Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I will invest P500 per quarter for my retirement at 7.3% compounding quarterly for 32 years. I have a choice of making that payment

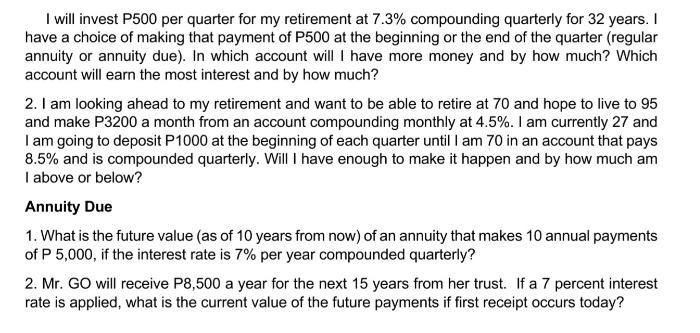

I will invest P500 per quarter for my retirement at 7.3% compounding quarterly for 32 years. I have a choice of making that payment of P500 at the beginning or the end of the quarter (regular annuity or annuity due). In which account will I have more money and by how much? Which account will earn the most interest and by how much? 2. I am looking ahead to my retirement and want to be able to retire at 70 and hope to live to 95 and make P3200 a month from an account compounding monthly at 4.5%. I am currently 27 and I am going to deposit P1000 at the beginning of each quarter until I am 70 in an account that pays 8.5% and is compounded quarterly. Will I have enough to make it happen and by how much am I above or below? Annuity Due 1. What is the future value (as of 10 years from now) of an annuity that makes 10 annual payments of P 5,000, if the interest rate is 7% per year compounded quarterly? 2. Mr. GO will receive P8,500 a year for the next 15 years from her trust. If a 7 percent interest rate is applied, what is the current value of the future payments if first receipt occurs today?

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Retirement Annuity Due vs Regular Annuity 1 Account with More Money The annuity due account will have more money at the end of 32 years Thi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started