I will give your answer a thumbs up! (:

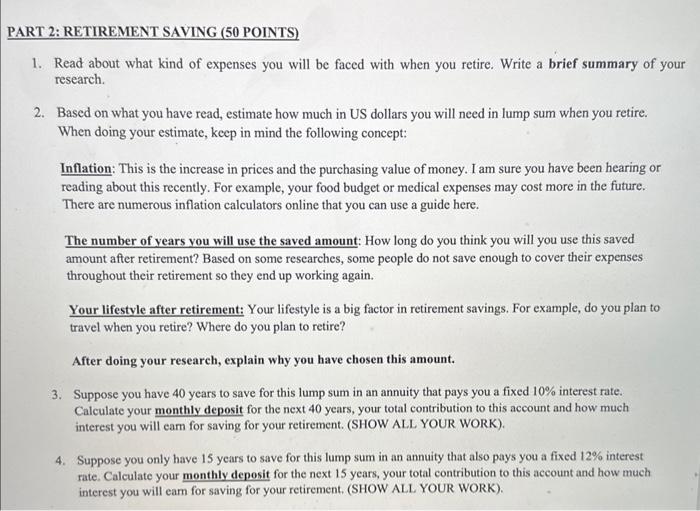

1. Read about what kind of expenses you will be faced with when you retire. Write a brief summary of your research. 2. Based on what you have read, estimate how much in US dollars you will need in lump sum when you retire. When doing your estimate, keep in mind the following concept: Inflation: This is the increase in prices and the purchasing value of money. I am sure you have been hearing or reading about this recently. For example, your food budget or medical expenses may cost more in the future. There are numerous inflation calculators online that you can use a guide here. The number of years you will use the saved amount: How long do you think you will you use this saved amount after retirement? Based on some researches, some people do not save enough to cover their expenses throughout their retirement so they end up working again. Your lifestyle after retirement: Your lifestyle is a big factor in retirement savings. For example, do you plan to travel when you retire? Where do you plan to retire? After doing your research, explain why you have chosen this amount. 3. Suppose you have 40 years to save for this lump sum in an annuity that pays you a fixed 10% interest rate. Calculate your monthly deposit for the next 40 years, your total contribution to this account and how much interest you will eam for saving for your retirement. (SHOW ALL YOUR WORK). 4. Suppose you only have 15 years to save for this lump sum in an annuity that also pays you a fixed 12% interest rate. Calculate your monthly deposit for the next 15 years, your total contribution to this account and how much interest you will eam for saving for your retirement. (SHOW ALL YOUR WORK). 1. Read about what kind of expenses you will be faced with when you retire. Write a brief summary of your research. 2. Based on what you have read, estimate how much in US dollars you will need in lump sum when you retire. When doing your estimate, keep in mind the following concept: Inflation: This is the increase in prices and the purchasing value of money. I am sure you have been hearing or reading about this recently. For example, your food budget or medical expenses may cost more in the future. There are numerous inflation calculators online that you can use a guide here. The number of years you will use the saved amount: How long do you think you will you use this saved amount after retirement? Based on some researches, some people do not save enough to cover their expenses throughout their retirement so they end up working again. Your lifestyle after retirement: Your lifestyle is a big factor in retirement savings. For example, do you plan to travel when you retire? Where do you plan to retire? After doing your research, explain why you have chosen this amount. 3. Suppose you have 40 years to save for this lump sum in an annuity that pays you a fixed 10% interest rate. Calculate your monthly deposit for the next 40 years, your total contribution to this account and how much interest you will eam for saving for your retirement. (SHOW ALL YOUR WORK). 4. Suppose you only have 15 years to save for this lump sum in an annuity that also pays you a fixed 12% interest rate. Calculate your monthly deposit for the next 15 years, your total contribution to this account and how much interest you will eam for saving for your retirement. (SHOW ALL YOUR WORK)