Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I will give thumbs up for correct answers and explanations ASAP! On January 1, 2020, Random Company acquired 30 percent of the voting shares of

I will give thumbs up for correct answers and explanations ASAP!

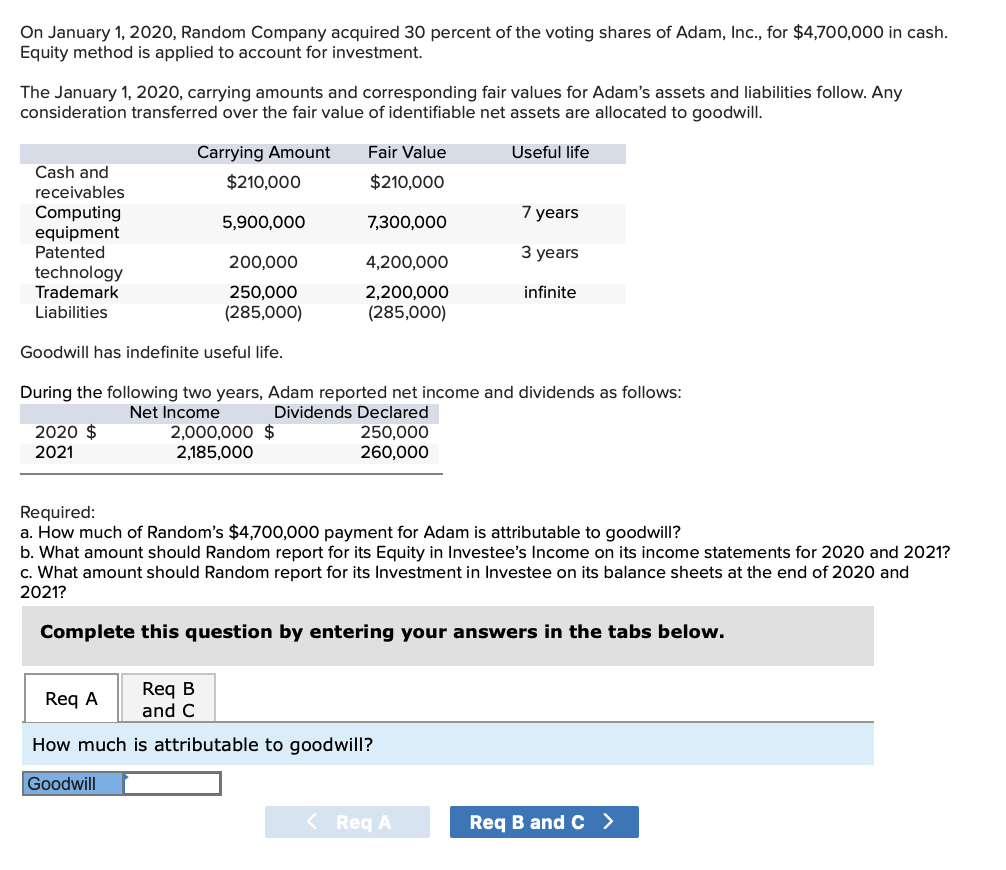

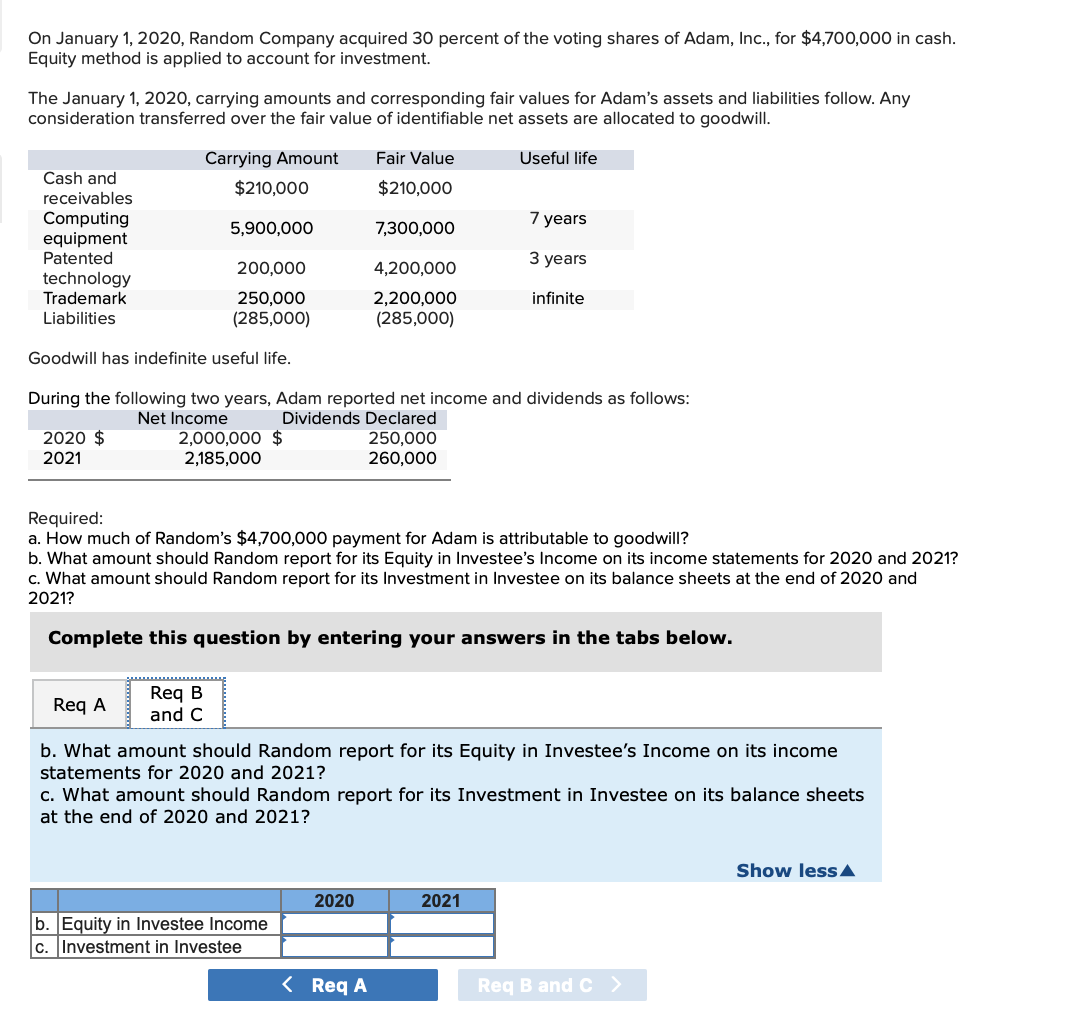

On January 1, 2020, Random Company acquired 30 percent of the voting shares of Adam, Inc., for $4,700,000 in cash. Equity method is applied to account for investment. The January 1, 2020, carrying amounts and corresponding fair values for Adam's assets and liabilities follow. Any consideration transferred over the fair value of identifiable net assets are allocated to goodwill. Carrying Amount Useful life Cash and Fair Value $210,000 $210,000 receivables Computing 7 years 5,900,000 7,300,000 equipment Patented 3 years 200,000 4,200,000 technology Trademark 250,000 2,200,000 infinite Liabilities (285,000) (285,000) Goodwill has indefinite useful life. During the following two years, Adam reported net income and dividends as follows: Net Income Dividends Declared 2,000,000 $ 2020 $ 2021 250,000 260,000 2,185,000 Required: a. How much of Random's $4,700,000 payment for Adam is attributable to goodwill? b. What amount should Random report for its Equity in Investee's Income on its income statements for 2020 and 2021? c. What amount should Random report for its Investment in Investee on its balance sheets at the end of 2020 and 2021? Complete this question by entering your answers in the tabs below. Req B Req A and C How much is attributable to goodwill? Goodwill Req A Req B and C > On January 1, 2020, Random Company acquired 30 percent of the voting shares of Adam, Inc., for $4,700,000 in cash. Equity method is applied to account for investment. The January 1, 2020, carrying amounts and corresponding fair values for Adam's assets and liabilities follow. Any consideration transferred over the fair value of identifiable net assets are allocated to goodwill. Fair Value Useful life Cash and Carrying Amount $210,000 $210,000 receivables Computing 7 years 5,900,000 7,300,000 equipment Patented 3 years 200,000 4,200,000 technology Trademark 250,000 2,200,000 infinite Liabilities (285,000) (285,000) Goodwill has indefinite useful life. During the following two years, Adam reported net income and dividends as follows: Net Income Dividends Declared 2,000,000 $ 2020 $ 2021 250,000 260,000 2,185,000 Required: a. How much of Random's $4,700,000 payment for Adam is attributable to goodwill? b. What amount should Random report for its Equity in Investee's Income on its income statements for 2020 and 2021? c. What amount should Random report for its Investment in Investee on its balance sheets at the end of 2020 and 2021? Complete this question by entering your answers in the tabs below. Req A Req B and C b. What amount should Random report for its Equity in Investee's Income on its income statements for 2020 and 2021? c. What amount should Random report for its Investment in Investee on its balance sheets at the end of 2020 and 2021? Show less 2020 2021 b. Equity in Investee Income c. Investment in InvesteeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started