Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I will give a high rating and thumbs up please do all parts An investor is considering the purchase of a(n)6.000%,15-year corporate bond that's being

I will give a high rating and thumbs up please do all parts

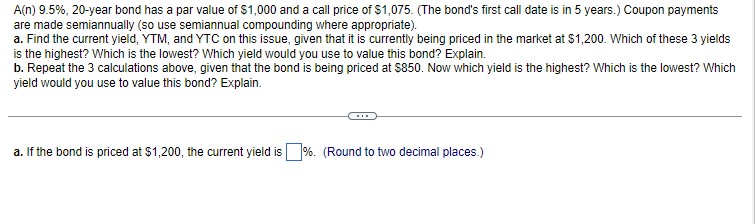

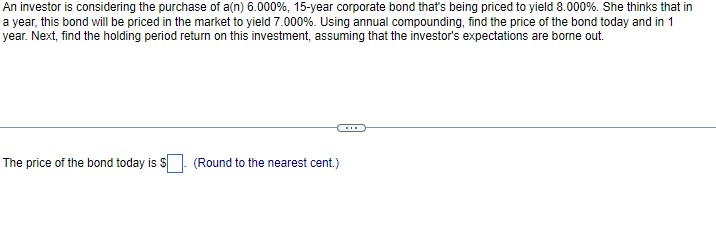

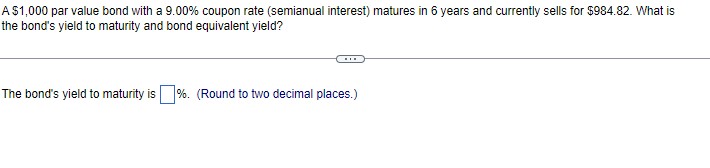

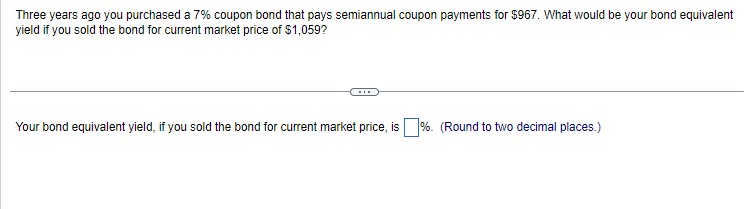

An investor is considering the purchase of a(n)6.000%,15-year corporate bond that's being priced to yield 8.000%. She thinks that in a year, this bond will be priced in the market to yield 7.000%. Using annual compounding, find the price of the bond today and in 1 year. Next, find the holding period return on this investment, assuming that the investor's expectations are borne out. The price of the bond today is (Round to the nearest cent.) A(n)9.5%,20-year bond has a par value of $1,000 and a call price of $1,075. (The bond's first call date is in 5 years.) Coupon payments are made semiannually (so use semiannual compounding where appropriate). a. Find the current yield, YTM, and YTC on this issue, given that it is currently being priced in the market at $1,200. Which of these 3 yields is the highest? Which is the lowest? Which yield would you use to value this bond? Explain. b. Repeat the 3 calculations above, given that the bond is being priced at $850. Now which yield is the highest? Which is the lowest? Which yield would you use to value this bond? Explain. a. If the bond is priced at $1,200, the current yield is \%. (Round to two decimal places.) A $1,000 par value bond with a 9.00% coupon rate (semianual interest) matures in 6 years and currently sells for $984.82. What is the bond's yield to maturity and bond equivalent yield? The bond's yield to maturity is \%. (Round to two decimal places.) Three years ago you purchased a 7% coupon bond that pays semiannual coupon payments for $967. What would be your bond equivalent yield if you sold the bond for current market price of $1,059 ? Your bond equivalent yield, if you sold the bond for current market price, is \%. (Round to two decimal places.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started