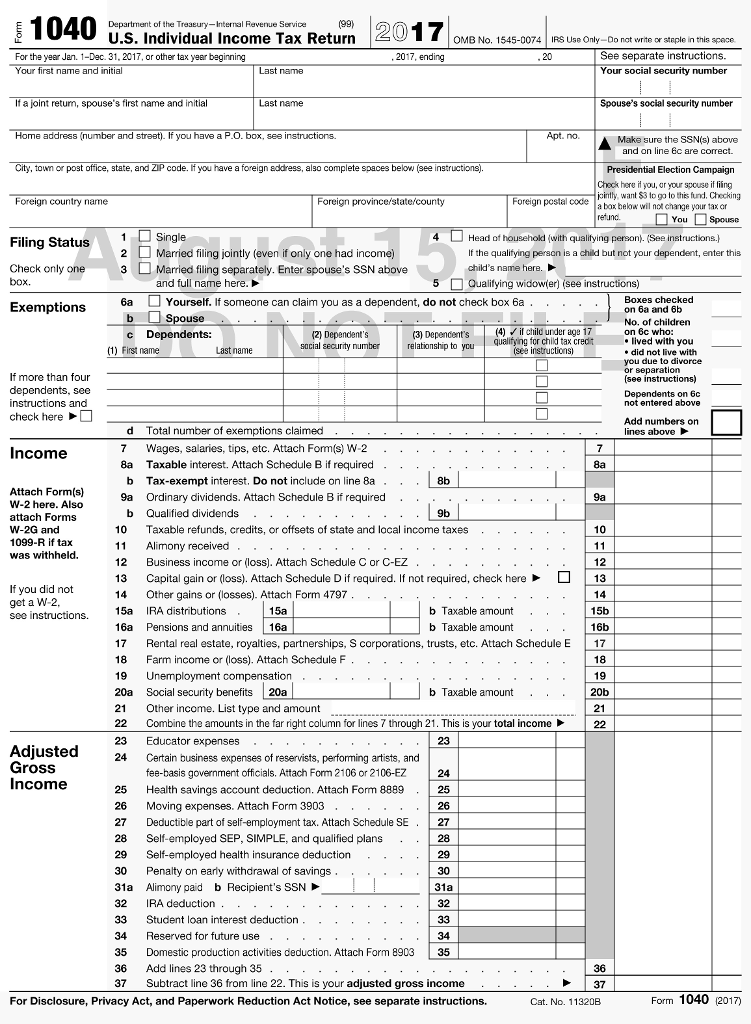

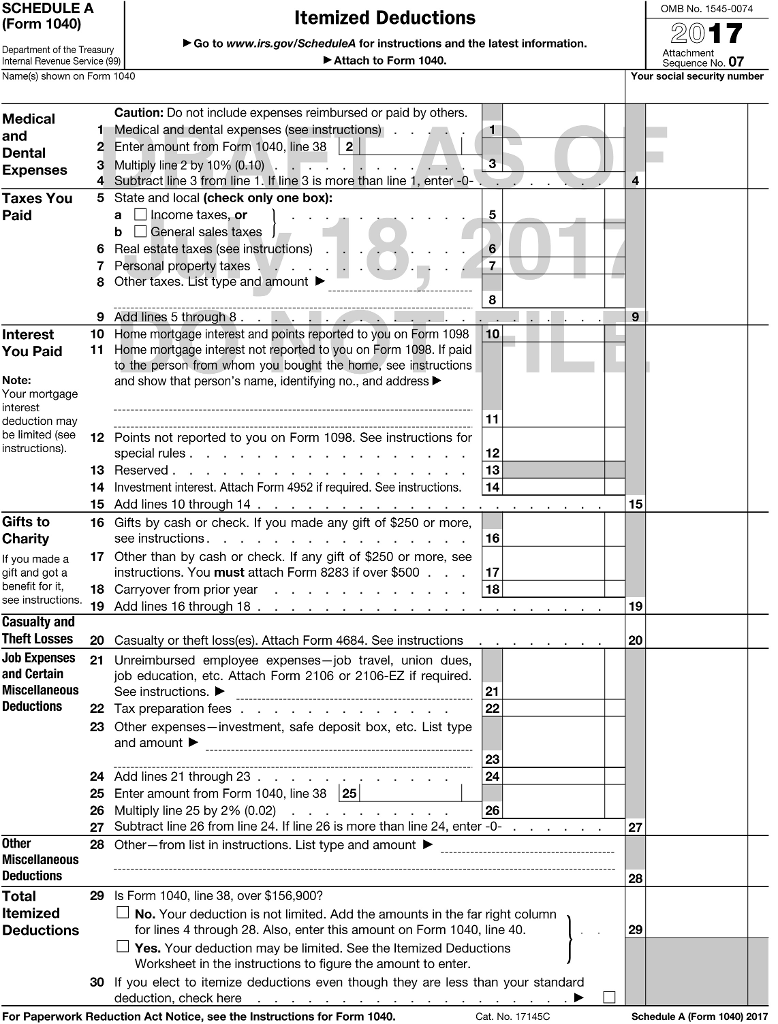

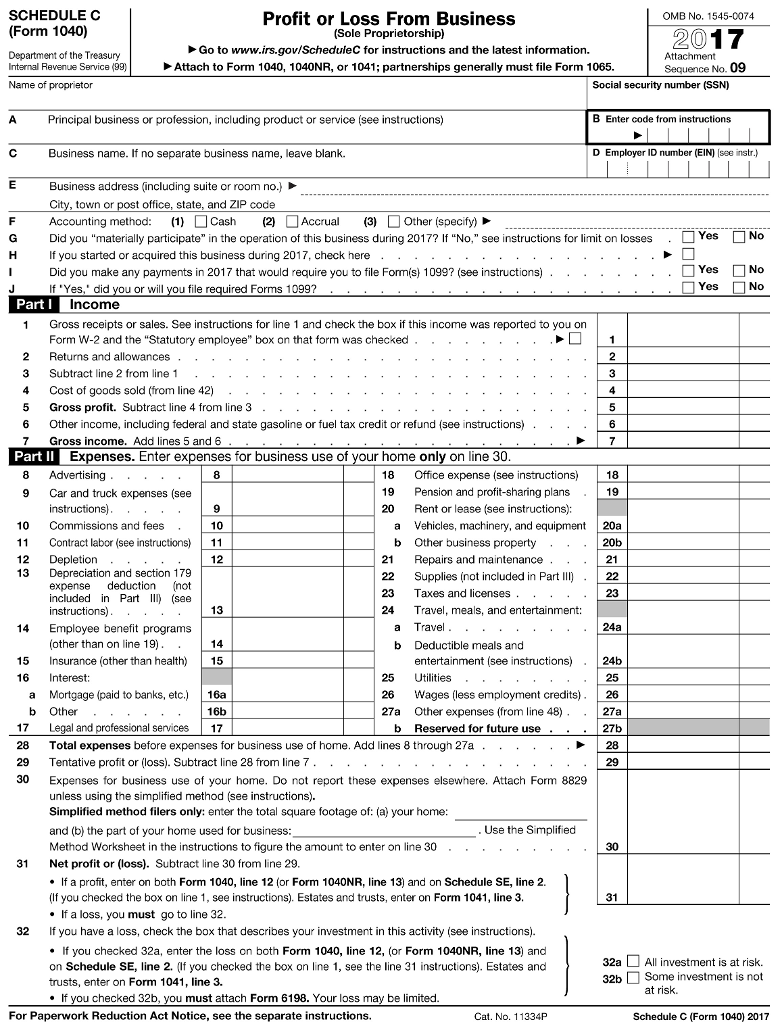

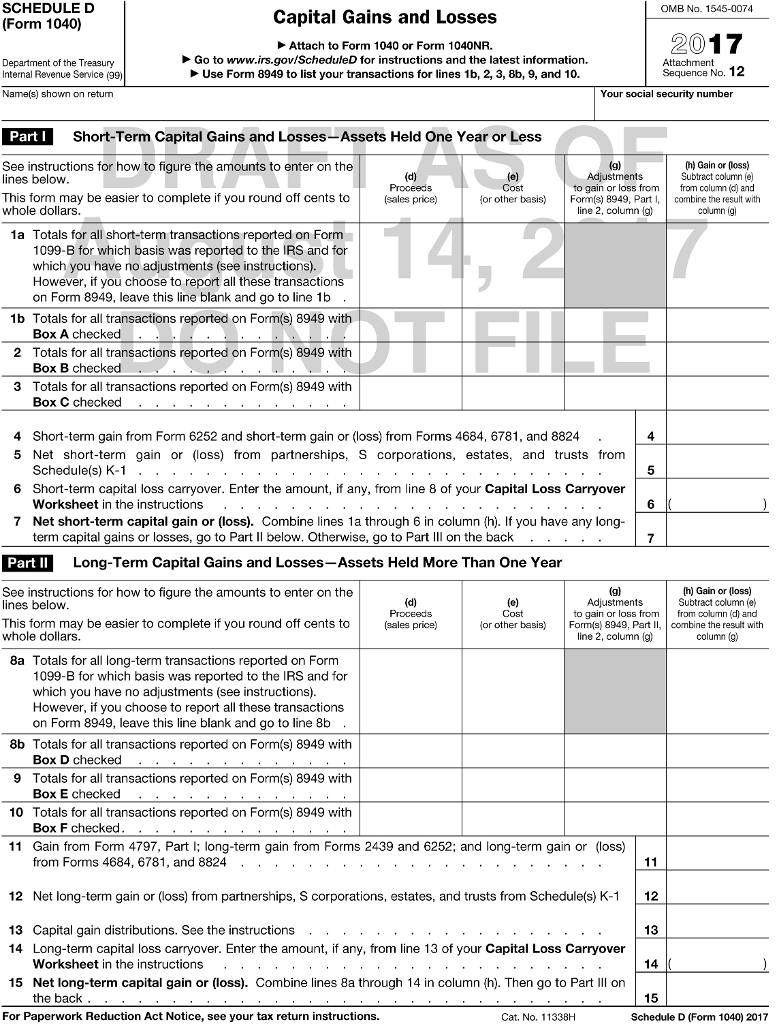

I will attach the Forms, Please answer by putting the number next to the corresponding answer For Example: Form 1040: 7: 35,000 8: 3 9:

I will attach the Forms, Please answer by putting the number next to the corresponding answer

For Example:

Form 1040:

7: 35,000

8: 3

9: 3,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started