Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I will give upvote if the answer are correct The ABC Corporation is considering opening an office in a new market area that would allow

I will give upvote if the answer are correct

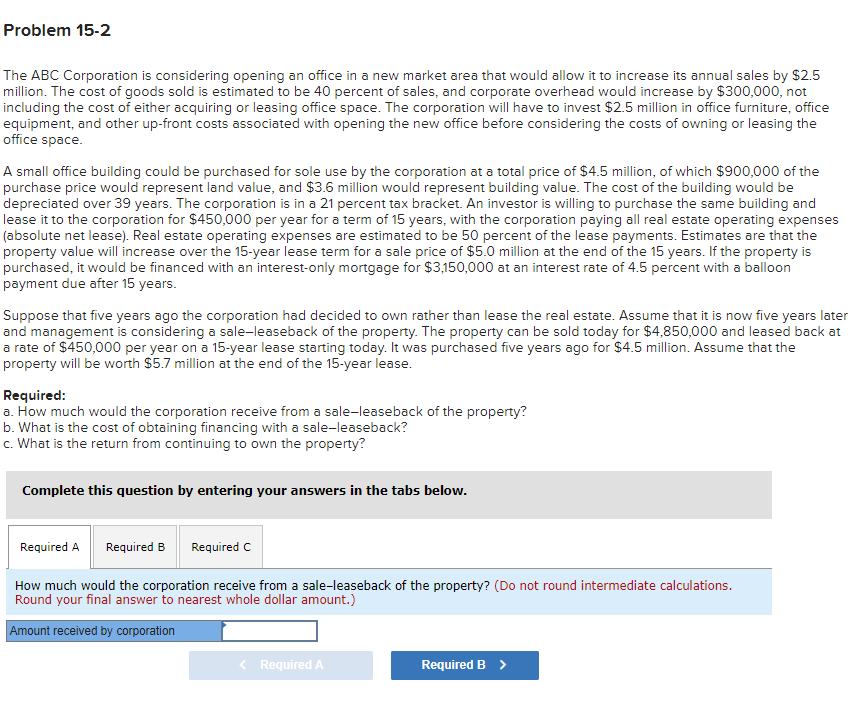

The ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.5 million. The cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $300,000, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.5 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $4.5 million, of which $900,000 of the purchase price would represent land value, and $3.6 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 21 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $450,000 per year for a term of 15 years, with the corporation paying all real estate operating expenses (absolute net lease). Real estate operating expenses are estimated to be 50 percent of the lease payments. Estimates are that the property value will increase over the 15 -year lease term for a sale price of $5.0 million at the end of the 15 years. If the property is purchased, it would be financed with an interest-only mortgage for $3,150,000 at an interest rate of 4.5 percent with a balloon payment due after 15 years. Suppose that five years ago the corporation had decided to own rather than lease the real estate. Assume that it is now five years later and management is considering a sale-leaseback of the property. The property can be sold today for $4,850,000 and leased back at a rate of $450,000 per year on a 15 -year lease starting today. It was purchased five years ago for $4.5 million. Assume that the property will be worth $5.7 million at the end of the 15 -year lease. Required: a. How much would the corporation receive from a sale-leaseback of the property? b. What is the cost of obtaining financing with a sale-leaseback? c. What is the return from continuing to own the property? Complete this question by entering your answers in the tabs below. How much would the corporation receive from a sale-leaseback of the property? (Do not round intermediate calculations. Round your final answer to nearest whole dollar amount.) What is the cost of obtaining financing with a sale-leaseback? (Do not round intermediate calculations. Round your final answer to nearest whole dollar amount.) What is the return from continuing to own the property? (Do not round intermediate calculations. Round your final answer to nearest whole dollar amount.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started