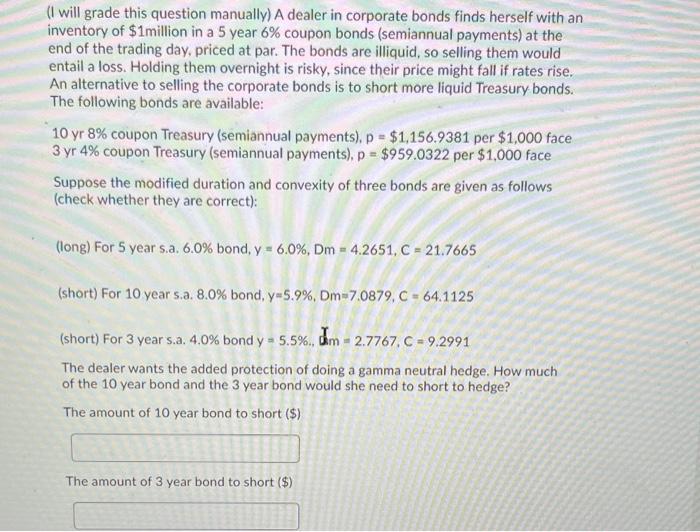

(I will grade this question manually) A dealer in corporate bonds finds herself with an inventory of $1 million in a 5 year 6% coupon bonds (semiannual payments) at the end of the trading day, priced at par. The bonds are illiquid, so selling them would entail a loss. Holding them overnight is risky, since their price might fall if rates rise. An alternative to selling the corporate bonds is to short more liquid Treasury bonds. The following bonds are available: 10 yr 8% coupon Treasury (semiannual payments), p=$1,156.9381 per $1,000 face 3 yr 4% coupon Treasury (semiannual payments), p=$959.0322 per $1,000 face Suppose the modified duration and convexity of three bonds are given as follows (check whether they are correct): (long) For 5 year s.a. 6.0% bond, y=6.0%,Dm=4.2651,C=21.7665 (short) For 10 year s.a. 8.0% bond, y=5.9%,Dm=7.0879,C=64.1125 (short) For 3 year s.a. 4.0% bond y=5.5%.,Im=2.7767,C=9.2991 The dealer wants the added protection of doing a gamma neutral hedge. How much of the 10 year bond and the 3 year bond would she need to short to hedge? The amount of 10 year bond to short (\$) The amount of 3 year bond to short (\$) (I will grade this question manually) A dealer in corporate bonds finds herself with an inventory of $1 million in a 5 year 6% coupon bonds (semiannual payments) at the end of the trading day, priced at par. The bonds are illiquid, so selling them would entail a loss. Holding them overnight is risky, since their price might fall if rates rise. An alternative to selling the corporate bonds is to short more liquid Treasury bonds. The following bonds are available: 10 yr 8% coupon Treasury (semiannual payments), p=$1,156.9381 per $1,000 face 3 yr 4% coupon Treasury (semiannual payments), p=$959.0322 per $1,000 face Suppose the modified duration and convexity of three bonds are given as follows (check whether they are correct): (long) For 5 year s.a. 6.0% bond, y=6.0%,Dm=4.2651,C=21.7665 (short) For 10 year s.a. 8.0% bond, y=5.9%,Dm=7.0879,C=64.1125 (short) For 3 year s.a. 4.0% bond y=5.5%.,Im=2.7767,C=9.2991 The dealer wants the added protection of doing a gamma neutral hedge. How much of the 10 year bond and the 3 year bond would she need to short to hedge? The amount of 10 year bond to short (\$) The amount of 3 year bond to short (\$)