I will downvote if you dont answer all parts in detail. Please answer all the subparts.. either answer all of them or dont answer at all. Thanks in advance

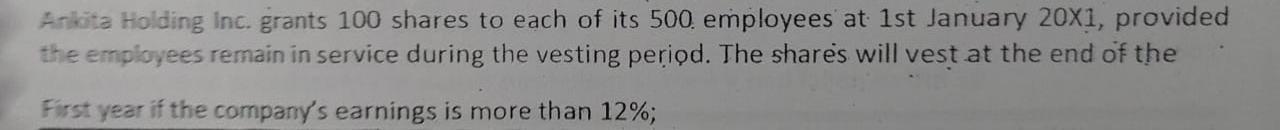

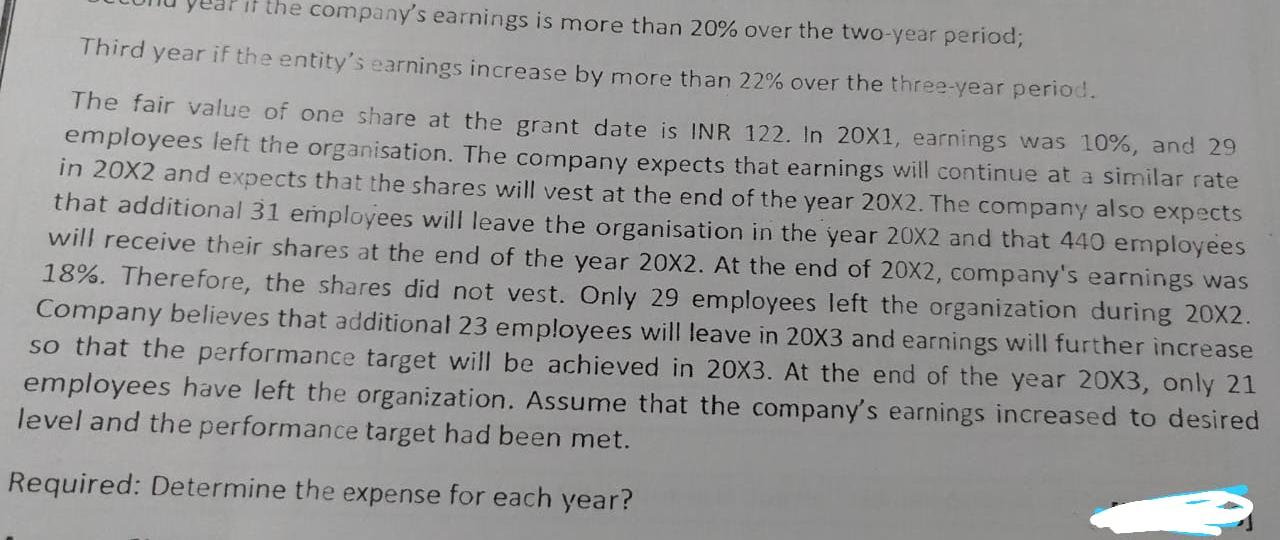

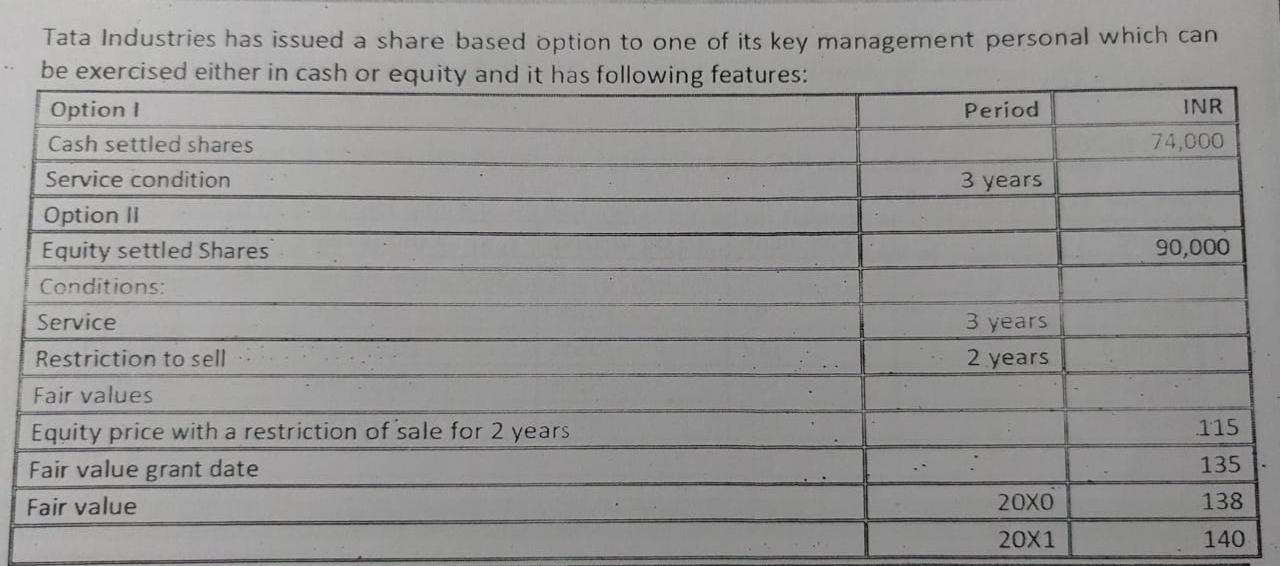

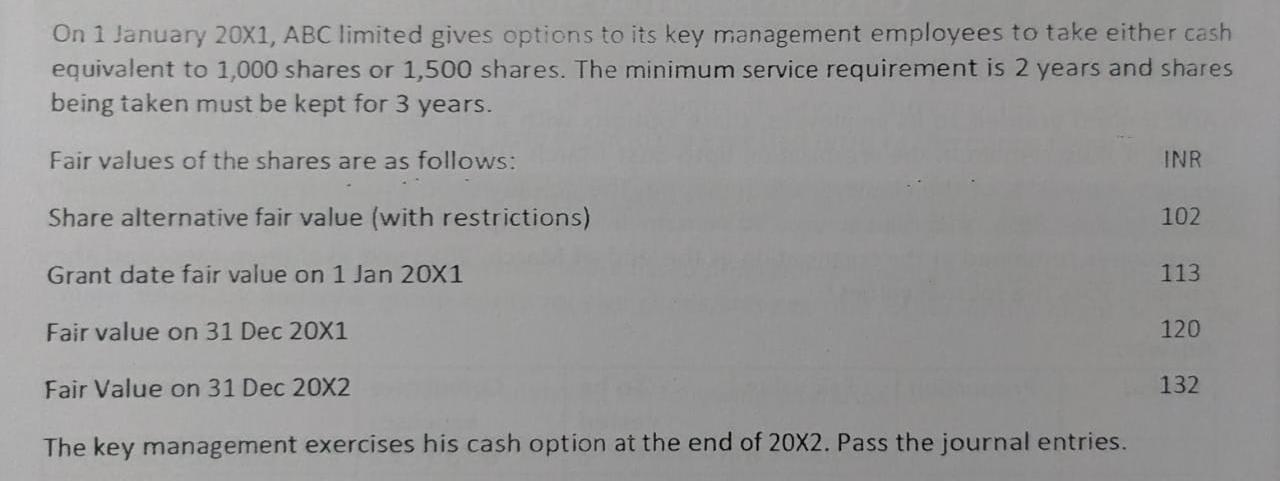

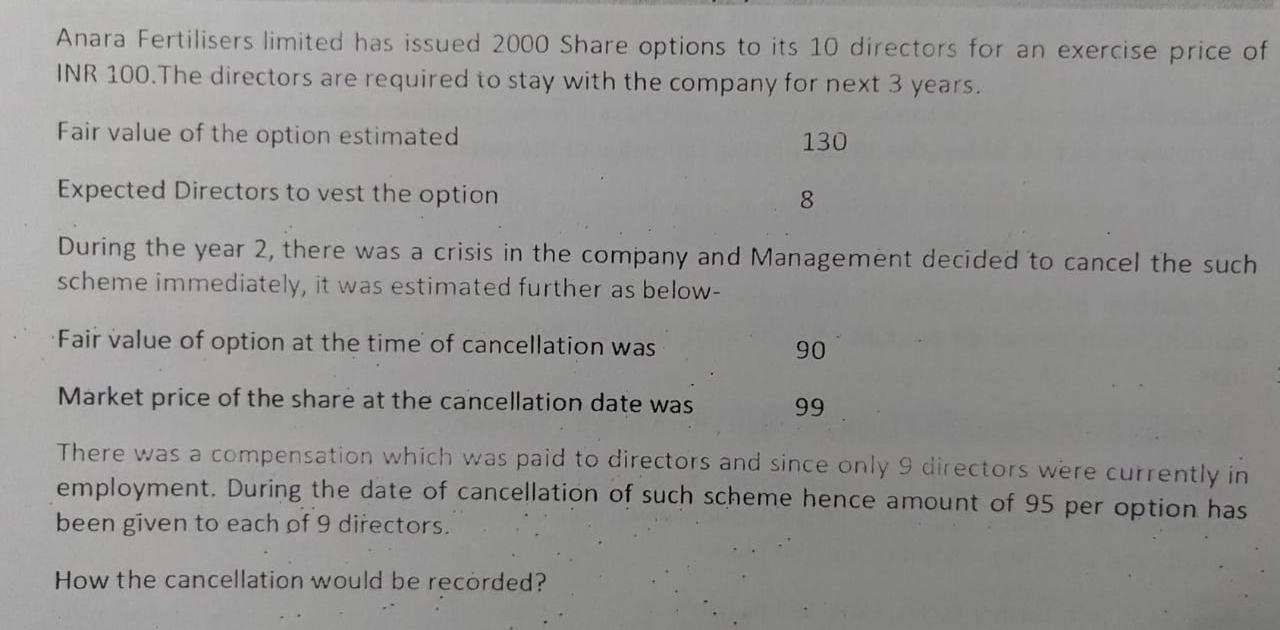

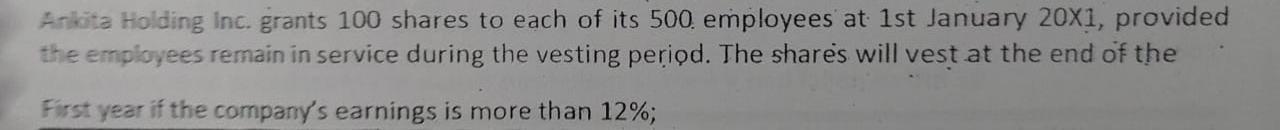

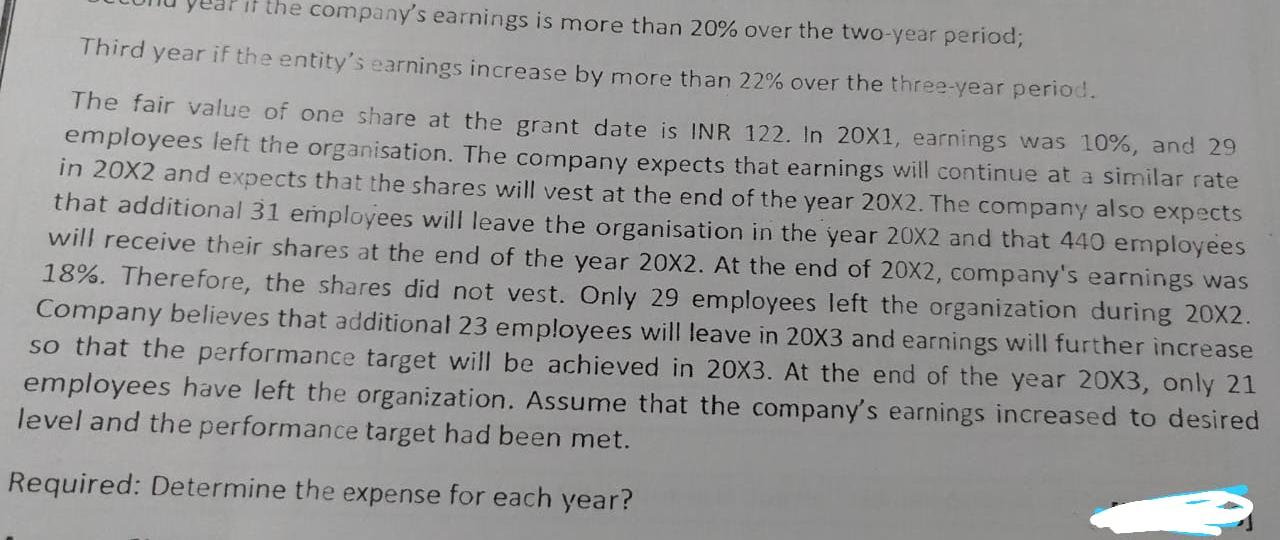

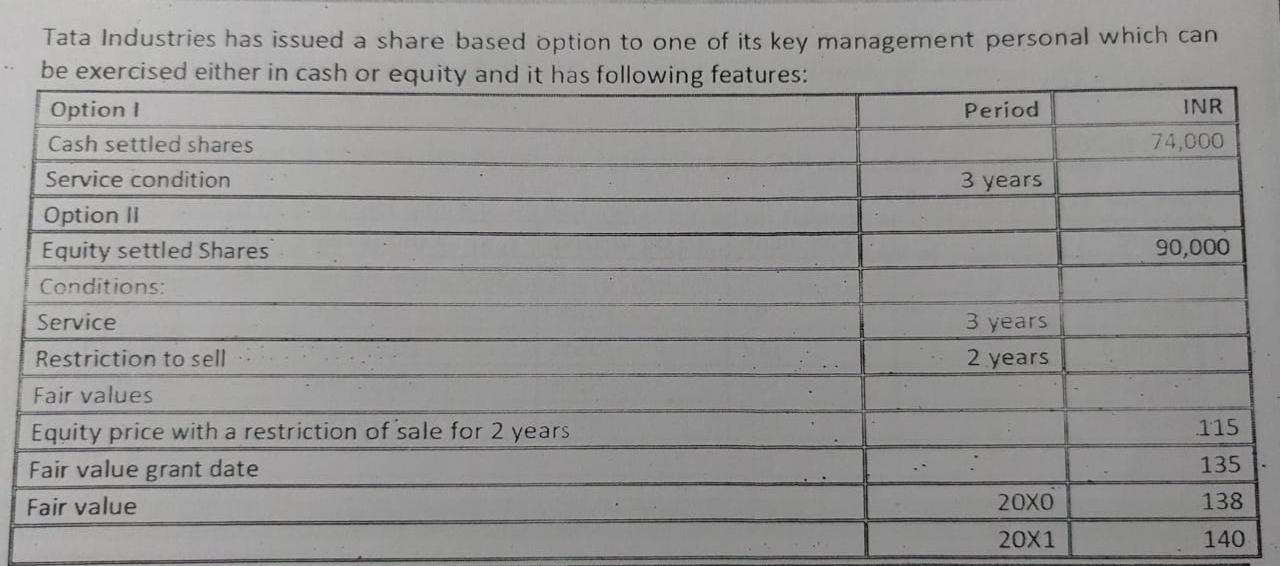

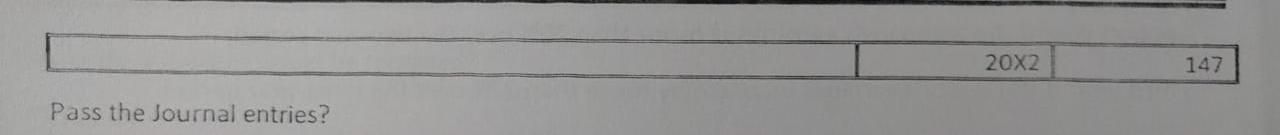

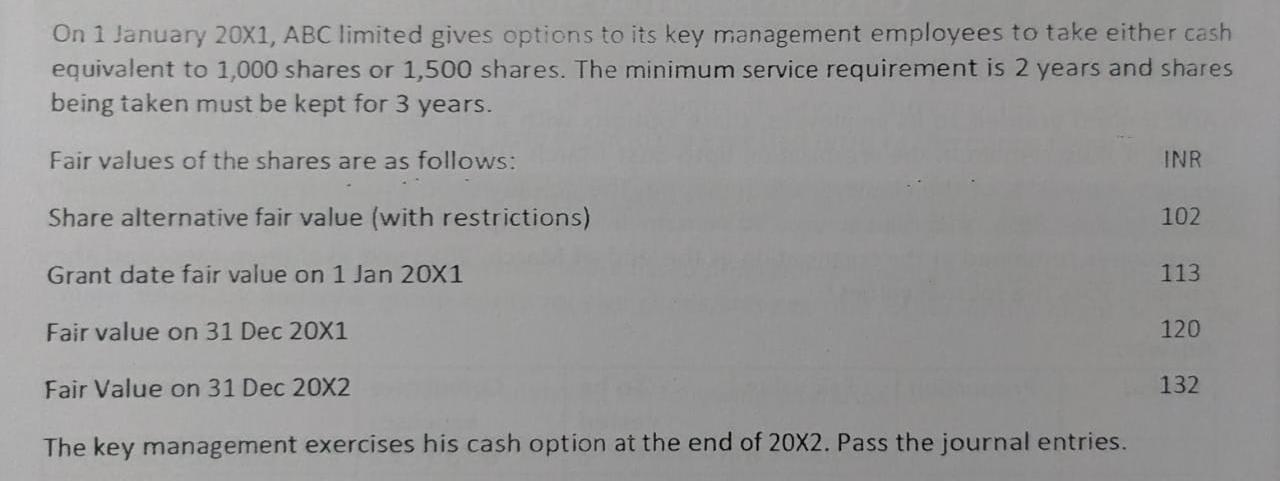

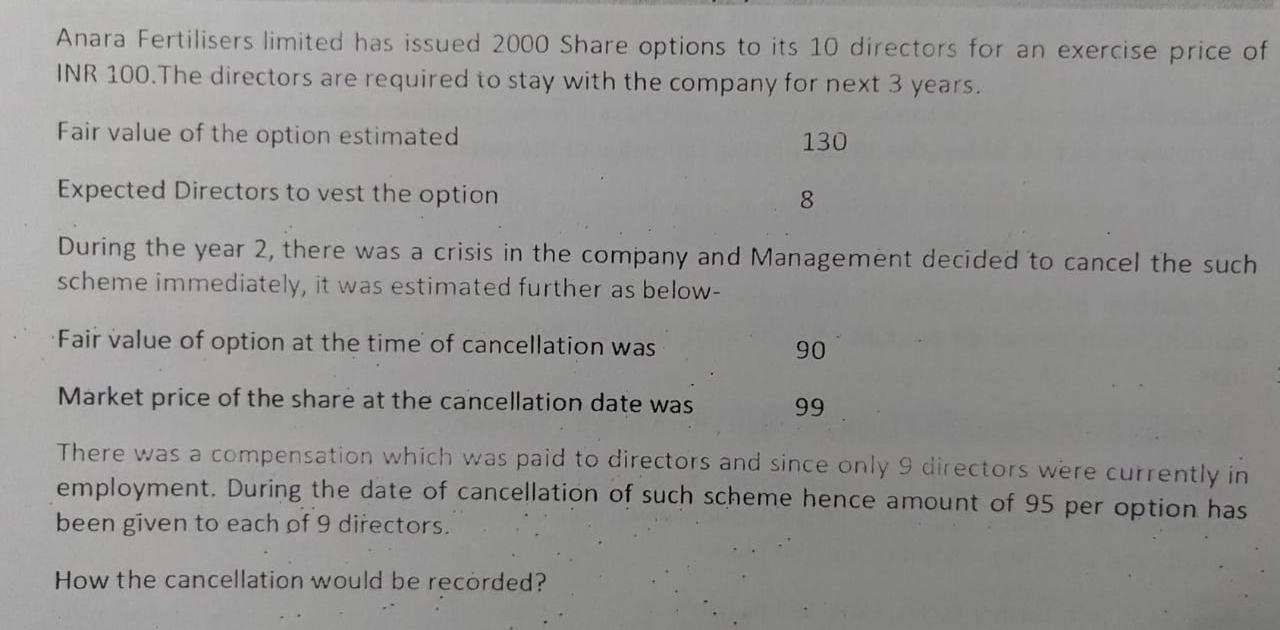

Anita Holding inc. grants 100 shares to each of its 500 employees at 1st January 20X1, provided the employees remain in service during the vesting period. The shares will vest at the end of the First year if the company's earnings is more than 12%; if the company's earnings is more than 20% over the two-year period; Third year if the entity's earnings increase by more than 22% over the three-year period. The fair value of one share at the grant date is INR 122. In 20x1, earnings was 10%, and 29 employees left the organisation. The company expects that earnings will continue at a similar rate in 20X2 and expects that the shares will vest at the end of the year 20X2. The company also expects that additional 31 employees will leave the organisation in the year 20x2 and that 440 employees will receive their shares at the end of the year 20X2. At the end of 20X2, company's earnings was 18%. Therefore, the shares did not vest. Only 29 employees left the organization during 20X2. Company believes that additional 23 employees will leave in 20x3 and earnings will further increase so that the performance target will be achieved in 20X3. At the end of the year 20X3, only 21 employees have left the organization. Assume that the company's earnings increased to desired level and the performance target had been met. Required: Determine the expense for each year? Tata Industries has issued a share based option to one of its key management personal which can be exercised either in cash or equity and it has following features: Option ! Period INR Cash settled shares 74,000 Service condition 3 years Option II Equity settled Shares 90,000 Conditions Service Restriction to sell 2 years Fair values Equity price with a restriction of sale for 2 years 115 Fair value grant date 135 Fair value 20XO 138 20X1 140 3 years 20X2 147 Pass the Journal entries? On 1 January 20X1, ABC limited gives options to its key management employees to take either cash equivalent to 1,000 shares or 1,500 shares. The minimum service requirement is 2 years and shares being taken must be kept for 3 years. Fair values of the shares are as follows: INR Share alternative fair value (with restrictions) 102 Grant date fair value on 1 Jan 20X1 113 Fair value on 31 Dec 20X1 120 Fair Value on 31 Dec 20X2 132 The key management exercises his cash option at the end of 20X2. Pass the journal entries. Anara Fertilisers limited has issued 2000 Share options to its 10 directors for an exercise price of INR 100. The directors are required to stay with the company for next 3 years. Fair value of the option estimated 130 Expected Directors to vest the option 8 During the year 2, there was a crisis in the company and Management decided to cancel the such scheme immediately, it was estimated further as below- Fair value of option at the time of cancellation was 90 Market price of the share at the cancellation date was 99 There was a compensation which was paid to directors and since only 9 directors were currently in employment. During the date of cancellation of such scheme hence amount of 95 per option has been given to each of 9 directors. How the cancellation would be recorded