Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I will give an upwote!!!!! Miramar Corporation has 60,000 shares of common stock outstanding at a market price of C24 per share The firm has

I will give an upwote!!!!!

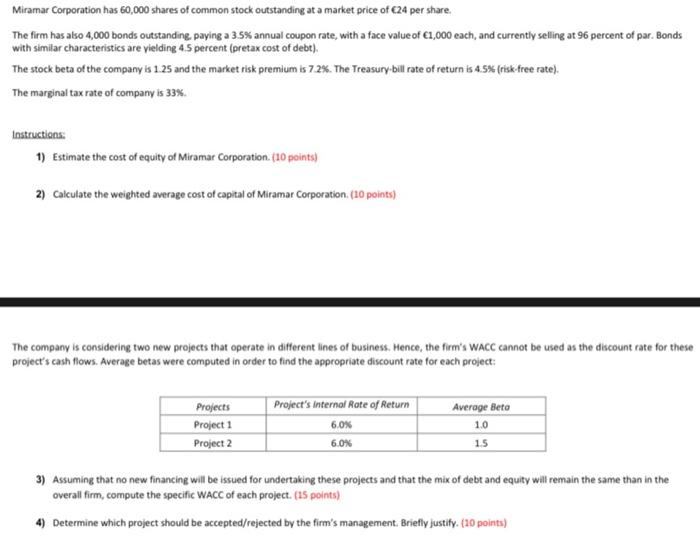

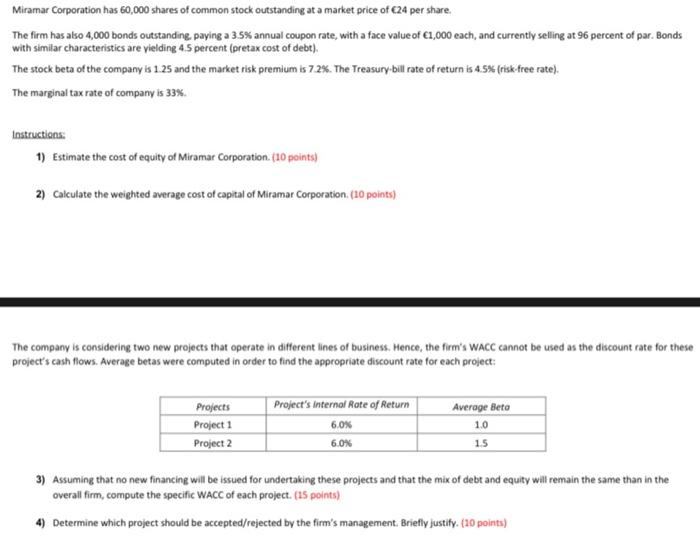

Miramar Corporation has 60,000 shares of common stock outstanding at a market price of C24 per share The firm has also 4,000 bonds outstanding paying a 35% annual coupon rate, with a face value of 1,000 each, and currently selling at 96 percent of par. Bands with similar characteristics are yielding 4.5 percent (pretax cost of debt). The stock beta of the company is 1.25 and the market risk premium is 7.2%. The Treasury-bill rate of return is 4.5% (risk-free rate). The marginal tax rate of company is 33% Instructions: 1) Estimate the cost of equity of Miramar Corporation (10 points) 2) Calculate the weighted average cost of capital of Miramar Corporation. (20 points) The company is considering two new projects that operate in different lines of business. Hence, the firm's WACC cannot be used as the discount rate for these project's cash flows. Average betas were computed in order to find the appropriate discount rate for each project: Projects Project 1 Project 2 Project's Internal Rate of Return 6.0% 6.0% Average Beto 1.0 15 3) Assuming that no new financing will be issued for undertaking these projects and that the mix of debt and equity will remain the same than in the overall firm, compute the specific WACC of each project. (15 points) 4) Determine which project should be accepted/rejected by the firm's management. Briefly justify. (10 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started