Answered step by step

Verified Expert Solution

Question

1 Approved Answer

-A firm is trying to decide which of two alternate weighing scales it should install to check a package filling operation in the plant.

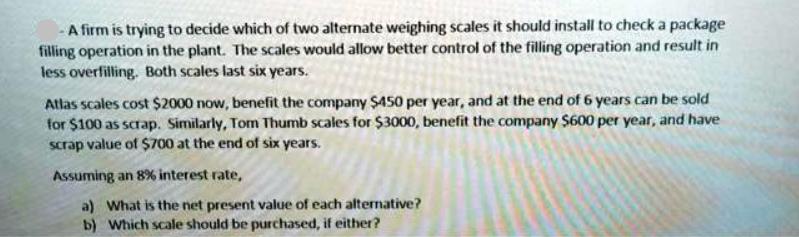

-A firm is trying to decide which of two alternate weighing scales it should install to check a package filling operation in the plant. The scales would allow better control of the filling operation and result in less overfilling. Both scales last six years. Atlas scales cost $2000 now, benefit the company $450 per year, and at the end of 6 years can be sold for $100 as scrap. Similarly, Tom Thumb scales for $3000, benefit the company $600 per year, and have scrap value of $700 at the end of six years. Assuming an 8% interest rate, a) What is the net present value of each alternative? b) Which scale should be purchased, if either?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

This question pertains to the analysis of two different investments in weighing scales based on their net present value NPV To answer the parts a and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started